Did you know that some traders can predict market moves as accurately as a squirrel predicting the weather? If only it were that easy! In the world of day trading, mastering order flow analysis is crucial for making informed decisions. This article dives into the essentials of order flow analysis, detailing its definition, key components, and how it differs from traditional technical analysis. You'll learn how to interpret order flow charts, the significance of volume, and the best tools for effective analysis. Additionally, we’ll explore common pitfalls to avoid, strategies for leveraging order flow, and the impact of economic news on market behavior. Whether you're a novice or a seasoned trader, DayTradingBusiness is here to guide you through the intricacies of order flow analysis to enhance your trading skills.

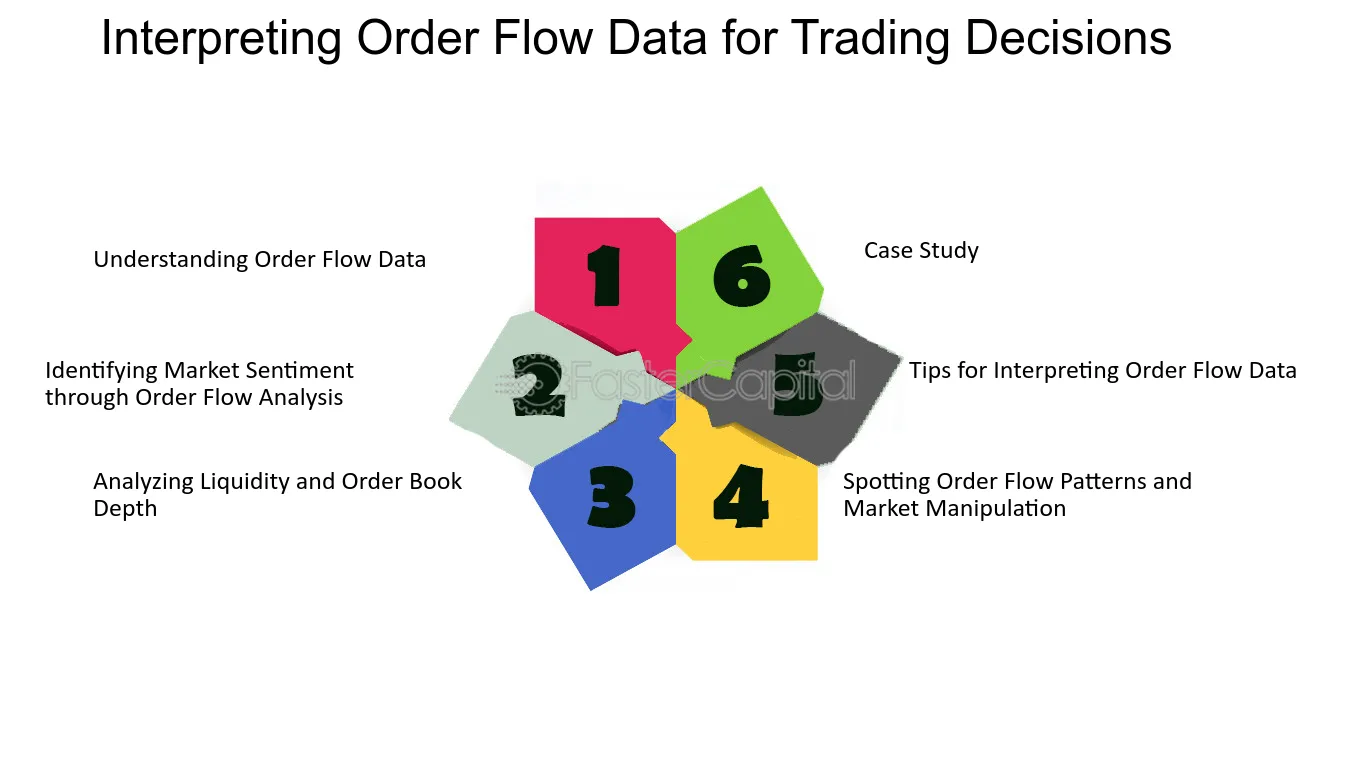

What is Order Flow Analysis in Day Trading?

