Did you know that even the most sophisticated trading algorithms can throw a tantrum just like toddlers? Properly monitoring your day trading algorithms is crucial to ensure they behave predictably and profitably. In this article, we delve into key strategies for tracking performance, including the best tools, essential metrics, and common pitfalls to avoid. Learn how often to review your algorithms, set effective alerts, and utilize backtesting for optimization. We also explore the role of AI in enhancing monitoring and provide insights on compliance, logging practices, and automating the entire process. With the right approach, you can fine-tune your algorithms and maximize your trading success with DayTradingBusiness.

How can I track the performance of my day trading algorithms?

To track the performance of your day trading algorithms, follow these steps:

1. Use Backtesting: Simulate trades using historical data to gauge profitability and risk.

2. Set Up Real-Time Monitoring: Utilize trading software that provides live data on your algorithms' performance.

3. Analyze Key Metrics: Focus on metrics like win rate, average profit/loss, drawdown, and Sharpe ratio.

4. Implement Alerts: Set alerts for significant losses or gains to act quickly.

5. Review Regularly: Conduct weekly or monthly reviews to assess performance and adjust strategies.

6. Maintain a Trading Journal: Document trades and decisions to identify patterns and areas for improvement.

These practices will help you effectively monitor and optimize your day trading algorithms.

What tools are best for monitoring day trading algorithms?

The best tools for monitoring day trading algorithms include:

1. TradingView: Offers advanced charting, real-time data, and alerts for custom strategies.

2. MetaTrader 4/5: Provides extensive backtesting capabilities and supports automated trading strategies.

3. NinjaTrader: Ideal for advanced analytics and features robust market replay and backtesting functionalities.

4. QuantConnect: A cloud-based platform that allows for backtesting and live trading with multiple APIs.

5. Zorro Trader: Lightweight software for algorithmic trading with scripting capabilities and live monitoring.

Choose tools based on your specific needs for data analysis, backtesting, and real-time alerts.

How often should I review my trading algorithm's performance?

Review your trading algorithm's performance at least weekly. This frequency helps you identify trends, adjust for market changes, and optimize strategies. Additionally, conduct a deeper monthly analysis to evaluate overall effectiveness and make significant adjustments if necessary. Regular checks ensure your algorithm remains aligned with your trading goals.

What metrics should I use to evaluate day trading algorithms?

Use these key metrics to evaluate day trading algorithms:

1. Sharpe Ratio: Measures risk-adjusted return. A higher ratio indicates better performance relative to risk taken.

2. Win Rate: Percentage of profitable trades. A higher win rate suggests more successful trades.

3. Average Gain vs. Average Loss: Compares the average profit of winning trades to the average loss of losing trades. Ideally, the average gain should exceed the average loss.

4. Maximum Drawdown: Indicates the largest peak-to-trough decline. Lower drawdowns show better risk management.

5. Profit Factor: Ratio of gross profit to gross loss. A value above 1 indicates profitability.

6. Trade Frequency: Number of trades executed over a given period. Helps assess the algorithm's activity level.

7. Execution Speed: Time taken to execute trades. Faster execution can lead to better prices and profits.

Monitor these metrics regularly to ensure your day trading algorithms are performing optimally.

How can I identify issues in my day trading algorithms?

To identify issues in your day trading algorithms, regularly monitor performance metrics like win rate, drawdown, and overall profitability. Use backtesting to simulate trades over historical data, looking for discrepancies between expected and actual results. Implement real-time tracking to assess how the algorithm performs in varying market conditions. Analyze trade execution speed and slippage to ensure orders are filled as intended. Lastly, review logs for errors or unexpected behaviors to pinpoint areas needing improvement.

How do I set alerts for my trading algorithm’s performance?

To set alerts for your trading algorithm's performance, follow these steps:

1. Choose a Platform: Use trading platforms like MetaTrader, TradingView, or custom coding in Python that supports alert functionalities.

2. Define Metrics: Identify the key performance indicators (KPIs) you want to monitor, such as profit/loss, drawdown, or win rate.

3. Set Alert Conditions: Create specific conditions for alerts based on those KPIs. For instance, set an alert for when your drawdown exceeds 5% or when profit reaches a certain threshold.

4. Use Notification Tools: Leverage built-in notification systems, like email or SMS alerts, to stay updated on your algorithm's performance in real-time.

