Did you know that even the stock market can have mood swings just like people? Understanding sentiment analysis in day trading is crucial for navigating these emotional tides. This article breaks down what sentiment analysis is and how you can implement it in your trading strategy. You'll discover the best tools for sentiment analysis and learn how it influences stock market predictions. Additionally, we’ll cover key indicators of market sentiment, the impact of social media and news headlines, and how to interpret sentiment data effectively. We’ll also highlight common mistakes traders make and explore how machine learning can enhance your analysis. Finally, we'll discuss the limitations of sentiment analysis, how to analyze trends, and which assets benefit the most from this approach. All of this information is designed to empower you in your trading journey with insights from DayTradingBusiness.

What is sentiment analysis in day trading?

Sentiment analysis in day trading involves evaluating market sentiment to gauge potential price movements. Traders analyze news, social media, and market data to determine if sentiment is bullish or bearish. By identifying trends in trader emotions, they can make informed buy or sell decisions. For instance, a surge in positive sentiment about a stock could signal a buying opportunity, while negative sentiment might indicate a sell. Tools like sentiment indicators and sentiment analysis software can aid traders in this process.

How can I implement sentiment analysis in my trading strategy?

To implement sentiment analysis in your trading strategy, start by gathering data from social media, news articles, and financial forums. Use sentiment analysis tools or APIs to quantify this data, converting qualitative sentiments into numerical scores. Analyze trends in sentiment data alongside price movements to identify potential market reversals or continuations. For day trading, focus on real-time sentiment updates to make quick decisions. Combine sentiment indicators with technical analysis for more robust signals, ensuring you have a clear entry and exit strategy based on this analysis.

What tools are best for sentiment analysis in day trading?

The best tools for sentiment analysis in day trading include:

1. Twitter Sentiment Analysis Tools: Platforms like TweetDeck and StockTwits help gauge real-time sentiment on stocks based on social media chatter.

2. News Aggregators: Tools like Benzinga Pro and MarketPulse provide breaking news and sentiment scoring, helping traders react quickly to market-moving events.

3. Sentiment Analysis Software: Services like RavenPack and MarketPsych analyze large datasets to provide sentiment scores based on news and social media.

4. Technical Analysis Platforms: TradingView and ThinkorSwim offer built-in sentiment indicators, integrating social sentiment with price data.

5. Economic Calendars: Tools like Forex Factory highlight market sentiment around economic events, influencing day trading decisions.

Combine these tools for a comprehensive view of market sentiment, enhancing your day trading strategy.

How does sentiment analysis affect stock market predictions?

Sentiment analysis affects stock market predictions by gauging investor mood through social media, news, and forums. Positive sentiment can indicate potential price increases, while negative sentiment may signal declines. Day traders can leverage sentiment analysis to identify trends and make informed trades. For instance, if sentiment around a stock turns bullish following strong earnings reports, traders might buy in before the price rises. Conversely, if sentiment shifts due to negative news, traders may short the stock to profit from expected declines. Using sentiment analysis alongside technical indicators can enhance decision-making in day trading.

