Did you know that the first computer program to trade stocks was developed in the 1980s, and it still couldn't make coffee? Fast forward to today, and machine learning is revolutionizing day trading, turning algorithms into powerful trading allies. In this article, we explore how machine learning enhances trading strategies and the key techniques you can implement for success. Discover what data is essential, how to select the right model, and the benefits and challenges of using machine learning in your trading approach. Plus, learn about backtesting strategies, feature engineering, and the importance of big data. Stay ahead of the curve with insights from DayTradingBusiness and transform your trading game.

What is Machine Learning in Day Trading?

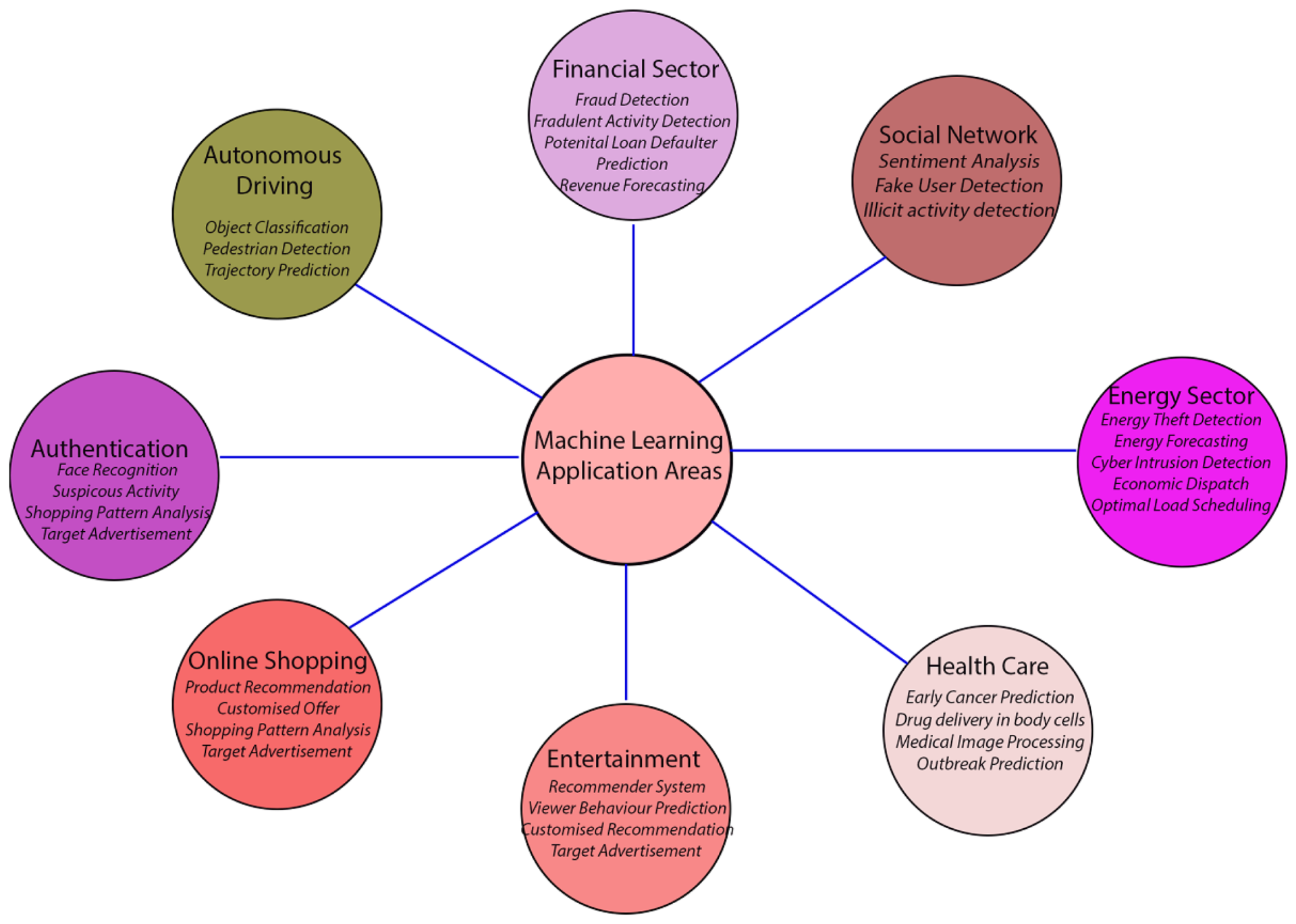

Machine learning in day trading involves using algorithms to analyze vast amounts of market data and identify patterns for making trading decisions. These algorithms can predict price movements, optimize trading strategies, and adapt to changing market conditions in real-time. By incorporating machine learning, traders can enhance their decision-making processes, reduce risks, and potentially increase their returns. Techniques like supervised learning, unsupervised learning, and reinforcement learning are often applied to improve accuracy and efficiency in trading algorithms.

How Does Machine Learning Improve Trading Strategies?