Order Flow Analysis in day trading involves examining the volume and types of orders in the market to understand price movements and market sentiment. Traders use real-time data on buy and sell orders to identify trends and potential reversals. Key concepts include the bid-ask spread, liquidity, and market depth. By analyzing order flow, traders can make informed decisions on entry and exit points, enhancing their trading strategies.

How Does Order Flow Analysis Improve Trading Decisions?

Order flow analysis improves trading decisions by providing insights into market dynamics through real-time data on buy and sell orders. By tracking the volume and price at which trades occur, traders can identify trends, reversals, and potential support and resistance levels. This allows for better entry and exit points, increasing the chances of profitable trades. Understanding the intensity of buying or selling pressure helps traders anticipate market movements, making their strategies more responsive and informed. Ultimately, order flow analysis enhances decision-making by grounding it in actual market behavior rather than relying solely on indicators or historical data.

What Are the Key Components of Order Flow Analysis?

The key components of order flow analysis in day trading include:

1. Volume: Measure the number of shares traded to gauge market activity and strength.

2. Price Action: Analyze price movements to identify trends and reversals.

3. Order Types: Understand market, limit, and stop orders to anticipate market behavior.

4. Bid-Ask Spread: Monitor the difference between the buying and selling price to assess market liquidity.

5. Time and Sales: Review transaction data to see real-time trades and identify buying or selling pressure.

6. Footprint Charts: Use these to visualize volume at specific price levels for deeper insights.

7. Market Depth: Examine order book data to see pending orders and gauge supply and demand.

These components help traders make informed decisions by understanding market dynamics.

How to Read Order Flow Charts in Day Trading?

To read order flow charts in day trading, focus on these key concepts:

1. Volume: Look at the volume bars to gauge the strength of price movements. Higher volume usually indicates stronger trends.

2. Bid/Ask Levels: Pay attention to the bid and ask prices. A crowded bid suggests buying pressure, while a crowded ask indicates selling pressure.

3. Cumulative Delta: This shows the difference between buying and selling volume. A positive delta signals more buyers, while a negative delta indicates more sellers.

4. Time and Sales: Monitor the tape for real-time trades. This reveals actual market activity and can indicate where momentum is building.

5. Price Levels: Identify key support and resistance levels based on order clusters. Strong order flow around these levels can signal potential reversals or breakouts.

6. Market Depth: Analyze the order book to see pending orders. Large orders can influence price direction, so be aware of them.

Use these elements to make informed trading decisions based on market dynamics.

What Is the Role of Volume in Order Flow Analysis?

Volume in order flow analysis indicates the strength of a price movement. High volume signals strong interest and can confirm trends, while low volume may suggest weak momentum. Traders use volume to identify potential reversals or continuations. For example, if prices rise on high volume, it indicates strong buying pressure. Conversely, if prices fall on low volume, it might suggest a lack of selling interest. Analyzing volume alongside price movements helps traders make informed decisions in day trading.

