Did you know that the average day trader spends more time on their screens than a teenager binge-watching their favorite series? In the fast-paced world of day trading, having the right tools is crucial for success. This article dives into essential day trading tools, from trading platforms and software for technical analysis to the importance of real-time data and stock screeners. Discover how charts can refine your strategies, why news feeds matter, and the role of mobile apps in your trading arsenal. We’ll also cover risk management tools, the benefits of automated trading systems, and the value of community forums. Plus, learn how to effectively use paper trading tools and maintain a trading journal to boost your performance. Finally, we’ll discuss the costs of these tools and how to choose the right broker. Let DayTradingBusiness guide you through each vital aspect to elevate your day trading game!

What are the essential tools for day trading?

The essential tools for day trading include:

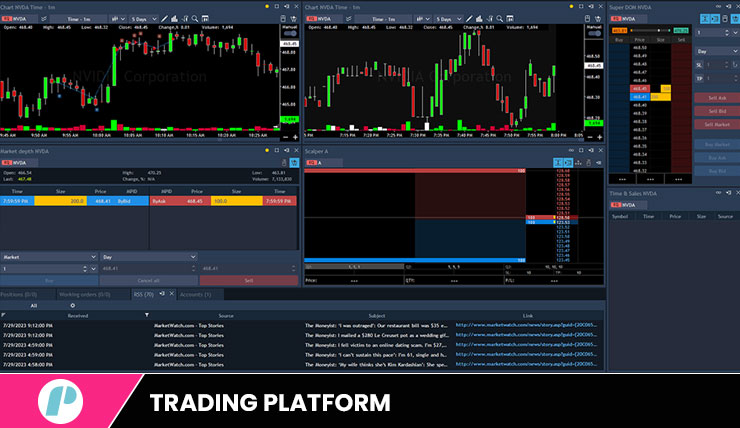

1. Trading Platform: A reliable platform like TD Ameritrade, E*TRADE, or Interactive Brokers for executing trades efficiently.

2. Charting Software: Tools like TradingView or MetaTrader for real-time charting and technical analysis.

3. Brokerage Account: A brokerage account with low commissions and access to real-time data.

4. News Feed: A fast news feed service, such as Bloomberg or CNBC, to stay updated on market-moving events.

5. Technical Indicators: Tools like moving averages, RSI, or MACD for analyzing price trends.

6. Risk Management Tools: Stop-loss orders and position sizing calculators to manage risk effectively.

7. Economic Calendar: A calendar to track upcoming economic events that may impact the markets.

These tools help streamline trading processes and enhance decision-making.

How do trading platforms differ for day traders?

Trading platforms for day traders differ mainly in features, speed, fees, and usability. Key differences include:

1. Execution Speed: Some platforms offer faster trade execution, crucial for day traders who rely on quick entries and exits.

2. Charting Tools: Advanced charting capabilities and technical analysis tools vary, impacting decision-making.

3. Fees and Commissions: Platforms differ in trading fees, which can significantly affect profitability for high-frequency traders.

4. User Interface: A more intuitive and customizable interface can enhance the trading experience, allowing for quicker navigation.

5. Order Types: Availability of advanced order types (like stop-loss or trailing stops) can influence trading strategies.

Choose a platform that aligns with your trading style and needs.

What software is best for technical analysis in day trading?

The best software for technical analysis in day trading includes TradingView for its user-friendly interface and advanced charting tools, MetaTrader 4/5 for robust trading features, and Thinkorswim for comprehensive analysis and educational resources. Each offers real-time data, customizable indicators, and backtesting capabilities, making them ideal for traders looking to analyze market trends effectively.

How can charts improve my day trading strategy?

Charts can enhance your day trading strategy by providing visual insights into price movements and trends. They help you identify patterns, support and resistance levels, and potential entry and exit points. Using indicators like moving averages or RSI on charts can refine your analysis, allowing you to make quicker, data-driven decisions. Additionally, real-time charting can help you react swiftly to market changes, improving your timing and overall profitability.

What role do stock screeners play in day trading?

Stock screeners help day traders quickly identify stocks that meet specific criteria, such as price movements, volume, or technical indicators. They filter out irrelevant stocks, allowing traders to focus on the most promising opportunities. By using stock screeners, day traders can save time, make informed decisions, and react swiftly to market changes.

How important is real-time data for day trading?

Real-time data is crucial for day trading. It allows traders to make informed decisions quickly based on the latest price movements and market trends. Timely information helps identify entry and exit points, manage risk, and capitalize on short-term opportunities. Without real-time data, traders may miss critical trades or react too slowly, leading to losses. In day trading, speed and accuracy are everything.

What are the best mobile apps for day trading?

The best mobile apps for day trading include:

1. TD Ameritrade – Offers powerful trading tools and research.

2. E*TRADE – User-friendly interface with robust features.

3. Robinhood – Commission-free trading with a simple design.

4. Fidelity – Comprehensive research and trading capabilities.

5. Webull – Advanced charting tools and no commission fees.

6. Interactive Brokers – Great for experienced traders with low fees.

Choose an app based on your trading style and needs.

How do news feeds impact day trading decisions?

News feeds impact day trading decisions by providing real-time information that can influence stock prices. Traders rely on breaking news to make quick buy or sell decisions based on events like earnings reports, economic data releases, or geopolitical developments. Timely updates allow traders to react to market sentiment and volatility, helping them capitalize on price swings. In day trading, being first to the news can lead to significant profit opportunities, while delays can result in missed chances or losses.

