Did you know that even the best traders can be swayed by a cute cat video during market hours? In the world of day trading, sentiment plays a pivotal role in shaping decisions and outcomes. This article delves into the significance of sentiment in day trading psychology, exploring how it influences success and the critical role of emotional control. You'll learn to analyze market sentiment and avoid common emotional pitfalls, understand the impact of fear on performance, and discover effective strategies to manage your emotions. We’ll also cover the relationship between market trends and sentiment, the effects of news events, and the importance of self-awareness. Plus, find out how visualization techniques and community sentiment can enhance your trading mindset. With insights from DayTradingBusiness, you'll be better equipped to navigate the emotional landscape of trading.

How Does Sentiment Influence Day Trading Success?

Sentiment significantly influences day trading success by affecting traders' decisions and market behavior. Positive sentiment can drive buying pressure, leading to price increases, while negative sentiment often results in selling and price declines. Traders who can gauge market sentiment—through news, social media, or technical indicators—can make more informed decisions. Emotional discipline is crucial; fear and greed can lead to impulsive trades, undermining strategy. Understanding sentiment helps traders anticipate market movements and manage risk effectively, enhancing their overall performance.

What Role Does Emotional Control Play in Day Trading?

Emotional control is crucial in day trading because it helps traders make rational decisions rather than impulsive ones. When emotions like fear or greed take over, traders may exit positions too early or hold onto losing trades too long. By maintaining emotional control, traders can stick to their strategies, manage risk effectively, and stay disciplined during market fluctuations. This control enhances focus, reduces stress, and ultimately leads to better trading outcomes.

Why Is Understanding Market Sentiment Crucial for Traders?

Understanding market sentiment is crucial for traders because it influences price movements and helps predict market trends. Traders who grasp sentiment can make informed decisions, identify potential reversals, and time their entries and exits more effectively. It aids in gauging the emotional state of the market, allowing traders to capitalize on overreactions or irrational behaviors. By aligning their strategies with prevailing sentiment, traders can enhance their chances of success and manage risk better.

How Can Traders Analyze Sentiment to Make Better Decisions?

Traders can analyze sentiment by monitoring social media trends, news headlines, and market forums to gauge public opinion about stocks. Tools like sentiment analysis software or platforms that track trader sentiment can provide insights into bullish or bearish trends. Additionally, observing price movements in relation to news events helps identify how sentiment influences market behavior. By integrating this analysis with technical indicators, traders can make informed decisions, aligning their strategies with prevailing market emotions.

