Did you know that some traders have made a fortune by exploiting price differences between platforms—essentially playing a game of financial hide-and-seek? In this article, we delve into the world of day trading arbitrage, explaining what it is and how it operates across various trading platforms. You'll discover the best platforms for arbitrage, the risks involved, and how to spot lucrative opportunities. We’ll also cover essential tools, the impact of fees on profits, and whether automated trading bots can enhance your strategy. Understanding liquidity, market volatility, and timing is crucial, and we'll guide you through setting up your account and managing your capital effectively. Finally, we’ll touch on the tax implications of your trades. Join us as DayTradingBusiness equips you with the knowledge to navigate the exciting landscape of day trading arbitrage.

What is day trading arbitrage?

Day trading arbitrage involves exploiting price differences of the same asset across different platforms. Traders buy low on one exchange and sell high on another, aiming for quick profits. This strategy requires fast execution and often relies on advanced algorithms to capitalize on fleeting price discrepancies. Successful day traders monitor multiple exchanges simultaneously to identify and act on these opportunities promptly.

How does day trading arbitrage work across platforms?

Day trading arbitrage involves exploiting price differences for the same asset across different platforms. Traders buy the asset at a lower price on one platform and sell it at a higher price on another, pocketing the difference.

For example, if stock XYZ is $100 on Platform A and $102 on Platform B, a trader buys on A and sells on B, gaining $2 per share. Speed is crucial; traders use algorithms or bots to capitalize on fleeting opportunities. Transaction fees and execution speed can impact profitability, so choosing platforms with low fees and fast trade execution is essential.

What are the best platforms for day trading arbitrage?

The best platforms for day trading arbitrage include:

1. Interactive Brokers: Low commissions, advanced trading tools, and a wide range of assets.

2. TD Ameritrade: Comprehensive research tools and a user-friendly interface.

3. E*TRADE: Strong trading platform with real-time data and low fees.

4. Binance: Excellent for crypto arbitrage with high liquidity and low trading costs.

5. Coinbase Pro: Good for cryptocurrency trades, offering advanced features and lower fees than the standard Coinbase platform.

6. Thinkorswim: Powerful analysis tools and customizable features for stock and options trading.

Choose based on your trading style, asset preference, and fee structure.

What are the risks of day trading arbitrage?

The risks of day trading arbitrage include market volatility, which can lead to sudden price changes; execution risk, where trades may not execute as expected due to slippage; and liquidity risk, making it hard to enter or exit positions quickly. Additionally, there are fees and commissions that can erode profits, and reliance on technology means system failures or outages can disrupt trading. Regulatory risks also exist, as rules can change and impact strategies.

How can I identify arbitrage opportunities in day trading?

To identify arbitrage opportunities in day trading, monitor price discrepancies for the same asset across different platforms. Use real-time data feeds to track prices and set alerts for significant differences. Focus on high-liquidity assets, as they typically have more frequent price variations. Employ trading bots or algorithms to automate this process and execute trades quickly. Analyze transaction fees to ensure the profit margin exceeds costs. Keep an eye on market news and events that could cause sudden price shifts.

What tools are essential for day trading arbitrage?

Essential tools for day trading arbitrage include:

1. Trading Platform: A reliable platform like Interactive Brokers or TD Ameritrade that offers low latency and fast execution.

2. Market Data Feed: Access to real-time market data from services like Bloomberg or Reuters to identify price discrepancies.

3. Algorithmic Trading Software: Tools like TradeStation or NinjaTrader that allow you to automate trades based on specific criteria.

4. Risk Management Tools: Stop-loss orders and position sizing calculators to manage potential losses effectively.

5. News Aggregators: Services like Benzinga or MarketWatch to stay updated on market-moving news that could impact prices.

6. Charting Software: Programs like TradingView for technical analysis to spot trends and patterns quickly.

These tools help you identify and act on arbitrage opportunities efficiently.

How do fees impact day trading arbitrage profits?