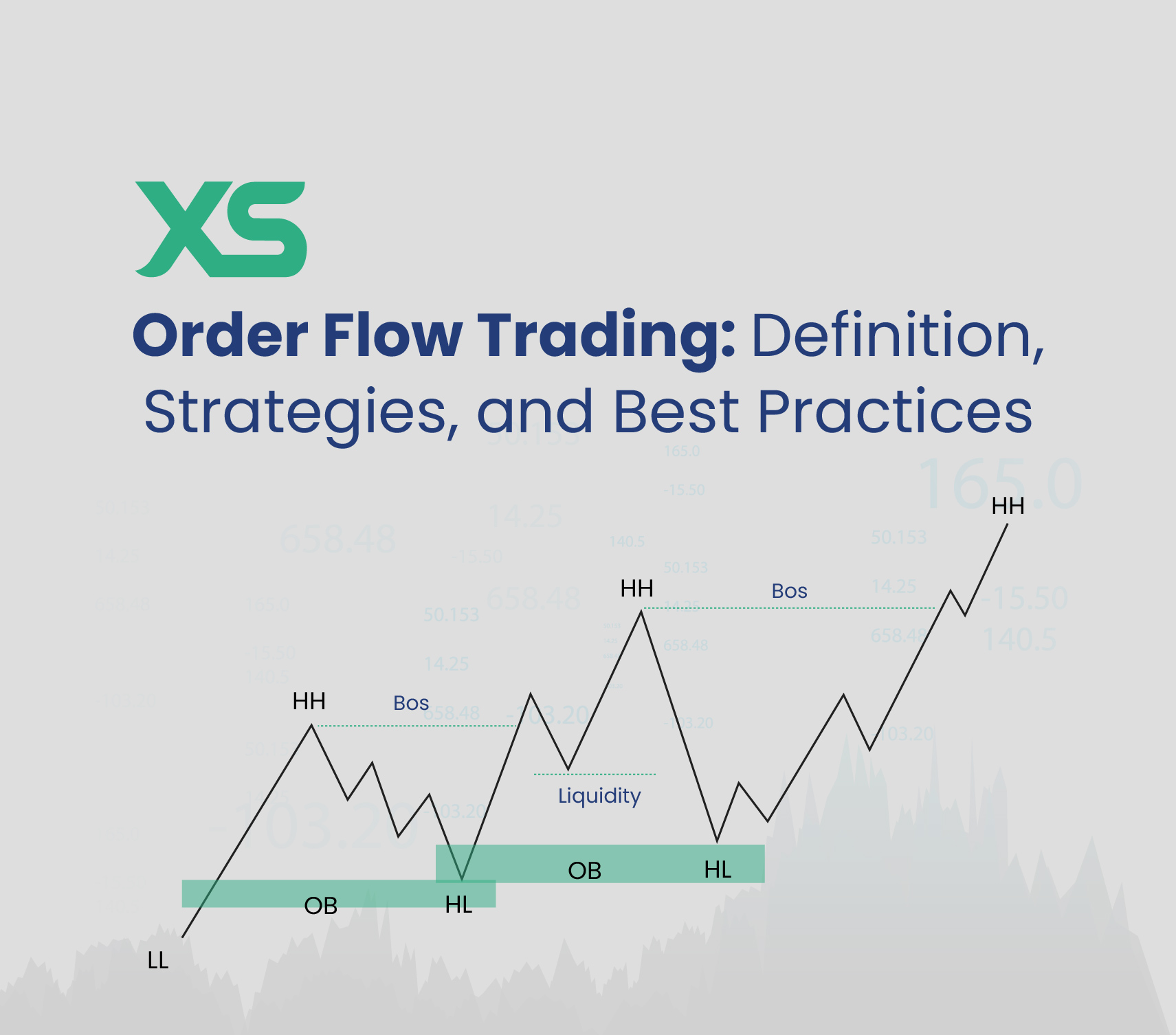

How Can Traders Use Order Flow to Identify Market Trends?

Traders can use order flow to identify market trends by analyzing real-time buying and selling activity. By observing the volume of trades at different price levels, traders can spot areas of support and resistance. If there’s significant buying pressure (more market orders to buy than sell), it typically indicates a bullish trend. Conversely, strong selling pressure suggests a bearish trend.

Additionally, traders look for the balance between aggressive buyers and sellers. A consistent increase in buy orders can signal an uptrend, while a rise in sell orders might indicate a downtrend. Monitoring the speed and size of trades helps traders gauge market sentiment and anticipate potential reversals. Using tools like footprint charts or volume profile can enhance this analysis, providing deeper insights into market dynamics.

