Did you know that 90% of traders believe they can predict the market just by reading the news—while only 10% actually can? In the world of day trading, sentiment analysis can be a game-changer, helping traders make informed decisions based on market psychology. This article dives into the best tools for day trading sentiment analysis, highlighting their impact on trading decisions, essential features to look for, and even free options available. We’ll also explore how to leverage social media and news sentiment, interpret data effectively, and integrate these insights into your trading strategy. Finally, we’ll discuss the limitations of sentiment analysis and how it differs from traditional technical analysis. Join us at DayTradingBusiness as we break down these key points to enhance your trading approach.

What are the best tools for day trading sentiment analysis?

The best tools for day trading sentiment analysis include:

1. Twitter Sentiment Analysis Tools: Platforms like TweetDeck or Sentiment140 analyze Twitter feeds for market sentiment.

2. StockTwits: This social network focuses on stock market conversations, providing insights into trader sentiments.

3. Finviz: Offers sentiment indicators along with stock screening features.

4. MarketPsych: Uses news and social media to analyze market sentiment and provides actionable insights.

5. Trade Ideas: Integrates AI to analyze sentiment and market trends in real-time.

6. Seeking Alpha: Features user-generated content and analyses that reflect trader sentiment on various stocks.

These tools help you gauge market mood and make informed trading decisions.

How does sentiment analysis impact day trading decisions?

