Did you know that Bollinger Bands were inspired by a famous dog named "Bandit"? Just like Bandit had a knack for sniffing out trouble, Bollinger Bands help day traders identify potential market movements. In this article, we delve into the ins and outs of Bollinger Bands, exploring their definition, key components, and how they function in day trading. You'll learn how to interpret signals, implement effective strategies, and set up Bollinger Bands on your trading platform. Additionally, we discuss market volatility, price reversals, and common pitfalls to avoid. Plus, discover optimization tips and the role of moving averages. Whether you’re targeting specific assets or looking to backtest strategies, DayTradingBusiness has you covered with essential insights for successful trading.

What are Bollinger Bands in day trading?

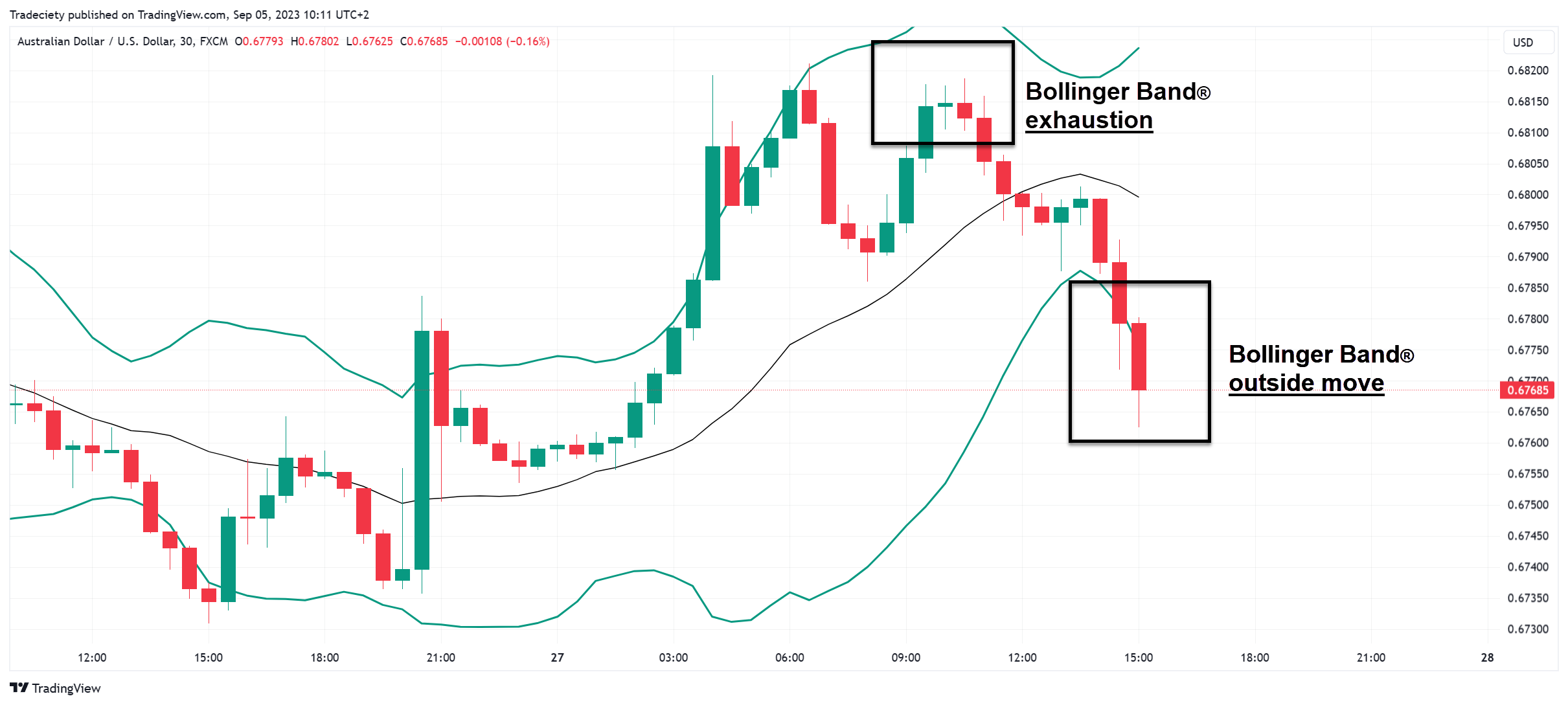

Bollinger Bands are a technical analysis tool used in day trading to measure market volatility and identify potential price movements. They consist of three lines: the middle band is a simple moving average, while the upper and lower bands are standard deviations away from this average. Traders use these bands to spot overbought or oversold conditions. When the price touches the upper band, it may indicate a sell signal, while touching the lower band can suggest a buy signal. The expansion and contraction of the bands also signal changes in volatility, helping traders make informed decisions.

