Did you know that a common mistake in trading is thinking that buying high and selling low is a strategy? In the world of day trading, particularly in order flow analysis, avoiding pitfalls is crucial for success. This article dives into the most frequent mistakes traders make, such as misinterpreting data, letting emotions cloud judgment, and ignoring market context. We’ll explore how beginners can sidestep these errors, the importance of risk management, and the role of volume in analysis. Additionally, you'll learn best practices for improving your order flow skills, spotting false signals, and utilizing tools to enhance accuracy. Join us at DayTradingBusiness as we help you navigate the complexities of order flow analysis and elevate your trading game!

What are the most common mistakes in order flow analysis for day traders?

Common mistakes in order flow analysis for day traders include:

1. Ignoring Context: Focusing solely on order flow without considering broader market conditions can lead to poor decisions.

2. Overtrading: Misinterpreting minor fluctuations in order flow as trading signals can result in excessive trades and increased costs.

3. Neglecting Volume: Not analyzing volume alongside order flow can give a misleading picture of market strength.

4. Failure to Adapt: Sticking to a rigid analysis method without adjusting to market changes can lead to missed opportunities.

5. Emotional Trading: Allowing emotions to influence decisions rather than relying on data can result in impulsive trades.

6. Misunderstanding Bid/Ask Dynamics: Not fully grasping how bid and ask prices interact can lead to misguided entries and exits.

7. Ignoring Slippage: Failing to account for slippage can affect expected profit margins and trade execution.

8. Poor Risk Management: Not setting appropriate stop-loss and take-profit levels based on order flow signals can increase potential losses.

How can beginners avoid pitfalls in order flow analysis?

Beginners can avoid pitfalls in order flow analysis by focusing on a few key practices. First, avoid overreacting to every tick; develop a clear strategy and stick to it. Second, don't ignore the context of market conditions; always consider broader trends. Third, be wary of relying solely on volume without understanding price action; they must be analyzed together. Fourth, limit distractions and focus on one or two markets to deepen your understanding. Lastly, practice consistently with a demo account to refine your skills before trading with real capital.

Why is misinterpretation of order flow data a frequent error?

Misinterpretation of order flow data often occurs due to cognitive biases, such as confirmation bias, where traders see only what they want to see. Inaccurate assumptions about market conditions can also lead to errors. Additionally, the complexity of reading order flow, including distinguishing between real buying/selling pressure and market noise, contributes to frequent mistakes. Traders may misread large orders as strong signals instead of recognizing them as potential traps. Lack of experience and emotional decision-making further exacerbate these misinterpretations, leading to poor trading choices.

What role does emotional trading play in order flow mistakes?

Emotional trading leads to impulsive decisions, causing day traders to misread order flow. Traders may overreact to minor market movements, resulting in poor entry and exit points. Fear can trigger premature selling, while greed might lead to holding losing positions too long. These emotions distort analysis, making it difficult to stick to a trading plan. By letting emotions dictate actions, traders often ignore clear signals in the order flow, leading to costly mistakes.

How does ignoring market context affect order flow analysis?

Ignoring market context can lead to misinterpretation of order flow signals. When traders overlook broader market trends, news events, or economic indicators, they may misread buying or selling pressure. This can result in taking positions based on false signals or failing to recognize shifts in market sentiment. Without context, traders might enter trades that are against the prevailing trend, increasing the risk of losses. Essentially, understanding the market environment is crucial for making informed decisions based on order flow analysis.

What are the consequences of relying solely on order flow indicators?

Relying solely on order flow indicators can lead to several consequences. First, you may miss broader market trends, as these indicators focus on immediate buying and selling activity. This narrow view can result in false signals or whipsaws, causing losses. Additionally, without considering other factors like news events or technical analysis, your trading decisions might lack context, increasing risk. Overconfidence in order flow can also lead to neglecting risk management practices, amplifying potential losses. Finally, market conditions can change rapidly; if you only depend on order flow, you might not adapt quickly enough.

How can poor risk management lead to order flow analysis errors?

Poor risk management can lead to order flow analysis errors by causing traders to focus more on short-term gains rather than the underlying market dynamics. When traders neglect risk management, they may over-leverage their positions, leading to emotional decision-making that distorts their analysis of order flow. This can result in misinterpreting buy and sell signals, as the trader might ignore critical market indicators in favor of chasing profits. Additionally, inadequate stop-loss strategies can exacerbate losses, skewing the trader’s perception of market trends and volume. Ultimately, without proper risk management, traders are more likely to misread order flow, leading to costly mistakes.

Why is it important to consider volume alongside order flow?

Considering volume alongside order flow is crucial because volume confirms the strength of price movements. High volume with order flow indicates strong buying or selling interest, validating trends. Conversely, low volume can signal weak moves, potentially leading to false signals. Ignoring volume might result in costly mistakes, like entering trades on weak price action. In day trading, aligning volume with order flow helps you make informed decisions and improves trade reliability.

