Did you know that a single stock can trade more shares in a day than the entire population of a small country? In the world of day trading, understanding high volume is crucial for navigating order flow and making informed decisions. This article delves into the impact of high trading volume on order flow, exploring how it affects price movements and liquidity. We discuss the importance of order flow for day traders, the relationship between volume and market trends, and the strategies traders can use during high-volume situations. Additionally, we shed light on the risks associated with trading in these periods, the influence of news on order flow, and the significance of volume spikes. With insights on algorithm responses and common misconceptions, this piece equips day traders with the knowledge to analyze volume effectively and enhance their trading performance. Join us at DayTradingBusiness for a deeper dive into these essential concepts.

How does high volume affect order flow in day trading?

High volume in day trading indicates increased buying and selling activity, which tightens spreads and improves liquidity. This leads to faster execution of orders and can reduce slippage. High volume also often correlates with stronger price moves, making it easier to spot trends. Traders can react to price changes more effectively, but it can also increase volatility and risk, as rapid price swings may occur. Overall, high volume enhances order flow efficiency, but traders must stay alert to market dynamics.

What is the relationship between trading volume and price movement?

High trading volume often indicates strong interest in a stock, leading to more significant price movement. When volume increases, it typically suggests that many buyers and sellers are active, which can push prices up or down rapidly. In day trading, high volume can confirm trends; for example, if a stock surges in price with high volume, it likely signals strong buying pressure. Conversely, a price drop with high volume often indicates strong selling pressure. Low volume can lead to erratic price movements, making it harder to predict trends.

Why is order flow important for day traders?

Order flow is crucial for day traders because it reveals real-time market activity, helping them anticipate price movements. High volume indicates strong buying or selling interest, allowing traders to gauge market sentiment and make informed decisions. By analyzing order flow, day traders can spot potential entry and exit points, manage risk effectively, and improve trade execution. Understanding order flow and its relationship with high volume gives traders a competitive edge in fast-paced markets.

How can high volume indicate market trends in day trading?