How do Bollinger Bands work for day traders?

Bollinger Bands consist of a middle band (the simple moving average) and two outer bands that represent standard deviations from the average. For day traders, they help identify price volatility and potential reversal points. When the price touches the upper band, it may indicate overbought conditions, while touching the lower band suggests oversold conditions. Traders often look for price breakouts or bounces off these bands to make entry or exit decisions. Using Bollinger Bands alongside other indicators can enhance trading strategies and improve timing in day trading.

What are the key components of Bollinger Bands?

The key components of Bollinger Bands are:

1. Middle Band: This is the simple moving average (SMA) of the price, typically set to 20 periods.

2. Upper Band: This is the middle band plus two standard deviations of the price over the same period.

3. Lower Band: This is the middle band minus two standard deviations of the price.

These components help traders identify volatility and potential price reversals in day trading.

How can I interpret Bollinger Bands signals?

To interpret Bollinger Bands signals in day trading, look for three key aspects:

1. Price Touching Bands: When the price touches the upper band, it suggests overbought conditions, signaling a potential sell. If it touches the lower band, it indicates oversold conditions, signaling a potential buy.

2. Band Squeeze: A squeeze occurs when the bands narrow, indicating low volatility. This often precedes a strong price movement, so watch for breakouts in either direction.

3. Trend Confirmation: Use the middle band (simple moving average) as a trend indicator. If the price is above the middle band, the trend is bullish; if below, it’s bearish.

Combine these signals with other indicators for better accuracy.

What strategies use Bollinger Bands for day trading?

Error: cURL error 52: Empty reply from server

How do I set up Bollinger Bands on my trading platform?

To set up Bollinger Bands on your trading platform, follow these steps:

1. Open your trading chart: Select the asset you want to analyze.

2. Locate the indicators menu: This is usually found in the chart settings or indicators section.

3. Search for Bollinger Bands: Type "Bollinger Bands" in the search bar or find it in the list of technical indicators.

4. Add the indicator: Click to add it to your chart.

5. Adjust settings if needed: The default settings are typically a 20-period moving average with 2 standard deviations. Modify these based on your strategy.

6. Apply and save: Confirm the settings and apply them to your chart.

Now you can use Bollinger Bands to analyze price volatility and potential trading opportunities.

What is the significance of Bollinger Band width?

Bollinger Band width measures market volatility. A narrow width indicates low volatility, often signaling a potential breakout, while a wide width suggests high volatility, which can lead to price reversals. Traders use this information to time entries and exits effectively. When the bands contract, it may precede significant price movements, making it crucial for day trading strategies.

How do Bollinger Bands indicate market volatility?

Bollinger Bands indicate market volatility through the distance between the upper and lower bands. When the bands widen, it shows increased volatility as prices fluctuate more significantly. Conversely, when the bands contract, it signals lower volatility, indicating that the market is stabilizing. Traders often look for price movements near the bands to identify potential breakouts or reversals.

Can Bollinger Bands predict price reversals?

Bollinger Bands can indicate potential price reversals by showing overbought or oversold conditions. When the price touches the upper band, it may signal a reversal to the downside. Conversely, if it touches the lower band, it could suggest a reversal to the upside. However, they are not foolproof; traders should combine them with other indicators for confirmation.

How do I combine Bollinger Bands with other indicators?

To combine Bollinger Bands with other indicators, first identify your trading strategy. Use the Relative Strength Index (RSI) to confirm overbought or oversold conditions when price touches the upper or lower bands. Pair it with Moving Averages to determine trend direction; buy when the price is above both the moving average and the upper band, and sell when below the moving average and the lower band. Additionally, incorporate MACD for momentum analysis; look for crossovers near the bands to signal potential reversals. Always validate signals from multiple indicators before making a trade.

What are common mistakes when using Bollinger Bands?

Common mistakes when using Bollinger Bands include:

1. Ignoring the trend: Traders often forget to consider the overall trend when making decisions based on Bollinger Bands, leading to poor trade entries or exits.

2. Overtrading on bounce signals: Relying too heavily on price bounces off the bands can result in missed opportunities and losses, especially in strong trends.

3. Misinterpreting band squeeze: Assuming that a squeeze always leads to a breakout can be misleading. Not all squeezes result in significant price movement.