How can day traders improve their order flow reading skills?

Day traders can improve their order flow reading skills by focusing on these key areas:

1. Practice Regularly: Spend time daily analyzing real-time order flow data to develop intuition and speed in recognizing patterns.

2. Use Advanced Tools: Utilize software that offers detailed order flow analysis, such as footprint charts or volume profile tools, to visualize market activity.

3. Study Market Context: Always consider the broader market environment. Recognize how news and events influence order flow to make informed decisions.

4. Identify Common Patterns: Learn to spot recurring patterns in order flow, such as absorption and accumulation, which can signal potential price movements.

5. Keep a Trading Journal: Document your trades and order flow insights to identify mistakes and refine your strategy over time.

6. Review Mistakes: Analyze past trades where your order flow reading was incorrect to understand what went wrong and avoid repeating those errors.

7. Engage with a Community: Join forums or trading groups to discuss order flow strategies and learn from experienced traders.

By focusing on these strategies, day traders can enhance their order flow reading skills and make more informed trading decisions.

What are the best practices for analyzing order flow effectively?

1. Avoid overcomplicating your analysis. Focus on key indicators like volume and price action.

2. Don’t ignore the context of the market. Analyze order flow in relation to overall market trends.

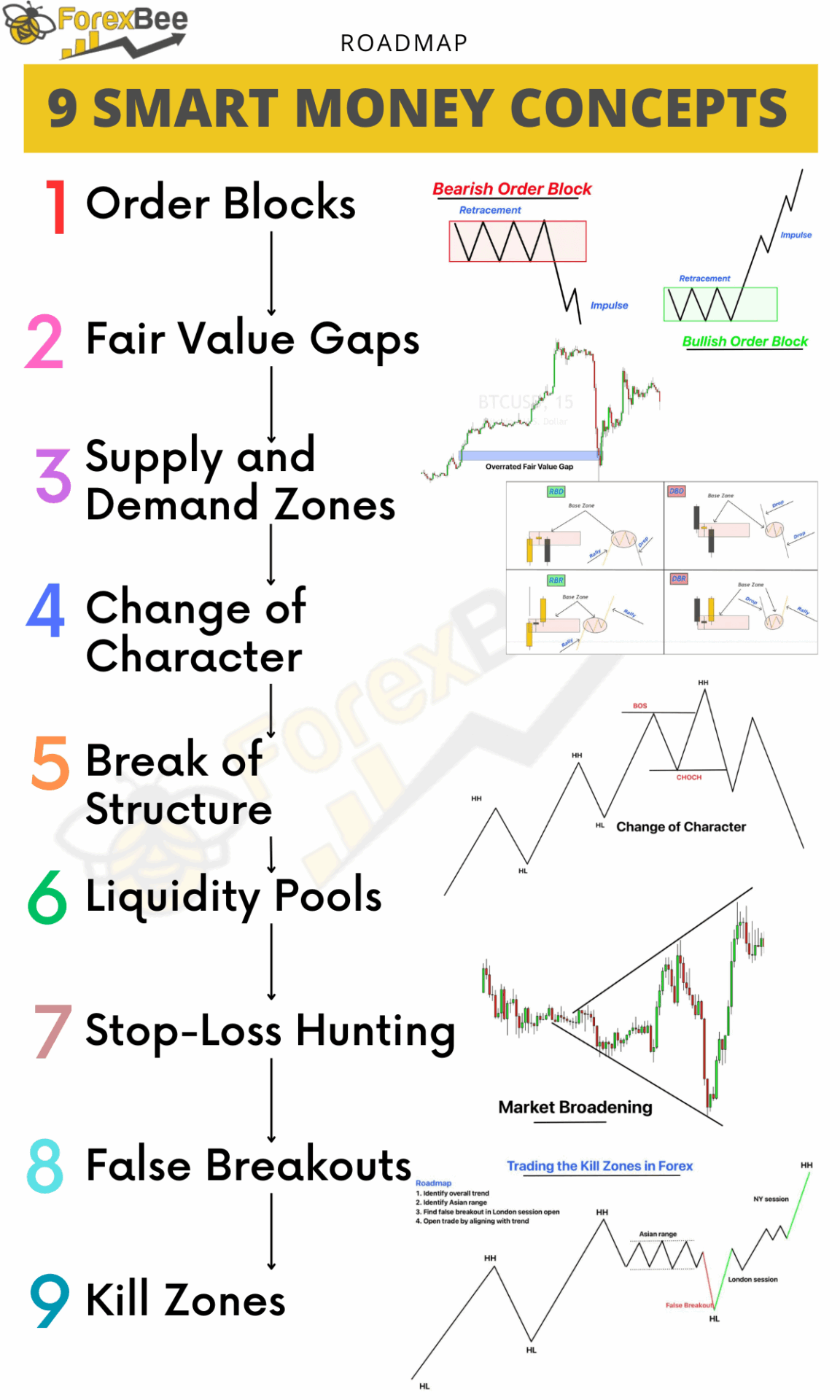

3. Watch for false signals. Confirm order flow patterns with other technical indicators before making trades.

4. Stay disciplined. Stick to your trading plan and avoid emotional decisions driven by order flow noise.

5. Keep your analysis time-frame consistent. Use the same time frame for analyzing order flow as you do for trading.

6. Document your trades. Review past order flow analysis to identify patterns and mistakes.

7. Be wary of herd mentality. Just because many traders are acting on a signal doesn’t mean it’s valid.

8. Regularly update your knowledge. Stay informed about market changes that could impact order flow dynamics.

How does overtrading impact order flow analysis accuracy?