Machine learning enhances trading strategies by analyzing vast amounts of data to identify patterns and trends that humans might miss. It enables algorithms to adapt to market changes in real-time, optimizing buy and sell decisions. Techniques like regression analysis and neural networks can predict price movements more accurately. Additionally, machine learning models can backtest strategies against historical data, refining them for better performance. This integration leads to increased efficiency, reduced risk, and potentially higher returns in day trading.

What Are the Key Machine Learning Techniques for Day Trading?

Key machine learning techniques for day trading include:

1. Supervised Learning: Used for predicting stock prices based on historical data. Algorithms like linear regression and decision trees help identify trends.

2. Unsupervised Learning: Techniques like clustering analyze market patterns without labeled data, revealing hidden correlations.

3. Reinforcement Learning: This method optimizes trading strategies by learning from the consequences of actions, making real-time decisions based on reward feedback.

4. Natural Language Processing (NLP): Analyzing news and social media sentiment can provide insights into market movements.

5. Time Series Analysis: Techniques like ARIMA and LSTM networks specifically target temporal data, essential for forecasting asset prices.

6. Ensemble Methods: Combining multiple models, such as random forests or boosting techniques, can improve prediction accuracy.

Integrating these techniques into day trading algorithms enhances decision-making and can lead to better performance.

How Can I Implement Machine Learning in My Trading Algorithm?

