Did you know that day traders can make dozens of trades in a single day, while long-term investors might only buy and hold a few stocks for years? In this article, we explore the key differences between day trading analysis and long-term analysis, including their unique techniques, indicators, and risk management strategies. We'll delve into how timeframes and market volatility impact each approach, as well as the psychological factors at play. Additionally, we’ll discuss whether day traders can benefit from long-term analysis techniques and highlight common mistakes in each strategy. Join us at DayTradingBusiness for a comprehensive understanding of these trading methodologies!

What is Day Trading Analysis?

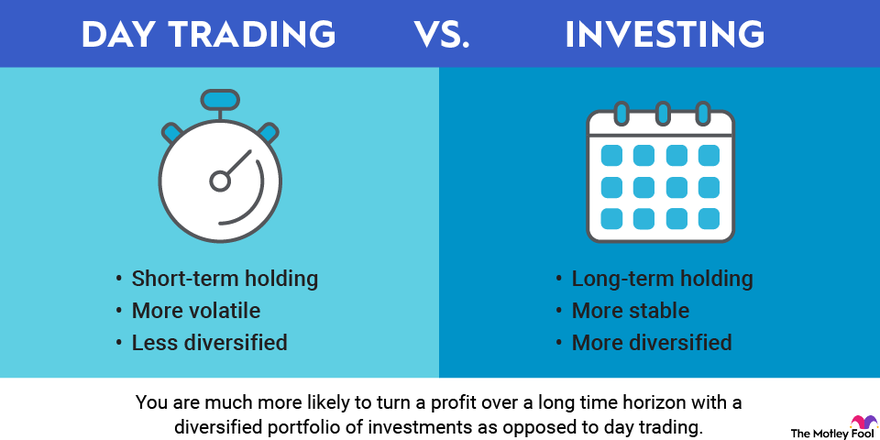

Day trading analysis focuses on short-term price movements and patterns, using technical indicators and real-time data to make quick trading decisions. In contrast, long-term analysis emphasizes fundamental factors, such as company performance and economic trends, to inform investment strategies over months or years. Day trading relies on charts and market sentiment, while long-term analysis looks at broader market conditions and valuations.

How Does Long-Term Analysis Differ from Day Trading?

Long-term analysis focuses on broader market trends and fundamental factors, aiming for investments held over months or years. It examines company performance, economic indicators, and industry conditions. In contrast, day trading analysis relies on short-term price movements and technical indicators, seeking quick profits from small price fluctuations within the same trading day. Day traders often use charts and patterns, while long-term investors prioritize valuation and growth potential.

What Are the Key Techniques in Day Trading Analysis?

Key techniques in day trading analysis include technical analysis, chart patterns, and indicators like moving averages and RSI. Day traders focus on price action, volume, and short-term trends, often using tools like candlestick charts to identify entry and exit points quickly. In contrast, long-term analysis emphasizes fundamental factors, such as company earnings and economic indicators, and typically involves less frequent trading based on broader market trends. Risk management and quick decision-making are crucial in day trading, while long-term analysis allows for a more patient investment approach.

What Methods Are Common in Long-Term Analysis?

Common methods in long-term analysis include fundamental analysis, which evaluates a company's financial health, market position, and economic factors. Investors often use technical analysis to identify long-term trends through chart patterns and indicators. Additionally, discounted cash flow (DCF) analysis helps assess a company's intrinsic value based on projected cash flows. Portfolio diversification and asset allocation strategies are also crucial for managing risk over the long term.

How Do Timeframes Impact Day Trading vs. Long-Term Analysis?

Timeframes significantly impact day trading and long-term analysis. Day trading relies on short timeframes, often minutes or hours, requiring quick decision-making based on real-time price movements and technical indicators. Traders focus on volatility and rapid trends to capitalize on small price changes.

In contrast, long-term analysis uses daily, weekly, or monthly charts. It emphasizes fundamental factors and broader market trends, allowing investors to withstand short-term fluctuations. This approach seeks to identify sustainable growth and value over time, often ignoring daily volatility.

In summary, day trading prioritizes immediate price action within short timeframes, while long-term analysis focuses on overarching trends and fundamentals over extended periods.

What Indicators Are Best for Day Trading?

The best indicators for day trading include moving averages (like the 50-day and 200-day), Relative Strength Index (RSI), Bollinger Bands, and MACD. These indicators help identify trends, momentum, and overbought or oversold conditions. In contrast, long-term analysis often utilizes fundamental indicators like earnings reports and economic indicators, focusing on broader market trends rather than short-term price movements. Day trading relies on quick, actionable signals, while long-term analysis looks at overall market direction and value.

Which Indicators Work Well for Long-Term Investments?

For long-term investments, focus on indicators like moving averages (50-day and 200-day), price-to-earnings (P/E) ratios, dividend yield, and earnings growth rate. These metrics help assess a stock's stability and growth potential over time. Unlike day trading, which relies on short-term price movements, long-term analysis emphasizes fundamentals, including company earnings, market position, and economic trends. Using these indicators can guide you in selecting stocks that are likely to appreciate in value over the long haul.

