Did you know that even the most seasoned traders sometimes rely on their lucky socks for decision-making? While superstitions might be fun, a solid fundamental analysis checklist is essential for serious day trading success. In this article, we explore the crucial elements of a fundamental analysis checklist, highlighting its importance in day trading. Learn how to create an effective checklist, identify key metrics, and understand the impact of earnings reports, news analysis, and economic indicators on your trading strategies. We’ll also cover financial ratios, industry trends, market sentiment, and management effectiveness, while offering tools and resources for streamlined analysis. Lastly, we’ll address common pitfalls and the importance of balancing technical and fundamental analysis. With insights from DayTradingBusiness, you’ll be equipped to make informed trading decisions and elevate your day trading game.

What is a fundamental analysis checklist for day trading?

1. Earnings Reports: Check recent earnings releases for surprises or guidance changes.

2. Revenue Growth: Look for consistent revenue increases year-over-year.

3. Market News: Stay updated on relevant news affecting the stock or sector.

4. Economic Indicators: Monitor key indicators like unemployment rates and interest rates.

5. Analyst Ratings: Review recent upgrades or downgrades from analysts.

6. Insider Trading: Watch for significant insider buying or selling activity.

7. Sector Performance: Compare the stock’s sector performance against the market.

8. Short Interest: Assess short interest as a percentage of float for sentiment analysis.

9. Dividends: Check dividend announcements or changes, as they can impact stock price.

10. Corporate Actions: Be aware of any stock splits, mergers, or acquisitions.

Why is fundamental analysis important for day trading?

Fundamental analysis is crucial for day trading because it helps traders understand the intrinsic value of stocks and the factors influencing price movements. A solid checklist should include:

1. Earnings Reports: Review recent earnings and forecasts to gauge company performance.

2. Economic Indicators: Monitor interest rates, employment data, and GDP growth that affect market sentiment.

3. News Events: Stay updated on relevant news that could impact stock prices, such as mergers, acquisitions, or regulatory changes.

4. Sector Performance: Analyze how specific sectors are performing to identify trends that may affect individual stocks.

5. Valuation Metrics: Use metrics like P/E ratios, PEG ratios, and dividend yields to assess if a stock is over or undervalued.

This approach helps traders make informed decisions quickly, enhancing their ability to capitalize on short-term price fluctuations.

How do you create a fundamental analysis checklist?

To create a fundamental analysis checklist for day trading, follow these steps:

1. Company Overview: Check the company’s business model, industry position, and recent news.

2. Financial Statements: Review the income statement, balance sheet, and cash flow statement for profitability, debt levels, and liquidity.

3. Key Ratios: Analyze important ratios like P/E, P/B, ROE, and current ratio for valuation and performance insights.

4. Earnings Reports: Look for recent earnings announcements, EPS growth, and guidance to gauge future performance.

5. Market Trends: Assess industry trends and economic indicators that could impact the stock.

6. Insider Activity: Monitor insider buying or selling for sentiment insights.

7. Analyst Ratings: Check analyst opinions and price targets for additional perspectives.

8. News Catalysts: Identify upcoming events like product launches or regulatory changes that could affect the stock.

Use this checklist to make informed trading decisions based on solid fundamentals.

