Did you know that some traders spend more time analyzing charts than they do sleeping? It’s no wonder that advanced charting tools are essential for day traders looking to refine their strategies. In this article, we dive into the best day trading platforms that offer powerful charting features, real-time data, and customizable options tailored for both beginners and seasoned traders. We’ll explore how these tools enhance trading strategies, compare platforms based on their charting capabilities, and address the costs associated with premium features. Join us as we uncover the top platforms that not only support automated trading but also integrate social features, making your trading experience with DayTradingBusiness more dynamic and effective.

What are the best day trading platforms with advanced charting tools?

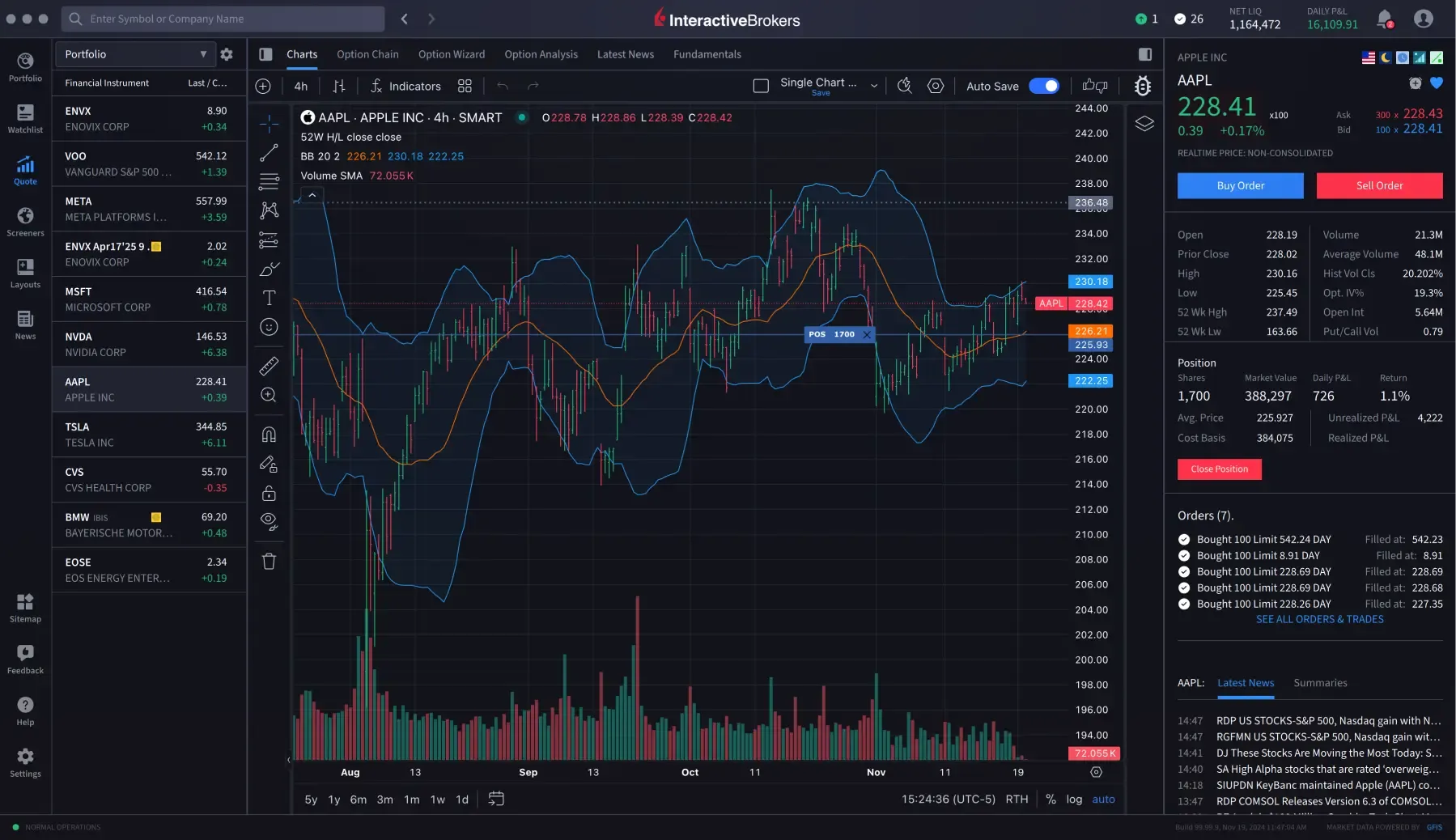

Thinkorswim by TD Ameritrade, TradingView, Interactive Brokers, E*TRADE Pro, and NinjaTrader offer the best day trading platforms with advanced charting tools.

How do advanced charting features improve day trading strategies?