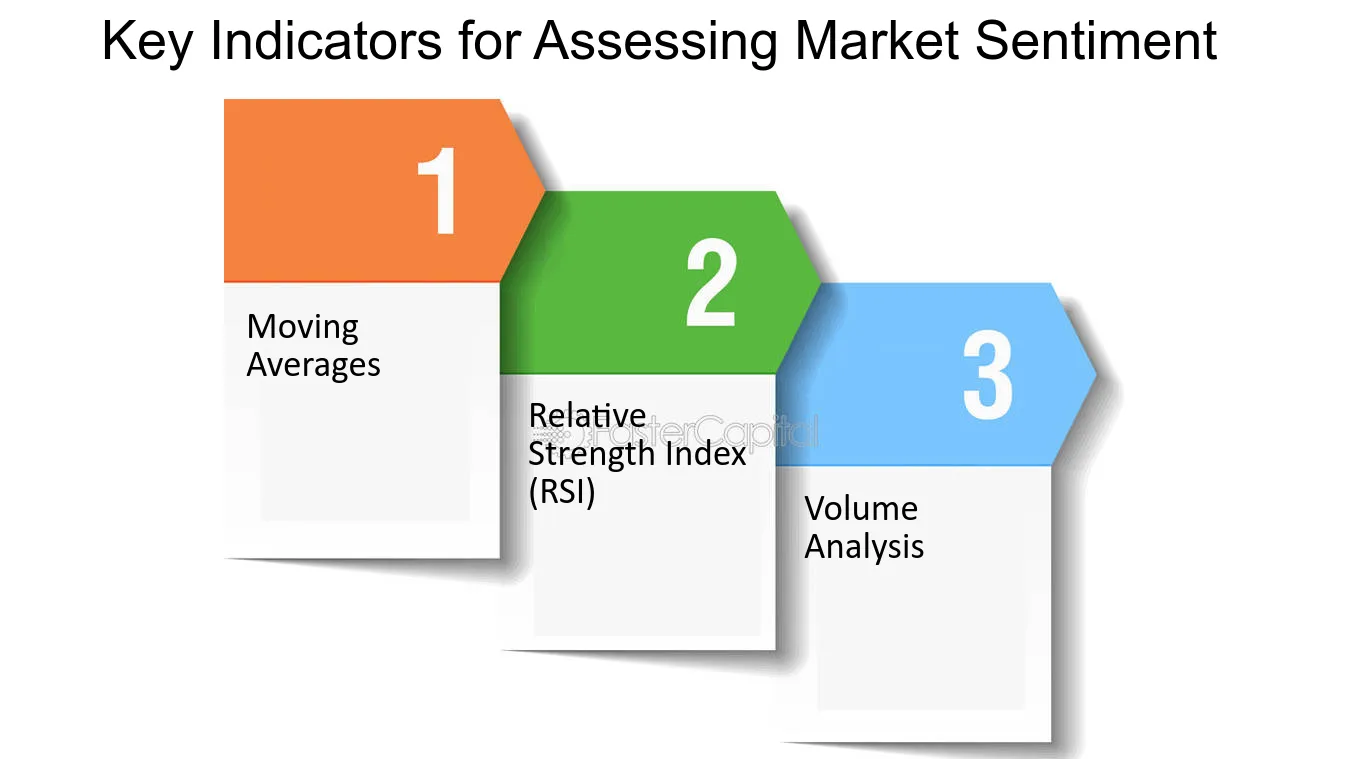

What are the key indicators of market sentiment?

Key indicators of market sentiment include:

1. News Headlines: Analyze financial news and headlines for bullish or bearish tones.

2. Social Media Trends: Monitor platforms like Twitter and Reddit for discussions around stocks or market trends.

3. Market Volume: High trading volume can indicate strong sentiment, either positive or negative.

4. Investor Surveys: Check sentiment surveys like the AAII Sentiment Survey for insights on investor outlook.

5. Put/Call Ratio: A high put/call ratio may signal bearish sentiment, while a low ratio suggests bullish sentiment.

6. Volatility Index (VIX): A rising VIX often indicates increasing fear or uncertainty in the market.

7. Technical Indicators: Patterns like moving averages or RSI can reflect market sentiment shifts.

Use these indicators to gauge sentiment and inform your day trading strategies effectively.

How can social media influence sentiment analysis in trading?

Social media influences sentiment analysis in trading by providing real-time insights into public opinions and market sentiment. Traders analyze posts, comments, and trends on platforms like Twitter and Reddit to gauge investor emotions, which can signal market movements. Positive sentiment often correlates with rising stock prices, while negative sentiment can indicate potential drops. Tools like natural language processing help quantify this sentiment, allowing traders to make data-driven decisions quickly. By integrating social media sentiment analysis, day traders can enhance their strategies and respond swiftly to market changes.

What role do news headlines play in sentiment analysis?

News headlines are crucial in sentiment analysis for day trading as they quickly convey market sentiment, influencing traders' decisions. Positive headlines can indicate bullish trends, while negative ones may signal bearish movements. By analyzing the tone and context of headlines, traders can gauge public sentiment and make informed buy or sell decisions, capitalizing on short-term price fluctuations.

How can I interpret sentiment analysis data effectively?

To interpret sentiment analysis data effectively in day trading, focus on these steps:

1. Identify Key Indicators: Look for sentiment scores, volume of mentions, and trends over time. Positive sentiment typically indicates buying pressure, while negative sentiment may signal selling pressure.