What indicators should I use for day trading?

For day trading, focus on these key indicators:

1. Moving Averages: Use the 50-day and 200-day moving averages to identify trends and potential reversal points.

2. Relative Strength Index (RSI): This momentum oscillator helps gauge overbought or oversold conditions.

3. Moving Average Convergence Divergence (MACD): This trend-following momentum indicator shows the relationship between two moving averages.

4. Bollinger Bands: These indicate volatility and potential price reversals based on standard deviations from a moving average.

5. Volume: Analyze trading volume to confirm trends; higher volume typically signals stronger moves.

6. Stochastic Oscillator: This helps identify potential reversal points by comparing a security's closing price to its price range over a set period.

Combine these indicators for better decision-making in day trading.

How can I use paper trading tools effectively?

To use paper trading tools effectively, start by selecting a reputable platform that simulates real market conditions. Set clear goals for your trading practice, like testing strategies or improving execution. Use a variety of instruments to diversify your experience. Track your trades meticulously to analyze your performance and refine your approach. Treat it like real trading—stick to your strategy and manage risk. Lastly, regularly assess your results and adjust your methods based on what you learn.

Learn about How to Use Backtesting Tools for Day Trading

What is the importance of risk management tools in day trading?

Risk management tools in day trading are crucial for protecting your capital and minimizing losses. They help set stop-loss orders, manage position sizes, and establish profit targets, ensuring you can exit trades before losses escalate. These tools also promote disciplined trading, reducing emotional decision-making and helping you stick to your strategy. By effectively managing risk, you increase the chances of long-term profitability in a volatile market.

Learn about How can poor risk management lead to losses in day trading?

How can community forums help day traders?

Community forums can help day traders by providing real-time insights, sharing trading strategies, and offering emotional support. Traders can discuss market trends, exchange tips on tools and platforms, and learn from each other's successes and mistakes. Additionally, forums often feature live discussions during market hours, allowing traders to react quickly to news and price movements. Overall, these forums foster a collaborative environment that enhances trading knowledge and skills.

What are the benefits of automated trading systems?

Automated trading systems offer several benefits for day traders. They execute trades instantly, reducing the impact of emotional decision-making. These systems can analyze vast amounts of data quickly, identifying trends and opportunities that may be missed manually. They also allow traders to backtest strategies using historical data, optimizing performance before risking real money. Additionally, automated systems can operate 24/7, capturing opportunities in different markets and time zones. Overall, they enhance efficiency, consistency, and potential profitability in day trading.

How does a trading journal enhance day trading performance?

A trading journal enhances day trading performance by allowing you to track your trades, analyze your strategies, and identify patterns. It helps you learn from mistakes, refine your decision-making, and improve your risk management. By documenting your emotions and reactions during trades, you can develop mental discipline and avoid impulsive actions. Regularly reviewing your journal also keeps you accountable, leading to more consistent performance and better results over time.

Learn about What Are Prop Firms and How Can They Enhance Your Day Trading Edge?

What are the costs associated with day trading tools?

Day trading tools come with various costs, including:

1. Brokerage Fees: Commissions per trade, which can vary by broker.

2. Platform Fees: Monthly or per-trade fees for using advanced trading platforms.

3. Data Feeds: Costs for real-time market data, which can range from $10 to several hundred dollars monthly.

4. Charting Software: Subscription fees for advanced charting and analysis tools.

5. Margin Costs: Interest on borrowed funds if trading on margin.

6. Hardware: Investment in a reliable computer and potentially multiple monitors for better visibility.

7. Education: Courses or resources for skill development can add to expenses.

Overall, costs can range from a few hundred to several thousand dollars monthly, depending on your trading style and tools used.

How can I choose the right broker for day trading?

To choose the right broker for day trading, consider these key factors:

1. Commission Fees: Look for brokers with low commission rates to maximize your profits on frequent trades.

2. Trading Platform: Ensure the platform is user-friendly, stable, and offers real-time data, charting tools, and quick order execution.

3. Margin Rates: Check the margin requirements and rates, as they impact your buying power and potential returns.

4. Customer Service: Choose a broker with responsive support to resolve issues quickly during trading hours.

5. Regulation and Security: Opt for a broker that is regulated by a reputable authority to ensure your funds are protected.

6. Research and Education: Find brokers that provide market research, analysis tools, and educational resources to enhance your trading strategy.

7. Account Types: Look for brokers offering different account types that suit your trading style and needs.

Evaluate these aspects to find a broker that aligns with your day trading goals.

Learn about How to Choose a Day Trading Broker with Good Compliance Standards

Conclusion about Day Trading Tools: What You Need to Know

In conclusion, equipping yourself with the right day trading tools is crucial for success in this fast-paced environment. Understanding the differences in trading platforms, leveraging advanced software for technical analysis, and utilizing real-time data can significantly enhance your strategies. Incorporating stock screeners, news feeds, and risk management tools further elevates your trading game. Additionally, engaging with community forums and maintaining a trading journal can provide invaluable insights. By thoroughly evaluating costs and choosing the right broker, you can set the stage for a successful trading journey. For comprehensive support and insights, remember to explore resources offered by DayTradingBusiness.

Learn about Day Trading Patterns: What New Traders Need to Know