Did you know that some AI trading bots have been known to operate faster than the average human can blink? In the fast-paced world of day trading, leveraging AI tools can significantly enhance your strategies and improve your performance. This article explores the best AI tools for day trading, highlighting their features, advantages, and how they can mitigate risks. We discuss the top platforms available in 2023, the role of machine learning, and even free options for those just starting out. Whether you're a beginner or an experienced trader, understanding how to integrate AI into your trading can transform your approach. Join us as we delve into the essential insights provided by DayTradingBusiness to help you choose the right AI tools tailored to your trading style.

What are the top AI tools for day trading?

The top AI tools for day trading include:

1. Trade Ideas: Uses AI to scan markets, identify patterns, and generate trade ideas in real-time.

2. MetaTrader 4/5: Offers algorithmic trading capabilities with custom scripts and expert advisors.

3. Kavout: Utilizes machine learning to provide stock ratings and predictions.

4. QuantConnect: A cloud-based algorithmic trading platform for backtesting and deploying strategies.

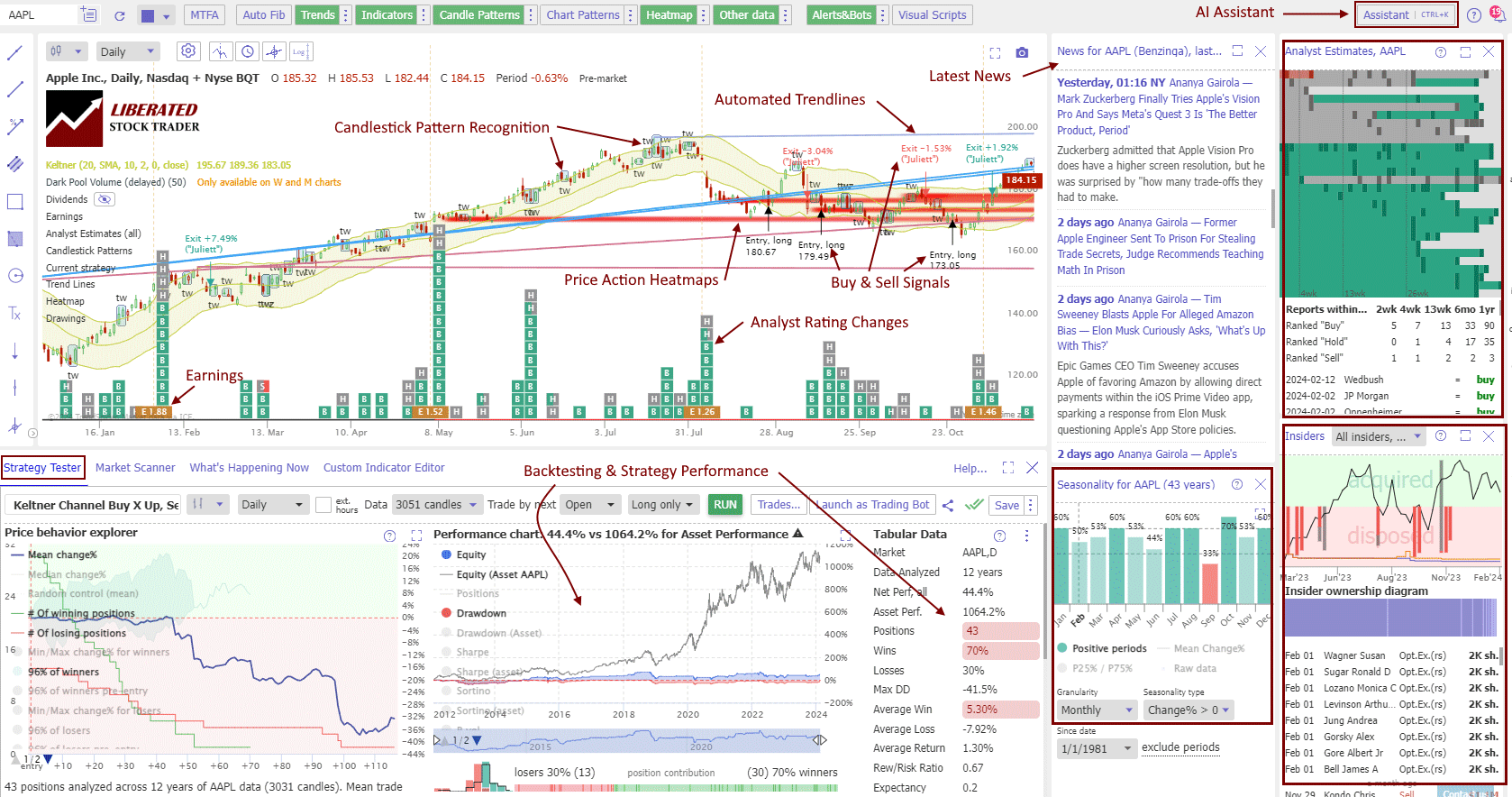

5. TrendSpider: Features AI-powered technical analysis and automated trendline detection.

6. Zorro Trader: A versatile platform for algorithmic trading with powerful scripting options.

7. AlgoTrader: Supports automated trading strategies across multiple asset classes.

These tools enhance decision-making and execution speed, crucial for successful day trading.