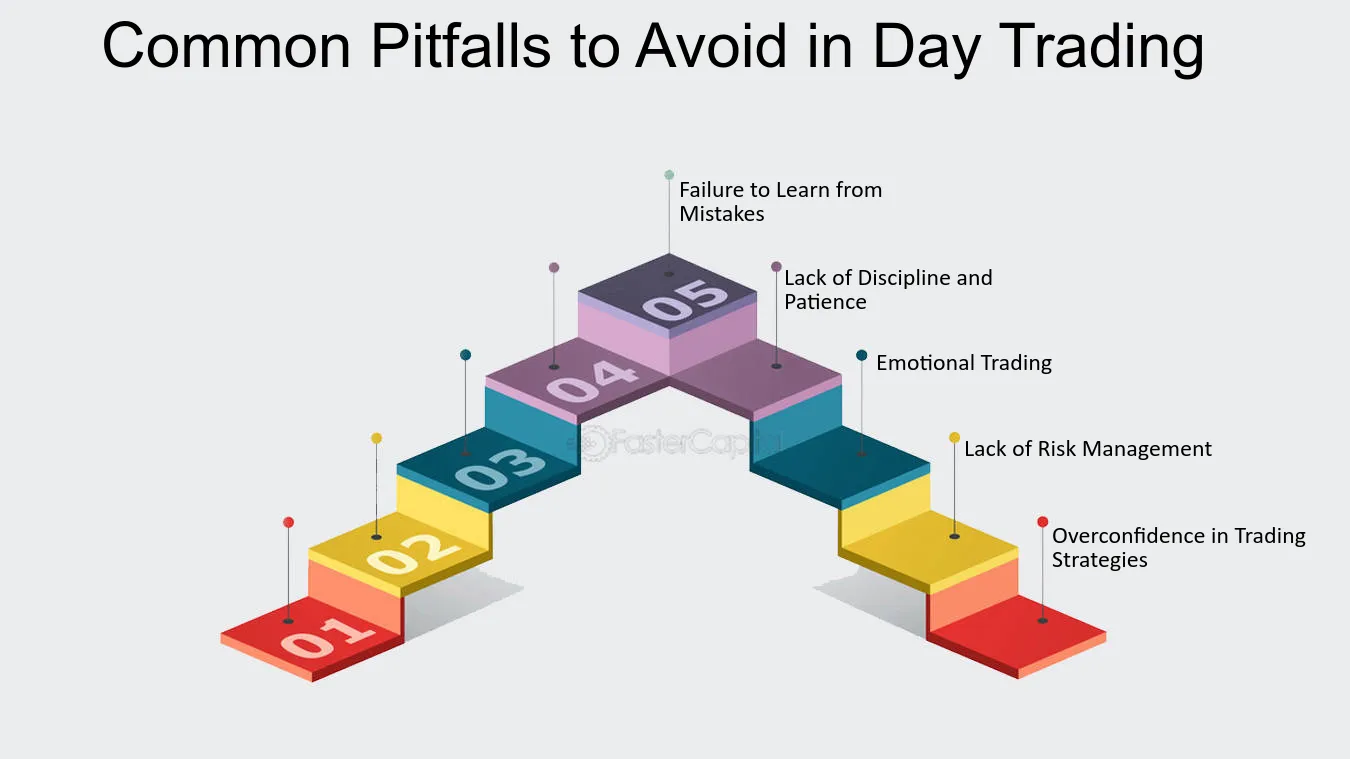

What Are Common Emotional Pitfalls in Day Trading?

Common emotional pitfalls in day trading include fear of missing out (FOMO), which drives traders to enter positions impulsively; overconfidence, leading to excessive risk-taking; and fear of loss, causing premature exits. Additionally, revenge trading can occur when traders try to recover losses quickly, often resulting in poor decisions. Emotional attachment to trades can cloud judgment, making it hard to stick to a strategy. Managing these emotions is crucial for successful day trading.

How Does Fear Impact Day Trading Performance?

Fear can significantly hinder day trading performance by clouding judgment and leading to impulsive decisions. When traders are afraid of losses, they might exit positions too early or avoid taking necessary risks, missing out on potential gains. This emotional reaction often causes them to overanalyze and second-guess strategies, resulting in missed opportunities. Additionally, heightened fear can lead to a lack of confidence, causing traders to stick to safer trades rather than executing their well-researched plans. Ultimately, managing fear is crucial for maintaining a disciplined approach and optimizing day trading outcomes.

What Strategies Help Manage Emotions in Day Trading?

1. Set Clear Rules: Establish a trading plan with entry and exit criteria to minimize impulsive decisions driven by emotions.

2. Use Stop-Loss Orders: Implement stop-loss orders to limit potential losses, reducing anxiety during trades.

3. Practice Mindfulness: Engage in mindfulness techniques to stay present and avoid emotional reactions to market fluctuations.

4. Keep a Trading Journal: Document trades and emotions to identify patterns and improve decision-making over time.

5. Take Breaks: Step away from the screen periodically to clear your mind and reduce emotional fatigue.

6. Focus on the Process: Concentrate on executing your strategy rather than the outcome of individual trades to maintain a balanced mindset.

7. Manage Risk: Only risk a small percentage of your capital on each trade to alleviate fear and stress.

8. Stay Educated: Continuously learn about market trends and strategies to boost confidence and reduce anxiety.

How Can Traders Use Sentiment Indicators Effectively?

Traders can use sentiment indicators effectively by analyzing market mood through tools like the Fear and Greed Index or sentiment surveys. They should look for extreme readings—high fear may signal a buying opportunity, while extreme greed could indicate a sell point. Combining sentiment analysis with technical indicators can enhance decision-making. Additionally, monitoring social media and news can provide real-time insights into trader psychology. Finally, staying aware of how sentiment shifts can impact price movements helps traders adapt strategies accordingly.

What Is the Relationship Between Sentiment and Market Trends?

