Did you know that some traders can predict market movements better than a fortune teller? In day trading, staying on top of economic data releases is crucial for success. This article dives into best practices for monitoring these releases, highlighting key economic indicators to watch, effective tracking methods, and essential tools for real-time updates. Learn how economic data impacts trading strategies, the importance of an economic calendar, and how to prepare for scheduled releases. We’ll also cover common pitfalls to avoid, interpretation of data reports, and the significance of market reactions. With insights on historical data and volatility, plus strategies for high-impact news events, you'll gain an edge in managing risk and staying informed. Join DayTradingBusiness as we equip you with the knowledge to navigate the fast-paced world of day trading effectively!

What are the key economic data releases to monitor for day trading?

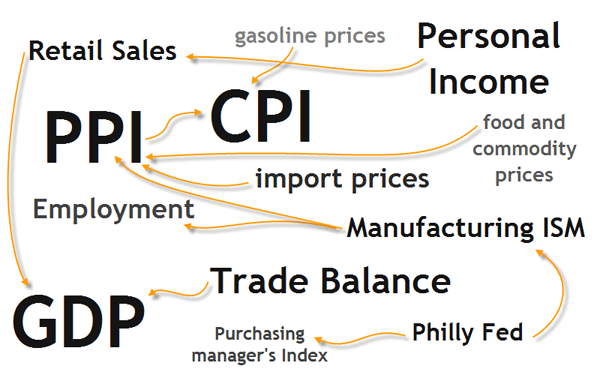

Key economic data releases to monitor for day trading include:

1. Non-Farm Payrolls (NFP) – Indicates job growth and economic health.

2. Consumer Price Index (CPI) – Measures inflation and affects interest rate expectations.

3. Gross Domestic Product (GDP) – Shows overall economic performance.

4. Retail Sales – Reflects consumer spending trends.

5. Initial Jobless Claims – Provides insights into unemployment trends.

6. Federal Reserve Meetings – Decisions on interest rates impact market volatility.

Focus on these releases to gauge market sentiment and potential price movements effectively.

How can I effectively track economic indicators during trading hours?

To effectively track economic indicators during trading hours, use real-time financial news platforms like Bloomberg or Reuters. Set up alerts for key economic data releases, such as GDP or unemployment rates, to stay informed. Utilize economic calendars that highlight scheduled events and their potential market impact. Follow social media accounts of economists and financial analysts for instant insights. Lastly, consider using trading platforms that integrate economic data feeds for immediate access while trading.

What tools are best for monitoring real-time economic data?

The best tools for monitoring real-time economic data include:

1. Economic Calendars: Websites like Forex Factory and Investing.com provide live updates on economic indicators and events.

2. Trading Platforms: MetaTrader and Thinkorswim offer built-in economic news feeds and alerts.

3. Financial News Apps: Bloomberg and CNBC apps deliver real-time notifications and analysis on economic releases.

4. Social Media: Follow financial analysts and economists on Twitter for instant insights and commentary.

5. Data Aggregators: Services like Trading Economics compile various economic indicators and provide real-time updates.

Choose a combination of these tools for comprehensive monitoring.

How do economic data releases impact day trading strategies?

Economic data releases impact day trading strategies by influencing market volatility and price movements. Traders should closely monitor key indicators like employment figures, GDP, and inflation reports. These releases often lead to rapid price changes, providing opportunities for quick trades.

Best practices include setting alerts for release times, analyzing historical data impacts, and using economic calendars to stay informed. Traders should also develop a plan for volatility management, such as setting stop-loss orders to mitigate risks. Adapting strategies based on the data's significance can enhance decision-making and maximize potential gains.

What are the benefits of using an economic calendar for day trading?

Using an economic calendar for day trading offers several key benefits:

1. Market Awareness: It keeps you informed about upcoming economic data releases that can impact market volatility and price movements.

2. Trade Timing: You can plan trades around significant events, maximizing opportunities when volatility is likely to increase.

3. Risk Management: Knowing when reports are released helps you mitigate risks by avoiding trades during high-impact news events.

4. Strategy Development: It enables you to develop strategies based on historical data reactions to similar releases.

5. Informed Decisions: Economic indicators like GDP, unemployment rates, and interest rate decisions provide context for market trends, improving your trading decisions.

6. Opportunity Identification: Spot potential trading opportunities by analyzing how different sectors react to specific economic news.

Incorporating an economic calendar into your routine enhances your trading effectiveness and helps you stay ahead in the fast-paced day trading environment.

How can I prepare for scheduled economic data releases?

To prepare for scheduled economic data releases in day trading, follow these steps:

1. Know the Calendar: Check an economic calendar for upcoming data releases, focusing on key indicators like GDP, employment figures, and inflation rates.

2. Understand the Impact: Research how each data point historically affects the markets. For instance, strong job numbers can boost stock prices.

