Did you know that even the most seasoned traders sometimes forget to pack their lunch for the trading day, let alone keep track of their strategies? A day trading pattern checklist is your essential guide to navigating the fast-paced trading world. In this article, we'll explore the importance of having a checklist, the key patterns to include, and effective methods for identifying and tracking these patterns. We’ll also discuss how to customize your checklist for various stocks, incorporate risk management, and the influence of market news. By the end, you'll know how to leverage your checklist to enhance trading discipline and evaluate its success—all with a little help from DayTradingBusiness.

What is a day trading pattern checklist?

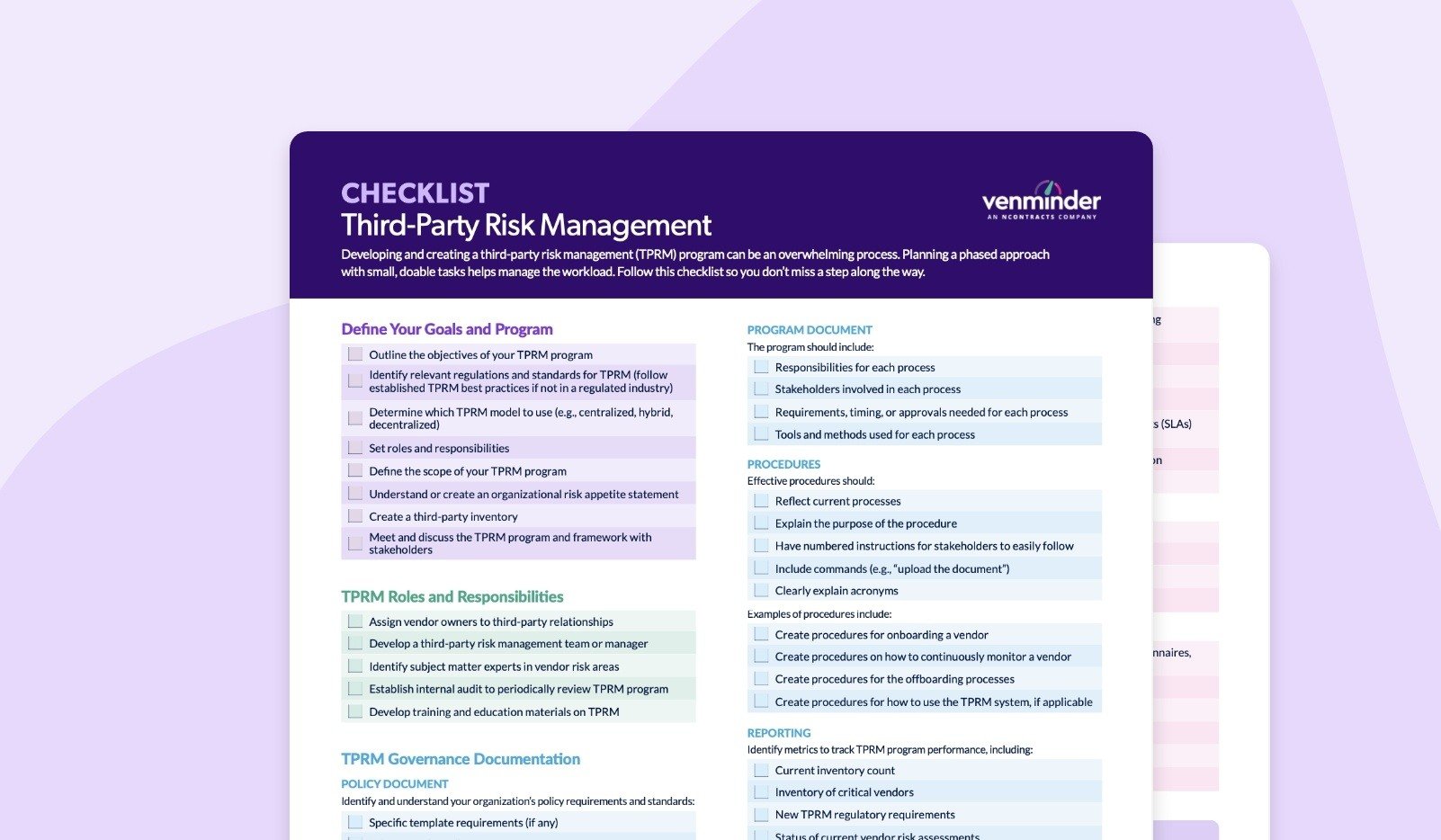

A day trading pattern checklist is a tool that helps traders identify and evaluate trading opportunities based on specific patterns. To create one, follow these steps:

1. Define Patterns: List the key patterns you want to trade, like flags, triangles, or head and shoulders.

2. Set Criteria: Establish criteria for entry, such as volume confirmation, breakout levels, or trend direction.

3. Risk Management: Include stop-loss and take-profit levels for each pattern.

4. Timeframes: Specify which timeframes you will analyze (e.g., 1-minute, 5-minute).

5. Market Conditions: Note the ideal market conditions for each pattern, like volatility or news events.

6. Review and Adjust: Regularly review your checklist to refine patterns and criteria based on performance.

This checklist helps streamline decision-making and improves consistency in day trading.

