Did you know that the stock market has more volume than a rock concert? Just like the crowd at a concert can sway the mood, trading volume plays a crucial role in influencing price movements. In this article, we delve into how volume impacts day trading, covering everything from its significance in price trends to practical strategies for predicting price movements. We’ll explore the importance of volume indicators, the effects of low and high volume, and how volume spikes can shape trading decisions. Additionally, we’ll highlight common mistakes traders make regarding volume and the relationship between volume and volatility. By understanding these concepts, you can enhance your trading strategies and timing. Let DayTradingBusiness guide you through the intricacies of volume analysis for better trading outcomes.

How Does Volume Influence Price Movements in Day Trading?

Volume influences price movements in day trading by indicating the strength of a price trend. High volume often confirms a price movement, suggesting strong interest and potential continuation. Conversely, low volume can signal weakness, making price reversals more likely. Traders use volume to identify potential breakouts; if a stock breaks resistance with high volume, it’s seen as a bullish signal. Additionally, volume can help traders spot false breakouts when price moves significantly with low volume. Overall, analyzing volume helps traders make informed decisions about entry and exit points.

Why Is Trading Volume Important for Day Traders?

Trading volume is crucial for day traders because it indicates the strength of price movements. High volume suggests strong interest in a stock, making price changes more reliable. It helps confirm trends; if a stock moves up with high volume, that rise is likely to continue. Conversely, low volume can lead to false signals, as small trades can disproportionately affect price. Day traders use volume to identify entry and exit points, ensuring they trade in active markets where liquidity is high. Overall, understanding volume helps traders make informed decisions and manage risk effectively.

What Role Does Volume Play in Price Trends?

Volume indicates the strength of price movements in day trading. High volume often confirms a price trend, signaling strong buying or selling interest. When prices rise on high volume, it suggests that the trend is likely to continue. Conversely, if prices increase but volume is low, the trend may be weak and prone to reversal. Volume also helps identify potential breakouts; a spike in volume during price movement can signal a shift in market sentiment. In summary, volume is crucial for validating trends, anticipating reversals, and confirming breakouts in day trading.

How Can I Use Volume to Predict Price Movements?

To use volume to predict price movements in day trading, monitor volume spikes alongside price changes. High volume during price increases suggests strong buying interest, potentially leading to higher prices. Conversely, high volume during price declines indicates strong selling pressure, which may result in further drops. Look for volume confirmation on breakout patterns; a breakout with high volume is more likely to sustain the movement. Additionally, use volume indicators like the On-Balance Volume (OBV) or the Volume Weighted Average Price (VWAP) to assess trends and potential reversals. Always consider volume in conjunction with other technical indicators for more accurate predictions.

What Are Volume Indicators in Day Trading?

Volume indicators in day trading measure the number of shares or contracts traded in a specific timeframe. They help traders assess the strength of price movements. High volume often signals strong momentum, confirming trends, while low volume may indicate weak price action. Common volume indicators include the Volume itself, On-Balance Volume (OBV), and the Accumulation/Distribution Line. These tools help traders make informed decisions about entries and exits based on the relationship between price and trading activity.

How Does Low Volume Affect Stock Prices?

Low volume can lead to higher volatility in stock prices. When fewer shares are being traded, even small buy or sell orders can significantly impact the stock's price. This can cause sudden price swings, making it riskier for day traders. Additionally, low volume often indicates a lack of investor interest, which can result in less liquidity, making it harder to enter or exit positions without affecting the stock's price. Overall, low trading volume can create opportunities but also increase risk for traders.

Can High Volume Signal Market Reversals?

Yes, high volume can signal market reversals. When trading volume spikes, it often indicates strong interest in a price move. If a security is rising on high volume, it may confirm an uptrend. Conversely, if a price decline is accompanied by high volume, it could suggest a potential reversal to the downside. Day traders watch these volume patterns closely, as they can indicate whether a price movement is sustainable or likely to change direction. Always consider volume alongside price action for better insights.

How Do Volume Spikes Impact Day Trading Decisions?

Volume spikes indicate increased trading activity and can signal potential price movements. For day traders, a sudden surge in volume often means heightened interest in a stock, leading to possible breakouts or reversals. When volume spikes coincide with price changes, traders may enter positions quickly to capitalize on momentum. Conversely, if volume spikes with little price movement, it might indicate false signals, prompting caution. Ultimately, analyzing volume trends helps traders make informed decisions about entry and exit points.

