Did you know that the average high-frequency trading (HFT) strategy can execute hundreds of trades in just a second? In the fast-paced world of HFT, backtesting is not just a luxury—it's essential. This article explores the fundamentals of backtesting in HFT, highlighting its importance, best practices, and potential pitfalls. You'll learn how to kickstart your backtesting process, choose the right tools, ensure data quality, and utilize metrics effectively. Additionally, we delve into how to avoid overfitting, validate your results, and understand the impact of market conditions and transaction costs. By integrating these insights from DayTradingBusiness, you can optimize your backtesting process and enhance your trading strategies with machine learning. Buckle up for a deep dive into mastering HFT backtesting!

What is Backtesting in High-Frequency Trading (HFT)?

Backtesting in high-frequency trading (HFT) is the process of testing trading strategies using historical data to evaluate their potential performance. It involves simulating trades based on past market conditions to identify profitability and risk. Effective backtesting in HFT requires high-quality data, accurate execution modeling, and consideration of transaction costs and slippage. Use robust statistical methods to analyze results and ensure strategies are not overfitted to historical data. Focus on speed and efficiency, as HFT strategies operate on microsecond timeframes.

Why is Backtesting Crucial for HFT Strategies?

Backtesting is crucial for high-frequency trading (HFT) strategies because it allows traders to evaluate the effectiveness of their algorithms using historical data. This process helps identify potential profitability, assess risk, and refine strategies before deploying real capital. Effective backtesting reveals how a strategy would have performed in various market conditions, ensuring it’s robust and adaptable. It also helps in optimizing parameters and minimizing overfitting, which can lead to false confidence in live trading. Without rigorous backtesting, traders risk significant losses due to unforeseen market dynamics.

How Do You Start Backtesting an HFT Strategy?

To start backtesting an HFT (High-Frequency Trading) strategy, follow these steps:

1. Define the Strategy: Clearly the trading rules, entry and exit points, and risk management parameters.

2. Collect Data: Gather high-quality historical data, including tick data, order book data, and relevant market indicators.

3. Choose a Backtesting Framework: Select a backtesting platform or programming language (like Python or R) that supports HFT analysis.

4. Implement the Strategy: Code the strategy into the backtesting framework, ensuring it accurately reflects the defined rules.

5. Run the Backtest: Execute the backtest on historical data, monitoring for execution speed and slippage.

6. Analyze Results: Evaluate performance metrics such as return on investment, Sharpe ratio, and drawdowns to assess strategy viability.

7. Optimize and Iterate: Refine the strategy based on backtest results, adjusting parameters to improve performance.

8. Test in Real Conditions: Once satisfied, simulate the strategy in a paper trading environment to gauge real-time performance before going live.

What Tools Are Best for Backtesting HFT Strategies?

The best tools for backtesting high-frequency trading (HFT) strategies include:

1. QuantConnect – Offers cloud-based backtesting with extensive data support.

2. MetaTrader 5 – Provides advanced backtesting capabilities for algorithmic trading.

3. Quantopian – Ideal for Python-based strategy development and backtesting.

4. Backtrader – A flexible Python library for backtesting strategies with real data.

5. TradeStation – Comprehensive tools for testing and optimizing trading strategies.

6. NinjaTrader – Offers robust backtesting features and historical data access.

7. Amibroker – Known for its speed and powerful backtesting engine.

Choose based on your coding skills, data needs, and specific strategy requirements.

How Can You Ensure Data Quality in HFT Backtesting?

To ensure data quality in HFT backtesting, follow these steps:

1. Use High-Resolution Data: Obtain tick-by-tick data to capture all market movements accurately.

2. Clean and Validate Data: Remove outliers, fill gaps, and check for inconsistencies to maintain integrity.

3. Synchronize Data Sources: Align timestamps from different data feeds to avoid discrepancies.

4. Account for Market Conditions: Adjust data for events like splits, dividends, or market holidays that can skew results.

5. Test Across Multiple Periods: Validate strategies over various time frames to ensure robustness.

6. Implement Transaction Cost Modeling: Include realistic trading costs and slippage in your backtesting to reflect actual performance.

7. Run Sensitivity Analysis: Vary parameters to see how data quality impacts strategy outcomes.

These practices will help maintain high data quality, leading to more reliable backtest results for HFT strategies.

What Metrics Should You Use in HFT Backtesting?

