Did you know that the average day trader spends about 100 hours a month just researching brokers? Choosing the right day trading broker is crucial for maximizing your profits and minimizing fees. In this article, we’ll break down the essential features to consider, from trading commissions and margin requirements to customer support and mobile app usability. We’ll also explore potential hidden fees, execution speeds, and the importance of research and educational resources. Plus, we’ll highlight the best promotions and how to assess a broker’s reliability. Let DayTradingBusiness guide you through the complexities of comparing day trading brokers effectively!

What are the key features to look for in day trading brokers?

When comparing day trading brokers, key features to look for include:

1. Low Commissions: Seek brokers with competitive fees to maximize your profits.

2. Fast Execution Speeds: Quick order execution is crucial for day trading success.

3. Robust Trading Platform: A user-friendly and reliable platform with advanced charting tools enhances trading efficiency.

4. Variety of Investment Options: Access to stocks, ETFs, options, and futures allows for diverse trading strategies.

5. Margin Requirements: Check the margin rates and requirements to leverage your trades effectively.

6. Research and Educational Resources: Quality research tools and educational materials support informed trading decisions.

7. Customer Support: Responsive support can help resolve issues quickly, which is vital during market hours.

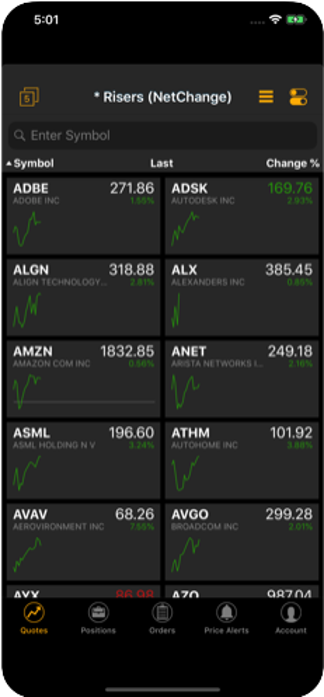

8. Mobile Trading Capability: A strong mobile app ensures you can trade on the go.

9. Regulatory Compliance: Ensure the broker is regulated by a reputable authority for security and trustworthiness.

These features will help you choose a broker that aligns with your day trading needs.

How do day trading broker fees vary across platforms?

Day trading broker fees vary significantly across platforms. Generally, they can include commissions per trade, spreads, and account maintenance fees. Some brokers offer commission-free trading, while others charge a flat fee or a percentage of the trade value. Additionally, platforms may impose different fees for options or futures trading. Look for hidden costs like inactivity fees or withdrawal charges, as these can impact overall profitability. Compare platforms based on your trading style and frequency to find the most cost-effective option. Always check for promotional offers that might waive fees for new accounts.

What is the best way to compare day trading commissions?

To compare day trading commissions effectively, focus on these key factors:

1. Commission Structure: Look for brokers that offer low or zero commission on trades.

2. Spread Costs: Consider the bid-ask spread, as this affects overall trading costs.

3. Account Fees: Check for any monthly fees, inactivity fees, or maintenance fees that could impact profitability.

4. Margin Rates: If you plan to trade on margin, compare the interest rates charged by different brokers.

5. Platform Features: Evaluate the trading platform’s tools and resources, as these can influence your trading success.

6. Customer Support: Reliable support can be crucial for day traders; assess the availability and quality of customer service.

By analyzing these aspects, you can find a broker with the best overall value for your day trading needs.

Are there any hidden fees with day trading brokers?

Yes, many day trading brokers have hidden fees. Common ones include inactivity fees, data feed charges, margin interest, and withdrawal fees. Always read the fine print and check for commissions on trades, especially for options or futures. Some brokers may also charge for premium research tools or advanced charting features.

How do margin requirements differ among day trading brokers?

Margin requirements among day trading brokers differ based on several factors, including the broker's policies, regulatory standards, and account types. Generally, brokers may offer different leverage ratios, affecting how much capital you need to control larger positions. For example, some brokers might require 25% margin for day trading, while others may offer 2:1 leverage, allowing you to trade with less cash upfront. Additionally, the minimum account balance can vary, influencing your ability to meet margin requirements. Always check specific broker terms to understand their margin rules and how they could impact your trading strategy.

What trading tools do top day trading brokers offer?

Top day trading brokers typically offer advanced charting tools, real-time market data, customizable watchlists, and technical analysis indicators. They provide direct market access for quicker trades, risk management features like stop-loss orders, and educational resources such as webinars and tutorials. Many also include mobile trading apps for on-the-go access and social trading platforms for community insights. Fees vary, but competitive commissions and low spreads are common among the best brokers.

How important is customer support for day trading brokers?

Customer support is crucial for day trading brokers. Quick, reliable support can make a significant difference in executing trades and resolving issues. Traders often face time-sensitive decisions, so having accessible assistance—via chat, phone, or email—enhances trading confidence. Effective customer service can differentiate brokers, impacting overall satisfaction and retention. A broker with strong support can help navigate platform complexities and address technical problems, which is vital in the fast-paced world of day trading.

What account minimums should I expect from day trading brokers?

Day trading brokers typically require account minimums ranging from $500 to $25,000. Many brokers set the minimum at $2,000 for margin accounts to meet the SEC's Pattern Day Trader rule. However, some brokers offer lower minimums for cash accounts, often around $500. Always check individual broker policies, as they can vary significantly.