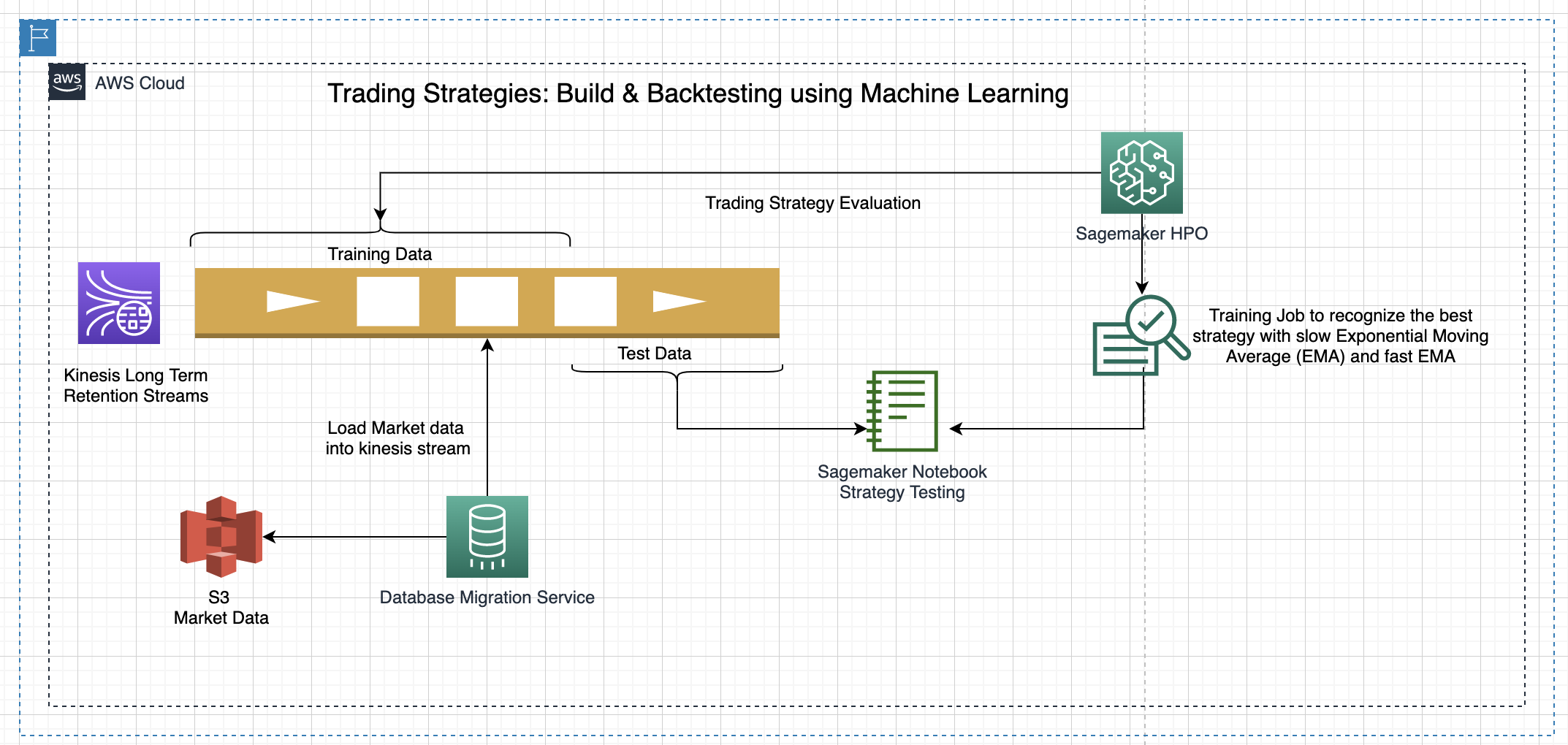

To implement machine learning in your trading algorithm, start by defining your trading strategy and objectives. Next, gather historical market data relevant to your strategy, such as price movements, volume, and indicators. Choose a machine learning model suited for your needs, like regression for price prediction or classification for trade signals.

Train your model on the historical data, ensuring to split it into training and testing sets to evaluate performance. Use features like technical indicators or sentiment analysis from news data. Optimize your model's parameters and validate its performance using metrics like accuracy or Sharpe ratio.

Once validated, integrate the model into your trading system, ensuring it can make real-time predictions. Monitor performance continuously and adjust as necessary to adapt to changing market conditions.

What Data Do I Need for Machine Learning in Day Trading?

For machine learning in day trading, you need historical price data, volume data, and order book data. Additionally, include technical indicators, sentiment analysis from news or social media, macroeconomic indicators, and any relevant trading signals. Ensure your dataset is clean, structured, and covers various market conditions for effective model training.

How Do I Choose the Right Machine Learning Model for Trading?

To choose the right machine learning model for trading, start by defining your trading strategy and data type. For time series data, models like LSTM or ARIMA are effective. If you're working with features derived from market indicators, consider decision trees or random forests. Evaluate the model's performance using metrics like accuracy or Sharpe ratio on historical data. Don’t forget to factor in overfitting; use techniques like cross-validation. Finally, ensure the model aligns with your risk tolerance and trading goals.

What Are the Benefits of Using Machine Learning in Day Trading?