Use the following metrics in HFT backtesting:

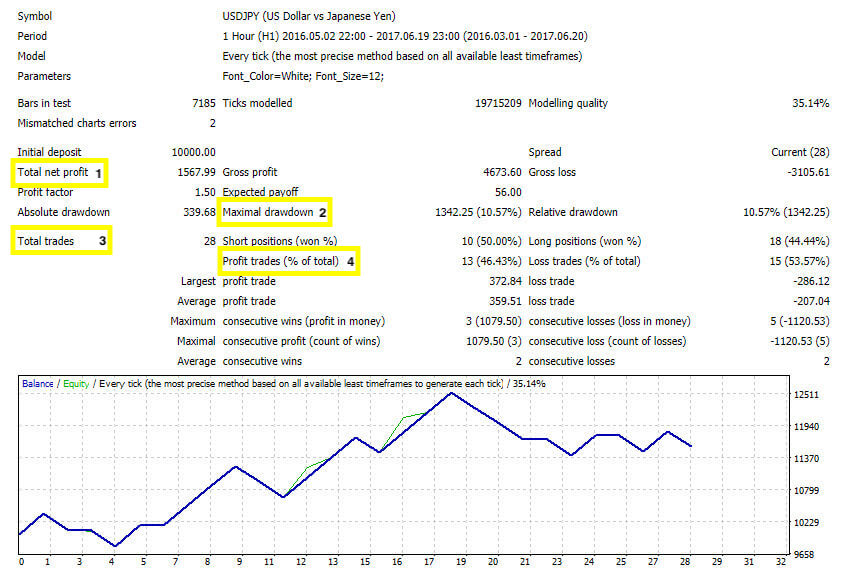

1. Sharpe Ratio: Measures risk-adjusted return.

2. Maximum Drawdown: Assesses potential peak-to-trough losses.

3. Profit Factor: Ratio of gross profit to gross loss.

4. Win Rate: Percentage of profitable trades.

5. Sortino Ratio: Focuses on downside volatility.

6. Execution Speed: Time taken to execute trades.

7. Slippage: Difference between expected and actual trade prices.

8. Trade Frequency: Number of trades executed over a period.

9. Alpha: Measures performance relative to a benchmark.

10. Beta: Gauges volatility compared to the market.

These metrics provide a comprehensive view of strategy performance and risk.

How Do You Avoid Overfitting in HFT Backtesting?

To avoid overfitting in high-frequency trading (HFT) backtesting, follow these strategies:

1. Use a Robust Dataset: Ensure your dataset is large and diverse to capture different market conditions.

2. Limit Complexity: Keep your models simple. Avoid excessive parameters that can lead to overfitting.

3. Out-of-Sample Testing: Always validate your strategy on a separate dataset not used during training.

4. Cross-Validation: Implement k-fold cross-validation to assess model performance across different subsets of data.

5. Regularization Techniques: Apply regularization methods like L1 or L2 to penalize overly complex models.

6. Walk-Forward Analysis: Continuously test your strategy in a simulated live environment, adjusting as market conditions change.

7. Avoid Data Snooping: Ensure your strategy is theoretically sound and not just a product of finding patterns in historical data.

By incorporating these practices, you can enhance the reliability of your HFT strategies and mitigate the risks of overfitting.

What Are Common Pitfalls in Backtesting HFT Strategies?

Common pitfalls in backtesting high-frequency trading (HFT) strategies include:

1. Data Quality: Using inaccurate or incomplete historical data can lead to misleading results.

2. Overfitting: Designing strategies that perform well on historical data but fail in live markets due to excessive optimization.

3. Ignoring Market Impact: Failing to account for slippage and transaction costs can skew performance metrics.

4. Static Assumptions: Assuming market conditions will remain constant can result in poor adaptability.

5. Inadequate Risk Management: Neglecting to incorporate risk controls can lead to significant losses.

6. Lack of Robustness Testing: Not stress-testing strategies across various market conditions can expose vulnerabilities.

7. Insufficient Frequency: Using too infrequent data sampling can miss critical price movements essential for HFT.

Avoiding these pitfalls is crucial for effective backtesting and strategy development in high-frequency trading.

How Can You Optimize Your Backtesting Process for HFT?

To optimize your backtesting process for high-frequency trading (HFT), follow these key steps:

1. Use High-Quality Data: Ensure your historical data is accurate, granular, and includes tick data for precise simulations.

2. Implement Robust Infrastructure: Utilize a powerful computing environment with low-latency connections to handle extensive calculations quickly.

3. Focus on Realistic Execution Models: Incorporate slippage, transaction costs, and market impact into your backtests to mimic real trading conditions.

4. Perform Sensitivity Analysis: Test your strategies under various market conditions to gauge performance consistency and robustness.

5. Utilize Parallel Processing: Leverage parallel computing to run multiple backtests simultaneously, speeding up the evaluation of different strategies.

6. Keep It Simple: Avoid overcomplicating your models; simpler strategies often yield better results and are easier to analyze.

7. Iterate and Refine: Continuously update your models based on new data and insights to improve accuracy.

8. Validate with Walk-Forward Analysis: Test your strategy on out-of-sample data to ensure its effectiveness beyond historical performance.