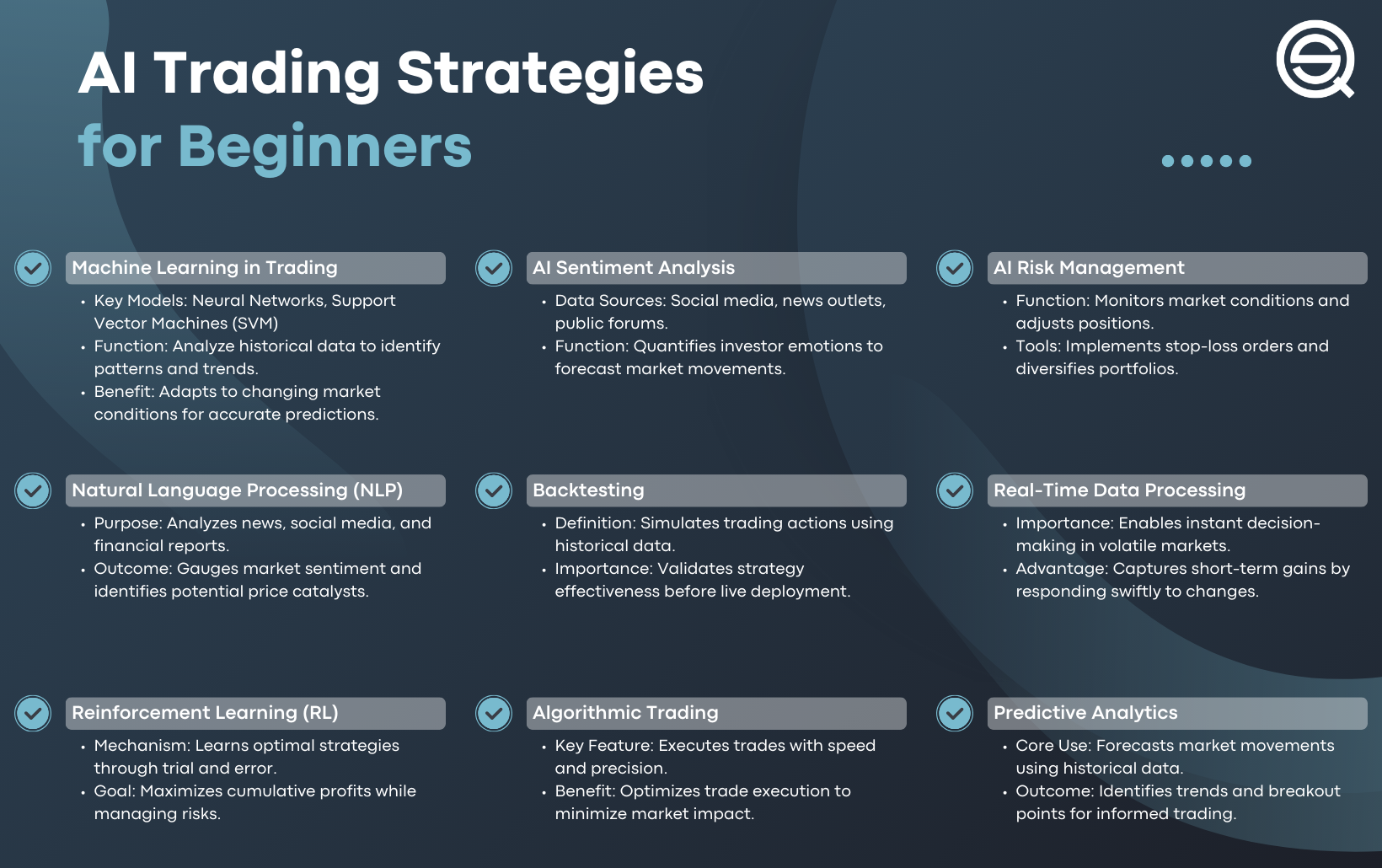

Sentiment analysis impacts day trading decisions by providing insights into market emotions and trends. Traders use sentiment analysis tools to gauge public opinion on stocks, which helps them identify potential price movements. Positive sentiment can indicate buying opportunities, while negative sentiment may signal when to sell or short a stock. By analyzing social media, news articles, and forums, traders can make more informed decisions, enhance their timing, and manage risk effectively. Tools like natural language processing algorithms and sentiment indicators streamline this analysis, offering real-time data that can influence trades.

What features should I look for in sentiment analysis tools?

Look for sentiment analysis tools that offer real-time data, social media monitoring, and news sentiment analysis. Ensure they provide customizable alerts for market changes and integrate with trading platforms. Advanced features like natural language processing (NLP) capabilities and historical data analysis can enhance accuracy. Also, consider user-friendly interfaces and strong customer support for effective utilization.

Are there free tools for sentiment analysis in day trading?

Yes, there are several free tools for sentiment analysis in day trading. Some popular options include:

1. Twitter Sentiment Analysis: Tools like TweetDeck or sentiment analysis APIs like VADER can help gauge market sentiment from Twitter feeds.

2. StockTwits: This platform aggregates trader sentiments and provides a sentiment score for stocks based on user posts.

3. Finviz: Offers a sentiment section showing bullish and bearish sentiment for various stocks based on social media and news.

4. Google Trends: Analyzing search trends can provide insights into market sentiment around specific stocks.

5. Seeking Alpha: Includes sentiment analysis features in its articles and user comments, helping traders assess market feelings.

These tools can enhance your day trading strategy by providing insights into market mood.

How can I use social media for day trading sentiment analysis?

To use social media for day trading sentiment analysis, follow these steps:

1. Monitor Platforms: Focus on Twitter, Reddit, and StockTwits. Track trending stocks and discussions.

2. Use Sentiment Analysis Tools: Utilize tools like StockTwits sentiment score, Swaggy Stocks, or Sentifi to gauge market mood.

3. Analyze Hashtags and Keywords: Search for relevant hashtags (e.g., #stocks, #daytrading) to identify popular trends and sentiments.

4. Engage with Influencers: Follow and analyze insights from trading influencers who discuss market sentiments.

5. Track News and Events: Watch for breaking news that may impact stock prices and sentiment.

6. Join Trading Communities: Participate in forums or groups to gain insights and sentiment from collective discussions.

7. Visualize Data: Use platforms like TradingView to visualize sentiment data alongside price movements for better trading decisions.

By actively engaging with these elements, you can effectively leverage social media for day trading sentiment analysis.

What role does news sentiment play in day trading?

News sentiment significantly influences day trading by impacting stock prices and market volatility. Traders analyze news sentiment to gauge market reactions—positive news can drive prices up, while negative news can cause declines. Tools for sentiment analysis, like social media trackers and news aggregators, help traders quickly identify trends and sentiment shifts. By interpreting sentiment data, day traders can make informed decisions on entry and exit points, enhancing their trading strategies.

