Did you know that the average day trader spends more time analyzing charts than most people spend deciding what to watch on Netflix? In the world of day trading, selecting the right platform is crucial for success. This article dives into the essential features of day trading platforms, highlighting the importance of charting tools, order types, and real-time data. It also explores security measures, the impact of commissions on profitability, and the best technical indicators for trading. Additionally, discover the benefits of mobile access, customer support options, and speed of execution. Learn how demo accounts and margin trading work, and the role of automated features and educational resources. Finally, get tips on choosing the best day trading platform for your needs, all brought to you by DayTradingBusiness.

What are the essential features of day trading platforms?

Essential features of day trading platforms include:

1. Real-time Data: Instant access to live market data and quotes.

2. Advanced Charting Tools: Customizable charts for technical analysis.

3. Order Types: Multiple order options, including market, limit, and stop orders.

4. Speed and Reliability: Fast execution of trades to capitalize on market movements.

5. User-Friendly Interface: Intuitive design for efficient navigation.

6. Risk Management Tools: Features like stop-loss and take-profit orders.

7. Research and Analysis: Access to news, economic calendars, and analyst reports.

8. Mobile Trading: Capability to trade on-the-go through mobile apps.

9. Customization Options: Ability to personalize layouts and alerts.

10. Customer Support: Responsive support for troubleshooting and inquiries.

How do charting tools enhance day trading?

Charting tools enhance day trading by providing real-time data visualization, helping traders identify trends and patterns quickly. Key features include customizable indicators, which allow traders to analyze price movements and volume, and advanced chart types like candlestick and line charts. These tools enable technical analysis, facilitating informed decisions on entry and exit points. Alerts for price movements and trend changes keep traders responsive, while historical data analysis aids in strategy development. Overall, effective charting tools are essential for making timely, data-driven trading decisions.

What role do order types play in day trading platforms?

Order types in day trading platforms help traders execute strategies efficiently. Market orders allow immediate buying or selling at the current price, ensuring quick entry or exit. Limit orders set a specific price for buying or selling, providing control over trade execution. Stop-loss orders protect against significant losses by automatically selling when a stock hits a certain price. These diverse order types enhance flexibility and risk management, enabling traders to react quickly to market movements and optimize their trading performance.

How important is real-time data for day traders?

Real-time data is critical for day traders. It enables them to make informed decisions quickly, capitalizing on market fluctuations. Accurate, up-to-the-second information on stock prices, volume, and market trends allows traders to execute trades at the optimal moment, minimizing losses and maximizing profits. Delays in data can lead to missed opportunities or costly mistakes, making real-time data a non-negotiable feature of effective day trading platforms.

What security features should I look for in a day trading platform?

Look for two-factor authentication (2FA), encryption for data protection, and secure payment methods. Ensure the platform has a strong privacy policy and regular security audits. Check for features like real-time monitoring for unusual activity and a robust customer support system. Additionally, consider platforms that offer account insurance or protection against unauthorized transactions.

How do commissions and fees affect day trading profitability?

Commissions and fees directly reduce your profit margins in day trading. Higher fees can eat into gains, making it harder to be consistently profitable. For example, if you pay $10 per trade and make a $50 profit, your net gain is only $40. Frequent trading increases the impact of these costs, emphasizing the need for low-fee platforms. Choosing a trading platform with minimal commissions can significantly enhance overall profitability. Always factor in these costs when calculating potential returns.

What are the best technical indicators for day trading?

The best technical indicators for day trading include:

1. Moving Averages: Help identify trends by smoothing price data.

2. Relative Strength Index (RSI): Measures momentum and identifies overbought or oversold conditions.

3. MACD (Moving Average Convergence Divergence): Shows the relationship between two moving averages for trend strength.

4. Bollinger Bands: Indicate volatility and potential price reversals.

5. Volume: Confirms trends and signals potential reversals when volume spikes.

6. Stochastic Oscillator: Compares a security's closing price to its price range over a specific period to identify overbought or oversold conditions.

These indicators can enhance decision-making in day trading by providing insights into price movements and market trends.

How does mobile access benefit day traders?

Mobile access benefits day traders by enabling real-time trading from anywhere, allowing them to react quickly to market fluctuations. It provides instant notifications for price changes and news alerts, ensuring they don't miss crucial opportunities. Additionally, mobile platforms often feature user-friendly interfaces that simplify order execution and portfolio management on the go. This flexibility can enhance decision-making and improve overall trading efficiency.

What customer support options are available for day trading platforms?