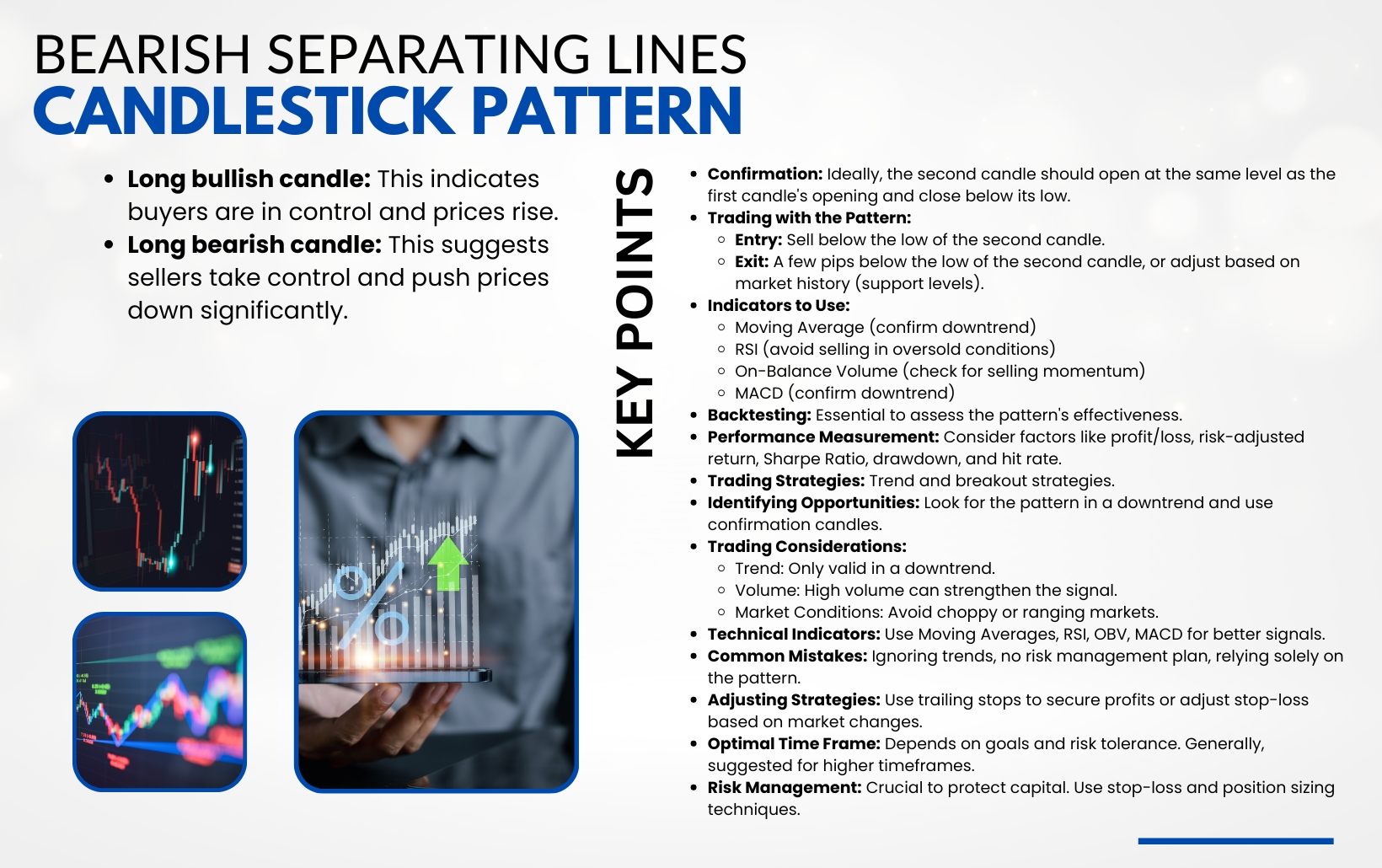

High volume in day trading signals strong interest in a stock, often indicating potential market trends. When trading volume spikes, it suggests that many traders are entering or exiting positions, which can lead to price movements. For instance, if a stock experiences high volume alongside rising prices, it may indicate bullish sentiment, suggesting an upward trend. Conversely, high volume with falling prices can reflect bearish sentiment, signaling a downward trend. Monitoring volume helps traders assess the strength of price movements and make informed decisions based on order flow dynamics.

What role does liquidity play in high-volume trading?

Liquidity is crucial in high-volume trading because it ensures that orders can be executed quickly without significantly impacting the price. High liquidity allows traders to enter and exit positions swiftly, minimizing slippage and enhancing the ability to capitalize on market movements. In day trading, adequate liquidity enables traders to buy and sell large quantities of assets efficiently, ultimately leading to better execution prices and reduced transaction costs. Without sufficient liquidity, high-volume trading can lead to increased volatility and difficulty in executing orders at desired levels.

How do traders use volume indicators for decision-making?

Traders use volume indicators to gauge market activity and confirm trends. High volume often signals strong interest in a security, indicating that price movements are likely to continue. For example, if a stock breaks through resistance with high volume, traders may view this as a buy signal, believing the momentum will sustain. Conversely, if a price increase occurs with low volume, it might suggest weakness, leading traders to hesitate or sell. Volume indicators help identify potential reversals or continuations, guiding traders in their entry and exit decisions based on order flow dynamics.

What are the risks of trading during high-volume periods?

Trading during high-volume periods can lead to increased volatility and slippage, making it harder to execute orders at desired prices. You might face rapid price changes, which can result in larger losses if the market moves against your position. High volume often attracts more traders, increasing competition and potentially widening spreads. Additionally, market manipulation can occur more frequently, leading to unpredictable price swings. Finally, the speed of information dissemination can lead to reactionary trading, causing poor decision-making.

How does high volume influence bid-ask spreads?