3. Set Alerts: Use trading platforms or apps to set alerts for economic releases to ensure you don’t miss them.

4. Analyze Expectations: Look at analysts’ forecasts and consensus estimates. Market reactions often hinge on whether the actual data meets, exceeds, or falls short of expectations.

5. Develop a Plan: Create a trading strategy that outlines your entry and exit points based on potential market movements post-release.

6. Practice Risk Management: Determine your risk tolerance and set stop-loss orders to protect your capital during volatile periods.

7. Stay Updated: Follow financial news and real-time updates on the day of the release to adjust your strategy as needed.

By incorporating these practices, you can effectively navigate the impact of economic data releases on day trading.

What common mistakes should I avoid when trading on economic news?

Avoid these common mistakes when trading on economic news:

1. Ignoring the Calendar: Always check the economic calendar to know when key releases are happening.

2. Overreacting to Data: Don't make impulsive trades based on initial market reactions; wait for the dust to settle.

3. Neglecting Market Sentiment: Pay attention to how traders are interpreting the news, not just the data itself.

4. Lack of Risk Management: Always set stop-loss orders to protect against unexpected volatility.

5. Forgetting to Analyze Historical Data: Review past reactions to similar economic releases to gauge potential market movements.

6. Trading Without a Plan: Have a clear strategy in place before the news is released to avoid hasty decisions.

7. Chasing the Market: Avoid jumping into trades after a big move; wait for confirmation of your analysis.

By steering clear of these pitfalls, you can enhance your trading effectiveness around economic data releases.

How do I interpret economic data reports for day trading?

To interpret economic data reports for day trading, focus on key indicators like GDP, employment figures, inflation rates, and consumer confidence. Pay attention to the consensus forecast and actual results; deviations can trigger market volatility.

Use an economic calendar to track release dates and times. Analyze the context—look at trends and market sentiment surrounding the data. Understand how different assets react; for example, a strong jobs report might boost stocks but weaken bonds.

Finally, practice risk management; always have a plan for potential market reactions.

What is the significance of market reactions to economic data?

Market reactions to economic data are crucial for day trading because they indicate trader sentiment and can lead to immediate price volatility. Positive data often triggers bullish movements, while negative results can cause sharp declines. Understanding these reactions helps traders anticipate market trends, adjust strategies, and make informed decisions quickly. Monitoring economic releases allows day traders to capitalize on these movements for potential profit.

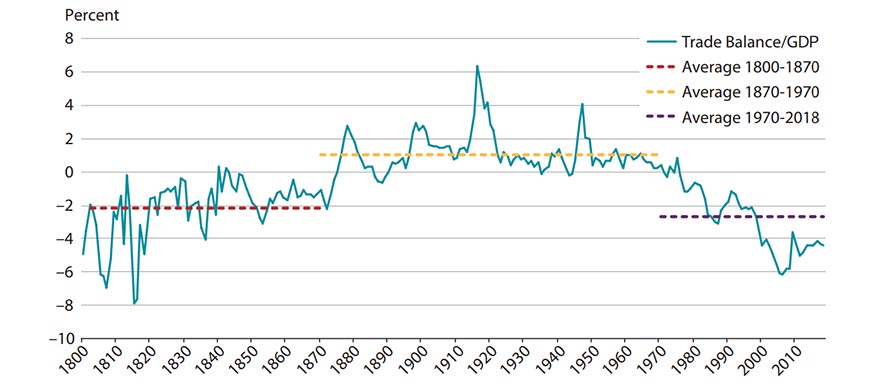

How can I use historical economic data to improve my trading?

To improve your trading with historical economic data, start by analyzing past data releases and their market impacts. Identify patterns in how specific economic indicators, like GDP or employment figures, influence asset prices. Use this information to anticipate market reactions to upcoming releases.

Set up alerts for key economic data releases relevant to your trading strategy. Monitor economic calendars and focus on high-impact events. Backtest your trading strategies against historical data to see how they perform around these releases, adjusting your approach based on findings.

Additionally, stay updated on economic trends and news that may affect future data. This context helps you make informed decisions and refine your entry and exit points. Use historical data to develop a disciplined trading plan that incorporates these insights for better risk management and potential profitability.

Learn about How to Use Market Microstructure Data to Improve Day Trading Outcomes

What role does volatility play in day trading around economic releases?

Volatility is crucial in day trading around economic releases. It creates price swings that traders can exploit for quick profits. Positive or negative news can lead to sharp movements, allowing traders to enter and exit positions rapidly. Monitoring economic data helps anticipate these swings; for example, strong job reports might spike stock prices, while disappointing GDP figures may cause drops. Understanding expected volatility can help traders set stop-loss orders and target profits effectively, ensuring they capitalize on market reactions without getting caught in unexpected downturns.

Learn about What Role Does Compliance Play in Day Trading Platform Certification?

How can I set alerts for important economic data releases?

To set alerts for important economic data releases, follow these steps:

1. Use Economic Calendars: Websites like Investing.com or Forex Factory provide calendars with upcoming data releases. You can set alerts through their platforms.