By focusing on data quality, realistic simulations, and iterative refinement, you can enhance the effectiveness of your HFT backtesting process.

What Timeframes Should You Use for HFT Backtests?

For HFT backtests, use timeframes ranging from milliseconds to seconds. Focus on tick data for the most granular insights. Simulate various market conditions over short periods, like days or weeks, to capture high-frequency dynamics. Ensure your backtesting covers diverse market scenarios to validate strategy robustness.

How Do Market Conditions Affect HFT Backtesting?

Market conditions significantly impact HFT backtesting by influencing trade execution, slippage, and volatility. During volatile periods, backtesting results may show more favorable outcomes due to larger price movements, while in stable markets, profits can diminish. Liquidity also varies; thin markets can lead to poor execution and increased slippage, skewing backtest results. Additionally, changes in market structure, like new regulations or shifts in participant behavior, can affect the effectiveness of strategies. Therefore, it's crucial to incorporate realistic market conditions and historical data into your HFT backtesting to ensure your strategies perform well in diverse environments.

Learn about How Market Conditions Affect HFT Strategies

What Role Does Transaction Cost Play in HFT Backtesting?

Transaction costs are crucial in HFT backtesting as they directly impact profitability. High-frequency trading strategies often rely on small price movements, so even minimal transaction costs can erode gains. Incorporating realistic transaction costs into backtests helps assess the true viability of a strategy. This includes brokerage fees, slippage, and market impact. Accurate modeling of these costs ensures that backtesting results reflect actual trading conditions, leading to more reliable strategy evaluations.

How Can You Validate Your HFT Backtesting Results?

To validate your high-frequency trading (HFT) backtesting results, follow these steps:

1. Data Quality: Ensure your historical data is accurate and granular (tick-level data is ideal).

2. Out-of-Sample Testing: Use a separate set of data not involved in the initial backtest to confirm results.

3. Walk-Forward Analysis: Implement walk-forward optimization to assess performance over different market conditions.

4. Robustness Checks: Test strategies across various timeframes and market scenarios to check consistency.

5. Transaction Costs: Incorporate realistic transaction costs and slippage in your models.

6. Statistical Significance: Use statistical tests to ensure results aren't due to chance; consider metrics like Sharpe ratio and drawdown.

7. Peer Review: Have your methods and results evaluated by others for additional scrutiny.

This approach helps ensure your HFT strategy is viable and reliable in real market conditions.

What Is the Difference Between Simulated and Live Trading in HFT?

Simulated trading in high-frequency trading (HFT) uses historical data to test strategies without real money, allowing for risk-free experimentation. Live trading, on the other hand, involves executing strategies in real-time with actual capital, exposing traders to market conditions and slippage. Simulated trading helps refine strategies, while live trading tests their effectiveness in a dynamic environment. Both are essential for developing robust HFT strategies, but they serve different purposes in the backtesting process.

How Often Should You Backtest Your HFT Strategies?

Backtest your HFT strategies regularly, ideally after any significant market change or strategy adjustment. Monthly reviews are common, but weekly assessments can provide more timely insights. Ensure you backtest whenever you introduce new data, algorithms, or trading conditions. Frequent testing helps identify performance degradation and adapt to market dynamics effectively.

How Can Machine Learning Enhance HFT Strategy Backtesting?

Machine learning can enhance high-frequency trading (HFT) strategy backtesting by enabling more accurate predictions and faster analysis of large datasets. It can identify complex patterns in market data that traditional methods might miss. Algorithms can be trained on historical data to optimize trading parameters and reduce overfitting. By incorporating reinforcement learning, strategies can adapt based on simulated market conditions. Additionally, machine learning can automate the backtesting process, allowing for quicker iterations and more robust validation of HFT strategies.

Learn about How Does Machine Learning Enhance Day Trading?

Conclusion about How to Backtest HFT Strategies Effectively

Incorporating effective backtesting methods is essential for developing successful high-frequency trading (HFT) strategies. By utilizing the right tools, ensuring data quality, and focusing on key metrics, traders can refine their approaches and avoid common pitfalls. Remember, continuous validation and adapting to changing market conditions are vital for maintaining strategy performance. For comprehensive insights and expert guidance on mastering HFT backtesting, consider leveraging the resources offered by DayTradingBusiness.

Learn about How to Backtest Day Trading Strategies Effectively

Sources:

- A profitable trading algorithm for cryptocurrencies using a Neural ...

- Backtest overfitting in the machine learning era: A comparison of out ...

- Statistical Overfitting and Backtest Performance by David H. Bailey ...

- Backtest Overfitting in the Machine Learning Era: A Comparison of ...

- A Profitable Day Trading Strategy For The US Equity Market

- A multi-agent reinforcement learning framework for optimizing ...