Did you know that the trading volume of a single stock can sometimes rival the population of a small country? Understanding volume in day trading charts is vital for making informed decisions. This article dives into the essence of volume, explaining its significance in identifying price movements, confirming trend reversals, and recognizing support and resistance levels. We’ll explore high-volume days, the impact of volume spikes, and the risks of low volume. Additionally, we’ll discuss essential volume indicators and common pitfalls to avoid. By incorporating volume analysis into your trading strategy, you can enhance your decision-making process and potentially boost your success. Join us at DayTradingBusiness as we break down these key concepts for day traders.

What is volume in day trading charts?

Volume in day trading charts shows how many shares or contracts are traded during a specific period. It indicates market activity and liquidity. High volume suggests strong trader interest and can confirm price moves, while low volume may signal weak momentum or potential reversals. Traders use volume to validate breakouts, identify trend strength, or spot potential reversals.

Why is volume important for day traders?

Volume shows how much money is moving in and out of a stock, confirming trends or reversals. High volume indicates strong trader interest, making price moves more reliable. Low volume can mean a move lacks support and might reverse quickly. Day traders rely on volume to time entries and exits, avoiding false signals. It helps identify breakouts, breakdowns, and liquidity levels, making trades more precise. Without volume analysis, it’s like flying blind in fast markets.

How does volume signal potential price movements?

Higher trading volume often indicates strong investor interest, signaling potential price moves. When volume spikes, it suggests the current trend may accelerate or reverse. Low volume can mean a lack of conviction, making price movements less reliable. Sudden increases in volume during breakout points or support/resistance levels typically confirm the move's strength. Traders watch volume to confirm whether a price change is genuine or a false signal.

What are high-volume days and why do they matter?

High-volume days are days when trading activity spikes, with a large number of shares or contracts traded. They matter because increased volume confirms price movements, signals strong market interest, and can indicate potential trend reversals or breakouts. In day trading chart analysis, high-volume days help traders identify reliable entry and exit points, reducing false signals and increasing chances of profit.

How can volume confirm trend reversals?

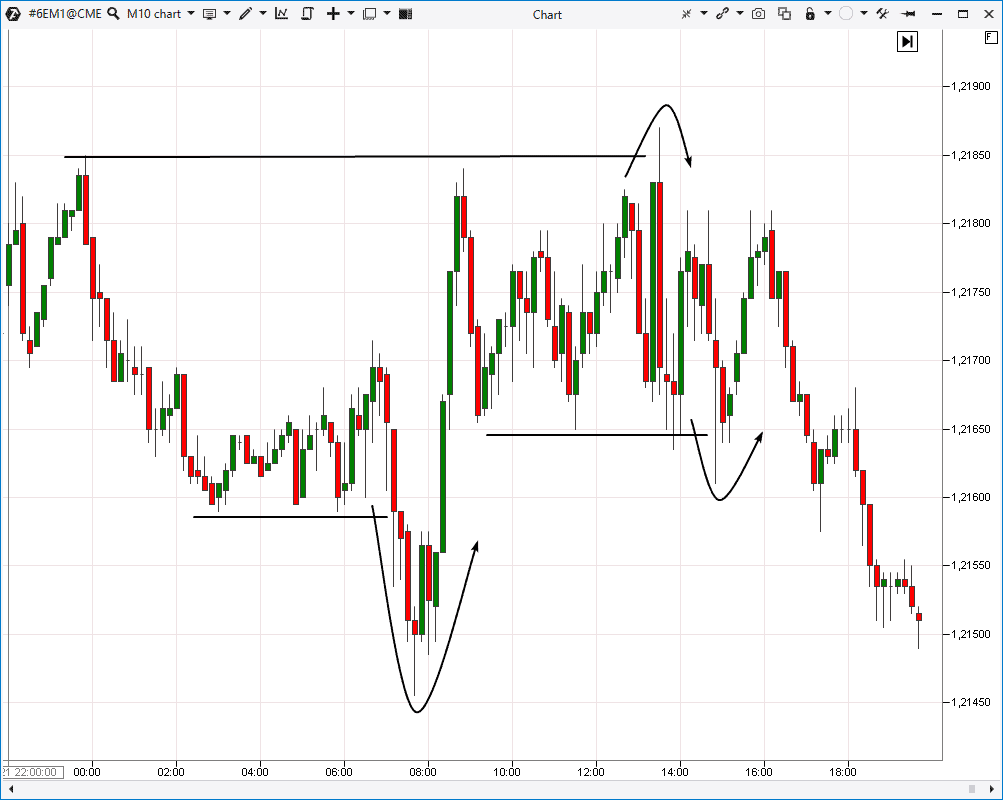

Volume confirms trend reversals when a spike in trading volume accompanies a price move opposite to the current trend. For example, a sudden high volume on a downward move suggests strong selling pressure ending, signaling a potential reversal to the upside. Conversely, increased volume during a rally indicates strong buying interest that may exhaust, hinting at a reversal downward. Look for volume surges at key support or resistance levels, confirming that a trend change is backed by significant market participation.