5. Backtest Alerts: Before going live, backtest your alert settings to ensure they trigger correctly based on historical data.

6. Monitor Regularly: Keep an eye on the alerts and adjust your conditions as necessary based on your trading strategy's evolution.

This process will help you effectively monitor your day trading algorithms.

What are the common pitfalls in monitoring trading algorithms?

Common pitfalls in monitoring trading algorithms include:

1. Ignoring Performance Metrics: Failing to track key metrics like win rate, drawdown, and Sharpe ratio can lead to misguided decisions.

2. Overfitting: Adjusting algorithms too much based on historical data can make them ineffective in live markets.

3. Lack of Real-Time Monitoring: Not keeping an eye on performance in real-time may result in missing critical issues or market changes.

4. Neglecting Risk Management: Underestimating risk parameters can expose your portfolio to significant losses.

5. Infrequent Testing: Running algorithms without regular backtesting and optimization can lead to outdated strategies.

6. Ignoring Market Conditions: Not adapting to changing market environments can render algorithms ineffective.

7. Insufficient Documentation: Failing to document changes or strategies can create confusion and hinder performance analysis.

8. Emotional Decision-Making: Allowing emotions to influence monitoring and adjustments can compromise algorithm integrity.

How can I optimize my day trading algorithms based on performance data?

To optimize your day trading algorithms based on performance data, follow these steps:

1. Analyze Historical Data: Review past trades to identify patterns and trends. Focus on metrics like win rate, average profit/loss, and drawdown.

2. Adjust Parameters: Tweak algorithm parameters—like entry/exit points and stop-loss levels—based on performance insights. Test these changes through backtesting.

3. Incorporate Machine Learning: Use machine learning models to recognize complex patterns in data that can enhance decision-making.

4. Implement Real-Time Monitoring: Set up dashboards to track live performance and key metrics. Adjust algorithms in real-time based on market conditions.

5. A/B Testing: Run different versions of your algorithm simultaneously to see which performs better under specific conditions.

6. Review Performance Regularly: Establish a routine for reviewing your algorithms’ performance. Look for anomalies or consistent underperformance.

7. Keep Up with Market Changes: Stay informed about market news and trends that could impact your algorithm's assumptions and adjust accordingly.

By focusing on these strategies, you can effectively monitor and optimize your day trading algorithms.

What role does backtesting play in monitoring algorithms?

Backtesting is crucial for monitoring algorithms as it evaluates their performance using historical data. It helps identify strengths and weaknesses, ensuring strategies are robust before live trading. By analyzing past trades, you can refine parameters and improve decision-making. Consistent backtesting allows you to adapt to changing market conditions and enhances overall algorithm reliability.

How can I analyze real-time data for my trading algorithms?

To analyze real-time data for your trading algorithms, first, choose a reliable data feed that provides live market information. Use tools like Python or R to process and analyze this data. Implement libraries such as Pandas for data manipulation and NumPy for numerical analysis. Set up a real-time monitoring system using platforms like MetaTrader or TradingView to visualize performance and detect anomalies. Regularly backtest your algorithms with historical data to ensure effectiveness before deploying them in real-time trading. Finally, establish alerts for key performance indicators to stay updated on your algorithm's performance.

Learn about How to Analyze Historical Data Using Day Trading Charts

What software can help me monitor multiple day trading algorithms?

To monitor multiple day trading algorithms, consider using software like TradeStation, MultiCharts, or NinjaTrader. These platforms offer robust tools for tracking algorithm performance, backtesting strategies, and analyzing market data in real-time. You can also explore QuantConnect and MetaTrader for more advanced algorithmic trading capabilities. Choose a platform that fits your trading style and offers features like alerts, performance metrics, and portfolio management.

Learn about Day Trading Software for Multiple Markets

How do I ensure my trading algorithms are compliant with regulations?

To ensure your trading algorithms comply with regulations, follow these steps:

1. Stay Informed: Regularly review relevant regulations from bodies like the SEC and FINRA.

2. Implement Risk Controls: Set limits on trades, losses, and leverage to align with regulatory standards.

3. Audit Your Code: Regularly audit your algorithms for adherence to compliance requirements, including market manipulation rules.