What Is the Relationship Between Volume and Volatility?

Volume and volatility are closely linked in day trading. High trading volume often precedes significant price movements, indicating strong interest in a stock. When volume spikes, it can lead to increased volatility as traders react to new information or trends. Conversely, low volume typically results in less price movement, as there are fewer participants to drive changes. In summary, rising volume can amplify volatility, while low volume may dampen price fluctuations.

How Can I Analyze Volume for Better Trading Strategies?

To analyze volume for better trading strategies, focus on these key points:

1. Identify Trends: Look for increasing volume as prices rise or fall to confirm trends. High volume during an upward price movement suggests strong buying interest.

2. Volume Spikes: Monitor sudden spikes in volume, which can indicate potential reversals or breakouts. These often precede significant price movements.

3. Volume Relative to Price: Use volume indicators like the Volume Weighted Average Price (VWAP) to assess the average price against volume. It helps determine if a trend is sustainable.

4. Divergence: Watch for divergence between price and volume. If prices are rising but volume is declining, it may signal a weakening trend.

5. Support and Resistance Levels: Analyze volume at key support and resistance levels. High volume at these points can confirm their strength or weakness.

6. Use Volume Indicators: Incorporate tools like On-Balance Volume (OBV) or the Accumulation/Distribution Line to gauge buying and selling pressure over time.

By strategically analyzing volume alongside price movements, you can enhance your day trading strategies.