Sentiment significantly influences market trends in day trading. When traders are optimistic, buying pressure increases, often driving prices up. Conversely, negative sentiment can lead to selling pressure and declining prices. Understanding market sentiment helps traders anticipate movements and make informed decisions. Analyzing social media, news, and trader behavior can provide insights into the prevailing sentiment, guiding entry and exit points effectively.

How Do News Events Affect Trader Sentiment?

News events significantly impact trader sentiment by influencing perceptions of market conditions. Positive news, like strong earnings reports, can boost optimism, leading to increased buying activity. Conversely, negative news, such as economic downturns or geopolitical tensions, can create fear, prompting selling pressure. This shift in sentiment affects trading decisions, driving volatility and creating opportunities for day traders. Understanding these reactions helps traders anticipate market movements and adjust strategies accordingly.

Learn about How News Events Affect Reversal Trading Strategies

Why Is Self-Awareness Important in Day Trading Psychology?

Self-awareness in day trading psychology is crucial because it helps traders recognize their emotions and biases, which can impact decision-making. By understanding personal triggers, traders can manage fear and greed, leading to more rational choices. This awareness also allows for better risk assessment and the ability to stick to a trading plan. Ultimately, self-awareness fosters discipline and resilience, essential traits for navigating the volatile market effectively.

Learn about Why Is Institutional Trading Important for Day Traders?

How Can Visualization Techniques Improve Trading Mindset?

Visualization techniques can enhance your trading mindset by helping you mentally rehearse successful trading scenarios. By vividly imagining profitable trades, you reinforce positive outcomes and reduce anxiety. This practice builds confidence and clarity, allowing you to make better decisions under pressure. Additionally, visualizing potential pitfalls prepares you for setbacks, promoting resilience. Overall, visualization sharpens focus, aligns your mindset with your trading goals, and helps manage emotions, which is crucial for effective day trading.

What Are the Benefits of a Positive Trading Mindset?

A positive trading mindset boosts confidence, enhances decision-making, and reduces emotional stress. It helps traders stay disciplined, stick to their strategies, and avoid impulsive actions. With optimism, you’re more likely to view losses as learning opportunities, which fosters resilience. A constructive outlook also improves focus, allowing for better analysis of market trends. Ultimately, this mindset can lead to more consistent profits and a healthier trading experience.