2. Monitor Social Media and News: Track platforms like Twitter and financial news sites. Real-time sentiment from these sources can provide insight into market reactions.

3. Analyze Context: Understand the context behind the sentiment. A spike in negative sentiment due to an earnings report can differ from a general market downturn.

4. Combine with Technical Analysis: Use sentiment data alongside charts and indicators to confirm trends. If sentiment is bullish and technical signals align, it’s a stronger buy signal.

5. Set Alerts: Use tools to set alerts for significant changes in sentiment to act quickly.

6. Adjust for Market Conditions: Be aware that sentiment can be more volatile in certain market conditions. Adapt your strategy accordingly.

7. Backtest Your Findings: Analyze past sentiment data against market movements to refine your approach.

By integrating these methods, you can make informed trading decisions based on sentiment analysis data.

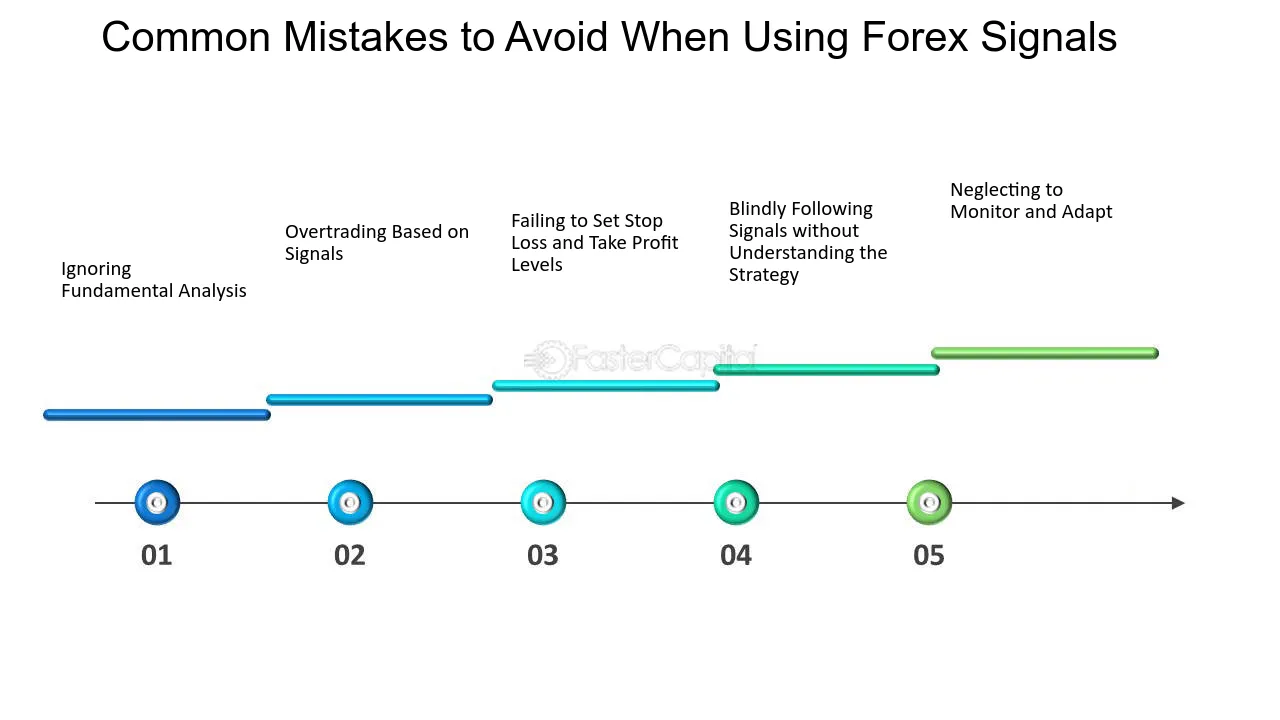

What are common mistakes in using sentiment analysis for trading?

Common mistakes in using sentiment analysis for trading include:

1. Ignoring context: Not considering the broader market conditions can lead to misinterpretation of sentiment data.

2. Over-reliance on social media: Basing decisions solely on social media sentiment can be misleading due to noise and misinformation.