4. Neglecting volume: Overlooking volume confirmation can lead to false signals, as price movements without volume support may not be sustainable.

5. Failing to adjust settings: Using the default settings of 20 periods and 2 standard deviations without tailoring them to specific market conditions can reduce effectiveness.

6. Lack of risk management: Not setting stop-loss orders or position sizing can amplify losses when trades go against expectations.

Avoid these mistakes to improve your trading strategy with Bollinger Bands.

How can I optimize Bollinger Bands settings for day trading?

To optimize Bollinger Bands for day trading, adjust the settings based on your trading style and the asset's volatility. Start with the standard settings: a 20-period simple moving average (SMA) and 2 standard deviations.

1. Experiment with Period Length: Test shorter periods like 10 or 14 for quicker signals or longer periods like 30 for smoother trends.

2. Adjust Standard Deviations: Use 1.5 or 2.5 standard deviations if you want tighter or wider bands, respectively, to adapt to market volatility.

3. Monitor Timeframes: Use shorter timeframes (5-minute or 15-minute charts) for day trading to capture quick price movements.

4. Combine with Other Indicators: Use RSI or MACD alongside Bollinger Bands to confirm signals and reduce false breakouts.

5. Backtest Your Settings: Use historical data to see how your adjusted settings perform before live trading.

6. Stay Flexible: Continuously assess market conditions and adjust settings as needed.

This approach will enhance your day trading strategy with Bollinger Bands.

What is the role of the moving average in Bollinger Bands?

The moving average in Bollinger Bands serves as the central line, indicating the trend direction over a specific period. It smooths price data, helping traders identify potential support and resistance levels. The bands themselves, which are standard deviations above and below this moving average, expand and contract based on market volatility. When the price approaches the upper band, it may signal overbought conditions; conversely, touching the lower band might indicate oversold conditions. This setup aids day traders in making informed decisions about entry and exit points.

How do Bollinger Bands perform in trending markets?

In trending markets, Bollinger Bands can help identify the strength and direction of a trend. When the price consistently touches the upper band, it signals strong upward momentum. Conversely, repeated touches of the lower band indicate downward movement.

Traders often use the bands to spot potential breakouts; for example, a price closing above the upper band may suggest a continuation of the bullish trend. However, during strong trends, the bands can widen significantly, which might lead to false signals.

It's essential to combine Bollinger Bands with other indicators, like moving averages or the RSI, for better accuracy in trending markets.

Are there specific stocks or assets that work well with Bollinger Bands?

Stocks with high volatility often work best with Bollinger Bands. Look for assets like tech stocks (e.g., Apple, Tesla) or commodities (like oil and gold). These tend to have significant price fluctuations, making Bollinger Bands effective for identifying potential breakouts or reversals. Additionally, trading ETFs that track volatile sectors can also yield good results when using Bollinger Bands.

How can I backtest Bollinger Bands strategies effectively?

To backtest Bollinger Bands strategies effectively, follow these steps:

1. Choose a Trading Platform: Use software like TradingView or MetaTrader that supports backtesting.

2. Select Your Asset and Timeframe: Pick the stocks or forex pairs and the timeframes you want to analyze.

3. Define Your Strategy: Specify entry and exit rules using Bollinger Bands, such as buying when the price touches the lower band and selling at the upper band.

4. Use Historical Data: Gather historical price data for your selected asset, ensuring it includes enough data points for reliable results.

5. Implement Your Strategy: Code your Bollinger Bands strategy into the backtesting tool, setting conditions for trades based on the defined rules.

6. Run Backtests: Execute the backtest over various time periods to see how the strategy would have performed.

7. Analyze Results: Look at key metrics like win rate, average profit/loss, and maximum drawdown to evaluate effectiveness.

8. Refine Your Strategy: Adjust your parameters based on results and retest until you find a consistently profitable approach.

9. Consider Market Conditions: Test across different market conditions to ensure robustness.

10. Paper Trade: After backtesting, simulate trades in a live market without real money to validate your strategy.

This process helps in honing your Bollinger Bands strategies for day trading success.

Conclusion about Bollinger Bands: Day Trading Insights

In summary, Bollinger Bands are a vital tool for day traders, offering insights into market volatility and potential price movements. Understanding their components and how to interpret signals can enhance trading strategies. By combining Bollinger Bands with other indicators and optimizing settings, traders can improve their decision-making process. For those looking to deepen their trading knowledge and skills, DayTradingBusiness provides essential resources and support tailored to your trading journey.