What Tools Are Best for Order Flow Analysis?

The best tools for order flow analysis in day trading include:

1. Sierra Chart – Offers advanced order flow features and customizable charts.

2. Market Profile by NinjaTrader – Provides extensive market data and visualization tools.

3. Bookmap – Visualizes order book data in real-time, showing liquidity and market dynamics.

4. TradeStation – Combines order flow analysis with robust trading features.

5. ATAS – Focuses on volume analysis and order flow with user-friendly interfaces.

These tools help traders make informed decisions based on real-time market activity.

How Does Order Flow Analysis Differ from Technical Analysis?

Order flow analysis focuses on the real-time buying and selling activity in the market, using data like trade volume and order book dynamics to gauge market sentiment. In contrast, technical analysis relies on historical price movements and chart patterns to predict future price behavior. While technical analysis uses indicators and trend lines to identify potential trades, order flow analysis provides insights into immediate market pressure, helping traders make quicker decisions based on actual market transactions.

What Are the Advantages of Using Order Flow Analysis?

Order flow analysis offers several advantages in day trading. It provides real-time insights into market sentiment by showing the actual buying and selling activity. This helps traders identify potential reversals and trend continuations more accurately. By tracking the flow of orders, traders can make more informed decisions, leading to better entry and exit points. Additionally, it enhances risk management by revealing liquidity levels and potential support or resistance areas. Overall, order flow analysis gives traders a clearer picture of market dynamics, improving their trading strategy effectiveness.

How Can New Traders Start Learning Order Flow Analysis?

New traders can start learning order flow analysis by focusing on these key concepts:

1. Understanding Market Orders vs. Limit Orders: Get familiar with how these orders affect price movement and liquidity.

2. Reading Level II Quotes: Use Level II data to see real-time bids and asks, helping gauge market sentiment.

3. Using Volume Profile: Analyze volume at different price levels to identify support and resistance zones.

4. Identifying Order Flow Patterns: Look for patterns in buying and selling activity that signal potential price movements.

5. Practicing with a Simulator: Use trading simulators to practice reading order flow without financial risk.

6. Studying Footprint Charts: Learn to interpret footprint charts for detailed insights into market transactions.

7. Joining Trading Communities: Engage with online forums or groups focused on order flow analysis to share insights and strategies.

Start with these steps to build a solid foundation in order flow analysis for day trading.

Learn about How Do Institutional Traders Use Volume and Order Flow Data?

What Common Mistakes Should Traders Avoid in Order Flow Analysis?

Traders should avoid these common mistakes in order flow analysis:

1. Ignoring Context: Always consider market context; don’t analyze order flow in isolation.

2. Overtrading: Don’t act on every signal; focus on high-probability setups.

3. Neglecting Volume: Pay attention to volume alongside order flow; it confirms strength.

4. Misreading Bid/Ask: Understand the significance of bid and ask prices; don’t just look at the numbers.

5. Lack of Patience: Wait for clear signals instead of jumping in too early or too late.

6. Failure to Adapt: Markets change; adjust your strategies based on current behavior.

7. Emotional Trading: Keep emotions in check; stick to your plan and analysis.

Avoiding these pitfalls will enhance your effectiveness in order flow analysis for day trading.

Learn about Common Mistakes in Order Flow Analysis for Day Traders

How Do Market Orders and Limit Orders Affect Order Flow?

Market orders and limit orders significantly influence order flow in day trading. Market orders execute immediately at the best available price, increasing liquidity and often leading to rapid price changes. This can create a surge in buying or selling pressure, impacting the stock's movement.

Limit orders, on the other hand, set a specific price for buying or selling. They add depth to the market but may not execute immediately, which can lead to slower price adjustments. When many traders place limit orders, it can create resistance or support levels, affecting how quickly prices move.

In summary, market orders drive quick transactions and price volatility, while limit orders contribute to market structure and price stability. Both types are crucial for understanding the dynamics of order flow.