3. Timing issues: Acting on sentiment signals too late or too early can result in missed opportunities or losses.

4. Neglecting fundamental analysis: Focusing only on sentiment without integrating fundamental data can yield incomplete insights.

5. Confirmation bias: Only seeking sentiment that aligns with existing beliefs can cloud judgment and lead to poor decisions.

6. Lack of backtesting: Failing to test sentiment strategies against historical data may result in ineffective trading approaches.

How can machine learning enhance sentiment analysis in trading?

Machine learning enhances sentiment analysis in trading by improving accuracy in predicting market movements based on public sentiment. It analyzes vast amounts of data from social media, news articles, and financial reports to identify trends and sentiments that affect stock prices. Algorithms can learn from historical data to better recognize patterns and sentiment shifts, enabling traders to make informed decisions quickly. By using natural language processing (NLP), machine learning models can classify sentiments as positive, negative, or neutral, providing real-time insights that help in day trading strategies. This leads to more effective trading signals and ultimately better trading performance.

Learn about How Does Machine Learning Enhance Day Trading?

What are the benefits of using sentiment analysis in day trading?

Sentiment analysis in day trading helps identify market trends and trader emotions, allowing you to make informed decisions. It can highlight bullish or bearish sentiments, guiding your buy or sell actions. By analyzing news, social media, and market data, you can anticipate price movements and reduce risks. This approach also enables you to spot potential reversals and capitalize on short-term opportunities. In essence, sentiment analysis enhances your trading strategy by providing insights into market psychology.

Learn about What Are the Benefits of Using a Prop Firm for Day Trading?

How do I combine sentiment analysis with technical analysis?

To combine sentiment analysis with technical analysis in day trading, start by monitoring social media, news, and forums for sentiment indicators about a stock or market. Use tools like Twitter sentiment scores or Google Trends to gauge public mood.

Next, apply technical analysis by identifying key price levels, trends, and chart patterns. Look for alignment between positive sentiment and bullish technical signals, like a breakout above resistance. Conversely, if sentiment is negative and technical indicators show bearish patterns, consider selling or shorting.

Integrate both methods by using sentiment as a confirmation tool for your trades. For example, if technical analysis suggests a buy, check sentiment to ensure it’s also positive. This dual approach enhances decision-making and can improve your trading outcomes.

Learn about How to Combine Sentiment Analysis with Trading Strategies

What are the limitations of sentiment analysis in day trading?

Sentiment analysis in day trading has several limitations. First, it can misinterpret sarcasm or context, leading to inaccurate signals. Second, it often relies on social media data, which may not reflect broader market sentiment. Third, sentiment can change rapidly, making it difficult to act on signals in real-time. Additionally, it may not account for macroeconomic factors that influence prices. Lastly, overreliance on sentiment can distract from technical analysis and fundamental data, leading to poor trading decisions.

