Did you know that the first online stock trade was executed in 1994, and it cost a whopping $25? Fast forward to today, and day trading platforms have evolved tremendously, offering a myriad of options for traders of all experience levels. In this article, we dive into the best day trading platforms available, exploring essential features, fees, and customer support options. We’ll guide you on how to choose the right platform for your needs, assess reliability and security measures, and compare mobile app performance. Additionally, we’ll highlight tools and resources crucial for day traders while discussing the importance of education and training. Whether you’re a novice or a seasoned trader, DayTradingBusiness is here to help you navigate the complexities of selecting the ideal trading platform.

What are the best day trading platforms available today?

The best day trading platforms today include:

1. TD Ameritrade – Offers advanced tools and research options.

2. E*TRADE – Known for its user-friendly interface and mobile app.

3. Charles Schwab – Provides robust trading features and no commission on stocks.

4. Interactive Brokers – Ideal for experienced traders with low fees and powerful tools.

5. Webull – Great for commission-free trading and extensive charting features.

6. Fidelity – Excellent research and customer service support.

Choose based on your trading style, tools needed, and commission structure.

How do I choose the right day trading platform for my needs?

To choose the right day trading platform, consider these key factors:

1. Fees and Commissions: Look for platforms with low trading fees and no commission on trades.

2. User Interface: Select a platform that is easy to navigate and suits your trading style.

3. Tools and Features: Ensure it offers essential tools like real-time data, charting capabilities, and technical indicators.

4. Execution Speed: Choose a platform known for fast order execution to capitalize on market movements.

5. Customer Service: Opt for a platform with responsive support to assist you when needed.

6. Regulation and Security: Verify that the platform is regulated and provides robust security measures for your funds and data.

7. Account Types: Check if it offers various account types that fit your trading strategy and capital.

Evaluate these factors based on your specific trading goals to find the best fit.

What features should I look for in a day trading platform?

Look for these key features in a day trading platform:

1. Low Commissions and Fees: Minimize costs to maximize profits.

2. Real-Time Data: Access live market data for timely decisions.

3. Advanced Charting Tools: Use technical analysis to identify trends.

4. Order Types: Ensure a variety of order types for flexibility.

5. Fast Execution Speed: Quick order execution to capitalize on market movements.

6. Mobile Access: Trade on-the-go with a reliable mobile app.

7. User-Friendly Interface: Easy navigation for efficient trading.

8. Research and Analysis Tools: Access to news and insights to inform trades.

9. Risk Management Features: Set stop-loss and take-profit orders to manage risk.

10. Customer Support: Responsive support for troubleshooting and inquiries.

Choose a platform that aligns with your trading style and goals.

How do trading fees vary across different day trading platforms?

Trading fees vary significantly across day trading platforms. Some platforms charge a flat fee per trade, while others may have tiered pricing based on trading volume. Commissions can range from $0 to $10 per trade, with many brokers offering commission-free trading. Additionally, platforms might impose other fees, such as withdrawal fees, inactivity fees, or data feed charges. It's crucial to compare these costs based on your trading frequency and strategy to find the most cost-effective option for your needs.

What are the pros and cons of popular day trading platforms?

Pros and Cons of Popular Day Trading Platforms:

1. TD Ameritrade:

– *Pros:* Robust research tools, no commission fees on trades, excellent customer support.

– *Cons:* High margin rates, complex interface for beginners.

2. E*TRADE:

– *Pros:* Intuitive platform, extensive educational resources, multiple trading options.

– *Cons:* Higher fees on broker-assisted trades, limited international trading.

3. Fidelity:

– *Pros:* No commission fees, strong research and analysis tools, great for long-term investors as well.

– *Cons:* Less focus on advanced trading features, limited options for futures trading.

4. Robinhood:

– *Pros:* Easy-to-use mobile app, commission-free trades, no account minimum.

– *Cons:* Limited research tools, outages during high volatility, no retirement accounts.

5. Charles Schwab:

– *Pros:* Comprehensive trading platform, no commissions, strong customer service.