Day trading platforms typically offer several customer support options, including:

1. Live Chat: Instant messaging support for quick questions and issues.

2. Phone Support: Direct access to representatives for immediate assistance.

3. Email Support: For detailed queries that may require documentation.

4. Help Center/FAQs: A resource hub with articles and guides on common issues.

5. Webinars and Tutorials: Educational sessions to assist users in navigating the platform.

6. Community Forums: User-driven discussions for peer support and insights.

These options ensure traders can get timely help when needed.

How can I evaluate the speed of execution in trading platforms?

To evaluate the speed of execution in trading platforms, focus on these key features:

1. Order Execution Speed: Check the average time it takes for your orders to be executed. Look for platforms that provide real-time data on execution times.

2. Latency: Assess the latency between your action and the trade execution. Lower latency means faster trades.

3. Market Depth: Analyze how well the platform handles multiple orders at varying price levels. A robust market depth can indicate better execution capabilities.

4. Slippage: Monitor slippage rates during high volatility. A platform with minimal slippage ensures your orders are filled at expected prices.

5. Backtesting: Use backtesting tools to simulate trading strategies and evaluate execution speed under different market conditions.

6. User Reviews: Read reviews and feedback from other traders about their experiences with execution speed on the platform.

By focusing on these features, you can effectively gauge a trading platform's execution speed.

What user interface features improve day trading efficiency?

Key user interface features that improve day trading efficiency include:

1. Real-Time Data: Instant access to live market data and price updates helps traders make quick decisions.

2. Customizable Layouts: Ability to arrange charts, news feeds, and order entry windows according to personal preference enhances usability.

3. Advanced Charting Tools: Features like technical indicators, drawing tools, and multiple time frames allow for in-depth analysis.

4. One-Click Trading: Simplifies order execution, reducing the time between decision and action.

5. Hotkeys: Keyboard shortcuts for common actions speed up trading processes.

6. Alerts and Notifications: Custom alerts for price movements or technical indicators keep traders informed without constant monitoring.

7. Multi-Monitor Support: Expands workspace and enables simultaneous tracking of multiple assets or charts.

8. Integrated News Feed: Access to real-time news helps traders react swiftly to market-moving events.

9. Order Types: A variety of order types (limit, stop-loss, etc.) allows for strategic trading based on market conditions.

These features collectively enhance efficiency and responsiveness in day trading.

How does a demo account help new day traders?

A demo account helps new day traders by providing a risk-free environment to practice trading strategies. It allows users to familiarize themselves with the trading platform, understand market dynamics, and develop skills without financial pressure. Traders can test different approaches, analyze their performance, and gain confidence before trading with real money. This hands-on experience is crucial for making informed decisions and enhancing overall trading competence.

What should I know about margin trading on day trading platforms?

Margin trading on day trading platforms allows you to borrow funds to increase your buying power. Key features include:

1. Leverage: You can control larger positions with a smaller amount of your own capital, increasing potential profits but also risks.

2. Margin Requirements: Each platform has specific requirements; typically, you need to maintain a minimum balance to avoid margin calls.

3. Interest Rates: Be aware of interest charges on borrowed funds, which can eat into your profits.

4. Risk Management Tools: Use stop-loss orders and alerts to manage potential losses effectively.

5. Platform Fees: Check for commissions or fees associated with margin trading, as these can vary significantly.

6. Regulations: Understand the rules and regulations governing margin accounts in your region, as they can impact trading strategies.

7. Volatility: Day trading with margin amplifies both gains and losses, so a solid strategy and market understanding are crucial.

Learn about What Are the Most Common Myths About Day Trading Bots?