Using machine learning in day trading offers several key benefits. First, it enhances predictive accuracy by analyzing vast amounts of data to identify patterns and trends that human traders might miss. Second, it enables real-time decision-making, allowing algorithms to execute trades faster than manual methods. Third, machine learning can adapt to market changes, continuously learning from new data to improve trading strategies. Additionally, it helps in risk management by assessing potential losses and optimizing portfolio performance. Overall, integrating machine learning into day trading can lead to more profitable and efficient trading systems.

What Challenges Do Traders Face When Using Machine Learning?

Traders face several challenges when integrating machine learning into day trading algorithms. First, data quality is crucial; inaccurate or incomplete data can lead to poor model performance. Second, model overfitting is a risk, where a model learns noise instead of patterns, causing it to perform poorly on new data. Third, real-time processing is needed for day trading, which can strain computational resources. Additionally, understanding and interpreting model outputs can be complex, potentially leading to misinformed trading decisions. Finally, market volatility and unexpected events can render machine learning models ineffective, requiring constant updates and retraining.

How Can I Backtest My Machine Learning Trading Strategy?

To backtest your machine learning trading strategy, follow these steps:

1. Collect Historical Data: Gather price data and relevant features (like volume, indicators) from reliable sources.

2. Preprocess Data: Clean and format the data, handling missing values and scaling features as needed.

3. Split Data: Divide your dataset into training, validation, and testing sets to avoid overfitting.

4. Train the Model: Use your training data to build the machine learning model, selecting algorithms like decision trees, SVM, or neural networks.

5. Evaluate the Model: Test the model on the validation set, using metrics like accuracy, precision, or Sharpe ratio to assess performance.

6. Backtest: Implement the strategy on the testing set, simulating trades based on model predictions. Track metrics like profit, drawdown, and win rate.

7. Analyze Results: Review performance and adjust parameters or features based on findings.

8. Repeat: Refine your approach with iterative testing and model tuning.

Using tools like Python with libraries such as Pandas, NumPy, and Scikit-learn can streamline this process.

What Are Common Mistakes in Machine Learning for Day Trading?

Common mistakes in machine learning for day trading include:

1. Overfitting: Tailoring models too closely to historical data, which reduces their performance on unseen data.

2. Ignoring Feature Engineering: Failing to create or select relevant features can lead to poor model predictions.

3. Lack of Sufficient Data: Using an inadequate amount of training data can result in unreliable models.

4. Not Accounting for Market Conditions: Models should adapt to different market environments; ignoring this can lead to losses.

5. Poor Backtesting: Inadequate testing can overlook model weaknesses, leading to unexpected failures in real trading.

6. Misunderstanding Risk Management: Neglecting to implement proper risk controls can amplify losses.

7. Focusing Solely on Predictions: Ignoring execution strategies and transaction costs can diminish profitability.

8. Overly Complex Models: Complicated models may not necessarily yield better results and can be harder to interpret.

Avoiding these pitfalls can significantly enhance the effectiveness of machine learning in day trading algorithms.

Learn about What Are Common Mistakes in Institutional Day Trading?

How Does Feature Engineering Impact Trading Algorithms?

Feature engineering significantly impacts trading algorithms by enhancing the model's ability to identify patterns and make accurate predictions. Well-crafted features can capture market trends, volatility, and price movements, improving the algorithm's performance. For instance, using indicators like moving averages or RSI can help the algorithm react more effectively to market conditions. Conversely, poorly chosen features can lead to overfitting or missed opportunities. Ultimately, effective feature engineering boosts the predictive power and profitability of day trading algorithms.

Can Machine Learning Predict Stock Prices Accurately?

Machine learning can improve stock price predictions but rarely guarantees high accuracy. Algorithms analyze historical data, identify patterns, and adapt to market changes. However, stock prices are influenced by unpredictable factors like news and market sentiment, limiting precision. Successful integration in day trading relies on robust models, continuous learning, and risk management.

What Role Does Big Data Play in Machine Learning Trading?