Overtrading skews order flow analysis accuracy by creating noise in the data. When traders excessively buy and sell, they introduce erratic price movements that mask true market sentiment. This can lead to false signals, making it difficult to identify genuine buying or selling pressure. Additionally, emotional decision-making during overtrading can further distort analysis, causing traders to misinterpret trends and volumes. Ultimately, this undermines the reliability of order flow indicators and can result in poor trading outcomes.

Learn about How to Incorporate Order Flow Analysis into Your Trading Routine

What common biases affect order flow interpretation?

Common biases that affect order flow interpretation include confirmation bias, where traders favor information that supports their existing beliefs; anchoring bias, which leads them to rely too heavily on initial price levels; and loss aversion, making them more sensitive to potential losses than gains. Additionally, overconfidence can cause traders to overestimate their ability to predict market movements, while recency bias may lead them to give too much weight to recent price action. These biases can skew decision-making and hinder effective order flow analysis in day trading.

How can day traders spot false signals in order flow?

Day traders can spot false signals in order flow by focusing on these key strategies:

1. Volume Analysis: Look for discrepancies between price movement and volume. If price rises but volume is low, it may indicate a false breakout.

2. Order Book Depth: Monitor the order book for large buy or sell orders that could influence price but aren’t executed. A sudden lack of follow-through can signal false moves.

3. Price Action Confirmation: Wait for price action to confirm signals. If a breakout occurs without subsequent support, it’s likely weak.

4. Market Sentiment: Keep an eye on broader market trends and news. A shift in sentiment can provide context to order flow signals.

5. Technical Indicators: Use indicators like RSI or MACD alongside order flow to cross-check signals. Divergence can highlight potential false signals.

6. Time Frames: Analyze multiple time frames. A signal that appears strong on a lower time frame may look different on a higher one.

By applying these techniques, day traders can better identify and avoid false signals in order flow.

Learn about How to Spot Reversal Signals on Day Trading Charts

What tools can help minimize mistakes in order flow analysis?

To minimize mistakes in order flow analysis, use these tools:

1. Trading Software: Platforms like NinjaTrader or Sierra Chart provide advanced charting and order flow analytics features.

2. Volume Profile Tools: These help visualize trading volume at different price levels, aiding in decision-making.

3. Order Flow Indicators: Tools like Delta and Cumulative Delta can clarify buying and selling pressure.

4. Level 2 Data: Access to real-time market depth helps you understand supply and demand dynamics.

5. Risk Management Tools: Use stop-loss orders and position sizing calculators to protect against errors.

6. Backtesting Software: This helps you test strategies against historical data to refine your approach.

Incorporating these tools can significantly reduce errors in your order flow analysis.

How does a lack of strategy contribute to order flow errors?

A lack of strategy leads to order flow errors by causing traders to react impulsively to market movements instead of following a clear plan. Without defined entry and exit points, traders might misinterpret signals, resulting in missed opportunities or unnecessary losses. Additionally, the absence of a strategy can lead to inconsistent execution, where traders place orders without considering market context, volume, or timing. This inconsistency fuels mistakes like overtrading or chasing prices, ultimately disrupting effective order flow analysis.

What are the benefits of continuous learning in order flow analysis?

Continuous learning in order flow analysis enhances a trader's ability to interpret market dynamics, improving decision-making skills. It helps in identifying patterns, reducing errors, and increasing adaptability to market changes. By staying updated on new tools and techniques, traders can refine their strategies and avoid common pitfalls like overtrading or misreading signals. This ongoing education fosters confidence, enabling traders to respond effectively to real-time market conditions. Overall, continuous learning cultivates a more robust trading approach, leading to better performance and reduced risk.

Conclusion about Common Mistakes in Order Flow Analysis for Day Traders

In summary, mastering order flow analysis is crucial for day traders to avoid common pitfalls that can hinder their success. By recognizing mistakes such as emotional trading, misinterpretation of data, and neglecting market context, beginners can enhance their analysis skills. Emphasizing risk management and continuous learning, along with utilizing the right tools, will empower traders to make informed decisions. For comprehensive guidance on improving order flow analysis, DayTradingBusiness is here to support your trading journey.

Learn about Order Flow Analysis vs. Technical Analysis in Day Trading