How do execution speeds impact day trading success?

Execution speeds significantly impact day trading success by directly affecting trade entry and exit timing. Faster execution allows traders to capitalize on short-lived market opportunities, reducing slippage and improving profitability. Delays in execution can result in missed trades or worse prices, undermining strategies that rely on precision. Choosing a broker with low latency and high-speed order execution is crucial for maximizing day trading effectiveness.

What platforms have the best mobile apps for day trading?

The best platforms for mobile day trading apps include:

1. TD Ameritrade – Offers the thinkorswim app with advanced charting and analysis tools.

2. E*TRADE – Features a user-friendly mobile app with real-time quotes and trading capabilities.

3. Fidelity – Provides a robust app with comprehensive research and trading tools.

4. Charles Schwab – Offers a solid mobile experience with easy access to market data and trading.

5. Robinhood – Known for its straightforward interface and commission-free trades.

Each platform has unique features and fee structures, so choose based on your trading style and needs.

Learn about Best Mobile Apps for Day Trading

How do research resources compare among day trading brokers?

Research resources among day trading brokers vary significantly. Some offer advanced charting tools, real-time news feeds, and in-depth analysis, while others may provide only basic market data. Brokers like TD Ameritrade and E*TRADE excel with comprehensive educational content and research reports. In contrast, others may charge lower fees but lack robust research features. It's crucial to assess each broker's offerings based on your trading strategy and information needs. Always compare the tools, costs, and resources to find the best fit for your day trading approach.

Learn about How to Research Day Trading Stocks

What is the role of educational resources in choosing a broker?

Educational resources play a crucial role in choosing a day trading broker by helping traders understand market dynamics, strategies, and platform functionalities. Brokers that offer comprehensive educational materials, such as webinars, tutorials, and articles, empower traders to make informed decisions. Access to real-time market analysis and demo accounts can further enhance learning and confidence. Ultimately, solid educational resources can lead to better trading outcomes and a more satisfying experience with the broker.

How do trading platforms differ in terms of user experience?

Trading platforms differ in user experience primarily through their interface design, ease of navigation, order execution speed, and available tools. Some platforms offer intuitive layouts with customizable dashboards, while others may feel cluttered or complicated. Execution speed can vary, affecting how quickly trades are placed, which is crucial for day traders.

Additionally, features like charting tools, research resources, and mobile compatibility impact user experience. Fees also play a role; some brokers have lower commissions but may charge for premium features, while others might offer more comprehensive services without hidden costs. Overall, the best platform for you will depend on your trading style and the specific features that enhance your experience.

What are the tax implications of day trading with different brokers?

Day trading tax implications primarily depend on how the broker handles transactions and your trading frequency. If you trade frequently, you may qualify for "trader tax status," allowing you to deduct trading-related expenses.

Brokers that provide detailed transaction reports simplify tax filing, while others may require you to compile data manually. Some brokers offer tax-loss harvesting tools, which can help offset gains.

Short-term capital gains from day trading are taxed as ordinary income, typically at higher rates than long-term gains. The choice of broker affects fees and commissions, which can influence your net gains. Always consult a tax professional to understand specific implications based on your trading activities and broker choice.

Learn about Tax Implications of Day Trading in Different Countries

Which day trading brokers offer the best promotions or bonuses?

Some of the best day trading brokers offering attractive promotions and bonuses include:

1. TD Ameritrade: Offers cash bonus promotions for new accounts, often based on deposit amounts.

2. E*TRADE: Frequently provides cash bonuses for new customers who meet certain trading or deposit criteria.

3. Charles Schwab: Offers promotions that include cash bonuses for referrals and new account openings.

4. Fidelity: Occasionally has incentives like cash bonuses or investment credits for new customers.

5. Webull: Attracts users with free stock promotions when signing up and making an initial deposit.

Always check the broker's website for the latest offers as they frequently change.

Learn about Day Trading Brokers with the Best Trading Platforms

How can I assess the reliability of a day trading broker?

To assess the reliability of a day trading broker, check the following:

1. Regulation: Ensure they are regulated by a recognized authority (e.g., SEC, FINRA, FCA).

2. Trading Fees: Compare commissions, spreads, and any hidden fees. Look for transparent pricing.

3. Platform Stability: Test the trading platform for reliability and ease of use, including speed and uptime.

4. Customer Support: Evaluate the quality and availability of customer service through reviews and direct inquiries.

5. User Reviews: Read feedback from other traders regarding their experiences, focusing on trustworthiness and service quality.

6. Account Types: Look for a variety of account options that suit your trading style and capital.

7. Tools and Resources: Assess the availability of trading tools, educational resources, and research to support your trading decisions.

By examining these factors, you can determine if a day trading broker is reliable for your needs.

Conclusion about Comparing Day Trading Brokers: Features and Fees

In conclusion, selecting the right day trading broker involves a careful evaluation of key features, fees, and support services. It's crucial to compare commissions, identify hidden fees, and understand margin requirements to ensure optimal trading conditions. Additionally, the availability of trading tools, execution speeds, and educational resources can significantly impact your trading success. By considering these factors and leveraging insights from DayTradingBusiness, you can make informed decisions that align with your trading goals.