Did you know that the average day trader spends about 10 hours a day glued to their screens? With so much time invested, choosing the right day trading platform is crucial. This article dives into the essential features that every trader should consider, such as the importance of real-time data, effective charting tools, and a user-friendly interface. We’ll explore how commission structures, order execution speed, and security features can impact your trading success. Additionally, we’ll highlight the benefits of mobile trading, customer support, and demo accounts. Finally, for both beginners and experienced traders, we’ll discuss customization options and third-party integrations that can elevate your trading experience. Trust DayTradingBusiness to guide you through these key points!

What are the essential features of day trading platforms?

Essential features of day trading platforms include:

1. Real-Time Market Data: Instant access to live price feeds and market news.

2. Advanced Charting Tools: Comprehensive technical analysis tools for tracking price movements.

3. Customizable Interface: Ability to tailor the layout and features to individual preferences.

4. Order Types: Support for various order types, including market, limit, and stop orders.

5. Speed and Reliability: Fast execution times and minimal downtime to capitalize on market opportunities.

6. Risk Management Tools: Features like stop-loss orders and alerts to manage risk effectively.

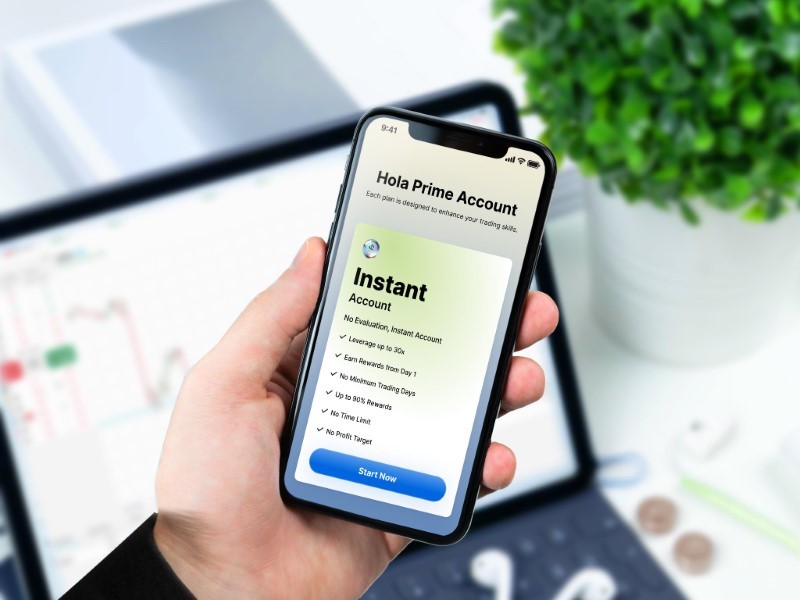

7. Mobile Trading: Access to trading on-the-go through a mobile app.

8. Educational Resources: Access to tutorials, webinars, and articles to enhance trading skills.

9. Low Commissions and Fees: Competitive pricing structures to maximize profits.

10. Customer Support: Responsive assistance for troubleshooting and inquiries.

How important is real-time data for day trading?

Real-time data is crucial for day trading. It allows traders to make informed decisions quickly, reacting to market movements as they happen. Accurate, instant information on stock prices, volume, and news can significantly impact entry and exit points, maximizing profits and minimizing losses. Without real-time data, traders risk missing opportunities or making decisions based on outdated information.

Which charting tools should a day trader consider?

Day traders should consider charting tools like TradingView, Thinkorswim, and MetaTrader 4. Look for features like real-time data, customizable indicators, multiple time frames, and advanced chart types. Also, ensure the platform offers easy order execution and backtesting capabilities to refine strategies.

What role does commission structure play in choosing a trading platform?

Commission structure significantly impacts the overall cost of trading. A lower commission reduces expenses, allowing more of your profits to remain intact. Platforms with competitive fees can enhance your trading strategy by enabling more frequent trades without eating into gains. Additionally, transparent commission structures help you understand your total costs, leading to better decision-making. Always compare commission rates and consider how they align with your trading style and frequency before choosing a platform.

How does order execution speed affect day trading success?

Order execution speed is crucial for day trading success because it directly impacts your ability to capitalize on short-term price movements. Faster execution means you can enter and exit trades quickly, minimizing slippage and maximizing profits. Delays can lead to missed opportunities or increased losses, especially in volatile markets. Therefore, when choosing a day trading platform, look for features like low latency and high order fill rates to ensure your trades are executed as swiftly as possible.

Why is a user-friendly interface crucial for day trading?

A user-friendly interface is crucial for day trading because it enables quick decision-making and efficient trade execution. Traders need to analyze charts, place orders, and react to market changes rapidly. An intuitive layout reduces the learning curve, allowing users to focus on strategy rather than navigating the platform. Features like customizable dashboards, easy access to tools, and clear visualizations enhance the overall trading experience, leading to better performance and reduced errors.

What security features should day trading platforms have?

Day trading platforms should have robust security features, including:

1. Two-Factor Authentication (2FA): Adds an extra layer of protection against unauthorized access.

2. Encryption: Protects sensitive data during transmission and storage.

3. Secure Socket Layer (SSL) Protocols: Ensures secure connections between the user and the platform.

4. Regular Security Audits: Identifies and mitigates vulnerabilities in the system.

5. Withdrawal Whitelists: Requires users to pre-approve withdrawal addresses, preventing unauthorized transfers.

6. Anti-Phishing Measures: Alerts users about potential phishing attempts and suspicious activity.

7. Account Activity Monitoring: Tracks unusual account behavior and alerts users.

8. Insurance Policies: Some platforms offer insurance against breaches or losses.

These features help secure your investments and personal information while trading.

