Did you know that traders once relied on chickens to predict market trends? While poultry-based forecasts are long gone, understanding reversal patterns in day trading is more relevant than ever. This article dives deep into recognizing reversal patterns, covering their definitions, effective identification techniques, and common types. We'll explore how candlestick patterns and market volume signal reversals, the influence of trend lines and market sentiment, and the importance of support and resistance levels. Additionally, we’ll discuss bullish and bearish patterns, the role of technical indicators, common pitfalls to avoid, and the significance of time frames. Plus, discover strategies to confirm reversals before making your move. For those eager to enhance their trading skills, DayTradingBusiness offers invaluable resources to master these essential concepts.

What are reversal patterns in day trading?

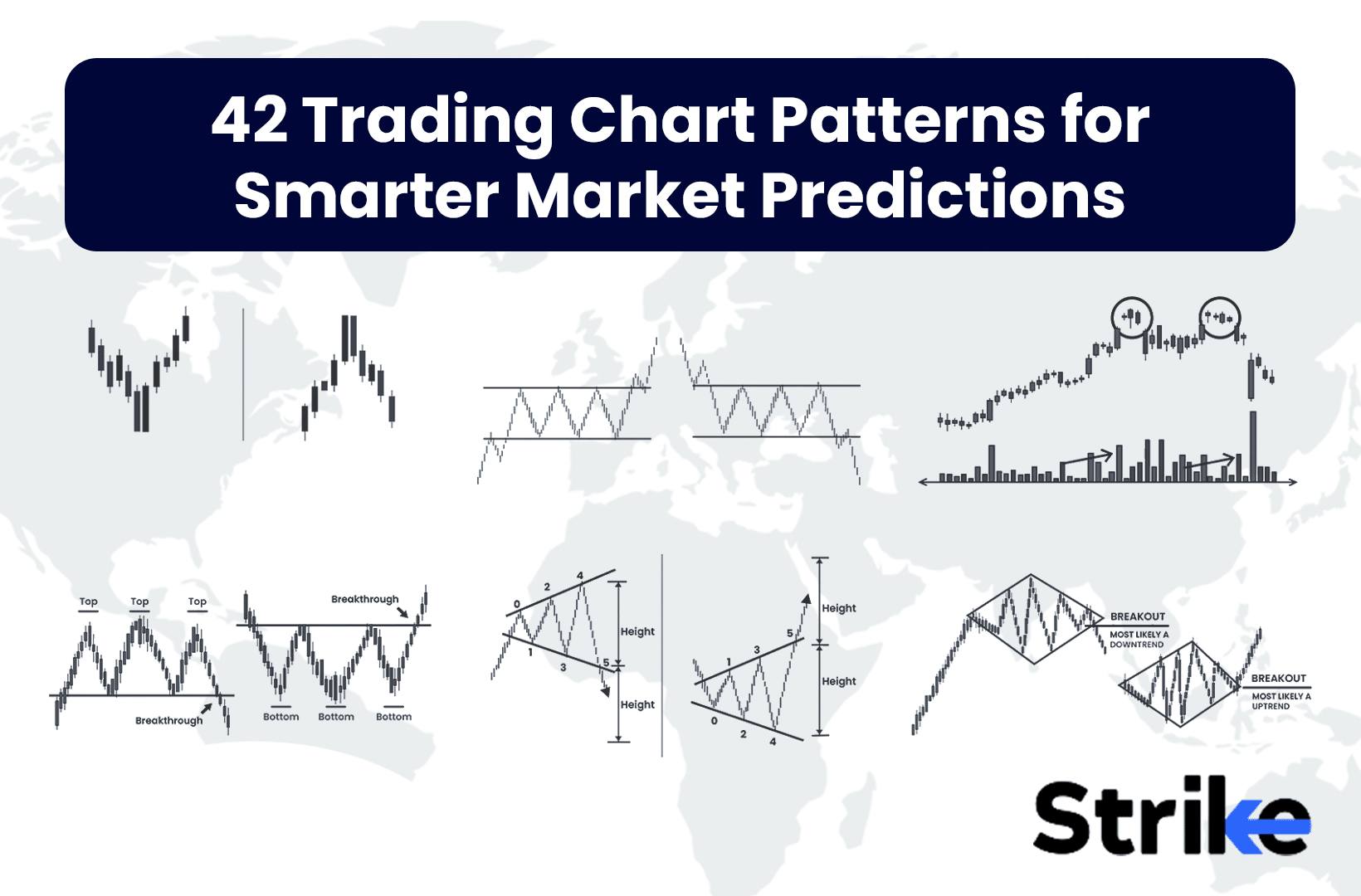

Reversal patterns in day trading signal potential changes in the direction of a stock's price. Common types include head and shoulders, double tops and bottoms, and triangles.

A head and shoulders pattern indicates a price peak followed by a decline, while a double top suggests a reversal after a price rise. Conversely, a double bottom shows a potential upward turn after a decline.

Traders look for these patterns to enter or exit positions, using them to anticipate shifts in market momentum. Recognizing these patterns can help make informed trading decisions.

How can I identify reversal patterns effectively?