Why is a checklist important for day trading?

A checklist is crucial for day trading because it helps ensure consistency and discipline in your trading strategy. It keeps you focused on your criteria for entering and exiting trades, reducing emotional decision-making. A well-structured checklist can include patterns to recognize, risk management rules, and specific indicators to watch. This systematic approach enhances your ability to identify profitable opportunities and minimize losses. To create a day trading pattern checklist, list the key patterns you trade, define entry and exit signals, and incorporate risk assessment steps.

How do I start creating a day trading pattern checklist?

To create a day trading pattern checklist, follow these steps:

1. Identify Key Patterns: List specific trading patterns you want to focus on, like flags, triangles, or head and shoulders.

2. Set Entry Criteria: Define what signals indicate a good entry point for each pattern, such as volume spikes or moving average crossovers.

3. Determine Exit Strategies: Specify conditions for exiting trades, including profit targets and stop-loss levels.

4. Risk Management: Establish rules for position sizing and risk-to-reward ratios for each trade.

5. Test Your Checklist: Backtest your patterns with historical data to ensure effectiveness.

6. Refine Periodically: Review and adjust your checklist regularly based on performance and market changes.

This structured approach will help you stay disciplined and improve your day trading strategy.

What key patterns should I include in my checklist?

1. Trend Patterns: Identify uptrends, downtrends, and sideways movements.

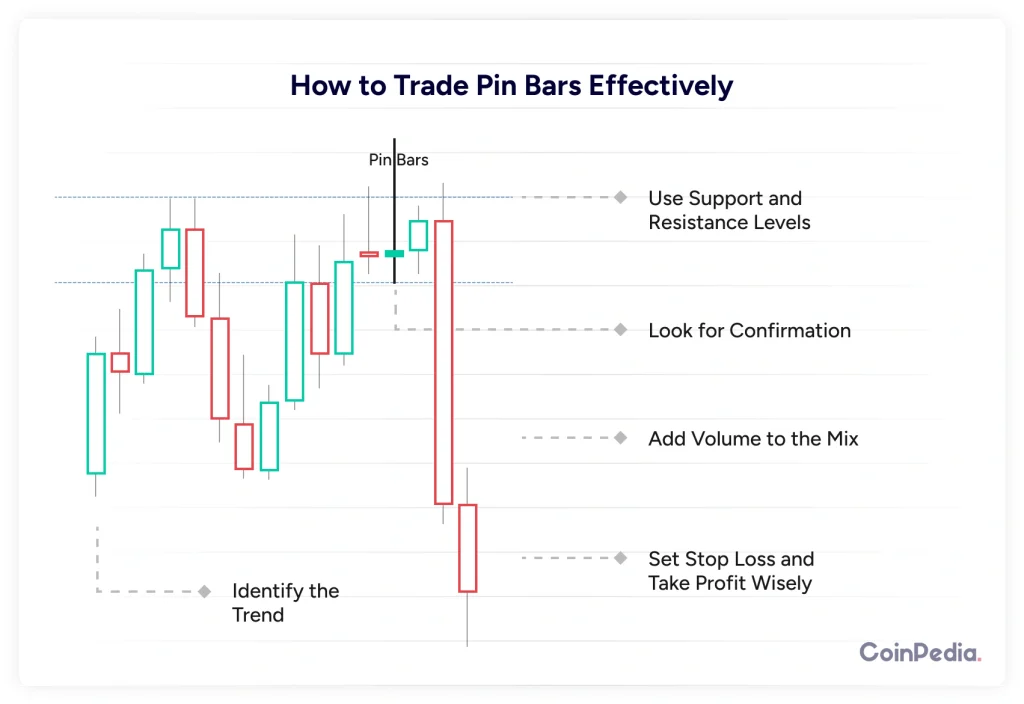

2. Reversal Patterns: Look for head and shoulders, double tops/bottoms, and pins.

3. Continuation Patterns: Note flags, pennants, and triangles.

4. Volume Patterns: Track volume spikes and trends to confirm price movements.

5. Time Patterns: Monitor specific trading hours for volatility and liquidity.

6. Support and Resistance Levels: Mark key price points where reversals may occur.

7. Candlestick Patterns: Include dojis, engulfing patterns, and hammers.

8. Moving Averages: Use crossovers and slopes to gauge momentum.

9. Fibonacci Levels: Integrate retracement and extension levels for potential reversals.

10. Market Sentiment: Assess news and events that could impact price patterns.

How can I identify trading patterns effectively?