How do AI tools improve day trading strategies?

AI tools improve day trading strategies by analyzing vast amounts of market data quickly, identifying patterns, and generating predictive insights. They can optimize trade execution, manage risk, and automate trading decisions based on real-time analysis. Some of the best AI tools for day trading include Trade Ideas for its powerful scanning capabilities, MetaTrader for algorithmic trading, and Thinkorswim for its advanced charting features. These tools enhance traders' abilities to make informed decisions, capitalize on market fluctuations, and minimize losses.

What features should I look for in AI day trading software?

Look for AI day trading software that offers real-time market analysis, predictive analytics, automated trading, customizable algorithms, backtesting capabilities, risk management tools, and a user-friendly interface. Ensure it integrates with multiple trading platforms and provides access to historical data. Additionally, prioritize software with strong customer support and a community for shared insights.

Are there free AI tools available for day trading?

Yes, there are several free AI tools available for day trading. Some of the best options include:

1. TradingView – Offers powerful charting tools and social networking features for traders.

2. Thinkorswim by TD Ameritrade – Includes paper trading and advanced analytics at no cost.

3. Yahoo Finance – Provides stock screening and real-time data.

4. Stocktwits – A platform for real-time insights and sentiment analysis from other traders.

5. QuantConnect – An algorithmic trading platform with free access to historical data for backtesting strategies.

These tools can enhance your trading strategies without any financial commitment.

How do AI algorithms analyze market trends for day trading?

AI algorithms analyze market trends for day trading by processing large datasets, identifying patterns, and making predictions. They use techniques like machine learning to evaluate historical price movements, trading volumes, and news sentiment. Tools like Trade Ideas, MetaTrader, and Alpaca leverage AI to generate real-time insights and automate trading strategies. These algorithms can adapt to market changes quickly, enhancing decision-making for traders.

Can AI tools help reduce risks in day trading?

Yes, AI tools can significantly reduce risks in day trading by providing data analysis, predictive analytics, and real-time insights. Some of the best AI tools for day trading include:

1. Trade Ideas: Offers AI-driven alerts and market predictions.

2. MetaStock: Analyzes historical data and trends for better decision-making.

3. Kavout: Uses machine learning to rate stocks and generate actionable signals.

4. Sentiment Analysis Tools: Monitor social media and news for market sentiment.

5. QuantConnect: Enables backtesting and algorithmic trading strategies.

These tools help traders make informed decisions, minimize losses, and optimize trading strategies.

What are the best AI trading bots for beginners?

The best AI trading bots for beginners include:

1. Trade Ideas: Offers real-time data and advanced charting.

2. CryptoHopper: User-friendly interface with automated trading for cryptocurrencies.

3. 3Commas: Supports various exchanges and features smart trading tools.

4. Zignaly: Focuses on copy trading and has a straightforward setup.

5. AlgoTrader: Provides backtesting and algorithm development for stocks and crypto.

These platforms simplify trading for beginners with intuitive designs and robust features.

How does machine learning enhance day trading performance?

Machine learning enhances day trading performance by analyzing vast amounts of market data to identify patterns and trends that human traders might miss. Tools like Trade Ideas and MetaTrader leverage algorithms to predict price movements, optimize trading strategies, and execute trades automatically. These AI tools provide real-time insights, backtesting features, and risk management solutions, allowing traders to make informed decisions quickly. By using machine learning, day traders can improve accuracy, reduce emotional bias, and increase profitability.

What are the advantages of using AI for day trading?

AI tools for day trading offer several advantages:

1. Data Analysis: They process vast amounts of market data quickly, identifying trends and patterns that human traders might miss.

2. Risk Management: AI algorithms can set stop-loss orders and manage trades based on real-time risk assessments.

3. Speed and Efficiency: AI executes trades faster than humans, capitalizing on fleeting market opportunities.

4. 24/7 Monitoring: AI tools continuously monitor markets, allowing for trades even when a trader is unavailable.

5. Emotion-Free Trading: AI removes emotional biases, making decisions based purely on data and algorithms.

6. Backtesting Capabilities: They can simulate trading strategies using historical data to optimize performance before real trading.

7. Customization: Many AI tools can be tailored to individual trading strategies and risk tolerances.

These advantages make AI a powerful ally for day traders aiming to improve their strategies and results.

How can I choose the right AI tool for my trading style?

To choose the right AI tool for day trading, consider these factors:

1. Trading Strategy: Identify your specific style, whether it's momentum trading, scalping, or swing trading. Look for tools that specialize in your approach.

2. Data Analysis: Ensure the AI tool provides real-time data analysis and indicators that align with your trading strategy.

3. User Experience: Choose a platform that is intuitive and easy to navigate. A complicated interface can hinder your trading efficiency.

4. Backtesting Features: Look for tools that allow you to backtest strategies with historical data to assess performance before live trading.