To identify reversal patterns in day trading, focus on these key techniques:

1. Candlestick Patterns: Look for specific formations like hammers, shooting stars, or engulfing patterns at significant support or resistance levels.

2. Trend Analysis: Notice when prices move against the prevailing trend, especially after a strong uptrend or downtrend, indicating potential reversals.

3. Volume Confirmation: An increase in volume accompanying a reversal pattern can validate the signal. Higher volume often confirms stronger buying or selling pressure.

4. Divergence: Watch for divergence between price and indicators like RSI or MACD. If the price makes a new high or low but the indicator does not, it may signal a reversal.

5. Support and Resistance Levels: Identify key levels where price has previously reversed. A bounce off these levels can indicate a potential reversal.

6. Chart Patterns: Recognize larger formations like double tops/bottoms or head and shoulders, which often precede a reversal.

Combine these methods for a more robust confirmation of reversal patterns.

What are the most common reversal patterns in day trading?

The most common reversal patterns in day trading are:

1. Head and Shoulders: Indicates a trend reversal, forming three peaks—one higher (head) between two lower (shoulders).

2. Inverse Head and Shoulders: The opposite of the head and shoulders, signaling a bullish reversal after a downtrend.

3. Double Top: Occurs after an uptrend, characterized by two peaks at roughly the same price level, suggesting a bearish reversal.

4. Double Bottom: Appears after a downtrend, featuring two troughs at similar price points, indicating a bullish reversal.

5. Triple Top and Triple Bottom: Similar to double tops/bottoms but with three peaks or troughs, reinforcing reversal signals.

6. Candlestick Patterns: Key patterns like the bullish engulfing and bearish engulfing can indicate potential reversals.

Recognizing these patterns can enhance your day trading strategy.

How do candlestick patterns indicate reversals?

Candlestick patterns indicate reversals by showing shifts in market sentiment. For example, a "hammer" at the bottom of a downtrend suggests buying interest, signaling a potential reversal to the upside. Conversely, a "shooting star" at the top of an uptrend indicates selling pressure, hinting at a possible downturn. Traders look for these formations along with volume spikes for confirmation. Patterns like "engulfing" and "doji" also highlight indecision, further signaling a change in direction. Monitoring these patterns helps traders anticipate reversals effectively.

What is the significance of volume in recognizing reversals?

Volume is crucial in recognizing reversals because it confirms the strength of a price movement. High volume during a reversal indicates strong interest and conviction from traders, suggesting that the trend is likely to change. Conversely, low volume may signal a lack of support for the reversal, making it less reliable. For example, if a stock's price drops sharply but volume remains low, the downward trend may not be sustainable. Overall, analyzing volume alongside price action helps traders make more informed decisions about potential reversals.

How can trend lines help in spotting reversal patterns?

Trend lines help spot reversal patterns by visually indicating changes in price direction. When prices approach a trend line, a break above or below it can signal a potential reversal. For instance, if a stock consistently bounces off a downward trend line, a breakout might indicate a bullish reversal. Conversely, if prices rise to a resistance trend line and fail to break through, it could hint at a bearish reversal. Observing these interactions can guide day traders in making informed decisions.

What role does market sentiment play in reversal patterns?

Market sentiment is crucial in identifying reversal patterns in day trading. When traders feel overly optimistic or pessimistic, it can lead to price extremes. For example, excessive bullish sentiment may create a double top pattern, signaling a potential reversal as sellers step in. Conversely, strong bearish sentiment can form a double bottom, indicating buyers may re-enter the market. Monitoring sentiment through indicators like the Fear & Greed Index or social media trends helps traders spot these patterns early, allowing for better decision-making.

How do I use support and resistance levels to find reversals?

To use support and resistance levels for identifying reversals, first, identify key support and resistance levels on your chart. Look for price points where the asset has previously bounced or reversed. When the price approaches these levels, watch for reversal patterns like double tops, double bottoms, or candlestick formations such as hammers and shooting stars. Confirm the reversal with volume spikes or momentum indicators. If the price breaks through these levels, it often indicates a continuation rather than a reversal. Use this information to plan your entry and exit points effectively.

What are the differences between bullish and bearish reversal patterns?

Bullish reversal patterns signal a potential price increase after a downtrend, while bearish reversal patterns indicate a possible price drop following an uptrend. Examples of bullish patterns include the double bottom and hammer, which suggest buying pressure. In contrast, bearish patterns like the double top and shooting star highlight selling pressure. Recognizing these patterns helps day traders make informed decisions about when to enter or exit trades.

How can technical indicators assist in identifying reversal patterns?

Technical indicators help identify reversal patterns by providing signals that suggest a change in market direction. For instance, the Relative Strength Index (RSI) can indicate overbought or oversold conditions, signaling potential reversals. Moving averages can show crossovers that suggest trend changes. Candlestick patterns, combined with volume indicators, can highlight buyer or seller exhaustion. By analyzing these indicators together, traders can spot reversal patterns more effectively and make informed decisions in day trading.

What mistakes should I avoid when trading reversal patterns?

