Did you know that some day traders rely on algorithms so fast they could outrun a cheetah? While high-frequency trading (HFT) strategies can offer significant advantages, they also come with unique challenges. This article delves into the myriad difficulties day traders face when employing HFT, from market volatility and technical issues to the psychological toll of rapid trading. We’ll explore the impact of latency and speed on trading success, the regulatory landscape, and how trading fees can erode profitability. Additionally, we’ll highlight effective risk management strategies and common pitfalls to avoid. Finally, discover essential educational resources that can help you navigate these challenges and adapt to the ever-evolving world of high-frequency trading with insights from DayTradingBusiness.

What are the main challenges day traders face with HFT strategies?

Day traders using high-frequency trading (HFT) strategies face several main challenges:

1. Technology Costs: HFT requires sophisticated technology and infrastructure, which can be expensive to maintain.

2. Market Competition: The high-speed nature of HFT means day traders compete against institutional firms with advanced algorithms and resources.

3. Regulatory Scrutiny: HFT strategies are subject to strict regulations, which can change rapidly and impact trading practices.

4. Execution Risk: Speed is crucial, but delays in execution can lead to significant losses, especially in volatile markets.

5. Data Overload: Analyzing vast amounts of data in real-time can overwhelm traders, making it difficult to make informed decisions quickly.

6. Liquidity Issues: While HFT typically benefits from liquidity, sudden market shifts can lead to slippage and reduced availability of trades.

7. Psychological Pressure: The fast-paced environment can create stress and lead to impulsive decisions, negatively affecting trading outcomes.

How does market volatility impact high-frequency trading?

Market volatility significantly impacts high-frequency trading (HFT) by increasing the frequency of price fluctuations, which can lead to both opportunities and risks. In volatile markets, HFT algorithms can capitalize on rapid price movements for quick profits, but they also face challenges like slippage and increased competition. High volatility can cause rapid changes in liquidity, making it harder to execute trades at expected prices. Additionally, unpredictable market behavior can lead to algorithmic errors, resulting in substantial losses. Thus, while volatility can enhance potential gains, it also amplifies risks for day traders using HFT strategies.

What technical issues do day traders encounter in HFT?

Day traders using high-frequency trading (HFT) strategies often face several technical issues:

1. Latency: Delays in data transmission can lead to missed opportunities or unfavorable trades.

2. Market Data Feeds: Inaccurate or incomplete market data can affect decision-making.

3. Connectivity Problems: Network outages or slow connections can hinder trading execution.

4. Algorithm Failures: Bugs in trading algorithms can cause unexpected losses or missed trades.

5. High Transaction Costs: Frequent trading can lead to significant fees, impacting profitability.

6. Regulatory Compliance: Adhering to complex regulations can pose technical challenges.

7. System Overload: High trading volumes can overwhelm systems, leading to crashes or slowdowns.

These issues can significantly impact the effectiveness of HFT strategies for day traders.

How do latency and speed affect HFT success?

Latency affects high-frequency trading (HFT) success by determining how quickly a trader can execute orders after identifying an opportunity. Lower latency means faster execution, which allows traders to capitalize on price discrepancies before the market adjusts. Speed influences the ability to leverage small price movements for profit, as delays can result in missed opportunities. In HFT, even milliseconds can make a significant difference in profitability, making both latency and speed critical for success.

What regulatory challenges do high-frequency traders face?

High-frequency traders (HFT) face several regulatory challenges, including increased scrutiny from regulators like the SEC and CFTC, which focus on market manipulation and fair trading practices. Compliance with complex regulations, such as the Dodd-Frank Act and MiFID II, imposes significant reporting and operational burdens. Additionally, changes in market structure, like the rise of dark pools and new trading fees, require constant adaptation. HFT firms also deal with risk management regulations that require robust systems to monitor trading algorithms and ensure they operate within legal limits.

How can data quality impact HFT strategies for day traders?

Data quality directly impacts HFT strategies for day traders by influencing decision-making and execution speed. High-quality, accurate data ensures traders can identify profitable patterns and market trends in real-time. Poor data leads to erroneous signals, resulting in costly mistakes and missed opportunities. Additionally, latency in data feeds can hinder execution, causing traders to miss critical price movements. Overall, maintaining high data integrity is essential for maximizing the effectiveness of HFT strategies in day trading.

What are the psychological challenges of day trading with HFT?

Day trading with high-frequency trading (HFT) presents several psychological challenges. First, the rapid pace can lead to anxiety and stress, as traders must make quick decisions with little room for error. This pressure may result in impulsive trades, driven by fear of missing out or overreacting to market fluctuations.

Additionally, the constant monitoring of market data can foster a sense of urgency, leading to burnout. Traders might also struggle with emotional detachment, as the need to remain objective clashes with the natural human tendency to become attached to positions. Finally, the potential for significant losses can create a cycle of fear and regret, making it difficult to stick to a trading plan.

How do trading fees influence high-frequency trading profitability?