2. Trading Platforms: Many trading platforms like MetaTrader or Thinkorswim allow you to set alerts for specific economic events directly within the software.

3. Mobile Apps: Download financial news apps like Bloomberg or CNBC. These often have alert features for major economic announcements.

4. Email Alerts: Sign up for email alerts from financial news websites. They typically notify you of significant economic data releases.

5. Social Media & News Feeds: Follow financial analysts or institutions on Twitter or LinkedIn for real-time updates and alerts.

Choose the method that fits your trading style best to ensure you don’t miss critical data releases.

What strategies work best for trading during high-impact news events?

To trade effectively during high-impact news events, focus on these strategies:

1. Pre-Event Analysis: Research expected outcomes and consensus forecasts to gauge market sentiment.

2. Volatility Assessment: Use tools like an economic calendar to identify high-impact releases and anticipate increased volatility.

3. Set Alerts: Create price alerts to react quickly when the news breaks.

4. Tight Stop-Losses: Implement tighter stop-loss orders to manage risk due to potential whipsaws.

5. Scalping: Consider quick, small trades to capitalize on immediate price movements without holding positions long.

6. Avoid Illiquidity: Stay cautious of trading right before or after the news, as spreads can widen significantly.

7. Post-Event Confirmation: Wait for confirmation of price direction after the news before entering a trade, ensuring the market has settled.

8. Review and Learn: After the event, analyze your trades to improve future strategies and adapt to market reactions.

How do different economic indicators affect various markets?

Different economic indicators influence markets in specific ways. For instance, a strong jobs report can boost stock prices as it signals economic growth, while rising unemployment might lead to bearish trends. Inflation data affects bonds; higher inflation often results in falling bond prices as interest rates rise.

In day trading, monitor key indicators like GDP, employment figures, and consumer spending. Use an economic calendar to anticipate releases. React quickly to the data; for example, if the Federal Reserve indicates interest rate changes, adjust your trading strategy accordingly.

Stay informed about how these indicators impact sectors—retail sales can affect consumer stocks, while manufacturing data may influence industrial stocks. This targeted approach helps navigate market volatility effectively.

What are the best practices for risk management when trading on economic data?

1. Stay Informed: Follow an economic calendar to track key data releases relevant to your trading strategy.

2. Analyze Market Impact: Understand how specific economic indicators like GDP, unemployment rates, and inflation affect the markets.

3. Set Clear Entry and Exit Points: Define your trade parameters before data releases to avoid impulsive decisions.

4. Use Stop-Loss Orders: Protect your capital by setting stop-losses to limit potential losses during volatile movements.

5. Manage Position Size: Adjust your trade size based on the volatility expected from the economic announcement.

6. Watch for Pre-Release Trends: Monitor market sentiment and price action leading up to the release for potential trading signals.

7. Be Cautious of Whipsaws: Expect and prepare for sudden price swings post-release; don't react impulsively.

8. Review Historical Data: Analyze past reactions to similar economic releases to better predict market behavior.

9. Stay Flexible: Be ready to adapt your strategy based on unexpected outcomes or market reactions.

10. Keep Emotions in Check: Stick to your trading plan and avoid emotional trading during high-stakes data releases.

How can I stay informed about unexpected economic data surprises?

To stay informed about unexpected economic data surprises in day trading, follow these practices:

1. Economic Calendars: Use reliable economic calendars like Forex Factory or Investing.com to track scheduled releases and potential surprises.

2. News Alerts: Set up alerts on financial news platforms like Bloomberg or Reuters for real-time updates on economic data.

3. Social Media: Follow economists, analysts, and financial news accounts on Twitter for immediate insights and reactions to data releases.

4. Market Analysis Tools: Utilize platforms like TradingView or Thinkorswim that provide instant analysis and updates on economic events.

5. Join Trading Communities: Engage in forums like Reddit or trading Discord groups where traders discuss and react to economic news.

6. Economic Reports: Regularly read reports from central banks and government agencies for in-depth analysis of trends and potential surprises.

7. Volatility Indicators: Monitor volatility indicators around data release times to gauge market reactions.

By combining these strategies, you can effectively stay on top of unexpected economic data surprises that impact day trading.

Conclusion about Best Practices for Monitoring Economic Data Releases in Day Trading

Incorporating these best practices for monitoring economic data releases can significantly enhance your day trading outcomes. Understanding key indicators, utilizing effective tools, and preparing for scheduled announcements are crucial steps for success. Additionally, awareness of market reactions and historical data analysis can refine your trading strategies. By avoiding common pitfalls and implementing robust risk management techniques, you can navigate the volatile landscape surrounding economic news with greater confidence. For ongoing support and insights, DayTradingBusiness remains your trusted partner in mastering the complexities of day trading.

Learn about What Are the Best Practices for Maintaining Day Trading Broker Compliance?