How Does Risk Management Vary Between Day Trading and Long-Term Analysis?

Risk management in day trading focuses on quick, tactical decisions to minimize losses on individual trades, often using stop-loss orders and tight risk-reward ratios. Day traders typically risk a smaller percentage of their capital per trade, aiming for quick profits.

In contrast, long-term analysis involves broader market assessments and can tolerate larger fluctuations over time. Investors manage risk by diversifying their portfolios and using fundamental analysis to select stocks with strong potential for growth. They often set wider stop-loss levels, accepting that short-term volatility won't derail their long-term strategy.

What Are the Psychological Factors in Day Trading vs. Long-Term Investing?

Day trading relies heavily on emotional control, quick decision-making, and stress management due to its fast-paced nature. Traders often deal with fear of missing out (FOMO) and the anxiety of rapid losses. In contrast, long-term investing focuses on patience, discipline, and a more analytical approach, emphasizing research and fundamental analysis. Long-term investors typically experience less emotional volatility as they ride out market fluctuations, while day traders must continuously adapt to market sentiment and technical indicators.

How Does Market Volatility Affect Day Trading Analysis?

Market volatility significantly impacts day trading analysis by creating rapid price movements, which traders exploit for short-term gains. High volatility offers more trading opportunities but also increases risk, requiring day traders to rely on technical indicators and real-time data to make quick decisions. In contrast, long-term analysis focuses on broader trends and fundamental factors, making it less sensitive to short-term fluctuations. Day traders must adapt their strategies to capitalize on volatile conditions, using tools like stop-loss orders and tight profit targets to manage risk effectively.

Learn about How Does Market Microstructure Affect Day Trading Strategies?

What Strategies Help Improve Long-Term Investment Returns?

Focus on fundamental analysis for long-term investments, assessing company performance, earnings growth, and market position. Diversify your portfolio across different sectors and asset classes to mitigate risk. Use dollar-cost averaging to invest consistently over time, reducing the impact of market volatility. Reinvest dividends to take advantage of compounding returns. Monitor your investments periodically without overreacting to short-term market fluctuations. Stay informed on macroeconomic trends and adjust your strategy as needed, but maintain a long-term perspective.

How Do News Events Influence Day Trading Decisions?

News events significantly impact day trading decisions by creating immediate volatility and price movements. Day traders often react quickly to news such as earnings reports, economic indicators, or geopolitical developments. This contrasts with long-term analysis, which focuses on broader trends and fundamentals over time. For day traders, analyzing news allows for quick entry and exit strategies, while long-term traders assess the overall market context and potential future value. Thus, while day trading capitalizes on short-term fluctuations driven by news, long-term analysis seeks stability and growth over extended periods.

Learn about How News Events Impact Day Trading Decisions

What Role Does Technical Analysis Play in Day Trading?

Technical analysis plays a crucial role in day trading by helping traders make quick decisions based on price movements and market patterns. Unlike long-term analysis, which focuses on fundamental factors, day trading relies on charts, indicators, and trends to identify short-term opportunities. Traders use tools like moving averages, RSI, and candlestick patterns to gauge market sentiment and predict price action. This allows them to enter and exit positions rapidly, maximizing profits within the same trading day. In contrast, long-term analysis emphasizes investment fundamentals, making it less effective for the fast-paced nature of day trading.

Learn about The Role of Volume in Day Trading Technical Analysis

How Important is Fundamental Analysis for Long-Term Investors?

Fundamental analysis is crucial for long-term investors because it assesses a company's intrinsic value based on financial health, market position, and economic factors. Unlike day trading, which focuses on short-term price movements and technical indicators, long-term analysis evaluates earnings, growth potential, and overall stability. This deeper understanding helps investors make informed decisions, minimize risks, and identify undervalued stocks for sustained growth. Ultimately, fundamental analysis aligns with a long-term investment strategy, ensuring better returns over time.

Can Day Traders Use Long-Term Analysis Techniques?