To identify trading patterns effectively, create a checklist with these key steps:

1. Define Your Patterns: List the specific patterns you want to focus on, such as head and shoulders, flags, or triangles.

2. Use Technical Indicators: Incorporate indicators like moving averages or RSI to confirm patterns.

3. Set Time Frames: Decide on the time frames you’ll analyze—1-minute, 5-minute, or daily charts.

4. Volume Analysis: Check volume trends alongside price movements to validate patterns.

5. Historical Data: Review past occurrences of your chosen patterns to understand their outcomes.

6. Risk Management: Include guidelines for stop-loss and take-profit levels based on identified patterns.

7. Continuous Learning: Regularly update your checklist with new patterns or insights gained from trading experiences.

By following this checklist, you'll sharpen your ability to spot trading patterns and enhance your day trading strategies.

What tools can help in tracking day trading patterns?

To track day trading patterns, consider these tools:

1. Charting Software: Platforms like TradingView or ThinkorSwim offer advanced charting options for technical analysis.

2. Stock Screeners: Use tools like Finviz or Trade Ideas to filter stocks based on specific criteria like volume and price movements.

3. Trade Journals: Applications like Edgewonk or Tradervue help document trades, analyze patterns, and improve strategies.

4. Market News Aggregators: Tools like Benzinga or Yahoo Finance keep you updated on market news that might affect trading patterns.

5. Social Trading Platforms: Services like eToro allow you to follow and analyze the trades of successful day traders.

Incorporate these tools into your day trading checklist for better pattern recognition and decision-making.

How often should I update my day trading checklist?

Update your day trading checklist weekly or after significant market changes. Regularly review your strategies based on performance and market conditions. If you notice patterns that no longer work or new opportunities arising, adjust your checklist accordingly.

What are common mistakes to avoid when creating a checklist?

1. Overcomplicating the Checklist: Keep it simple. Focus on key patterns and indicators instead of overwhelming details.

2. Neglecting Specificity: Be precise in what you're checking for. Vague entries lead to confusion and inconsistent application.

3. Ignoring Market Conditions: Tailor the checklist to different market environments. What works in a bullish market may not apply in a bearish one.

4. Failing to Update Regularly: Market dynamics change. Review and revise your checklist frequently to incorporate new patterns or strategies.

5. Not Testing the Checklist: Use historical data to test your checklist. Ensure it effectively identifies profitable patterns before relying on it live.

6. Assuming One Size Fits All: Customize your checklist to match your trading style and risk tolerance. What works for one trader may not work for another.

7. Lack of Prioritization: Rank the items based on importance. This helps focus on the most impactful patterns first.

8. Forgetting to Include Risk Management: Incorporate risk management strategies. A checklist without risk assessment can lead to significant losses.

9. Being Too Rigid: Allow for flexibility. Rigid adherence to a checklist can prevent you from adapting to unexpected market changes.

10. Neglecting Review and Reflection: After trades, review your checklist’s effectiveness. This reflection helps refine your approach over time.

How can I use my checklist to improve trading decisions?

To improve trading decisions with your checklist, start by clearly defining key criteria for your trades, such as entry and exit points, risk management rules, and market conditions. Use the checklist before every trade to ensure you meet all your criteria. Analyze past trades using the checklist to identify patterns and areas for improvement. Regularly update the checklist based on your experiences and market changes. This structured approach will help you make more informed, consistent trading decisions.

What timeframes are best for day trading patterns?

For day trading patterns, the best timeframes are typically 1-minute, 5-minute, and 15-minute charts. These shorter timeframes allow you to capture quick price movements and identify patterns like flags, triangles, and breakouts effectively. Use the 1-minute chart for immediate trades, the 5-minute for trend confirmation, and the 15-minute for broader context.

Learn about Best Timeframes for Momentum Day Trading

How do I evaluate the success of my checklist?