Avoid these mistakes when trading reversal patterns:

1. Ignoring confirmation signals: Always wait for additional indicators, like volume spikes or candlestick patterns, before acting on a reversal.

2. Overtrading: Don’t jump into every potential reversal; focus on high-probability setups.

3. Neglecting stop-loss orders: Always set stop-losses to manage risk effectively.

4. Misreading the trend: Ensure the reversal pattern aligns with the overall trend before entering a trade.

5. Failing to analyze market context: Consider news, economic data, or other external factors that might influence price movement.

6. Relying solely on one pattern: Use a combination of reversal patterns to strengthen your analysis and decision-making.

By avoiding these pitfalls, you can improve your chances of success when trading reversal patterns.

How do time frames affect the identification of reversal patterns?

Time frames significantly impact the identification of reversal patterns in day trading. Shorter time frames, like 1-minute or 5-minute charts, can produce frequent but less reliable reversal signals due to market noise. Conversely, longer time frames, such as 30-minute or hourly charts, offer clearer and more reliable patterns, as they filter out short-term volatility. Traders often look for confirmation across multiple time frames to validate a reversal, ensuring that patterns on a lower time frame align with those on a higher time frame for increased accuracy.

What are the best strategies for trading reversal patterns?

1. Identify Key Levels: Look for support and resistance zones where reversals are likely to occur.

2. Use Candlestick Patterns: Recognize reversal candlestick formations like hammer, engulfing, or shooting star.

3. Confirm with Indicators: Utilize indicators like RSI or MACD to check for divergence, signaling a potential reversal.

4. Volume Analysis: Look for increased volume during reversal patterns to validate the move.

5. Set Clear Entry and Exit Points: Define your entry based on the confirmation of the reversal and set stop-loss orders to manage risk.

6. Monitor Market Sentiment: Stay updated on news and events that could impact price movements and reversal patterns.

7. Practice Patience: Wait for confirmation before entering trades to avoid false signals.

How can I confirm a reversal pattern before entering a trade?

To confirm a reversal pattern before entering a trade, look for these key signals:

1. Volume Increase: Ensure there's a notable increase in trading volume during the formation of the reversal pattern, indicating strong interest.

2. Price Action: Watch for a clear break of key support or resistance levels. A decisive move beyond these points strengthens the reversal signal.

3. Candlestick Patterns: Identify specific candlestick formations, like bullish engulfing or shooting stars, which signify potential reversals.

4. Technical Indicators: Use indicators like RSI or MACD to check for divergence or overbought/oversold conditions that support the reversal.

5. Time Frame Confirmation: Look for the reversal pattern across multiple time frames for consistency.

By combining these factors, you can increase your confidence in the reversal pattern before making a trade.

What resources are available for learning about reversal patterns?

For learning about reversal patterns in day trading, consider these resources:

1. Books: "Technical Analysis of the Financial Markets" by John Murphy and "Japanese Candlestick Charting Techniques" by Steve Nison provide foundational knowledge.

2. Online Courses: Websites like Udemy and Coursera offer courses specifically on technical analysis and reversal patterns.

3. YouTube Channels: Follow channels like "The Trading Channel" or "Rayner Teo" for visual explanations and practical examples.

4. Trading Forums: Sites like Elite Trader and Trade2Win have discussions on reversal patterns where traders share insights.

5. Webinars: Many trading platforms host free webinars focusing on technical analysis and reversal patterns.

6. Market Analysis Tools: Utilize platforms like TradingView for real-time charting and pattern recognition.

7. Blogs and Articles: Websites like Investopedia and StockCharts publish articles on identifying and trading reversal patterns.

Use these resources to deepen your understanding and improve your skills in recognizing reversal patterns effectively.

How do news events influence reversal patterns in day trading?

News events can significantly influence reversal patterns in day trading by causing sudden price movements and volatility. Positive or negative news may lead to rapid shifts in market sentiment, prompting traders to react quickly. For example, a strong earnings report might reverse a downward trend, while bad economic data could trigger a price drop. Traders often watch news releases to identify potential reversal points, using patterns like double tops or bottoms as indicators. Monitoring these events helps traders anticipate shifts and adjust their strategies accordingly.

Learn about How News Events Impact Day Trading Decisions

Conclusion about Recognizing Reversal Patterns in Day Trading

In summary, recognizing reversal patterns is essential for successful day trading. Effective identification involves analyzing candlestick formations, understanding volume significance, and leveraging trend lines alongside support and resistance levels. Being aware of market sentiment and utilizing technical indicators can further enhance your trading strategy. Avoid common pitfalls, and always confirm reversal signals before entering trades. For more in-depth guidance and resources on mastering reversal patterns, consider exploring the insights offered by DayTradingBusiness.

Learn about How to Identify Reversal Patterns in Day Trading

Sources:

- Recognizing Intra-day Patterns of Stock Market Activity by Joanna ...

- Trend definition or holding strategy: What determines the profitability ...

- Enhancing stock market trend reversal prediction using feature ...

- The “night effect” of intraday trading: Evidence from Chinese gold ...

- Overnight returns, daytime reversals, and future stock returns ...

- A parallel hybrid neural networks model for forecasting returns with ...