What is the relationship between volume and price breakouts?

High volume during a price breakout confirms strong buying or selling interest, increasing the likelihood the move is genuine and sustainable. Low volume suggests the breakout may be false or weak, risking a quick reversal. Volume acts as a validation tool; when price breaks key levels on increased volume, it signals momentum and trader commitment. Without volume support, breakouts often fail, leading to false signals and potential losses.

How do you interpret volume spikes?

Volume spikes often signal strong buying or selling interest, indicating potential trend reversals or breakouts. They show increased trader activity, suggesting the current price move is backed by significant market attention. Use volume spikes to confirm breakouts, identify momentum shifts, or spot potential entry and exit points in day trading.

What is the significance of low volume in trading?

Low volume in trading signals less market participation, leading to less reliable price moves and higher volatility. It makes it harder to confirm trends or breakouts, increasing the risk of false signals. Traders see low volume as a warning to avoid entering or exiting positions, since price actions are less supported by strong market interest.

How does volume help identify support and resistance levels?

Volume confirms support and resistance levels by showing when buyers or sellers are actively defending or breaking through those zones. High volume at a support level suggests strong buying interest, making it more likely the price will bounce. Conversely, a surge in volume at resistance indicates heavy selling pressure, hinting the level may hold. Low volume near these levels signals uncertainty, increasing the chance of a breakout or breakdown. Essentially, volume adds weight to the significance of support and resistance, helping traders gauge the strength behind price moves.

Can volume prevent false breakouts?

Yes, higher volume can prevent false breakouts by confirming the strength of a price move. When volume spikes during a breakout, it shows trader conviction, reducing the chance it's a false signal. Low volume breakouts often lack follow-through, increasing the risk of reversal. Volume acts as a filter—strong volume supports genuine breakouts, while weak volume suggests a potential fakeout.

What volume indicators are best for day trading?

Best volume indicators for day trading include the Volume Moving Average (VMA), On-Balance Volume (OBV), Volume Rate of Change (VROC), and the Volume Weighted Average Price (VWAP). These tools help spot breakout signals, confirm price movements, and identify trend strength. Use them to gauge trading volume spikes and validate entry or exit points quickly.

How should traders use volume in conjunction with other tools?

Traders should use volume alongside price action, moving averages, and technical indicators to confirm trends and reversals. For example, high volume during an uptrend signals strong buying interest, while volume spikes at support or resistance levels suggest potential breakouts or reversals. Combining volume with candlestick patterns or RSI helps validate signals, making trades more reliable. Don’t rely on volume alone—use it to verify the strength of price moves and filter out false signals.

Learn about How Do Institutional Traders Use Volume and Order Flow Data?

What are common mistakes when relying on volume analysis?

Common mistakes in relying on volume analysis include ignoring price action signals, assuming volume always confirms trends, and overlooking low-volume periods that can lead to false signals. Traders often misinterpret high volume as a guaranteed breakout, neglecting context. Another mistake is focusing only on volume spikes without considering overall market conditions or other indicators. Relying solely on volume without integrating price patterns or momentum can lead to poor decisions.

How does time of day affect volume analysis?

Time of day impacts volume analysis because trading activity fluctuates during different periods. Morning sessions often see higher volume due to market openings, while midday tends to be quieter. The last hour of trading usually has increased volume as traders finalize positions. These volume shifts influence price movements and breakout signals, making it crucial to consider time when interpreting volume data.

How can volume analysis improve overall trading strategy?

Volume analysis reveals the strength behind price movements, helping traders confirm trends and spot reversals. High volume during a breakout signals genuine momentum, reducing false signals. It highlights market interest, showing where large players are active. Tracking volume spikes can warn of potential reversals or continuations, refining entry and exit points. Overall, integrating volume analysis makes trading decisions more precise and reduces risk.

Learn about How to Use Volume to Improve Day Trading

Conclusion about The Role of Volume in Day Trading Chart Analysis

Incorporating volume analysis into your day trading strategy is crucial for making informed decisions and identifying potential price movements. High-volume days can signal heightened activity and confirm trends, while volume spikes may indicate breakouts or reversals. By understanding the relationship between volume and price, traders can better establish support and resistance levels, minimizing the risk of false breakouts. For optimal results, integrating volume with other technical indicators enhances overall trading effectiveness. Remember, leveraging insights from DayTradingBusiness can further refine your approach to volume analysis and improve your trading success.

Learn about The Role of Volume in Day Trading Technical Analysis