How can mobile trading capabilities enhance day trading?

Mobile trading capabilities enhance day trading by providing real-time access to markets, allowing traders to execute orders instantly from anywhere. Key features to look for in day trading platforms include:

1. Real-Time Data: Live quotes and charts help make quick decisions.

2. Order Types: Multiple order options, like stop-loss and limit orders, improve risk management.

3. User Interface: An intuitive design enables swift navigation and execution.

4. Alerts and Notifications: Instant alerts for price changes or news keep traders informed.

5. Charting Tools: Advanced technical analysis tools assist in identifying trends.

6. Secure Transactions: Robust security measures protect sensitive information.

These features together empower traders to capitalize on market opportunities without being tied to a desktop.

What types of research and analysis tools do day traders need?

Day traders need research and analysis tools that include real-time market data, advanced charting capabilities, technical indicators, and customizable alerts. They should look for platforms offering mobile access, backtesting features, and news feeds for market updates. Additionally, tools for risk management, such as stop-loss orders and profit targets, are essential. Integration with financial news and social sentiment analysis can also enhance decision-making.

How does customer support impact your day trading experience?

Customer support significantly impacts your day trading experience by ensuring quick resolution of issues, providing guidance on platform features, and offering timely assistance during critical trading hours. Responsive support helps you navigate technical glitches, understand trading tools, and get answers to urgent questions, ultimately leading to more confident and informed trading decisions. Look for platforms with 24/7 support, live chat options, and knowledgeable representatives to enhance your trading efficiency.

Learn about How Do Prop Firms Impact Day Trading Profitability?

What are the benefits of using demo accounts in day trading platforms?

Using demo accounts in day trading platforms offers several benefits:

1. Risk-Free Practice: You can hone your trading skills without risking real money.

2. Familiarization: Get accustomed to the platform's features and tools before trading live.

3. Strategy Testing: Experiment with different trading strategies to see what works best for you.

4. Market Understanding: Gain insights into market behavior and how to react in various scenarios.

5. Emotional Control: Develop discipline and emotional resilience in a stress-free environment.

These features help build confidence and enhance your trading proficiency.

Learn about Day Trading Platforms Offering Demo Accounts

How do trading fees vary between day trading platforms?

Trading fees vary by platform based on several factors, including commission rates, spreads, and account types. Some platforms charge a flat fee per trade, while others may offer commission-free trading but include wider spreads. Look for platforms that provide tiered pricing based on trading volume; frequent traders might benefit from lower fees. Additionally, consider whether the platform charges inactivity fees or withdrawal fees, as these can impact overall costs.

Learn about How Regulators Detect Insider Trading in Day Markets

What are the best platforms for beginner day traders?

The best platforms for beginner day traders include:

1. TD Ameritrade: Offers a user-friendly interface, extensive educational resources, and powerful trading tools.

2. E*TRADE: Features a robust mobile app, research resources, and no commission on trades.

3. Robinhood: Great for simplicity and commission-free trading, but lacks advanced features.

4. Charles Schwab: Provides comprehensive research, easy navigation, and no commission fees.

5. Webull: Excellent for real-time data and technical analysis tools, with zero commission trades.

Look for platforms that offer educational resources, low fees, strong customer support, and easy-to-use interfaces for a smoother trading experience.

How can customization options improve a day trader's workflow?

Customization options enhance a day trader's workflow by allowing tailored layouts, personalized indicators, and specific trading tools that fit individual strategies. Traders can arrange charts and data feeds to focus on relevant information, increasing efficiency. Custom alerts help manage trades proactively, while personalized watchlists keep track of key stocks. Overall, these options streamline decision-making and improve response times in fast-paced trading environments.

What additional features should experienced day traders look for?

Experienced day traders should look for advanced charting tools, real-time data feeds, customizable layouts, and direct market access. They need robust risk management features, including stop-loss orders and trailing stops. Fast execution speeds and low transaction costs are crucial. Additionally, powerful analytical tools, market news integration, and back-testing capabilities enhance trading strategies. A reliable mobile app for trading on the go is also essential.

How do integrations with third-party tools enhance trading platforms?

Integrations with third-party tools enhance trading platforms by providing advanced analytics, automated trading, and real-time market data. They allow users to customize their trading experience with tools like charting software, news feeds, and risk management applications. This connectivity enables better decision-making and faster execution, giving traders a competitive edge. Additionally, seamless integration with platforms like CRM systems or tax software can streamline operations and improve overall efficiency.

Conclusion about Top Features to Look for in Day Trading Platforms

In summary, selecting the right day trading platform involves evaluating several key features, including real-time data, charting tools, commission structures, and order execution speed. A user-friendly interface and robust security are essential for a smooth trading experience, while mobile capabilities and research tools can significantly enhance your strategy. Customer support and demo accounts further contribute to your success, especially for beginners. For experienced traders, customization options and third-party integrations can optimize workflows. Ultimately, understanding these elements will empower you to make informed choices in your trading journey, and resources from DayTradingBusiness can guide you in navigating this complex landscape.

Learn about Features to Look for in a Day Trading Broker