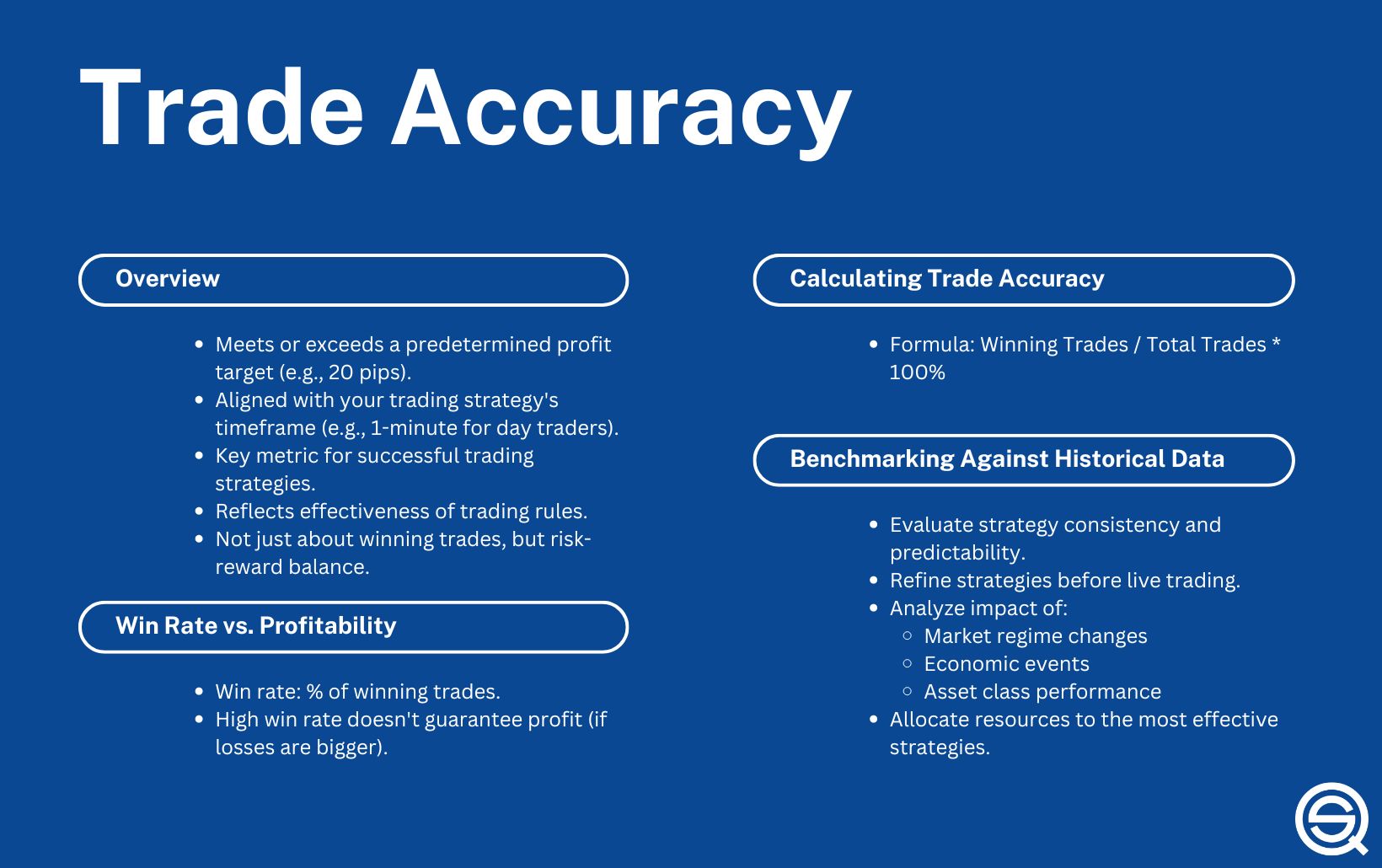

What key metrics should be included in a day trading checklist?

