Did you know that trading volume can sometimes be louder than a crowded concert? In the world of trading, volume analysis is a key player, providing insights that can significantly enhance your market strategies. This article delves into the essentials of volume analysis, exploring its importance in technical analysis, its role in confirming price trends, and how to effectively integrate it with other indicators like moving averages and momentum tools. Discover why understanding volume is crucial for identifying breakouts, predicting market reversals, and making informed trading decisions. With tips on avoiding common mistakes and utilizing visualization tools, DayTradingBusiness equips you with the knowledge to leverage volume analysis for optimal results.

What is Volume Analysis in Trading?

Volume analysis in trading examines the number of shares or contracts traded within a specific timeframe. It helps traders understand market strength and trends. When integrated with indicators like moving averages or RSI, volume can confirm price movements. For instance, rising prices with increasing volume often signal a strong uptrend, while decreasing volume might indicate a potential reversal. Using volume alongside these indicators enhances decision-making, providing a clearer picture of market dynamics.

How Does Volume Analysis Enhance Technical Analysis?

Volume analysis enhances technical analysis by providing insight into the strength of price movements. When price increases with high volume, it signals strong buying interest, potentially indicating a sustainable trend. Conversely, if prices rise on low volume, the trend may lack conviction.

Integrating volume with indicators like moving averages can confirm signals; for example, a crossover with high volume strengthens the signal's reliability. Additionally, combining volume with momentum indicators helps identify overbought or oversold conditions, offering clearer entry and exit points. Overall, volume analysis adds depth, helping traders make more informed decisions.

Why is Volume Important for Stock Market Trends?

Volume is crucial for stock market trends because it confirms price movements. High volume during a price increase suggests strong buying interest, while high volume during a decline indicates selling pressure. Integrating volume analysis with indicators like moving averages or RSI enhances reliability. For instance, if a stock breaks through resistance with high volume, it's a stronger signal than price movement alone. Conversely, a price change on low volume might indicate a lack of conviction. Overall, volume provides context and validates trends, making it essential for effective trading strategies.

What Indicators Work Well with Volume Analysis?

Moving Averages complement volume analysis by smoothing price data, helping identify trends. The Relative Strength Index (RSI) can indicate overbought or oversold conditions, enhancing volume insights. Bollinger Bands provide context for price volatility, making volume spikes more meaningful. On-Balance Volume (OBV) tracks cumulative volume changes, confirming price movements. Finally, the Accumulation/Distribution Line assesses buying and selling pressure, giving deeper insights when combined with volume metrics.

How Can You Use Volume to Confirm Price Trends?

To confirm price trends using volume, look for the following key indicators:

1. Rising Volume with Price Increase: When prices are rising, increasing volume supports the trend, indicating strong buyer interest.

2. Falling Volume with Price Increases: If prices rise but volume decreases, this suggests weakening momentum, signaling a potential reversal.

3. Rising Volume with Price Decrease: A price drop accompanied by increasing volume indicates strong selling pressure, reinforcing the downtrend.

4. Volume Spikes at Support/Resistance Levels: High volume at these levels can confirm breakouts or reversals. For example, if a stock breaks resistance with high volume, it’s likely to continue upward.

5. Volume Divergence: If price trends upward but volume trends downward (or vice versa), it can signal a potential trend change.

Integrate these volume insights with other indicators like moving averages or RSI for a more robust analysis.

What Role Does Volume Play in Identifying Breakouts?

Volume plays a crucial role in identifying breakouts by confirming the strength of a price movement. High volume during a breakout suggests strong investor interest and increases the likelihood that the trend will continue. Conversely, low volume may indicate a lack of conviction, potentially signaling a false breakout. When combined with other indicators like moving averages or RSI, volume can provide clearer signals, helping traders make more informed decisions. For instance, if a stock breaks above resistance with significant volume, it's more likely to sustain that upward movement.

How to Integrate Volume with Moving Averages?

To integrate volume with moving averages, follow these steps:

1. Choose Your Moving Average: Select a simple moving average (SMA) or exponential moving average (EMA) based on your trading strategy.

2. Analyze Volume Trends: Look at volume bars alongside price charts. High volume on price increases indicates strong buyer interest, while high volume on price decreases suggests selling pressure.

3. Confirm Signals: Use volume to confirm moving average crossovers. For example, if a short-term moving average crosses above a long-term average with high volume, it signals a strong bullish trend.

4. Divergence Analysis: Identify divergence between price and volume. If price rises but volume falls, it may indicate a weakening trend.

5. Volume-based Indicators: Combine moving averages with volume indicators like On-Balance Volume (OBV) or the Volume Weighted Average Price (VWAP) for deeper insights.

6. Adjust for Context: Consider the market context. In a trending market, volume confirmation is more crucial than in a sideways market.

By integrating volume with moving averages, you enhance your trading decisions through stronger confirmation of trends and reversals.

What are the Best Volume Indicators for Day Trading?

The best volume indicators for day trading include:

1. Volume Moving Average: Smooths out volume spikes to identify trends.

2. Accumulation/Distribution Line: Shows the relationship between price movement and volume, indicating buying or selling pressure.

3. On-Balance Volume (OBV): Links volume to price changes, helping to confirm trends.

4. Chaikin Money Flow (CMF): Combines price and volume to assess buying and selling pressure over a set period.

5. Volume Rate of Change (VROC): Measures the change in volume over time, indicating potential trend shifts.

Integrating these indicators with price action can enhance trading decisions and signal potential entry or exit points.

How Does Volume Affect Support and Resistance Levels?