High volume tightens bid-ask spreads. When many traders are active, there's more competition to buy and sell, leading to quicker transactions and less price discrepancy between bids and asks. This increased liquidity allows for better pricing, which benefits day traders by reducing costs on trades. In contrast, in low-volume situations, spreads widen, making it more expensive to enter or exit positions.

What strategies can traders employ during high-volume situations?

Traders can employ several strategies during high-volume situations:

1. Scalping: Quickly entering and exiting trades to capitalize on small price movements.

2. Momentum Trading: Identifying and riding trends to benefit from rapid price changes.

3. Level 2 Data Analysis: Monitoring order book data to gauge market depth and potential price direction.

4. Limit Orders: Using limit orders to control entry and exit points, reducing slippage.

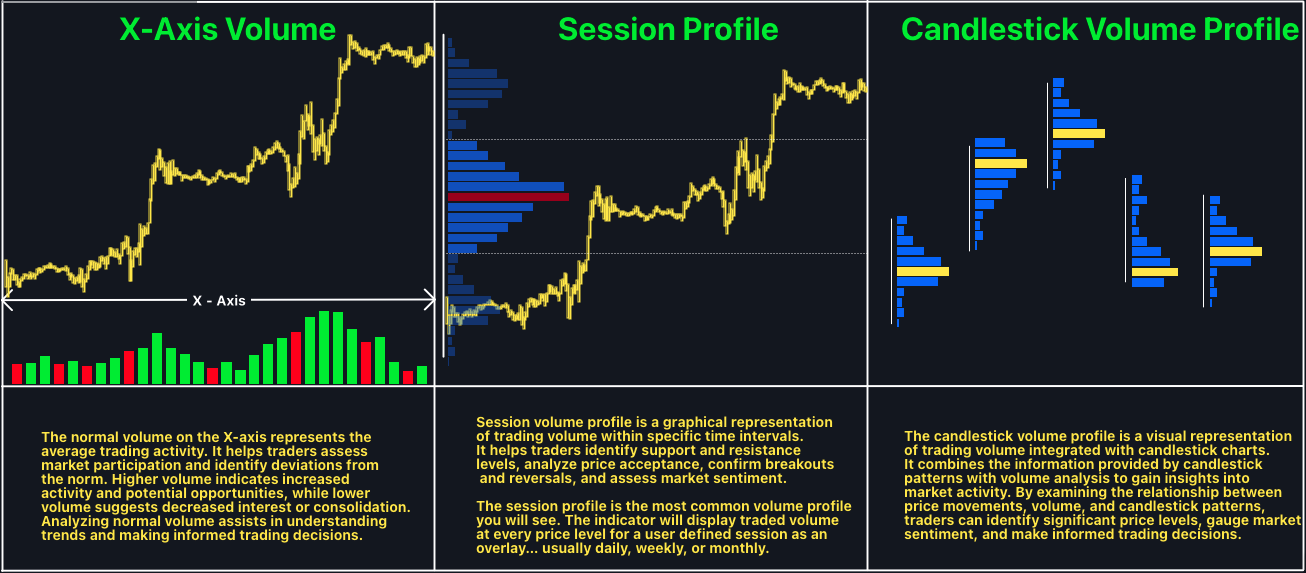

5. Volume Profile: Analyzing volume at different price levels to identify support and resistance zones.

6. Risk Management: Tightening stop-loss orders to protect against sudden volatility spikes.

7. News Trading: Reacting swiftly to news events that drive high volume, while being cautious of false moves.

These strategies help traders navigate the complexities of high-volume trading effectively.

How can news impact high-volume order flow in day trading?

News can significantly impact high-volume order flow in day trading by triggering rapid price movements and increased trading activity. When major news breaks—like earnings reports or economic data—traders often react quickly, leading to spikes in buy or sell orders. This can create volatility, causing sharp price changes that can either amplify gains or losses. High volume during these moments reflects heightened interest and can also result in slippage, as orders may not execute at expected prices. Thus, keeping an eye on news events is crucial for day traders to strategize effectively and manage risk.

Learn about How Do SEC Rules Impact Day Trading?

What is the significance of volume spikes in trading?