How do I interpret sentiment analysis data for trading?

To interpret sentiment analysis data for trading, start by assessing the overall sentiment score, which indicates market mood—positive, negative, or neutral. Look for trends in sentiment over time; increasing positive sentiment may signal bullish trends, while rising negativity could indicate bearish movements.

Use specific metrics like the volume of mentions, engagement rates, and sentiment shifts in key stocks or sectors. Combine sentiment data with technical indicators for a more robust trading strategy. For example, if sentiment turns positive while technical indicators show a buy signal, it may be a strong entry point.

Tools like social media sentiment trackers, news aggregators, and trading platforms with built-in sentiment analysis can provide real-time insights. Always validate sentiment findings with fundamental analysis to avoid false signals.

Which platforms offer real-time sentiment analysis for traders?

Platforms that offer real-time sentiment analysis for traders include:

1. TradingView: Provides sentiment indicators based on user activity and social media trends.

2. MarketPsych: Analyzes news and social media to gauge market sentiment.

3. Sentifi: Utilizes AI to track investor sentiment from various media sources.

4. StockTwits: Features sentiment scores based on social media discussions among traders.

5. Bloomberg Terminal: Offers comprehensive sentiment analysis tools integrated with market data.

6. Thomson Reuters Eikon: Includes sentiment analysis features based on news and social media feeds.

These platforms help traders make informed decisions by analyzing market sentiment in real time.

Can sentiment analysis tools predict market movements?

Yes, sentiment analysis tools can help predict market movements by analyzing social media, news, and other data sources to gauge market sentiment. These tools identify trends in trader emotions and behavior, which can influence buying and selling decisions. For day trading, they provide insights into potential price shifts based on collective sentiment, allowing traders to make informed decisions. However, while they can enhance predictions, they are not foolproof and should be used alongside other analysis methods.

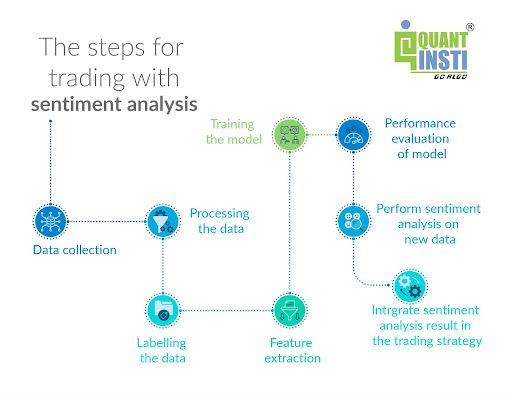

How do I integrate sentiment analysis into my trading strategy?

To integrate sentiment analysis into your trading strategy, start by using tools like social media sentiment trackers, news aggregators, and specialized trading platforms that analyze market sentiment. Monitor platforms like Twitter and Reddit for real-time sentiment shifts. Use APIs from sentiment analysis providers to incorporate data into your trading algorithms. Analyze historical sentiment data alongside price movements to identify patterns. Set alerts for significant sentiment changes that could impact your trades. Finally, backtest your strategy using historical sentiment data to refine your approach.

Learn about How to Incorporate Order Flow Analysis into Your Trading Routine

What are the limitations of sentiment analysis in day trading?

Sentiment analysis in day trading has several limitations. First, it often relies on subjective interpretation of text, which can lead to inaccuracies. Second, it may not account for the context in which sentiments are expressed, causing misinterpretation of market signals. Third, sentiment data can be noisy and influenced by temporary trends or events, leading to false positives. Additionally, algorithms may struggle with sarcasm or nuanced language, further complicating analysis. Finally, sentiment analysis tools often lag behind real-time market movements, reducing their effectiveness for immediate trading decisions.

How can I measure the effectiveness of sentiment analysis tools?

To measure the effectiveness of sentiment analysis tools for day trading, consider these factors:

1. Accuracy: Compare the tool's predictions against actual market movements. A higher correlation indicates better performance.

2. Real-time data processing: Assess how quickly the tool processes news and social media sentiment. Faster tools can provide a competitive edge.