– *Cons:* Less advanced charting tools, can be overwhelming for beginners.

6. Interactive Brokers:

– *Pros:* Low trading costs, access to international markets, advanced trading tools.

– *Cons:* Complex platform, high minimum deposit for some accounts, steep learning curve.

Choose a platform based on your trading style, experience, and specific needs.

How important is customer support when selecting a day trading platform?

Customer support is crucial when selecting a day trading platform. Quick, reliable support can help resolve issues that affect trading performance. Look for platforms with 24/7 support, multiple contact options, and knowledgeable representatives. Good customer service can enhance your trading experience and provide peace of mind, especially during volatile market conditions.

Which day trading platforms are best for beginners?

The best day trading platforms for beginners include:

1. TD Ameritrade: Offers a user-friendly interface and extensive educational resources.

2. E*TRADE: Great for beginners with its easy-to-navigate platform and mobile app.

3. Robinhood: Commission-free trading and a simple app make it accessible for new traders.

4. Webull: Provides advanced tools with zero commissions, ideal for those looking to learn.

5. Fidelity: Strong research tools and customer support help beginners make informed decisions.

Choose one based on your trading style and educational needs.

How can I assess the reliability of a day trading platform?

To assess the reliability of a day trading platform, check for regulatory compliance, user reviews, and customer support responsiveness. Look for a secure trading environment with robust encryption and two-factor authentication. Evaluate the platform's uptime and speed, as these affect trade execution. Test the demo account to gauge usability and features. Finally, compare fees and commissions to ensure they align with your trading strategy.

What are the security measures in place for day trading platforms?

Day trading platforms implement several key security measures:

1. Two-Factor Authentication (2FA): Adds an extra layer of protection by requiring a second form of verification.

2. Encryption: Protects data during transmission with strong encryption protocols.

3. Secure Socket Layer (SSL): Ensures a secure connection between the user and the platform.

4. Regular Security Audits: Platforms frequently assess vulnerabilities to enhance their security posture.

5. Account Monitoring: Real-time monitoring detects suspicious activity and alerts users.

6. Insurance: Some platforms offer insurance against losses due to breaches or fraud.

Evaluate these measures when comparing day trading platforms to ensure your investments are protected.

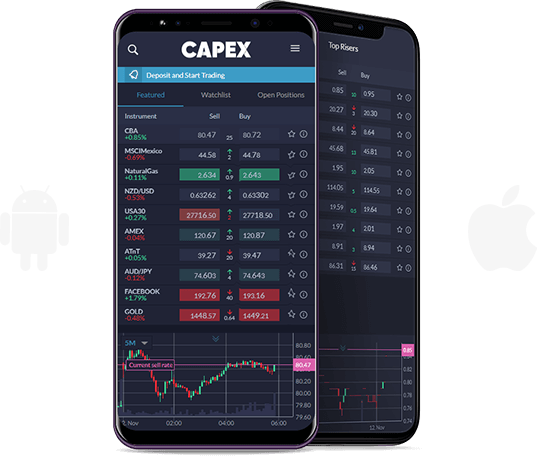

How do mobile apps compare for day trading platforms?

Mobile apps for day trading platforms vary significantly in features, usability, and performance. Key comparisons include:

1. User Interface: Some apps offer intuitive designs, making navigation easier for quick trades, while others may feel cluttered or complex.

2. Speed and Reliability: Top apps provide real-time data and fast execution times, crucial for day trading success. Check reviews for performance feedback.

3. Features: Look for tools like charting, technical analysis, and news integration. Some platforms excel in advanced features, while others focus on simplicity.

4. Fees: Compare commission structures and any hidden fees. Lower costs can impact your overall profitability.

5. Security: Ensure the app has robust security measures, like two-factor authentication, to protect your funds.

6. Customer Support: Reliable support can be essential, especially when issues arise during trading hours.

Choose a platform that aligns with your trading style and needs, emphasizing speed, usability, and features.

Learn about Day Trading Brokers with Mobile Trading Apps

What trading tools and resources do platforms offer for day traders?