Volume spikes in trading indicate strong interest in a stock, often signaling a potential price movement. High volume can lead to increased order flow, making it easier to execute trades quickly. For day traders, these spikes can reveal entry and exit points, as they often correlate with breakouts or reversals. Monitoring volume helps traders validate trends and anticipate market shifts, enhancing decision-making. In essence, volume spikes are crucial for understanding market dynamics and executing effective day trading strategies.

How do algorithms respond to high trading volume?

Algorithms respond to high trading volume by adjusting their strategies to manage increased order flow. They may execute trades more aggressively to capitalize on price movements or widen spreads to mitigate risk. High volume can trigger faster execution speeds and impact liquidity, leading algorithms to adapt by prioritizing market depth and analyzing real-time data for optimal entry and exit points. Additionally, they may employ techniques like slicing large orders into smaller ones to minimize market impact.

What are common misconceptions about volume in day trading?

A common misconception about volume in day trading is that high volume always indicates a strong price movement. In reality, high volume can occur during consolidations or reversals, not just trends. Another myth is that day traders should only focus on high-volume stocks; low-volume stocks can offer opportunities if approached correctly. Some traders believe that volume alone predicts direction, but it should be analyzed alongside price action and market context. Finally, many think that increasing volume guarantees a continuation of a trend, but volume spikes can also signal exhaustion or reversal points.

How can day traders analyze volume to improve performance?

Day traders can analyze volume by focusing on three key aspects: volume spikes, volume relative to price movements, and volume indicators.

1. Volume Spikes: Look for sudden increases in volume, which often indicate strong interest in a stock. This can signal potential breakouts or reversals.

2. Volume vs. Price Movements: Compare volume with price changes. If a price moves up on increasing volume, it suggests strong buying pressure. Conversely, if prices rise on low volume, it may indicate weakness.

3. Volume Indicators: Use tools like the On-Balance Volume (OBV) or the Volume Weighted Average Price (VWAP) to assess the strength of price trends. These indicators help confirm trends and potential entry or exit points.

By integrating these volume analysis techniques, day traders can make more informed decisions, enhance their order flow strategies, and ultimately improve their trading performance.

Learn about How to Use Volume to Improve Day Trading

What tools can help track order flow and volume effectively?

Tools that effectively track order flow and volume in day trading include:

1. Level II Market Data: Provides real-time bid and ask prices, showing depth of market orders.

2. Time and Sales (Tape Reading): Displays a real-time record of executed trades, helping identify volume spikes.

3. Volume Profile Indicators: Visual tools that show trading volume at specific price levels over time.

4. Footprint Charts: Combine price and volume data, illustrating where trades occur at specific price points.

5. Order Flow Software: Tools like Sierra Chart or NinjaTrader that analyze order flow dynamics and volume trends.

6. Market Depth Tools: Show the number of buy and sell orders at various price levels, indicating potential support and resistance.

Using these tools can enhance your understanding of market dynamics and improve trading decisions.

How does high volume correlate with volatility in day trading?

High volume in day trading often correlates with increased volatility. When many shares are traded, it indicates strong interest, which can lead to rapid price movements. High volume can amplify price swings, as large orders can impact the market more significantly. This increased order flow may create opportunities for traders to capitalize on quick price changes but also raises the risk of sudden reversals. Overall, high volume tends to signal heightened volatility, making it crucial for day traders to manage their risk effectively.

Conclusion about The Impact of High Volume on Order Flow in Day Trading

In summary, understanding the impact of high volume on order flow is crucial for successful day trading. High trading volume can significantly affect price movements, liquidity, and bid-ask spreads, providing key insights into market trends and potential strategies. By effectively analyzing volume and utilizing appropriate indicators, traders can make informed decisions that enhance their performance. Remember, integrating this knowledge into your trading routine is essential for navigating the fast-paced world of day trading. At DayTradingBusiness, we strive to equip you with the tools and insights needed to excel in this dynamic environment.

Learn about Differences Between Order Flow and Volume Analysis in Day Trading