Did you know that day trading can be so fast-paced that some traders joke they could burn calories just clicking their mouse? If you're a beginner looking to dive into the world of day trading, choosing the right platform is crucial. In this article, we explore the best day trading platforms tailored for newcomers, highlighting essential features, user-friendly options, and the importance of customer support. We also cover how to select a platform, the significance of fees, and the role of educational resources. Plus, discover how demo accounts and mobile apps can enhance your trading experience. With insights from DayTradingBusiness, you’ll be equipped to navigate the exciting yet risky landscape of day trading effectively.

What are the best day trading platforms for beginners?

The best day trading platforms for beginners include:

1. TD Ameritrade: Offers a user-friendly interface and extensive educational resources.

2. E*TRADE: Features a simple platform with powerful tools and a mobile app.

3. Robinhood: Great for zero-commission trades and easy navigation but limited research tools.

4. Interactive Brokers: Ideal for serious beginners with advanced tools and low fees.

5. Webull: Provides commission-free trading and strong analytical tools for new traders.

Choose a platform based on your trading style, desired features, and educational support.

How do I choose a day trading platform as a beginner?

To choose a day trading platform as a beginner, consider these key factors:

1. User-Friendly Interface: Look for platforms with intuitive designs that make navigation easy for newcomers.

2. Low Fees: Compare commission rates and fees for trades to minimize costs.

3. Educational Resources: Select platforms that offer tutorials, webinars, and articles to help you learn.

4. Real-Time Data: Ensure the platform provides real-time market data and analytics to make informed decisions.

5. Customer Support: Opt for platforms with robust customer service for quick assistance.

6. Mobile Access: Check if the platform has a mobile app for trading on the go.

7. Demo Account: Look for platforms that offer demo accounts to practice trading without risking real money.

Popular choices include TD Ameritrade, E*TRADE, and Webull, which cater well to beginners.

What features should beginners look for in day trading platforms?

Beginners should look for these features in day trading platforms:

1. User-Friendly Interface: Easy navigation and clear layouts help new traders focus on learning rather than struggling with the platform.

2. Low Fees: Choose platforms with low commissions and no hidden fees to maximize profits on small trades.

3. Educational Resources: Access to tutorials, webinars, and articles can help beginners understand trading strategies and market analysis.

4. Real-Time Data: Reliable market data and charts are essential for making informed decisions quickly.

5. Demo Accounts: A demo account allows beginners to practice trading without risking real money.

6. Mobile Access: A mobile app ensures you can trade on the go, keeping you connected to the market.

7. Customer Support: Responsive support can help resolve issues or answer questions promptly as you learn.

8. Risk Management Tools: Features like stop-loss orders help beginners manage their risk effectively.

These features create a supportive environment for novice traders to develop their skills.

Are there any free day trading platforms for beginners?

Yes, there are several free day trading platforms suitable for beginners. Some of the best options include:

1. TD Ameritrade – Offers a robust trading platform with no commission fees on stocks and ETFs.

2. Robinhood – User-friendly app with commission-free trades, ideal for beginners.

3. Webull – Provides commission-free trading and advanced charting tools, great for new traders.

4. Charles Schwab – Offers a comprehensive trading platform with no commissions on trades.

These platforms provide educational resources and tools to help beginners learn day trading effectively.

How do fees and commissions impact day trading for beginners?

Fees and commissions significantly impact day trading for beginners by reducing overall profitability. High trading fees can eat into gains from small price movements, making it harder to achieve consistent profits. For beginners, choosing platforms with low or zero commissions is crucial. Look for brokers that offer competitive spreads and no hidden fees to maximize returns. Additionally, consider platforms that provide useful tools and resources without extra costs to enhance your trading experience.

What are the top user-friendly day trading platforms?

The top user-friendly day trading platforms for beginners include:

1. TD Ameritrade – Offers a powerful thinkorswim platform with great educational resources.

2. E*TRADE – Easy-to-use interface and robust tools for new traders.

3. Charles Schwab – User-friendly platform with excellent research and no commissions on stocks.

4. Fidelity – Intuitive trading experience with strong customer support and educational content.

5. Robinhood – Simple mobile app for commission-free trading, ideal for beginners.

Each of these platforms provides essential features like real-time data, educational resources, and mobile access, making them suitable for novice traders.

