Did you know that even the most advanced AI can’t predict your coffee preferences? However, when it comes to day trading signals, AI is a game-changer. In this article, we delve into how AI can enhance your trading strategies, the top tools available, and the mechanics behind AI-generated signals. We’ll explore the accuracy of AI in predicting stock price movements and provide guidance on setting up AI-based trading alerts. We'll also discuss the reliability of AI recommendations, the essential data used, and the skills needed to leverage these technologies effectively. Furthermore, we'll cover backtesting methods, integration with trading platforms, common pitfalls, and costs associated with AI tools. With insights from DayTradingBusiness, you'll be equipped to customize AI trading signals to fit your strategy and make informed trading decisions.

How can AI improve day trading signals?

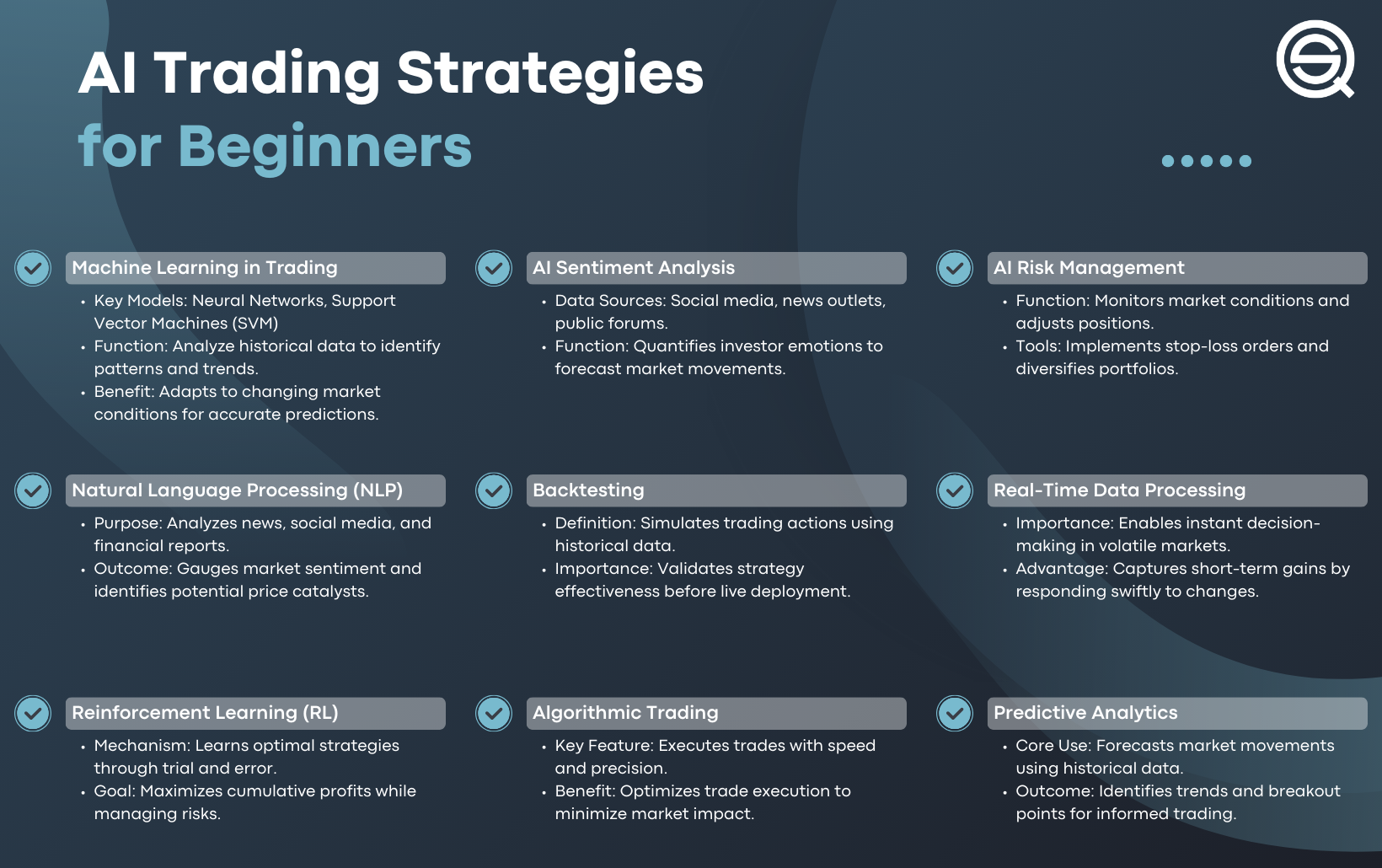

AI improves day trading signals by analyzing vast market data quickly, identifying patterns, and predicting price movements more accurately. It uses machine learning to adapt to changing market conditions, reducing false signals. AI-powered tools can deliver real-time alerts, helping traders make faster, data-driven decisions. They also incorporate news sentiment analysis and technical indicators, increasing the reliability of trading signals. Overall, AI enhances precision and timing in day trading strategies.

What are the best AI tools for day trading?

The best AI tools for day trading signals include Trade Ideas, TrendSpider, MetaStock, and TrendSpider’s AI-powered analysis. These tools analyze market data, identify patterns, and generate real-time trading signals. They use machine learning to adapt to market changes, helping traders spot entry and exit points. Integrate these with your trading platform for faster decision-making. Always backtest AI-generated signals before risking real money.

How does AI generate trading signals?

AI generates trading signals by analyzing large datasets of market data, news, and technical indicators using machine learning models. It identifies patterns, trends, and anomalies that humans might miss, then predicts short-term price movements. The AI continuously learns from new data to refine its predictions, providing buy or sell signals based on probability. It can also incorporate sentiment analysis from news and social media to gauge market mood, enhancing signal accuracy for day trading.