5. Integration: Ensure the AI tool integrates well with your existing trading platform or brokerage.

6. Cost: Assess the pricing structure. Some tools charge monthly fees, while others take a share of your profits.

7. Community and Support: Opt for tools that offer a strong user community and customer support for troubleshooting and sharing insights.

8. Reputation and Reviews: Check user reviews and testimonials to gauge the effectiveness of the tool in real-world trading scenarios.

By evaluating these aspects, you can select an AI tool that enhances your day trading experience.

Learn about How to Choose the Right Backtesting Software for Day Trading

What are the limitations of AI tools in day trading?

AI tools in day trading have several limitations:

1. Data Dependency: They rely on historical data, which may not predict future performance accurately.

2. Market Volatility: Rapid market changes can render algorithms ineffective or lead to losses.

3. Lack of Intuition: AI lacks human judgment and cannot consider news events or market sentiment.

4. Overfitting: Models can become too tailored to past data, failing to adapt to new conditions.

5. Technical Issues: System failures or glitches can disrupt trading strategies.

6. Regulatory Constraints: Compliance with trading regulations can limit AI tool capabilities.

7. Costs: High-quality AI tools may be expensive, impacting profitability.

These limitations highlight the need for human oversight when using AI in day trading.

How do I integrate AI tools with my existing trading platform?

To integrate AI tools with your existing trading platform, follow these steps:

1. Choose the Right AI Tool: Select an AI tool designed for day trading, like Trade Ideas or MetaTrader with AI plugins.

2. APIs and Plugins: Ensure the AI tool has API access or compatible plugins for your platform. This allows seamless data exchange.

3. Data Integration: Connect the AI tool to your trading platform by importing historical data and setting up real-time data feeds.

4. Customize Settings: Adjust the AI tool’s parameters to align with your trading strategy, including risk management and asset preferences.

5. Backtesting: Use historical data to backtest the AI’s performance before going live.

6. Monitor and Adjust: Continuously monitor the AI's performance and make adjustments as needed based on market conditions.

This approach will help you effectively integrate AI into your trading strategy for enhanced decision-making.

Learn about How to Integrate AI with My Day Trading Platform?

What are the most popular AI trading platforms in 2023?

The most popular AI trading platforms in 2023 include:

1. Trade Ideas – Known for its AI-powered stock scanning and real-time alerts.

2. MetaTrader 4/5 – Offers automated trading through expert advisors and algorithmic trading.

3. Zerodha Kite – Integrates AI tools for data analysis and trade execution.

4. QuantConnect – A cloud-based platform for algorithmic trading using AI models.

5. Tastyworks – Features AI-driven insights for options trading strategies.

These platforms leverage AI to enhance trading decisions, automate processes, and improve profitability.

How does sentiment analysis work in AI day trading tools?

Sentiment analysis in AI day trading tools works by analyzing news, social media, and market data to gauge public sentiment about stocks. It uses natural language processing (NLP) to identify positive, negative, or neutral sentiments, helping traders make informed decisions. These tools scan vast amounts of text to detect trends and predict market movements based on collective emotions and opinions. By integrating sentiment analysis with real-time trading data, AI tools can execute trades that align with market sentiment shifts, increasing the chances of profitable outcomes.

Learn about How to Build a Sentiment Analysis Dashboard for Day Trading

What are user reviews saying about AI day trading tools?

User reviews of AI day trading tools highlight their effectiveness in analyzing market trends and executing trades quickly. Many users praise the accuracy of predictions and the ability to manage risks through automated strategies. Some mention a steep learning curve but appreciate the educational resources provided. Overall, users value the time savings and potential profit increases these tools offer, while noting the importance of understanding market dynamics for optimal results.

Learn about User Reviews of Popular Day Trading Brokers

How can I automate my day trading using AI technology?

To automate your day trading using AI technology, consider these tools:

1. Trade Ideas: Offers AI-driven trading signals and backtesting features.

2. MetaTrader 4/5: Supports algorithmic trading with custom scripts and expert advisors.

3. QuantConnect: Provides a platform for algorithm development and backtesting with real market data.

4. Alpaca: A commission-free trading platform with API access for algorithmic trading.

5. Kavout: Uses AI to analyze stocks and generate trade ideas based on historical data.

Choose a tool that fits your trading strategy, and leverage its features to automate your trades effectively.

Learn about How to Automate My Day Trading with Bots?

Conclusion about What Are the Best AI Tools for Day Trading?

Incorporating AI tools into day trading can significantly enhance your strategies, improve decision-making, and reduce risks. When selecting the right AI software, consider features like market trend analysis, automation capabilities, and user reviews to ensure it aligns with your trading style. While there are free options available, it's vital to weigh their limitations against your goals. For those looking to elevate their trading game, exploring the offerings from DayTradingBusiness can provide valuable insights and guidance on the best AI tools tailored for your needs.

Sources:

- A Profitable Day Trading Strategy For The U.S. Equity Market by ...

- A profitable trading algorithm for cryptocurrencies using a Neural ...

- Opinion Paper: “So what if ChatGPT wrote it?” Multidisciplinary ...

- Artificial intelligence (AI) applications for marketing: A literature ...

- AI revolutionizing industries worldwide: A comprehensive overview ...