Fees significantly reduce day trading arbitrage profits by eating into the margins between buying and selling prices. Commissions, spreads, and slippage can all cut into potential gains. For example, if you profit $200 from an arbitrage opportunity but pay $50 in fees, your actual profit is only $150. To maximize profits, traders should choose platforms with lower fees and consider the impact of these costs when calculating potential returns.

Can I use automated trading bots for arbitrage?

Yes, you can use automated trading bots for arbitrage. These bots can quickly identify price discrepancies across different platforms and execute trades to capitalize on them. Ensure the bot is programmed effectively to handle latency issues and has access to multiple exchanges for optimal results.

What markets are best for day trading arbitrage?

The best markets for day trading arbitrage include cryptocurrency exchanges, forex markets, and stock markets. In cryptocurrency, platforms like Binance and Coinbase often have price discrepancies. For forex, trading pairs like EUR/USD and GBP/USD can yield opportunities. In stock markets, look at ETFs and high-volume stocks where price differences can arise between exchanges. Focus on markets with high liquidity and low transaction fees to maximize profits.

How do I set up an account for day trading arbitrage?

To set up an account for day trading arbitrage, follow these steps:

1. Choose a Brokerage: Select a brokerage that supports day trading and offers low fees, fast execution, and access to multiple markets. Examples include Interactive Brokers and TD Ameritrade.

2. Open an Account: Complete the online application on your chosen platform. Provide personal information, financial details, and trading experience.

3. Verify Your Identity: Submit required documents like a government ID and proof of address for verification.

4. Fund Your Account: Deposit capital into your trading account. Ensure you meet the minimum balance required for day trading.

5. Set Up Trading Tools: Install trading software or tools that facilitate arbitrage, such as real-time data feeds and analytical tools.

6. Understand the Markets: Familiarize yourself with the assets you plan to trade and the platforms you’ll use for price discrepancies.

7. Practice with a Demo Account: If available, use a demo account to practice your strategies without risking real money.

8. Start Trading: Once you're comfortable, begin executing your arbitrage trades, monitoring price differences across platforms.

Make sure to stay updated on market conditions and refine your strategies as needed.

Learn about How Does Broker Compliance Impact Day Trading Account Security?

What strategies are effective for day trading arbitrage?

Effective strategies for day trading arbitrage include:

1. Identify Price Discrepancies: Monitor multiple platforms for price differences in the same asset. Use tools or bots to track these fluctuations in real time.

2. High-Frequency Trading (HFT): Employ algorithms to execute trades rapidly when opportunities arise. This minimizes the risk of price changes during manual execution.

3. Use Leverage Wisely: Platforms often allow for leveraged trades. Use this to amplify profits, but be cautious of increased risk.

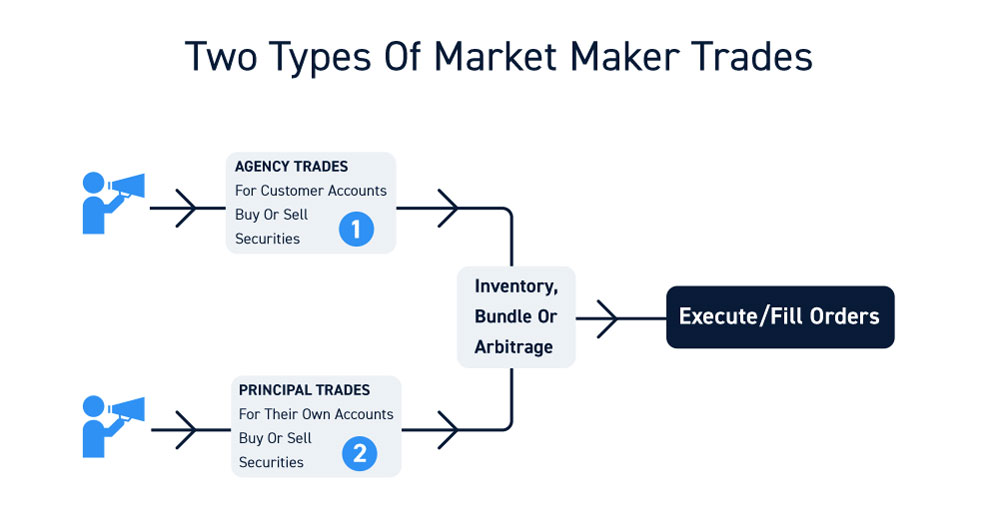

4. Market Making: Provide liquidity by placing buy and sell orders to capture the spread. This can generate consistent profits in volatile markets.