4. Document Everything: Keep detailed records of trading strategies, data sources, and decision-making processes.

5. Use Compliance Software: Invest in tools that monitor trades for compliance violations in real-time.

6. Conduct Regular Reviews: Schedule periodic assessments of your algorithms to ensure ongoing compliance with evolving regulations.

7. Seek Legal Advice: Consult with a legal expert specializing in financial regulations to review your algorithms and practices.

By following these steps, you can effectively monitor and maintain compliance for your trading algorithms.

What are the best practices for logging algorithm performance?

1. Define Key Metrics: Focus on metrics like win rate, average return per trade, and maximum drawdown.

2. Use a Consistent Format: Log performance data in a structured format, such as CSV or a database, for easy analysis.

3. Track Execution Time: Measure how quickly your algorithm executes trades to identify latency issues.

4. Record Market Conditions: Log data about market conditions during trades, including volatility and liquidity.

5. Regular Review: Schedule periodic reviews of performance logs to identify trends and areas for improvement.

6. Include Error Logs: Capture any errors or exceptions that occur during trading to troubleshoot and refine algorithms.

7. Visualize Data: Use charts and graphs to visualize performance over time, making it easier to spot patterns.

8. Backtesting Results: Compare live performance against backtested results to identify discrepancies.

9. Document Changes: Keep a record of any changes made to the algorithm and their impact on performance.

10. Automate Logging: Utilize APIs or scripts to automate the logging process, reducing manual errors.

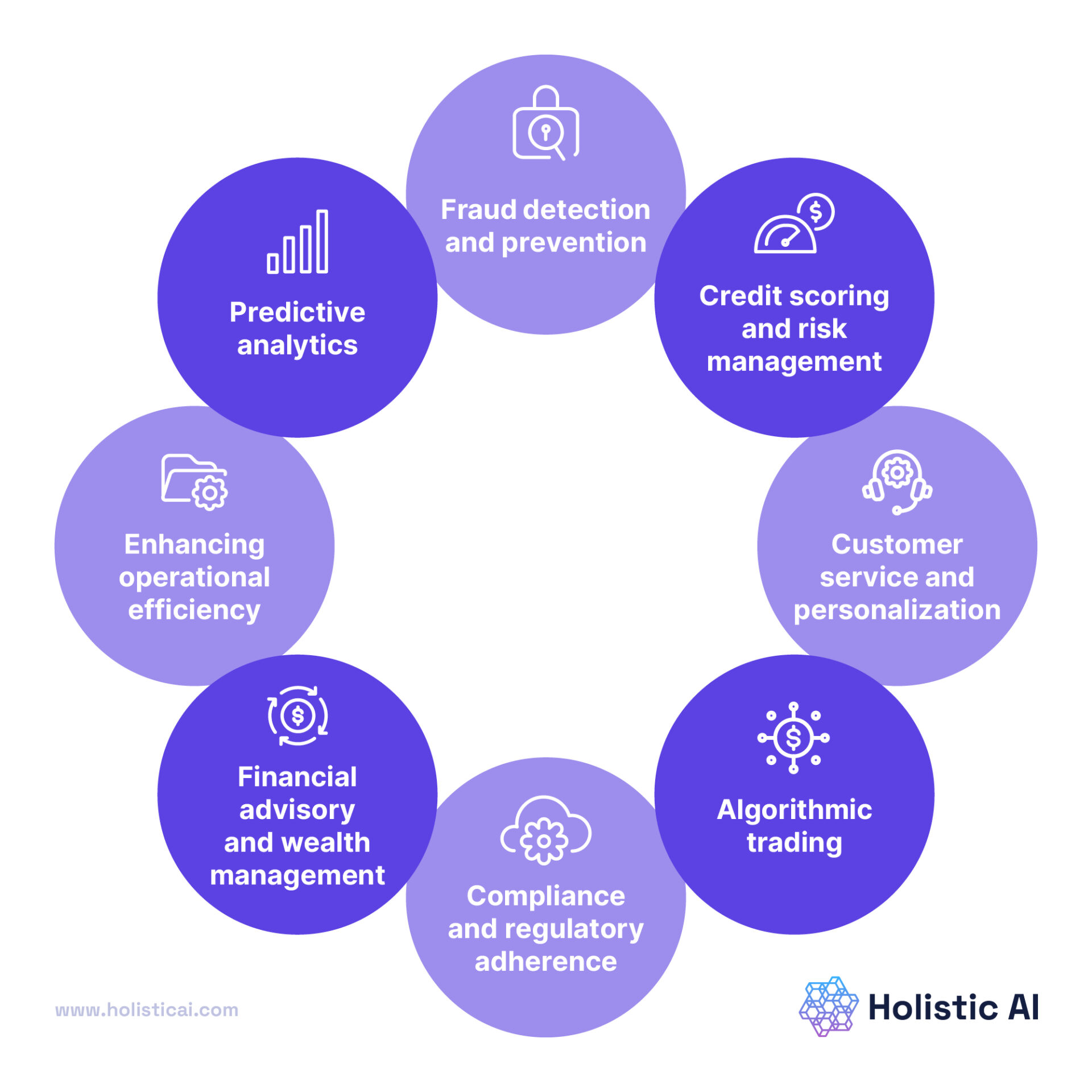

How can I use AI to enhance the monitoring of my trading algorithms?

You can enhance the monitoring of your trading algorithms using AI by implementing the following strategies:

1. Real-Time Data Analysis: Use AI to analyze market data in real-time, identifying trends and anomalies that may impact your algorithms.

2. Performance Metrics Tracking: Implement AI tools to track key performance indicators (KPIs) of your trading algorithms, such as win rate, drawdown, and profit factor.

3. Anomaly Detection: Leverage machine learning models to detect unusual trading patterns or deviations from expected performance, allowing for prompt adjustments.

4. Sentiment Analysis: Use AI to gauge market sentiment from news articles and social media, helping you anticipate market movements that your algorithms might not account for.

5. Backtesting Optimization: Apply AI to optimize backtesting processes, allowing you to simulate various market conditions and refine your algorithm's strategies.

6. Automated Alerts: Set up AI-driven alerts for significant changes in market conditions or algorithm performance, ensuring you stay informed without constant manual monitoring.