Learn about How to Analyze Trading Volume for Day Trading Success

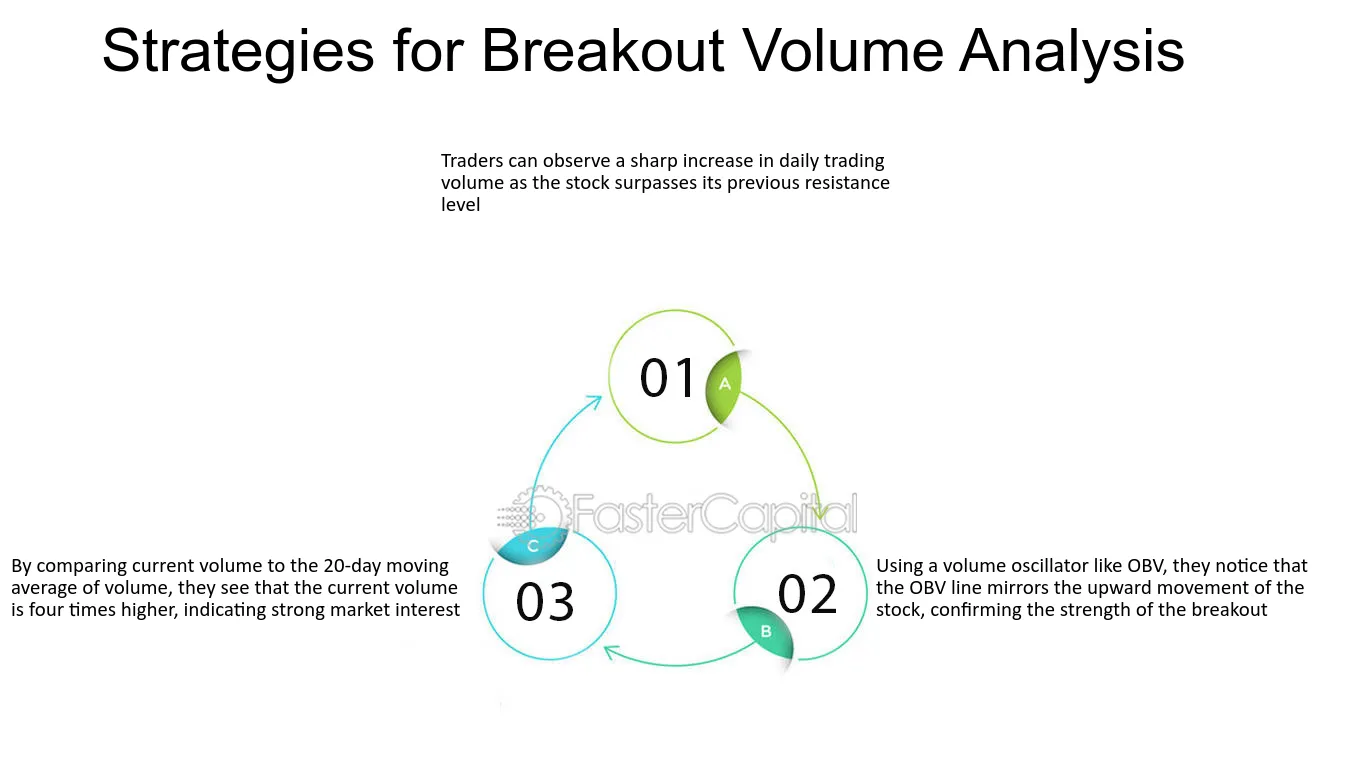

What Is the Effect of Volume on Breakouts and Breakdowns?

Volume significantly impacts breakouts and breakdowns in day trading. High volume during a breakout indicates strong momentum, suggesting that the price move is likely to continue. Conversely, low volume can signal weakness, making the breakout less reliable. For breakdowns, increased volume confirms selling pressure and the likelihood of further declines, while low volume may indicate a lack of conviction and possible reversal. Traders often look for volume spikes as confirmation of price movements.

How Does Volume Affect Liquidity in Day Trading?

Volume significantly affects liquidity in day trading. Higher trading volume usually leads to increased liquidity, meaning traders can buy and sell assets more easily without impacting the price. When volume is high, there are more orders in the market, allowing for quicker execution and tighter bid-ask spreads. Conversely, low volume can result in slippage, where trades execute at less favorable prices due to fewer participants. Thus, in day trading, high volume is crucial for making efficient trades and capitalizing on price movements.

Learn about How Do Market Makers and Liquidity Providers Affect Day Trading?

What Volume Patterns Should Day Traders Look For?

Day traders should look for the following volume patterns:

1. High Volume Breakouts: When a stock breaks through resistance with increased volume, it often signals a strong upward trend.

2. Volume Spikes: Sudden increases in volume can indicate news or events affecting the stock, often leading to rapid price movement.

3. Volume Clusters: Consistent high volume at specific price levels can indicate strong support or resistance zones.

4. Divergence: If price moves up but volume decreases, it may suggest a weakening trend, signaling a potential reversal.

5. Volume Trends: Rising volume during price increases and falling volume during declines suggests a healthy trend.

Focusing on these patterns can enhance decision-making and improve trading outcomes.

How Can Volume Analysis Improve My Trade Timing?

Volume analysis improves trade timing by indicating the strength of price movements. High volume often confirms trends, signaling when to enter or exit trades. For instance, if a stock price rises with increasing volume, it suggests strong buyer interest, making it a good time to buy. Conversely, if prices drop on high volume, it may signal a reversal or a good exit point. Watching volume patterns helps identify key support and resistance levels, allowing for better decision-making in day trading.

What Mistakes Do Traders Make Regarding Volume?

Traders often misinterpret volume, thinking high volume always signals strong price movement, which isn’t true. They may ignore low volume days, missing potential opportunities. Another mistake is following volume spikes without analyzing context; not all spikes lead to trend changes. Traders also fail to consider volume patterns alongside price action, leading to misguided entry or exit points. Finally, many overlook the importance of relative volume, which compares current volume to historical averages, crucial for assessing market strength.

How Does News Impact Trading Volume and Price Movements?

News significantly impacts trading volume and price movements. When major news breaks, trading volume typically spikes as traders react to new information. High volume often leads to more pronounced price movements; for example, positive earnings reports can drive prices up sharply, while negative news can cause rapid declines. Increased volume indicates heightened interest and can confirm trends or reversals. In day trading, monitoring news is crucial, as swift reactions to breaking events can create opportunities for profit or loss.

Learn about How News Events Impact Day Trading Decisions

Conclusion about How Volume Affects Price Movements in Day Trading

In summary, understanding volume is crucial for effective day trading. It influences price movements, reflects market sentiment, and plays a vital role in identifying trends and potential reversals. By analyzing volume indicators and patterns, day traders can enhance their strategies and improve trade timing. To navigate the complexities of trading effectively, leverage the expertise and resources offered by DayTradingBusiness for deeper insights into volume analysis and its impact on your trading success.

Learn about How to Interpret Volume Spikes in Day Trading