Day trading platforms typically offer tools like real-time market data, advanced charting software, technical analysis indicators, and customizable watchlists. They provide resources such as news feeds, economic calendars, and educational content, including webinars and tutorials. Many platforms also include risk management tools, like stop-loss orders, and community forums for trader discussions. Some offer paper trading accounts for practice without real money. Look for platforms that integrate these features to enhance your trading strategy and decision-making.

Learn about Day Trading Platforms with Customer Support and Resources

How does the user interface impact my trading experience?

The user interface (UI) significantly impacts your trading experience by influencing how easily you can execute trades, analyze data, and access tools. A clean, intuitive UI allows for quick navigation, making it easier to monitor market trends and react swiftly. Customizable layouts can enhance your workflow, while responsive design ensures a seamless experience on different devices. If the platform is cluttered or confusing, it can lead to errors and missed opportunities. Overall, a well-designed UI enhances efficiency, reduces stress, and supports better decision-making in day trading.

What are the margin requirements on different day trading platforms?

Margin requirements vary by day trading platform.

1. TD Ameritrade: Requires $25,000 for a margin account to day trade.

2. E*TRADE: Also requires $25,000 for day trading; lower for other types of trading.

3. Fidelity: Minimum of $25,000 for day trading; $2,000 for non-day trading accounts.

4. Charles Schwab: $25,000 for day trading; lower limits may apply for less active trading.

5. Interactive Brokers: Offers lower margin requirements, starting at $2,000, but varies by account type.

Check each platform for the most current and specific margin rules.

Learn about Understanding Margin Requirements in Futures Day Trading

How do day trading platforms handle market volatility?

Day trading platforms handle market volatility by offering real-time data, advanced charting tools, and customizable alerts. They provide fast order execution to capitalize on quick price movements and may include features like stop-loss orders to limit losses. Many platforms also offer risk management tools, such as margin trading and options for hedging positions. Look for platforms that support rapid trading and have robust customer support to assist during volatile conditions.

Learn about How Market Microstructure Insights Improve Day Trading Accuracy

What is the role of education and training in choosing a platform?

Education and training are crucial in choosing a day trading platform because they help you understand the features and tools that suit your trading style. A well-educated trader can identify platforms that offer necessary resources, like tutorials and demo accounts, enhancing their skills. Additionally, training helps you evaluate user interfaces, fees, and execution speeds, ensuring the platform aligns with your trading strategy. Ultimately, a solid educational foundation empowers you to make informed decisions, maximizing your trading potential.

How do I evaluate the performance of a day trading platform?

To evaluate the performance of a day trading platform, consider the following factors:

1. Execution Speed: Test how quickly trades are executed. Fast execution minimizes slippage and maximizes profit potential.

2. Fees and Commissions: Analyze trading fees, commissions, and any hidden costs. Lower fees can significantly impact overall profitability.

3. User Interface: Assess the platform’s usability. A clean, intuitive interface helps you make quick decisions.

4. Tools and Features: Look for essential tools like charting software, technical indicators, and news feeds that enhance your trading strategy.

5. Customer Support: Evaluate the availability and responsiveness of customer service. Good support is crucial for resolving issues quickly.

6. Mobile Access: Check if the platform offers a reliable mobile app for trading on the go.

7. Security: Ensure the platform has strong security measures to protect your funds and personal information.

8. Reviews and Reputation: Research user reviews to gauge overall satisfaction and reliability from other traders.

By focusing on these aspects, you can effectively compare day trading platforms and choose the one that fits your trading style.

Learn about How Do Prop Firms Evaluate Day Trading Performance?

Conclusion about Comparing Day Trading Platforms: Which One is Right for You?

In conclusion, selecting the right day trading platform is a critical step for successful trading. By evaluating factors such as fees, features, customer support, and security measures, traders can make informed choices that align with their goals. For those seeking comprehensive insights and assistance in navigating these options, DayTradingBusiness offers valuable resources to enhance your trading journey. Make sure to assess your unique needs and leverage the right tools for optimal performance.