Learn about How Do Institutional Orders Impact Market Liquidity?

What Is the Impact of High-Frequency Trading on Order Flow?

High-frequency trading (HFT) significantly impacts order flow by increasing market liquidity and reducing spreads. HFT firms execute large volumes of orders at incredibly fast speeds, which can lead to more efficient pricing. However, this can also result in increased volatility and the potential for market manipulation. Retail traders may find it harder to compete with HFTs, as their orders can be filled at less favorable prices. Overall, HFT alters the dynamics of order flow by influencing how quickly and efficiently trades are processed.

How Can Order Flow Analysis Help with Risk Management?

Order flow analysis helps with risk management by providing real-time insights into market dynamics. By understanding the buying and selling activity, traders can identify where significant orders are placed, enabling them to gauge market sentiment and potential price movements. This allows for better entry and exit points, reducing the likelihood of major losses. Additionally, recognizing areas of liquidity can help traders set more effective stop-loss levels, minimizing risk exposure. Overall, order flow analysis enhances decision-making, leading to more informed and strategic risk management in day trading.

Learn about How Can AI Help in Day Trading Risk Management?

What Strategies Utilize Order Flow Analysis for Day Trading?

1. Identify Supply and Demand Levels: Use order flow to spot where large buy or sell orders are concentrated, indicating potential support or resistance levels.

2. Monitor Volume and Price Action: Analyze volume spikes with price movements to confirm trends. High volume on price increases suggests strong buying interest.

3. Watch for Order Book Dynamics: Track changes in the order book to gauge market sentiment. A sudden increase in buy orders can signal bullish momentum.

4. Use Cumulative Delta: Measure the difference between buying and selling pressure over time. A rising cumulative delta indicates increasing buying strength.

5. Implement Footprint Charts: Utilize footprint charts to visualize trades at specific price levels, helping to identify where institutions are active.

6. Recognize Market Maker Activity: Observe how market makers adjust orders to manipulate price. This can provide insights into potential reversals or continuations.

7. Leverage Time and Sales Data: Analyze the time and sales data to see actual transaction prices and sizes, revealing real market intent.

8. Create Trade Scenarios: Develop potential trade scenarios based on order flow signals, adjusting your strategy as market conditions change.

9. Risk Management: Incorporate order flow signals into your risk management strategy to set stop-loss orders and take-profit levels effectively.

These strategies enhance decision-making by focusing on real-time market activity, improving day trading outcomes.

Learn about Strategies for Effective Order Flow Analysis in Day Trading

How Do Economic News Events Influence Order Flow?

Economic news events influence order flow by impacting trader sentiment and market expectations. When positive news, like strong job reports, is released, it often leads to increased buying activity, driving prices up. Conversely, negative news, such as higher inflation rates, can trigger selling pressure, causing prices to drop. Traders react quickly to these events, adjusting their orders based on perceived value, which creates volatility and shifts in order flow. Understanding how these news events affect market psychology is crucial for day traders to anticipate price movements and make informed decisions.

Conclusion about Key Concepts of Order Flow Analysis in Day Trading

Incorporating order flow analysis into your day trading strategy can significantly enhance decision-making and improve trading outcomes. By understanding market dynamics, volume, and the behavior of market participants, traders can better identify trends and manage risks. As you delve deeper into this critical area, remember that consistent practice and the right tools are essential for mastering order flow analysis. For comprehensive insights and guidance tailored to your trading journey, explore the resources offered by DayTradingBusiness.

Learn about Order Flow Analysis vs. Technical Analysis in Day Trading

Sources:

- News and intraday retail investor order flow in foreign exchange ...

- The use of flow analysis in foreign exchange: exploratory evidence ...

- How free is free? Retail trading costs with zero commissions ...

- High frequency trading and price discovery

- Asymmetric information risk in FX markets - ScienceDirect

- Chasing trends at the micro-level: The effect of technical trading on ...