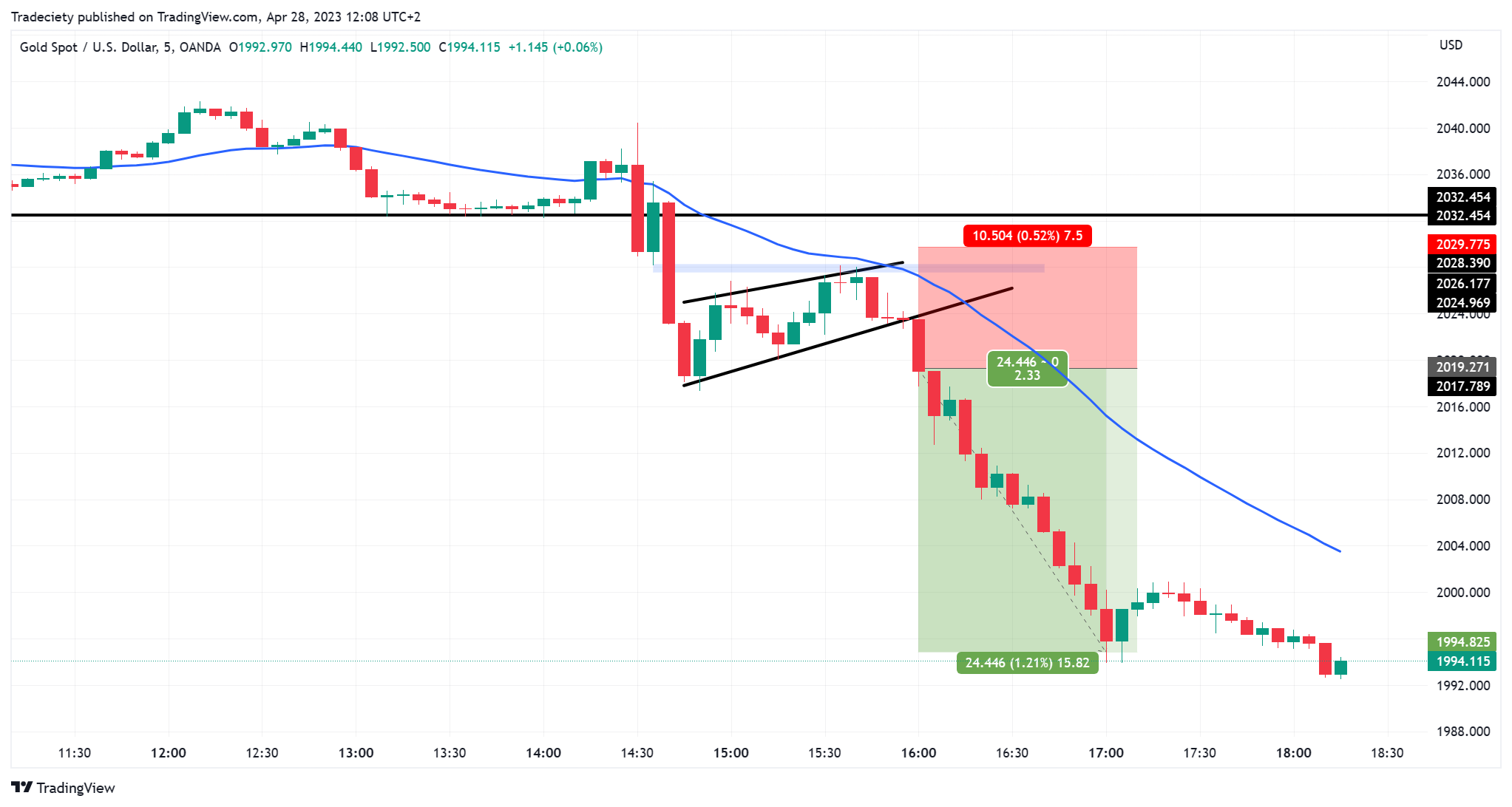

Advanced charting features help day traders spot quick trends, identify key support and resistance levels, and execute precise entries and exits. They offer real-time data, customizable indicators, and pattern recognition, making it easier to react fast. These tools can reveal hidden opportunities and reduce guesswork, boosting overall trading accuracy and confidence.

Which platforms offer real-time data and customizable charts for day traders?

Platforms like Thinkorswim, TradingView, MetaTrader 4 and 5, NinjaTrader, and Interactive Brokers offer real-time data and customizable charts tailored for day traders.

Are there free day trading platforms with professional charting tools?

Yes, platforms like TradingView, Webull, and Thinkorswim offer free access to professional-grade charting tools for day trading.

How reliable are the technical analysis tools on top trading platforms?

Technical analysis tools on top trading platforms are generally reliable for identifying market trends and entry/exit points, but they aren’t foolproof. They’re based on historical data and patterns, so they can signal potential movements but can’t predict future prices with certainty. Effective day traders combine these tools with real-time news, market sentiment, and experience to improve accuracy.