How important is customer support in day trading platforms?

Customer support is crucial in day trading platforms for beginners. It ensures timely assistance during trading hours, helping users navigate issues or questions that could impact trades. Quality support can provide guidance on platform features, troubleshooting, and account management, which is vital for new traders facing a steep learning curve. Fast and effective customer service can enhance user confidence and trading experience, making it a key factor when choosing the best day trading platforms.

Can beginners use mobile apps for day trading effectively?

Yes, beginners can effectively use mobile apps for day trading. The best day trading platforms for beginners include Robinhood, Webull, and TD Ameritrade’s thinkorswim. These apps offer user-friendly interfaces, educational resources, and real-time data, making it easier to execute trades and manage investments. Additionally, features like paper trading allow beginners to practice without financial risk.

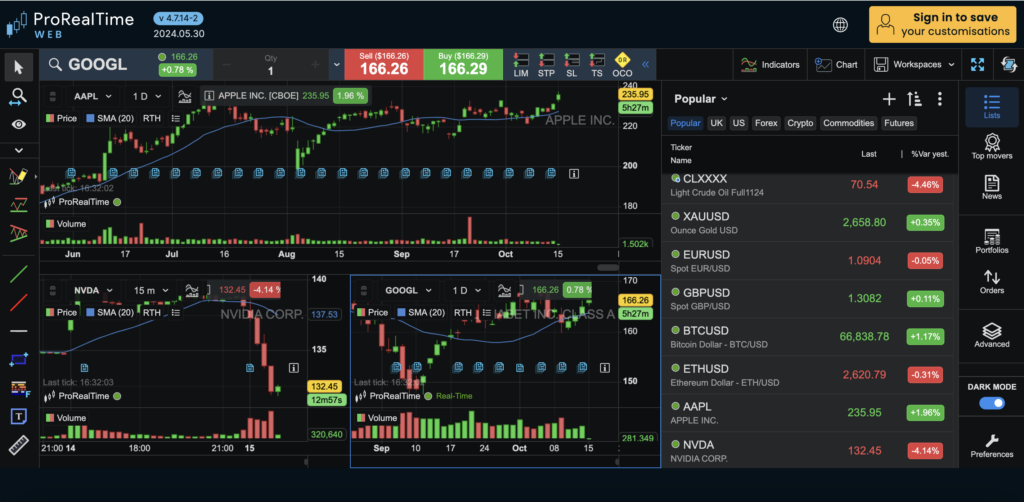

What is the role of charting tools in day trading for beginners?

Charting tools in day trading for beginners help visualize price movements and identify trends. They provide real-time data, allowing traders to make informed decisions quickly. With features like indicators, overlays, and customizable time frames, these tools enhance technical analysis. Beginners can spot entry and exit points, manage risk, and develop strategies effectively. Utilizing charting tools is essential for understanding market behavior and improving trading outcomes.

Are there educational resources available on day trading platforms?

Yes, many day trading platforms offer educational resources for beginners. Platforms like TD Ameritrade and E*TRADE provide free webinars, tutorials, and articles. Robinhood has a learning center with articles and videos. Interactive Brokers offers educational courses and trading simulations. Look for platforms that include demo accounts for practice.

Learn about Day Trading Brokers with Educational Resources

How do demo accounts work on day trading platforms?

Demo accounts on day trading platforms allow beginners to practice trading without risking real money. Users can simulate trades using virtual funds, gaining experience with market dynamics, order types, and platform features. These accounts replicate live market conditions, enabling traders to test strategies and build confidence before transitioning to real trading. Most platforms offer detailed analytics on performance, helping users refine their approach.

Learn about Day Trading Platforms Offering Demo Accounts

What security features should beginners consider in trading platforms?

Beginners should look for these security features in trading platforms:

1. Two-Factor Authentication (2FA): Adds an extra layer of protection by requiring a second form of verification.

2. Encryption: Ensure the platform uses SSL encryption to protect personal and financial data.

3. Regulatory Compliance: Choose platforms regulated by reputable authorities, like the SEC or FINRA, ensuring adherence to security standards.