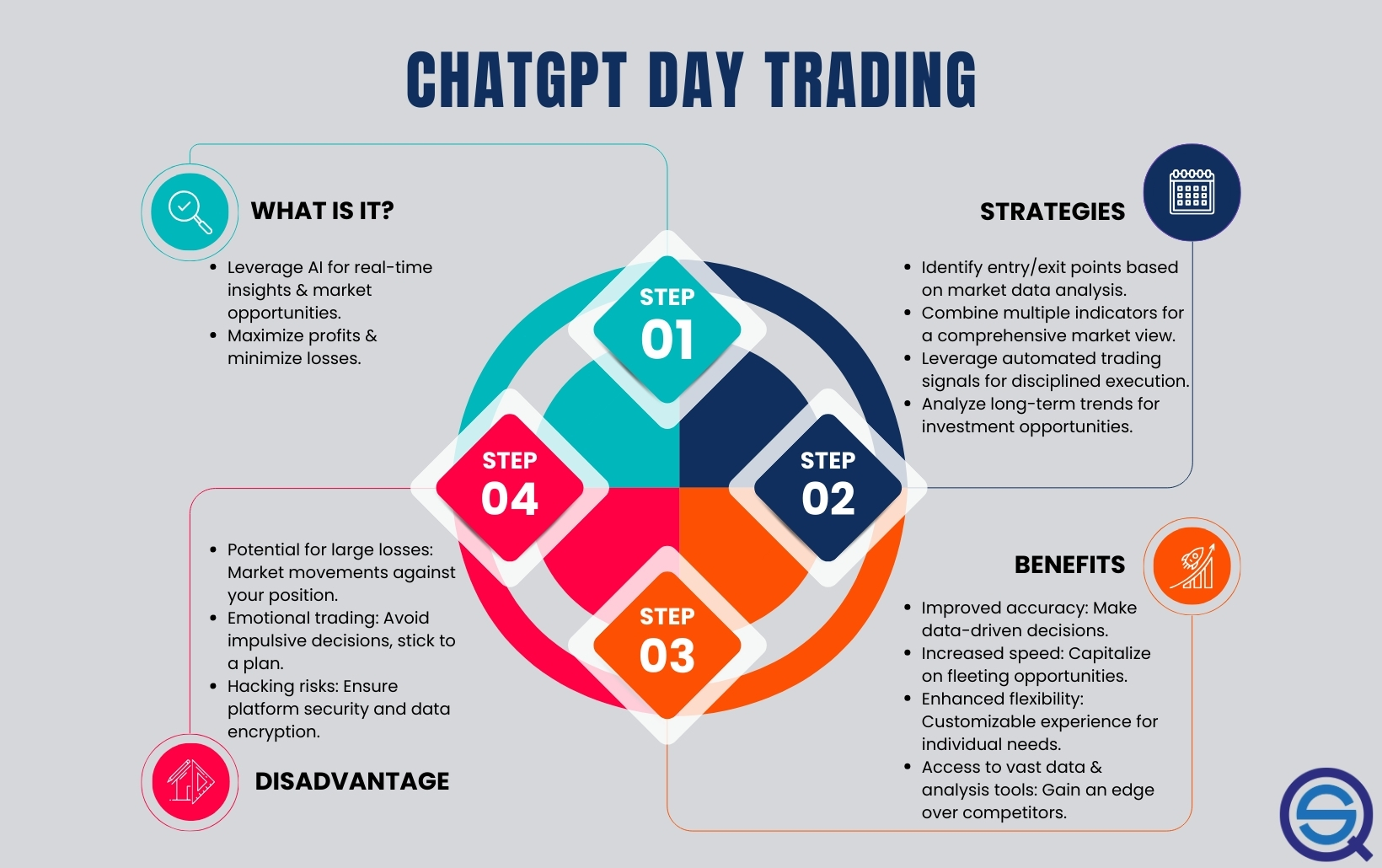

Yes, day traders can use long-term analysis techniques. While day trading focuses on short-term price movements, incorporating long-term analysis can provide context about market trends, support and resistance levels, and overall economic conditions. By understanding the larger trends, day traders can make more informed decisions, aligning their short-term trades with broader market movements. This holistic approach can enhance trading strategies and risk management.

What Are Common Mistakes in Day Trading Compared to Long-Term Investing?

Common mistakes in day trading compared to long-term investing include:

1. Emotional Trading: Day traders often react impulsively to market fluctuations, whereas long-term investors stick to their strategies.

2. Overtrading: Day traders may execute too many trades, leading to high fees and losses. Long-term investors focus on fewer, more significant decisions.

3. Ignoring Research: Day traders might overlook fundamental analysis, relying solely on technical indicators. Long-term investors prioritize comprehensive research on companies and market trends.

4. Lack of Risk Management: Day traders may not use stop-loss orders effectively, while long-term investors typically have a diversified portfolio to mitigate risk.

5. Short-Term Focus: Day traders often fixate on immediate gains, missing the bigger picture. Long-term investors aim for sustained growth over time.

6. Neglecting Taxes: Day traders may forget about the tax implications of frequent trading, while long-term investors benefit from lower capital gains taxes on held assets.

Learn about Is stop-loss risk higher in day trading than long-term investing?

Conclusion about Differences Between Day Trading Analysis and Long-Term Analysis

In summary, understanding the distinctions between day trading analysis and long-term analysis is crucial for any trader or investor. Day trading focuses on short-term price movements, utilizing specific indicators and strategies to capitalize on market volatility, while long-term analysis emphasizes foundational research and broader market trends. By recognizing the unique techniques, timeframes, and psychological factors associated with each approach, traders can better align their strategies with their goals. For more insights and guidance on navigating these complexities, explore the resources available through DayTradingBusiness.

Learn about Differences Between Order Flow and Volume Analysis in Day Trading