5. Diversify Across Assets: Don’t limit yourself to one asset class. Explore arbitrage opportunities in stocks, cryptocurrencies, and forex.

6. Stay Current on News: Market-moving news can create temporary price discrepancies. Use news alerts to react quickly to changes.

7. Risk Management: Set strict stop-loss orders to protect against sudden market moves and ensure you don’t overexpose your capital.

8. Utilize Trading Bots: Automate your trades to take advantage of arbitrage opportunities 24/7, especially in crypto markets.

Implementing these strategies can enhance your chances of success in day trading arbitrage across platforms.

Learn about Backtesting Strategies for Effective Day Trading

How important is timing in day trading arbitrage?

Timing is crucial in day trading arbitrage. Quick execution can mean the difference between profit and loss. Prices can shift rapidly across platforms, so identifying and acting on price discrepancies swiftly is essential. Delays can erode potential gains, making speed and precision vital for successful arbitrage strategies.

What are the tax implications of day trading arbitrage?

Day trading arbitrage can lead to short-term capital gains, taxed at your ordinary income rate. If you trade frequently, you may be classified as a trader by the IRS, allowing you to deduct certain expenses, but you lose the benefits of long-term capital gains rates. Different platforms may have varying reporting requirements, so ensure you track your trades accurately. Additionally, consider the wash sale rule, which can impact your losses. Always consult a tax professional for personalized advice based on your trading activities.

Learn about Tax Implications of Day Trading in Different Countries

How can I manage my capital for day trading arbitrage?

To manage your capital for day trading arbitrage, start by defining your risk tolerance and setting a clear budget. Allocate a specific percentage of your total capital for each trade, typically 1-2%. Use multiple platforms to identify price discrepancies, and ensure you have sufficient funds in each account for quick execution. Monitor real-time data to seize opportunities instantly. Keep a close eye on transaction fees, as they can eat into profits. Lastly, maintain a disciplined approach; regularly review your trades to refine your strategy and adjust your capital allocation as needed.

Learn about How Do Regulations Impact Day Trading Capital Requirements?

What should I know about liquidity in arbitrage trading?

In arbitrage trading, liquidity is crucial because it affects your ability to execute trades quickly and at the desired price. High liquidity means you can buy and sell assets without significantly impacting their price. On different platforms, check the trading volume and order book depth to ensure you can enter and exit positions swiftly. Low liquidity can lead to slippage, which eats into your profits. Always consider transaction costs as well; they can vary across platforms and impact your arbitrage opportunities. Timing is essential, so stay alert to market conditions that can affect liquidity.

How does market volatility affect day trading arbitrage?

Market volatility can significantly impact day trading arbitrage by creating price discrepancies between different platforms. High volatility often leads to rapid price swings, which can enhance arbitrage opportunities. Traders can exploit these differences by buying low on one platform and selling high on another. However, increased volatility also raises execution risk; prices may change before a trade completes. Successful arbitrage requires quick decision-making and effective risk management to capitalize on fleeting opportunities during volatile periods.

Learn about How Does Market Microstructure Affect Day Trading Strategies?

Conclusion about Day Trading Arbitrage on Different Platforms

In conclusion, mastering day trading arbitrage requires a solid understanding of various platforms, strategies, and market dynamics. As you've learned, identifying profitable opportunities, managing risks, and utilizing essential tools are crucial for success. Additionally, consider the impact of fees and market volatility on your profits. With a focus on timing and liquidity, you can enhance your trading approach. For comprehensive insights and support, DayTradingBusiness is here to help you navigate the complexities of day trading arbitrage effectively.

Learn about FAQs About Day Trading Platforms