What should I look for in a day trading platform’s charting capabilities?

Look for real-time data updates, customizable technical indicators, drawing tools, multiple chart types, and the ability to set alerts. Ensure it offers easy pattern recognition, fast loading times, and integration with trading execution. Advanced features like backtesting, multi-timeframe analysis, and scripting options add value. User-friendly interface and reliable performance are key for quick decision-making.

Can beginner traders benefit from advanced charting tools on trading platforms?

Yes, beginner traders can benefit from advanced charting tools on trading platforms. These tools help them recognize patterns, make informed decisions, and learn technical analysis faster. However, they should start with basic features and gradually explore advanced options to avoid confusion. Proper use of advanced charting can improve their trading skills over time.

How do different platforms compare in charting customization options?

TradingView offers the most customizable charts with extensive indicators, drawing tools, and scripting options like Pine Script. MetaTrader 4 and 5 provide strong charting features, including numerous technical indicators and expert advisors, but less flexibility in visual customization. Thinkorswim excels with advanced charting, multiple layout options, and detailed technical analysis tools suitable for day traders. NinjaTrader offers highly customizable charts with a wide range of indicators, automation, and scripting, making it ideal for traders who want tailored visual setups. Overall, TradingView leads in ease of customization, followed by NinjaTrader and Thinkorswim for depth, with MetaTrader being solid but slightly less flexible.

What are the top platforms for multi-timeframe chart analysis?

Thinkorswim, TradingView, NinjaTrader, MetaTrader 5, and ThinkMarkets are top platforms for multi-timeframe chart analysis. They offer advanced charting tools, multiple timeframes, and customization options ideal for day trading.

Do any platforms support automated trading with advanced charting?

Yes, platforms like TradingView, MetaTrader 5, NinjaTrader, and Thinkorswim support automated trading with advanced charting tools.

Which day trading platforms provide the best indicators and drawing tools?

Thinkorswim by TD Ameritrade and TradingView top the list for advanced indicators and drawing tools. Thinkorswim offers customizable technical indicators, a wide range of drawing tools, and robust charting options. TradingView provides extensive indicators, real-time data, and versatile drawing features suitable for day traders. Both platforms cater to traders needing detailed technical analysis.

Learn about Day Trading Brokers with the Best Trading Platforms

How user-friendly are the advanced charting features on popular platforms?

Advanced charting features on popular day trading platforms are generally user-friendly, with intuitive interfaces and customizable options. Many platforms offer drag-and-drop tools, clear indicators, and real-time data, making it easy for traders to analyze markets quickly. Beginners might find some features complex initially, but most platforms provide tutorials and support to help users get comfortable. Experienced traders appreciate the depth of tools available, which streamline technical analysis without clutter. Overall, these features balance power and usability, catering to both novice and expert day traders.

Are there platforms that combine social trading with advanced charting?

Yes, platforms like eToro and TradingView combine social trading with advanced charting tools, allowing users to follow other traders while analyzing markets with detailed charts.

What are the costs associated with premium charting tools on trading platforms?

Premium charting tools on trading platforms typically cost between $30 and $150 per month. Some platforms charge one-time setup fees or higher subscription rates for advanced features like custom indicators, real-time data, and extended historical charts. Additional costs may include data feed subscriptions, especially for real-time or specialized market data. Some platforms offer tiered pricing, so the more advanced the charting tools, the higher the fee.

How do I choose the right platform for my day trading style and charting needs?

Match the platform’s charting tools to your trading style—scalping needs quick, real-time updates, while swing trading benefits from detailed technical analysis. Look for platforms like TradingView or Thinkorswim that offer advanced charting features, customizable indicators, and fast execution. Consider ease of use; if you prefer complex setups, choose platforms with robust customization. Test demo accounts to see how the charting tools fit your analysis process. Ensure the platform supports your preferred asset classes and provides reliable data feeds.

Learn about How to Choose the Right Day Trading Platform

Conclusion about Day Trading Platforms with Advanced Charting Tools

In conclusion, selecting the right day trading platform with advanced charting tools is crucial for enhancing trading strategies and decision-making. Look for platforms that offer real-time data, customizable charts, and a variety of technical analysis features. Whether you're a beginner or an experienced trader, tools that support multi-timeframe analysis and automated trading can significantly boost your performance. DayTradingBusiness is here to guide you through the best options available, ensuring you find a platform that aligns with your trading style and needs.

Learn about FAQs About Day Trading Platforms

Sources:

- World Bank Open Data | Data

- AI revolutionizing industries worldwide: A comprehensive overview ...

- Speech by Governor Brainard on the structure of the Treasury ...

- How Pandemic Accelerated Digital Transformation in Advanced ...

- Red Sea Attacks Disrupt Global Trade

- A review of modelling tools for energy and electricity systems with ...