Trading fees significantly impact high-frequency trading (HFT) profitability by eroding margins on each trade. Even small fees can accumulate quickly due to the high volume of trades executed. If trading costs exceed profit margins, HFT strategies become unviable. Additionally, competition among HFT firms can lead to tighter spreads, making it crucial to minimize fees to maintain a competitive edge. Effective fee management, including choosing brokers with lower rates, is essential for sustaining profitability in HFT.

What risk management strategies can help day traders using HFT?

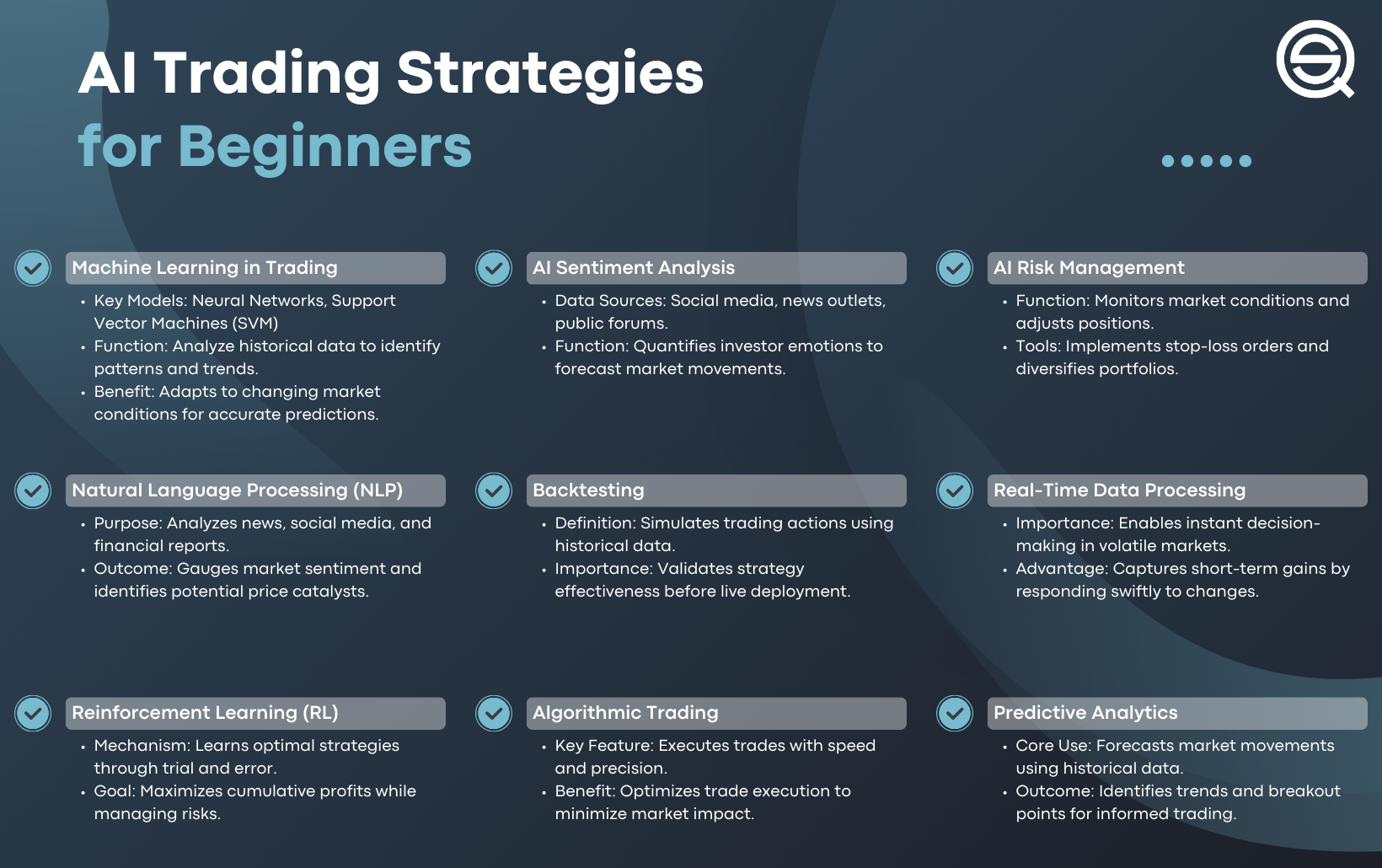

Day traders using high-frequency trading (HFT) can implement several risk management strategies:

1. Position Sizing: Limit the size of each trade to a small percentage of total capital to prevent significant losses.

2. Stop-Loss Orders: Set automated stop-loss orders to exit trades at predetermined loss levels, protecting from larger downturns.

3. Diversification: Spread trades across different assets or strategies to reduce exposure to any single market event.

4. Real-Time Monitoring: Use advanced analytics and monitoring tools to track market conditions and adjust strategies quickly.

5. Algorithm Testing: Rigorously backtest algorithms in various market conditions to identify weaknesses before live trading.

6. Limit Leverage: Use leverage cautiously to avoid amplifying losses, especially in volatile markets.

7. Daily Loss Limits: Establish daily loss limits to stop trading when losses exceed a set amount, preserving capital for future trades.