Volume affects support and resistance levels by confirming their strength. High volume at a support level suggests strong buying interest, increasing the likelihood that the price will hold. Conversely, high volume at a resistance level indicates strong selling pressure, making it harder for the price to break through. When combined with other indicators, like moving averages or trend lines, volume can validate price movements. For example, a breakout above resistance on high volume is more reliable than one on low volume, signaling stronger momentum.

Can Volume Analysis Help Predict Market Reversals?

Yes, volume analysis can help predict market reversals when integrated with other indicators. High volume during price movements often signals strength or weakness. For example, if a stock rallies on high volume and then reverses on low volume, it may indicate a potential reversal. Combining volume analysis with indicators like RSI or MACD enhances accuracy by confirming trends or divergences. Look for patterns where volume spikes accompany price changes for stronger signals.

How to Combine Volume with Momentum Indicators?

To combine volume with momentum indicators, start by using a momentum indicator like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD). Look for signals where momentum confirms volume trends. For example, if the RSI is rising and volume increases, it suggests a strong bullish trend. Conversely, if the price rises but volume declines, it may indicate a weakening trend. Use volume moving averages to identify breakouts. A price breakout with high volume and positive momentum signals a stronger move. Always cross-verify signals to improve accuracy.

What is the Relationship Between Volume and Volatility?

Volume and volatility are closely linked in trading. High trading volume often indicates strong interest and can precede or coincide with increased volatility. When volume spikes, it suggests that many traders are entering or exiting positions, which can lead to larger price swings. Conversely, low volume may indicate a lack of conviction, resulting in reduced volatility. Analyzing volume alongside volatility helps traders identify potential breakout or breakdown points, enhancing decision-making. Integrating volume analysis with other indicators, like moving averages or RSI, can provide a clearer picture of market trends and improve trading strategies.

How to Analyze Volume Patterns for Better Trading Decisions?

To analyze volume patterns for better trading decisions, start by observing volume spikes during price movements. High volume on uptrends suggests strong buying interest, while high volume on downtrends indicates selling pressure. Combine volume analysis with price action indicators like moving averages or RSI. For instance, if price breaks above a moving average on high volume, it signals a potential buy. Conversely, if price approaches resistance with increasing volume but fails to break, it may indicate a reversal. Use volume patterns alongside trend indicators to confirm signals and make more informed trading decisions.

Learn about How to Analyze Trading Volume for Day Trading Success

What Tools Can Help Visualize Volume Data?

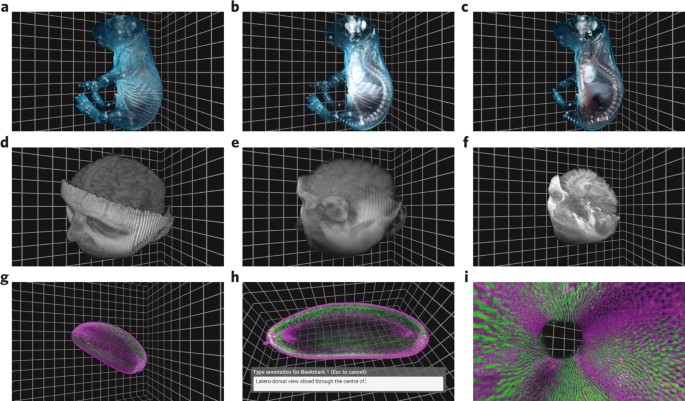

To visualize volume data effectively, use tools like TradingView for interactive charts, MetaTrader for forex and stock volume analysis, and Tableau for comprehensive data visualization. Additionally, consider software like Thinkorswim, which provides advanced volume indicators, and Python libraries like Matplotlib or Seaborn for custom visualizations. Each tool integrates well with other indicators for a holistic analysis.

How Does Volume Impact Different Asset Classes?

Volume impacts asset classes by indicating the strength of price movements. In stocks, high volume during a price increase suggests strong buying interest, while low volume can signal weakness. For commodities, volume can validate trends; rising prices with increased volume indicate robust demand. In forex, volume helps assess liquidity and market sentiment; high volume can confirm trend direction. Integrating volume analysis with indicators like moving averages or RSI enhances decision-making, providing a clearer picture of market dynamics.

What Common Mistakes Should You Avoid with Volume Analysis?

Avoid these common mistakes with volume analysis:

1. Ignoring price trends: Always consider volume alongside price movement. Volume spikes without price action can be misleading.

2. Relying solely on volume: Don’t use volume in isolation. Combine it with indicators like moving averages or RSI for better context.

3. Misinterpreting low volume: Low volume doesn’t always indicate a lack of interest. Assess it within the broader market context.

4. Overlooking timeframes: Use consistent timeframes for volume analysis. Daily volume can differ significantly from weekly or monthly.

5. Neglecting news events: Major news can skew volume. Be aware of upcoming announcements that might affect trading activity.

6. Failing to analyze patterns: Look for volume patterns, such as accumulation or distribution, to inform your trading decisions.

By integrating volume analysis with other indicators and being mindful of these pitfalls, you can enhance your trading strategy.

Conclusion about Integrating Volume Analysis with Other Indicators

Incorporating volume analysis into your trading strategy can significantly enhance your decision-making process. By understanding its relationship with other indicators, you can better identify trends, breakouts, and potential reversals. Leveraging tools and techniques discussed can lead to more informed trading choices. For those looking to elevate their trading game, resources from DayTradingBusiness provide invaluable insights and guidance on effectively utilizing volume analysis in conjunction with various indicators.