Can AI predict stock price movements accurately?

AI can predict stock price movements with some accuracy, but it isn't foolproof. It analyzes patterns, news, and historical data to generate day trading signals, helping traders make informed decisions. However, market unpredictability and sudden events limit its reliability, so use AI as a tool, not a crystal ball.

How do I set up AI-based trading alerts?

To set up AI-based trading alerts, connect your trading platform with an AI-powered signal service or tool. Configure the AI software to monitor specific market conditions, like price movements or technical indicators, and set alert thresholds. Customize notifications to your preferred method—email, push notifications, or SMS. Ensure the AI system is trained on relevant data for accurate signals. Test the alerts during different market scenarios to fine-tune their responsiveness.

What data do AI systems use for trading signals?

AI systems use historical price data, real-time market feeds, technical indicators, volume, news sentiment, and economic reports to generate trading signals. They analyze patterns, trends, and news to predict short-term price movements.

How reliable are AI-driven trading recommendations?

AI-driven trading recommendations are generally reliable but not infallible. They analyze vast data quickly, spotting patterns humans might miss, which can improve decision-making. However, market volatility and unexpected news can cause AI signals to misfire, so use them as tools, not guarantees. Always combine AI insights with your own analysis and risk management.

How can I backtest AI trading algorithms?

To backtest AI trading algorithms, gather historical market data relevant to your trading strategy. Implement the AI model within a backtesting platform or code environment, such as Python with libraries like pandas and backtrader. Run the algorithm on past data to evaluate performance, adjusting parameters as needed. Analyze metrics like win rate, profit factor, and drawdown to gauge effectiveness. Use the results to refine the AI model before deploying live.

What are the risks of relying on AI for trading?

Relying on AI for trading signals risks making decisions based on flawed or incomplete data, leading to significant financial losses. AI models can misinterpret market volatility, generate false positives, or miss sudden news events. Overdependence may cause traders to ignore fundamental analysis or human judgment. Technical glitches or algorithm errors can trigger incorrect trades. Market unpredictability and black swan events AI can't foresee also pose dangers.

How do I integrate AI signals into my trading platform?

Integrate AI signals into your trading platform by connecting AI-powered tools or APIs that generate real-time trading signals. Use platforms like MetaTrader, TradingView, or custom software that support API integration. Set up the AI system to analyze market data, then link its output to your trading dashboard or automated trading bot. Ensure the AI signals are tested thoroughly before live trading. Keep your platform updated and monitor AI performance regularly for accuracy.

Learn about How to Integrate AI with My Day Trading Platform?

What skills do I need to use AI for day trading?

You need skills in data analysis, programming (Python or R), understanding of trading algorithms, familiarity with machine learning, and knowledge of financial markets. Also, ability to interpret AI-generated signals, manage risk, and adapt strategies based on AI insights.

How does machine learning enhance trading signals?

Machine learning analyzes vast market data to identify patterns humans miss, improving the accuracy of trading signals. It adapts to changing market conditions, refining predictions over time. Algorithms quickly process news, price movements, and technical indicators, providing real-time, data-driven buy or sell signals. This boosts decision-making speed and reduces emotional bias in day trading. Overall, AI-driven machine learning creates more reliable, timely trading signals that can lead to better profit opportunities.

Learn about How Does Machine Learning Enhance Day Trading?

What are common mistakes when using AI in trading?

Common mistakes in using AI for day trading signals include relying solely on automated alerts without human oversight, ignoring model limitations and data quality, overfitting models to past data, and neglecting market context. Traders also often underestimate the importance of continuous model validation and fail to set proper risk management strategies. Using AI signals as the only decision factor instead of combining them with technical analysis or news can lead to poor trades.

How can I customize AI trading signals for my strategy?

To customize AI trading signals for your strategy, feed the AI your specific risk tolerance, preferred assets, and trading goals. Adjust the algorithm parameters to focus on short-term price movements or technical indicators you trust. Incorporate your own data, like historical trades, to fine-tune the AI’s predictions. Use backtesting to see how signals perform with your style, then tweak settings accordingly. Continuously monitor and refine the AI’s parameters based on real-time results to align signals with your day trading strategy.

What are the costs associated with AI trading tools?

AI trading tools typically cost between $50 and $300 per month, depending on features and data access. Some platforms charge one-time setup fees or tiered subscription plans. Additional costs include premium data feeds, API access, and advanced analytics. High-end AI systems with real-time alerts or custom modeling can run over $1,000 monthly. Always factor in potential costs for training or support services.

How do I interpret AI-generated trading insights?

To interpret AI-generated trading insights, look for clear buy or sell signals based on data patterns the AI detects. Check the confidence level or probability it assigns to each suggestion—higher confidence means stronger signals. Understand the underlying factors the AI considers, like market trends or technical indicators. Use these insights as part of your decision-making, not the sole basis. Cross-reference AI signals with your analysis to confirm trades. Remember, AI insights are tools, not guarantees—manage risk accordingly.

Conclusion about How to Use AI for Day Trading Signals?

Incorporating AI into day trading can significantly enhance trading signals, improve decision-making, and streamline strategies. By leveraging advanced algorithms and machine learning, traders can gain insights that may lead to more accurate predictions of stock price movements. However, it's essential to understand the data and risks involved, as well as to backtest AI algorithms to ensure reliability. Customizing AI signals to fit your unique strategy can further optimize performance. For those looking to deepen their trading knowledge and skills, DayTradingBusiness offers valuable resources and support to navigate the evolving landscape of AI in trading.

Learn about How to Use Market Microstructure Data to Improve Day Trading Outcomes