8. Regular Review: Continuously review and adjust strategies based on performance metrics and market changes.

Implementing these strategies can help mitigate risks inherent in high-frequency trading.

How does competition affect day traders employing HFT?

Competition intensifies pressure on high-frequency traders (HFT) as they race to execute trades faster than rivals. This speed advantage is crucial; even milliseconds can mean the difference between profit and loss. Additionally, increased competition often leads to tighter spreads, reducing potential profits. HFT firms must continuously innovate their algorithms and technology to maintain an edge, which drives up operational costs. Market saturation can also result in diminishing returns, making it harder for individual day traders to sustain profitability.

Learn about How Do Institutional Traders Affect Day Markets?

What are the common mistakes day traders make with HFT?

Common mistakes day traders make with high-frequency trading (HFT) include:

1. Overtrading: Executing too many trades can lead to excessive fees and reduced profits.

2. Ignoring Market Conditions: Not adapting strategies to current market volatility can result in losses.

3. Lack of Risk Management: Failing to set stop-loss orders can lead to significant drawdowns.

4. Chasing Losses: Trying to recover losses quickly can result in poor decision-making.

5. Neglecting Technology: Using outdated software or hardware can slow execution speeds.

6. Emotional Trading: Letting emotions dictate trades can lead to impulsive decisions.

7. Not Backtesting Strategies: Relying on untested strategies increases the risk of failure.

Avoiding these pitfalls can improve the effectiveness of HFT strategies.

Learn about Common Mistakes in Order Flow Analysis for Day Traders

How can technology failures hinder high-frequency trading?

Technology failures can significantly impact high-frequency trading (HFT) by causing delays in order execution, leading to missed opportunities. Network outages can disrupt data feeds, resulting in inaccurate market information and poor decision-making. Software bugs may trigger erroneous trades, creating financial losses. Additionally, latency issues can prevent traders from reacting quickly to market changes, undermining the speed advantage that HFT relies on. Overall, any technology hiccup can erode profitability and increase risk.

What role does algorithm optimization play in HFT challenges?

Algorithm optimization is crucial in overcoming high-frequency trading (HFT) challenges. It enhances speed and accuracy, allowing traders to execute orders faster than competitors. By fine-tuning algorithms, traders can improve decision-making under volatile market conditions. This optimization helps minimize latency, reduce slippage, and adapt to changing market dynamics. Ultimately, effective algorithm optimization can lead to increased profitability and a competitive edge in HFT.

How do changes in market structure affect HFT strategies?

Changes in market structure can significantly impact high-frequency trading (HFT) strategies. For instance, increased regulation may introduce latency due to compliance checks, making HFT less effective. Market fragmentation can lead to more data sources but complicate order execution, requiring better algorithms to navigate multiple venues. Changes in liquidity can also affect HFT profitability; reduced liquidity means higher slippage and transaction costs. Additionally, shifts in trading hours or market hours can alter strategy timing, necessitating adjustments in algorithm parameters. Overall, adapting to these changes is crucial for maintaining competitive advantage in HFT.

Learn about How Does Market Microstructure Affect Day Trading Strategies?

What educational resources help day traders navigate HFT challenges?

Day traders facing high-frequency trading (HFT) challenges can benefit from several educational resources:

1. Online Courses: Websites like Udemy and Coursera offer courses specifically on HFT strategies and day trading techniques.

2. Books: Titles like "Algorithmic Trading" by Ernie Chan and "High-Frequency Trading" by Irene Aldridge provide in-depth insights.

3. Webinars and Workshops: Many trading platforms host live sessions with experts discussing HFT challenges and solutions.

4. Forums and Communities: Joining platforms like Elite Trader or Trade2Win allows for real-time discussions and shared experiences among traders.

5. YouTube Channels: Channels focused on trading education often cover HFT topics, offering practical tips and strategies.

6. Research Papers: Academic papers on HFT can provide data-driven insights and help traders understand market dynamics.

Utilizing these resources can enhance a day trader's ability to navigate the complexities of high-frequency trading.

How can traders adapt to evolving regulations in high-frequency trading?

Traders can adapt to evolving regulations in high-frequency trading by staying informed about regulatory changes and implementing compliance measures. They should invest in robust risk management systems to ensure adherence to new rules. Regularly updating trading algorithms to align with legal requirements is crucial. Collaborating with legal experts can help navigate complexities. Additionally, diversifying trading strategies can mitigate risks associated with regulatory shifts. Keeping communication open with exchanges and regulators will also provide insights into upcoming changes.

Conclusion about Challenges Faced by Day Traders Using HFT Strategies

In summary, day traders utilizing high-frequency trading (HFT) strategies must navigate a complex landscape filled with challenges, including market volatility, technical issues, and regulatory hurdles. Addressing latency, ensuring data quality, and managing trading fees are critical for success. Additionally, psychological resilience and effective risk management strategies are essential to overcome common pitfalls. Staying informed through educational resources will empower traders to adapt to the ever-evolving trading environment. Leveraging insights from DayTradingBusiness can enhance your understanding and performance in high-frequency trading.

Learn about Advantages of HFT Strategies for Day Traders