3. Sentiment scoring: Evaluate the scoring system. A clear and consistent scoring method will help in better decision-making.

4. Backtesting results: Use historical data to see how well the tool’s signals would have performed in past trading scenarios.

5. User feedback: Look for reviews from other traders who have used the tool, focusing on their experiences with its effectiveness.

6. Integration capabilities: Check how well the tool integrates with your trading platform, as seamless integration can enhance workflow efficiency.

By focusing on these areas, you can effectively gauge the performance of sentiment analysis tools in day trading.

Are there specific indicators to watch in sentiment analysis?

Yes, key indicators to watch in sentiment analysis for day trading include:

1. Social Media Mentions: Track the volume and sentiment of mentions on platforms like Twitter and Reddit.

2. News Sentiment: Analyze headlines and articles for positive or negative bias towards stocks.

3. Stock Price Movements: Observe how stock prices react to sentiment changes; sharp movements can indicate market sentiment shifts.

4. Volume of Trades: High trading volume can signal strong sentiment, either bullish or bearish.

5. Options Activity: Look at call vs. put options; a spike in calls may indicate bullish sentiment.

These indicators can help gauge market mood and inform trading decisions effectively.

How does sentiment analysis differ from technical analysis?

Sentiment analysis focuses on gauging market mood by analyzing news, social media, and trader sentiment, helping day traders understand potential price movements driven by emotions. In contrast, technical analysis relies on historical price patterns, indicators, and charting tools to predict future price behavior based on past market data. While sentiment analysis captures the psychological aspect of trading, technical analysis emphasizes quantitative data and trends. Both tools can complement each other in day trading strategies.

What are the top paid sentiment analysis tools for day trading?

The top paid sentiment analysis tools for day trading include:

1. Bloomberg Terminal – Offers comprehensive news and social media sentiment analysis, crucial for real-time trading decisions.

2. Sentifi – Analyzes market sentiment using data from social media, news, and blogs, providing insights on stocks and trends.

3. Trade Ideas – Features AI-powered sentiment analysis to identify trading opportunities based on market news and social sentiment.

4. Refinitiv Eikon – Provides advanced analytics and sentiment data, helping traders gauge market mood effectively.

5. MarketPsych – Delivers sentiment data and analytics derived from news, social media, and other sources tailored for financial markets.

These tools help traders make informed decisions based on sentiment trends.

Learn about Top Sentiment Analysis Techniques for Day Traders

How can I combine sentiment analysis with other trading tools?

You can combine sentiment analysis with other trading tools by integrating it into your trading strategy. Use sentiment data to inform your technical analysis; for instance, if sentiment is bullish and technical indicators signal a buy, consider entering a position. Pair sentiment analysis with fundamental analysis to gauge market reactions to news events, helping you make more informed decisions.

Incorporate sentiment analysis into algorithmic trading by using APIs that aggregate social media and news sentiment. This can enhance your trading algorithms, allowing them to react to market sentiment in real-time. Additionally, utilize sentiment indicators alongside charting tools to visualize market mood, which can provide insights into potential price movements.

Learn about How to Combine Sentiment Analysis with Trading Strategies

Conclusion about Tools for Day Trading Sentiment Analysis

Incorporating sentiment analysis tools into your day trading strategy can significantly enhance decision-making by providing insights into market psychology. Understanding features such as real-time data, social media integration, and news sentiment is crucial for effective trading. While there are free options available, investing in premium tools may offer greater accuracy and predictive capabilities. Ultimately, combining sentiment analysis with traditional technical indicators can lead to a more comprehensive trading approach. For tailored insights and support on navigating these tools, consider leveraging the expertise of DayTradingBusiness.

Learn about Day Trading Brokers with Research and Analysis Tools

Sources:

- Revisiting time-varying dynamics in stock market forecasting: A multi ...

- Sentiment trading with large language models

- EmTract: Extracting emotions from social media - ScienceDirect

- Revisiting Financial Sentiment Analysis: A Language Model Approach

- Unveiling the nexus between energy storage and electricity markets ...

- Event-Based Trading: Building Superior Trading Strategies with ...