7. Adaptive Learning: Use reinforcement learning to enable your algorithms to adapt based on historical performance, improving their decision-making over time.

By integrating these AI capabilities, you can significantly enhance the monitoring and effectiveness of your trading algorithms.

What should I do if my trading algorithm underperforms?

If your trading algorithm underperforms, start by reviewing its performance metrics to identify specific issues. Analyze historical data to see if market conditions have changed. Adjust parameters or algorithms based on this analysis. Test modifications with backtesting and paper trading before deploying them live. Consider diversifying strategies or integrating new data sources for better insights. Lastly, continuously monitor and optimize your algorithm to adapt to evolving market trends.

How can I automate the monitoring process for my day trading algorithms?

To automate the monitoring process for your day trading algorithms, implement the following steps:

1. Use Trading Platforms: Leverage platforms like MetaTrader or TradeStation that offer built-in monitoring tools and alerts.

2. Set Up Automated Alerts: Configure alerts for key metrics such as trade execution, profit/loss thresholds, or market changes via email or SMS.

3. Integrate APIs: Utilize APIs from your trading platform to pull real-time data and track algorithm performance programmatically.

4. Implement Logging: Create a logging system that records every trade and performance metric for analysis.

5. Utilize Third-Party Tools: Consider tools like TradingView or NinjaTrader for additional monitoring capabilities and alerts.

6. Backtesting: Regularly backtest your algorithms to ensure they perform well under various market conditions.

7. Dashboard Creation: Build a custom dashboard using tools like Tableau or Power BI to visualize performance in real-time.

8. Automate Risk Management: Set parameters for position sizing and stop-loss levels to limit losses automatically.

By combining these strategies, you can effectively automate the monitoring of your day trading algorithms.

Learn about How to Automate Your Day Trading Backtesting Process

Conclusion about How to Monitor Your Day Trading Algorithms

In conclusion, effectively monitoring your day trading algorithms is crucial for maximizing performance and minimizing risks. By utilizing the right tools, regularly reviewing metrics, and implementing backtesting, you can gain valuable insights into your strategies. Identifying issues early and optimizing based on performance data will enhance your trading outcomes. Remember, continuous monitoring and compliance with regulations are essential for long-term success. For comprehensive guidance and resources, DayTradingBusiness is here to support you in refining your trading approaches.

Learn about How to Monitor the Performance of Day Trading Bots?