Big data is crucial in machine learning trading as it provides vast amounts of historical and real-time market data that algorithms analyze to identify trends and make predictions. This extensive data helps improve model accuracy, enabling traders to spot patterns that inform buy or sell decisions. Additionally, big data enhances risk management by allowing for better evaluation of market conditions and volatility. Ultimately, integrating big data with machine learning algorithms boosts the effectiveness and profitability of day trading strategies.

How Do I Evaluate the Performance of My Trading Algorithm?

Evaluate your trading algorithm's performance by analyzing key metrics:

1. Return on Investment (ROI): Measure total returns relative to the investment.

2. Sharpe Ratio: Assess risk-adjusted returns to gauge performance against volatility.

3. Win Rate: Calculate the percentage of profitable trades versus total trades.

4. Maximum Drawdown: Identify the largest peak-to-trough decline to understand risk exposure.

5. Profit Factor: Compare gross profits to gross losses to evaluate overall profitability.

Use backtesting with historical data to simulate performance and assess consistency. Incorporate machine learning techniques to refine predictions and adapt to changing market conditions. Regularly review and adjust your algorithm based on ongoing performance analysis.

What Tools and Libraries Are Best for Machine Learning in Trading?

The best tools and libraries for integrating machine learning in day trading algorithms include:

1. Python: The primary language for ML in finance.

2. Pandas: For data manipulation and analysis.

3. NumPy: Essential for numerical operations.

4. Scikit-learn: Offers a variety of ML algorithms for classification, regression, and clustering.

5. TensorFlow/Keras: Great for building deep learning models.

6. PyTorch: Another powerful deep learning library with dynamic computation graphs.

7. Statsmodels: Useful for statistical modeling and hypothesis testing.

8. Backtrader: A flexible framework for backtesting trading strategies.

9. Zipline: A backtesting library specifically designed for trading algorithms.

10. MetaTrader: Popular platform for trading that supports algorithm development.

These tools and libraries facilitate data handling, model building, and strategy testing in day trading.

How Can I Stay Updated on Machine Learning Trends in Day Trading?

To stay updated on machine learning trends in day trading, follow these steps:

1. Follow Industry Leaders: Subscribe to blogs and Twitter accounts of experts like Andrew Ng and Yann LeCun.

2. Join Forums and Communities: Engage in platforms like Reddit (r/algotrading) and specialized Discord servers.

3. Attend Webinars and Conferences: Participate in events like NeurIPS and local meetups focused on machine learning and finance.

4. Take Online Courses: Enroll in courses on platforms like Coursera or Udacity that focus on machine learning applications in finance.

5. Read Research Papers: Regularly check arXiv.org for the latest studies on machine learning in trading.

6. Experiment with Tools: Use Python libraries like TensorFlow and scikit-learn to build and refine your own trading algorithms.

7. Follow Financial News: Keep an eye on news from sources like Bloomberg and Financial Times for insights on market trends and technologies.

Implement these strategies consistently to remain informed and enhance your day trading algorithms with machine learning.

Learn about How to Stay Updated on AI Trends in Day Trading?

Conclusion about Integrating Machine Learning in Day Trading Algorithms

Incorporating machine learning into day trading algorithms can significantly enhance trading strategies by leveraging data-driven insights for better decision-making. By understanding key techniques and tools, traders can effectively implement machine learning models to optimize performance. However, it's essential to recognize the challenges and common pitfalls associated with this technology. Staying informed about trends and continuously evaluating algorithm performance is crucial for success. For comprehensive guidance and support in navigating these complexities, DayTradingBusiness provides valuable resources tailored to empower traders in their journey.

Sources:

- A hybrid stock trading framework integrating technical analysis with ...

- Machine learning techniques and data for stock market forecasting ...

- Intelligent cryptocurrency trading system using integrated AdaBoost ...

- Deep learning for algorithmic trading: A systematic review of ...

- EnergyShare AI: Transforming P2P energy trading through ...

- Ethical and Bias Considerations in Artificial Intelligence/Machine ...