4. Fund Insurance: Look for platforms that offer insurance on deposits, protecting against loss in case of a breach.

5. Account Monitoring: Select platforms that provide alerts for suspicious activity or unusual transactions.

6. Withdrawal Whitelists: Some platforms allow you to whitelist withdrawal addresses, minimizing unauthorized access.

These features help protect your assets and enhance trading security.

How do I set up an account on a day trading platform?

To set up an account on a day trading platform, follow these steps:

1. Choose a Platform: Research and select a beginner-friendly day trading platform like Robinhood, TD Ameritrade, or Webull.

2. Visit the Website/App: Go to the platform's website or download the app.

3. Sign Up: Click on “Sign Up” or “Open Account.” Enter your email and create a password.

4. Provide Personal Information: Fill in your name, address, date of birth, and Social Security number for identity verification.

5. Select Account Type: Choose between a cash or margin account, depending on your trading strategy.

6. Complete Financial Information: Answer questions about your trading experience, investment goals, and financial situation.

7. Verify Your Identity: Upload necessary documents like an ID or utility bill for verification.

8. Fund Your Account: Link a bank account and transfer funds to start trading.

9. Review and Agree: Read and accept the platform’s terms and conditions.

After these steps, your account will be set up, and you can start day trading.

Learn about How Does Broker Compliance Impact Day Trading Account Security?

What are the risks of day trading for beginners?

The risks of day trading for beginners include significant financial losses due to market volatility, the stress of rapid decision-making, and emotional trading that can lead to impulsive choices. Beginners may also face high transaction costs from frequent trades, lack of experience in technical analysis, and the potential for over-leveraging their accounts. Additionally, many beginners underestimate the time commitment required to research and monitor positions, which can lead to missed opportunities or poor trades.

How can beginners avoid common mistakes in day trading?

To avoid common mistakes in day trading, beginners should focus on using reliable trading platforms that offer user-friendly interfaces and educational resources. Choose platforms with demo accounts to practice without risk, like TD Ameritrade or eToro. Stick to a solid trading plan that includes clear entry and exit strategies. Set strict stop-loss levels to manage risk effectively. Stay updated on market news and trends, and avoid emotional trading by maintaining discipline. Lastly, start with smaller investments to minimize losses while you learn.

Learn about Common Mistakes in Day Trading Scalping and How to Avoid Them

What platforms offer the best analysis tools for day traders?

The best platforms for day traders that offer strong analysis tools include:

1. TD Ameritrade (thinkorswim) – Comprehensive charting, technical analysis, and real-time data.

2. E*TRADE – Robust research tools, advanced charting features, and customizable watchlists.

3. Interactive Brokers – Extensive analytics, low-cost trades, and powerful trading software.

4. Charles Schwab – Excellent research resources and advanced trading tools with intuitive navigation.

5. Fidelity – In-depth market analysis, research reports, and advanced charting capabilities.

These platforms cater well to beginners by providing user-friendly interfaces and educational resources alongside their analysis tools.

Learn about Best Technical Analysis Tools for Day Traders

Conclusion about Best Day Trading Platforms for Beginners

In conclusion, selecting the right day trading platform is crucial for beginners aiming to navigate the complexities of the market. Look for user-friendly interfaces, robust educational resources, and comprehensive customer support. Understanding fees, utilizing demo accounts, and leveraging analysis tools can significantly impact trading success. By considering these factors, beginners can make informed decisions that enhance their trading experience. For further insights and guidance, DayTradingBusiness is here to help you every step of the way.

Learn about Day Trading Brokers with the Best Trading Platforms

Sources:

- All-to-All Trading in the U.S. Treasury Market

- Finance & Development, June 2008 - Back to Basics

- A Profitable Day Trading Strategy For The U.S. Equity Market by ...

- Assessment of users' adoption behaviour for stock market ...

- Mobile device use and the ranking effect on trading behavior ...

- The performance of retail investors, trading intensity and time in the ...