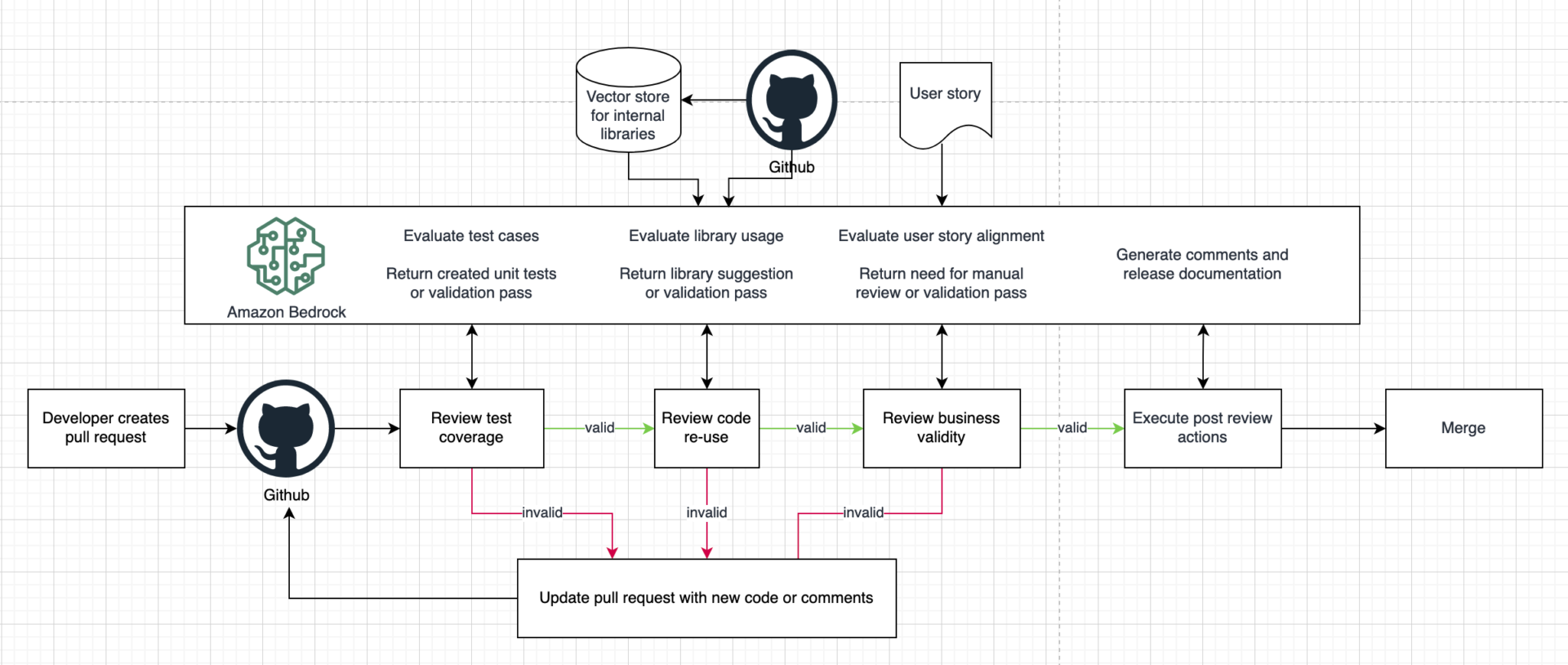

How do automated trading features work in day trading platforms?

Automated trading features in day trading platforms use algorithms to execute trades based on predefined criteria. Traders set parameters like entry and exit points, risk levels, and market conditions. The platform monitors the market, identifies opportunities, and places trades automatically, minimizing emotional decision-making. This can enhance efficiency and speed, allowing traders to capitalize on market movements instantly. Some platforms also offer backtesting, letting users test strategies against historical data before deploying them live.

Learn about How Regulators Detect Insider Trading in Day Markets

What educational resources do day trading platforms offer?

Day trading platforms typically offer educational resources such as webinars, video tutorials, and articles on trading strategies. Many provide live trading simulations and demo accounts for practice. Some platforms also have community forums for peer support and mentorship programs. Additionally, they may offer market analysis tools and research reports to help traders make informed decisions.

Learn about Day Trading Platforms with Customer Support and Resources

How can I choose the best day trading platform for my needs?

To choose the best day trading platform, focus on these key features:

1. Commission Fees: Look for low or zero commissions to maximize your profits.

2. Execution Speed: Opt for platforms with fast trade execution to capitalize on market movements.

3. User Interface: Choose an intuitive interface that makes trading easy and efficient.

4. Charting Tools: Ensure the platform offers advanced charting and technical analysis tools.

5. Research and Analysis: Look for integrated research resources and news feeds to inform your trades.

6. Mobile Access: Check if the platform has a reliable mobile app for trading on the go.

7. Customer Support: Prioritize platforms with responsive customer service for quick help when needed.

8. Account Types: Consider the types of accounts available and their features, like margin trading.

9. Regulation and Security: Ensure the platform is regulated and offers robust security measures.

Evaluate these features based on your trading style and preferences to find the right fit.

Learn about How to Choose the Best Prop Firm for Day Trading

Conclusion about Key Features of Day Trading Platforms

In summary, selecting the right day trading platform hinges on essential features such as advanced charting tools, diverse order types, and real-time data accessibility. Security measures, commission structures, and responsive customer support are also critical to maximizing profitability. Understanding technical indicators, mobile access, and the efficacy of demo accounts can further enhance your trading experience. For a comprehensive evaluation of your options, consider the insights provided by DayTradingBusiness to find a platform that aligns with your trading style and goals.

Learn about FAQs About Day Trading Platforms