To evaluate the success of your day trading pattern checklist, track your trade outcomes against the checklist criteria. Analyze win rates, risk-reward ratios, and adherence to the checklist during trades. Gather data over a significant period to identify patterns in your trading performance. Adjust the checklist based on your findings to improve accuracy and effectiveness. Regularly review and refine it to align with evolving market conditions.

Should I customize my checklist for different stocks?

Yes, you should customize your checklist for different stocks. Each stock has unique patterns, volatility, and market behavior. Tailoring your checklist helps you focus on the specific indicators and criteria relevant to each stock, improving your trading decisions. Adjust your criteria based on factors like sector performance, news events, and historical price movements to enhance your day trading strategy.

How can I incorporate risk management into my checklist?

To incorporate risk management into your day trading pattern checklist, follow these steps:

1. Define Risk Tolerance: Determine the maximum percentage of your capital you're willing to lose on a single trade.

2. Set Stop-Loss Orders: Include specific stop-loss levels for each pattern you trade to limit potential losses.

3. Position Sizing: Calculate the appropriate position size based on your risk tolerance and stop-loss distance.

4. Risk-Reward Ratio: Establish a minimum risk-reward ratio (e.g., 1:2) for every trade to ensure potential gains outweigh losses.

5. Review Historical Trades: Analyze past trades to identify patterns in risk management success and areas for improvement.

6. Daily Loss Limits: Set a maximum loss limit for each trading day to prevent emotional trading.

7. Diversification: Ensure your checklist includes guidelines for diversifying trades across different patterns or sectors.

Incorporating these elements will strengthen your day trading pattern checklist by prioritizing risk management.

What role does market news play in my checklist?

Market news is crucial in your day trading pattern checklist because it influences price movements and volatility. Incorporate key news events that could impact your stocks or assets, such as earnings reports, economic indicators, and geopolitical developments. Staying updated helps you anticipate market reactions and adjust your trading strategies accordingly. Evaluate how news affects historical patterns and integrate this analysis to improve decision-making.

How can I use my checklist to maintain discipline in trading?

To use your checklist for maintaining discipline in trading, follow these steps:

1. Define Criteria: Clearly the specific patterns or setups you want to trade. This ensures you only act on verified opportunities.

2. Daily Review: Before trading, review your checklist to remind yourself of your strategy and rules. This reinforces your trading plan.

3. Pre-Trade Checklist: Use your checklist to confirm that all conditions are met before entering a trade. This prevents impulsive decisions.

4. Post-Trade Analysis: After each trade, compare your actions against the checklist. Identify any deviations to learn and adjust your approach.

5. Set Reminders: Incorporate reminders of your checklist into your trading routine to reinforce discipline consistently.

6. Track Performance: Regularly assess how well you followed the checklist and its impact on your results. This helps you stay accountable.

By consistently applying your checklist, you’ll enhance your focus, reduce emotional trading, and improve overall discipline.

What are advanced techniques for enhancing my trading checklist?

1. Define Clear Criteria: Specify entry and exit points, including price levels and indicators like moving averages or RSI.

2. Incorporate Risk Management: Set stop-loss and take-profit levels for each trade to protect your capital.

3. Use a Scanning Tool: Implement stock screeners to filter stocks based on your criteria, saving time and enhancing focus.

4. Backtest Strategies: Analyze past trades to validate your checklist and refine strategies based on historical performance.

5. Include Market Conditions: Note market trends and news events that could impact your trades, adjusting your checklist accordingly.

6. Set Psychological Reminders: Add notes on emotional triggers to maintain discipline and avoid impulsive decisions during trading.

7. Review and Revise Regularly: Continuously assess your checklist for effectiveness and make adjustments based on performance data.

8. Visual Aids: Use charts and graphs to illustrate patterns and trends, helping you visualize potential trades.

Conclusion about How to Create a Day Trading Pattern Checklist

Incorporating a day trading pattern checklist is essential for making informed trading decisions and enhancing consistency. By identifying key patterns, utilizing effective tools, and regularly updating your checklist, you can improve your trading outcomes. Remember to customize your approach for different stocks and incorporate risk management strategies. This structured method will help you stay disciplined and responsive to market changes. For more in-depth insights and support, DayTradingBusiness is here to assist you on your trading journey.

Learn about How to Create a Day Trading Analysis Checklist

Sources:

- A Profitable Day Trading Strategy For The U.S. Equity Market by ...

- Can Day Trading Really Be Profitable? by Carlo Zarattini, Andrew ...

- Volume Weighted Average Price (VWAP) The Holy Grail for Day ...

- Pro Trader RL: Reinforcement learning framework for generating ...

- Delegated trading and the speed of adjustment in security prices ...