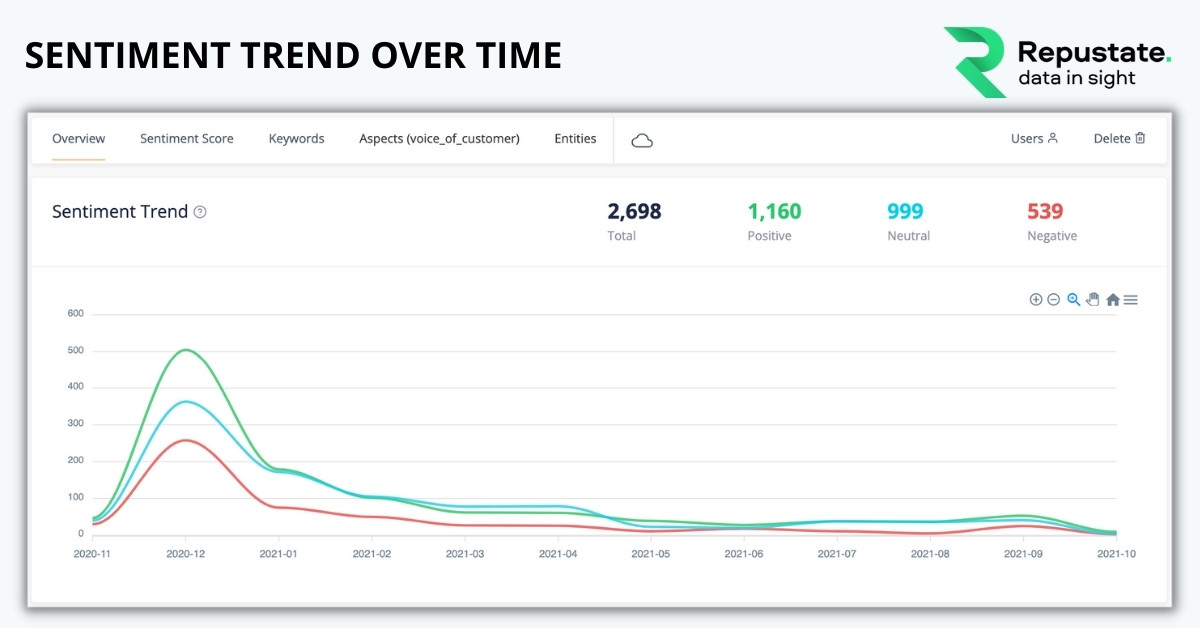

How can I analyze sentiment trends over time?

To analyze sentiment trends over time in day trading, follow these steps:

1. Collect Data: Use social media, news articles, and financial forums to gather relevant sentiment data. Tools like Twitter API or news aggregators can help.

2. Choose a Sentiment Analysis Tool: Utilize platforms like Natural Language Toolkit (NLTK) or commercial software that can process text and score sentiment.

3. Identify Keywords: Focus on specific keywords related to the stocks or markets you’re trading. This will help filter relevant sentiment.

4. Track Sentiment Over Time: Create a time series of sentiment scores to visualize trends. Graphing these scores can reveal patterns correlating with market movements.

5. Analyze Correlations: Compare sentiment data with stock prices to identify potential relationships. Look for spikes in positive or negative sentiment and their impact on price changes.

6. Adjust Trading Strategies: Use insights from sentiment trends to inform your trading decisions. For example, increasing positions when positive sentiment rises or hedging against downturns during negative sentiment spikes.

7. Regularly Update Your Analysis: Sentiment can change rapidly, so continuously monitor and adjust your analysis to stay relevant.

By consistently following these steps, you can effectively track and leverage sentiment trends to enhance your day trading strategy.

What types of assets can benefit from sentiment analysis?

Sentiment analysis can benefit various assets in day trading, including stocks, cryptocurrencies, forex, and commodities. For stocks, it helps gauge market sentiment from news articles, social media, and earnings reports. In cryptocurrencies, sentiment analysis tracks trends from forums and social media to predict price movements. For forex, it analyzes trader sentiment to understand currency fluctuations. Commodities also benefit by assessing market mood around economic indicators and geopolitical events.

How do traders measure market sentiment accurately?

Traders measure market sentiment using tools like sentiment indicators, social media analysis, and news sentiment. They analyze the put-call ratio, which indicates bullish or bearish sentiment through options trading. Monitoring online platforms, like Twitter and Reddit, helps gauge public opinion on stocks. Additionally, sentiment analysis software can quantify emotions in news articles or earnings reports. Combining these methods provides a clearer picture of market sentiment for informed day trading decisions.

Conclusion about How to Use Sentiment Analysis in Day Trading

Incorporating sentiment analysis into your day trading strategy can significantly enhance your decision-making process. By understanding market sentiment through various tools and indicators, you can better predict stock movements and capitalize on trading opportunities. However, it's crucial to combine sentiment analysis with other methods, such as technical analysis, to mitigate potential pitfalls. As you refine your approach, leveraging insights from social media and news headlines can provide a broader perspective on market dynamics. For more in-depth guidance and resources, explore the expertise offered by DayTradingBusiness.

Learn about How to Use Sentiment Data to Improve Day Trading Performance

Sources:

- Sentiment trading with large language models - ScienceDirect

- Intraday online investor sentiment and return patterns in the U.S. ...

- Prediction of stock market using sentiment analysis and ensemble ...

- The impact of sentiment and attention measures on stock market ...

- A profitable trading algorithm for cryptocurrencies using a Neural ...

- News-based supervised sentiment analysis for prediction of futures ...