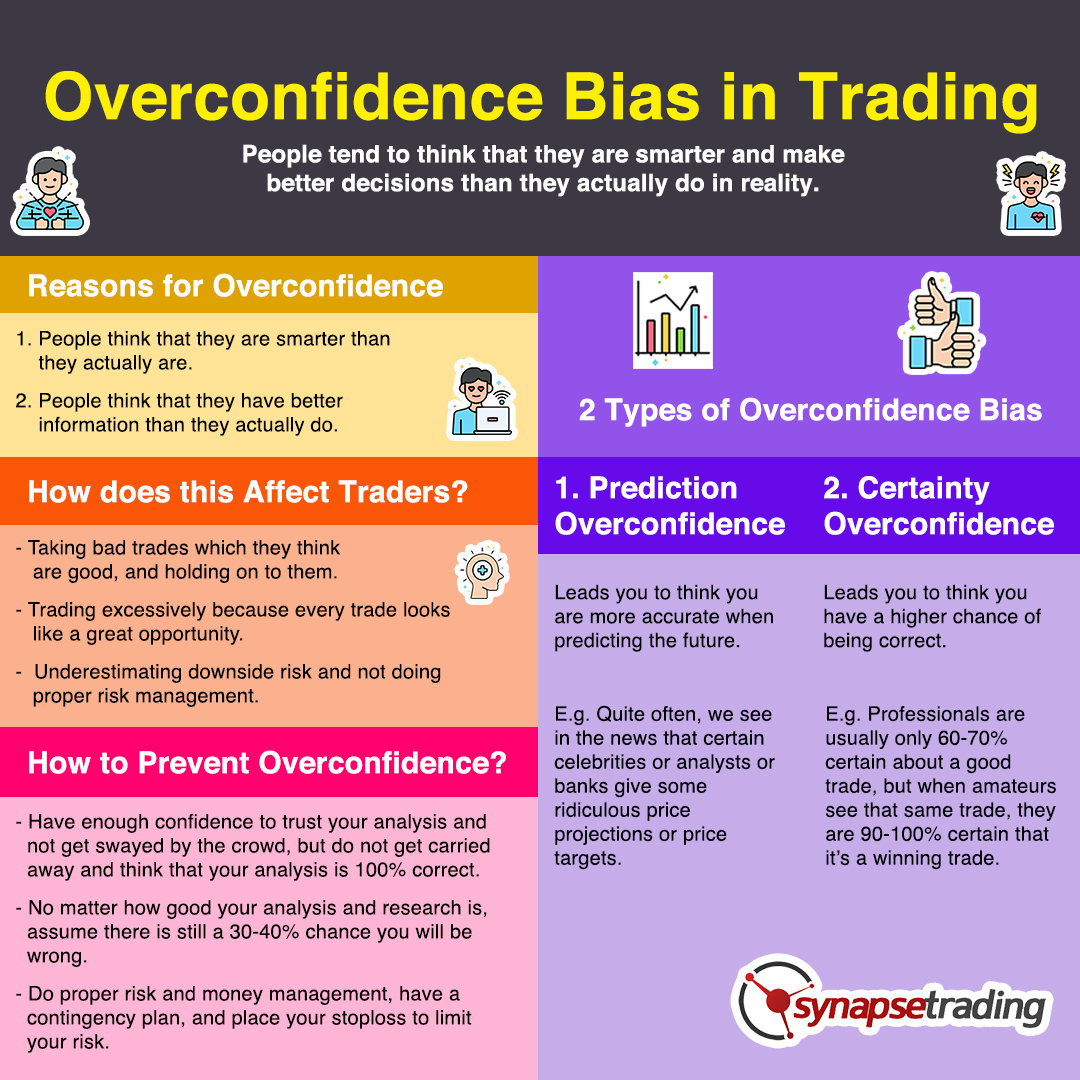

How Does Overconfidence Affect Day Trading Decisions?

Overconfidence in day trading leads to poor decision-making and increased risk-taking. Traders may overestimate their abilities, often resulting in excessive positions and ignoring market signals. This bias can cause them to hold losing trades too long, convinced they’ll turn around, or to enter trades without adequate analysis. Ultimately, overconfidence can inflate losses and skew performance, undermining overall trading success.

Learn about How Does Insider Trading Affect Day Traders?

What Techniques Can Help Traders Stay Objective?

Traders can stay objective by using several techniques:

1. Set Clear Rules: Establish specific entry and exit points before trading. This reduces emotional decision-making.

2. Use a Trading Journal: Document trades, thoughts, and feelings to identify patterns in behavior and improve discipline.

3. Practice Mindfulness: Engage in mindfulness or meditation to manage stress and maintain focus during trading sessions.

4. Limit Screen Time: Reduce exposure to market noise and social media to avoid influence from others' sentiments.

5. Emotional Check-ins: Regularly assess your emotional state before and during trading to recognize bias.

6. Automate Trades: Use algorithms or trading bots to take emotion out of the process and stick to your strategy.

7. Establish a Support System: Surround yourself with other traders for accountability and to share insights without bias.

Implementing these techniques can help maintain objectivity and improve trading outcomes.

How Can Community Sentiment Influence Individual Trading Choices?

Community sentiment can significantly shape individual trading choices by creating a collective mindset that influences decisions. When traders observe a majority expressing bullish or bearish views, they may feel compelled to align their trades with the prevailing sentiment, fearing they might miss out (FOMO) or face backlash. This social influence can lead to herd behavior, where traders follow trends rather than relying on their analysis. Additionally, sentiment can provide insights into market psychology, helping traders gauge potential price movements. Ultimately, being aware of community sentiment allows traders to make more informed choices, balancing personal analysis with the prevailing market mood.

Conclusion about The Importance of Sentiment in Day Trading Psychology

Understanding and managing sentiment is crucial for success in day trading. Emotional control directly impacts decision-making, and recognizing market sentiment helps traders navigate trends effectively. By analyzing sentiment indicators and remaining self-aware, traders can mitigate common emotional pitfalls and make informed choices. Visualization techniques and a positive mindset further enhance performance, while community sentiment can shape individual strategies. For those looking to deepen their grasp of trading psychology, leveraging insights from experts at DayTradingBusiness can provide valuable support and resources.