1. Market Sentiment: Analyze news and social media trends to gauge overall market mood.

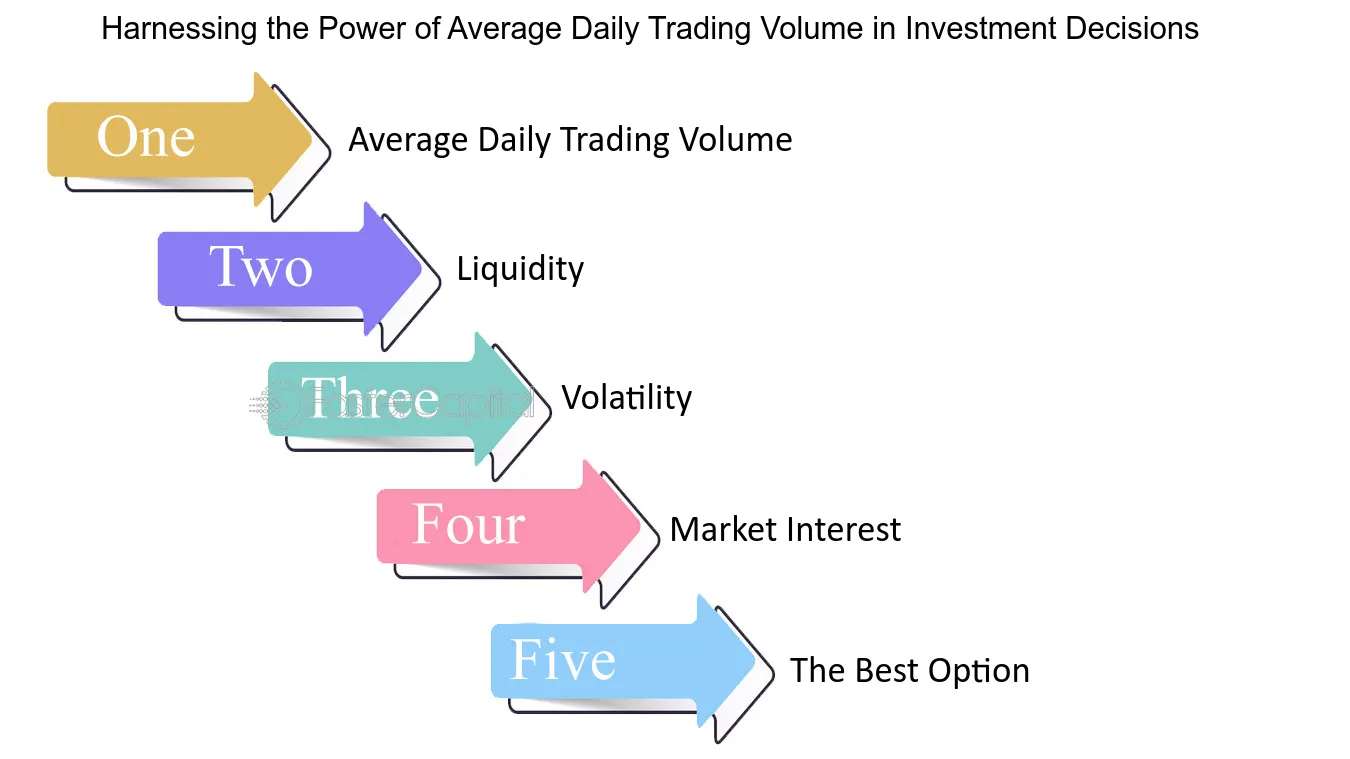

2. Stock Volume: Look for high trading volumes to ensure liquidity and volatility.

3. Price Action: Monitor recent price movements and patterns for entry and exit points.

4. Support and Resistance Levels: Identify key price levels where stocks have historically reversed.

5. Technical Indicators: Use indicators like RSI, MACD, and moving averages for buy/sell signals.

6. Economic Indicators: Keep track of relevant economic reports that could impact market conditions.

7. Sector Performance: Compare the stock’s sector performance against the overall market.

8. Risk-Reward Ratio: Calculate your potential profit against your potential loss for each trade.

9. Trade Setup Criteria: Define specific entry and exit criteria for consistency.

10. Stop-Loss Levels: Set predetermined stop-loss points to manage risk effectively.

How can earnings reports impact day trading decisions?

Earnings reports can significantly impact day trading decisions by influencing stock price volatility. Traders often look for earnings surprises—when actual earnings differ from analyst expectations—as these can lead to sharp price movements. A positive earnings report might trigger buying, while a disappointing one could lead to selling.

Key factors to consider in your checklist include:

1. Earnings Per Share (EPS): Compare actual EPS with estimates.

2. Revenue Growth: Look for trends in revenue compared to past quarters.

3. Guidance: Pay attention to future guidance; optimistic outlooks can boost prices.

4. Market Reaction: Analyze pre-market and after-hours trading for sentiment.

5. Volume: Increased trading volume can indicate strong interest or conviction.

Incorporating these elements will help you make informed and timely decisions based on earnings reports.

What role does news analysis play in day trading?

News analysis is crucial in day trading as it helps traders identify market-moving events. By assessing economic indicators, earnings reports, and geopolitical developments, traders can anticipate price movements. A solid fundamental analysis checklist includes tracking news sources, understanding the impact of announcements, and monitoring sentiment shifts. This allows traders to make informed decisions quickly, maximizing profit potential while minimizing risk.

How do economic indicators affect day trading strategies?

Economic indicators impact day trading strategies by influencing market sentiment and price volatility. Key indicators like GDP, unemployment rates, and inflation can signal economic health. Traders use these metrics to gauge potential market movements. For example, a strong jobs report might lead to bullish sentiment, prompting traders to buy stocks. Conversely, rising inflation could trigger sell-offs. Incorporating economic indicators into your fundamental analysis checklist helps anticipate market reactions and adjust strategies accordingly. Focus on real-time news, earnings reports, and economic data releases to refine entry and exit points.

What financial ratios should be prioritized in day trading?

Prioritize these financial ratios for day trading:

1. Price-to-Earnings (P/E) Ratio: Indicates valuation relative to earnings. Look for lower P/E as a potential buy signal.

2. Earnings Per Share (EPS): Higher EPS suggests a company's profitability, helping identify strong candidates.

3. Current Ratio: A measure of liquidity; aim for ratios above 1.5 for financial stability.

4. Debt-to-Equity (D/E) Ratio: Lower ratios indicate less risk from debt. A D/E below 1 is generally preferable.

5. Return on Equity (ROE): Higher ROE shows effective management. Look for companies with ROE above 15%.

6. Operating Margin: Higher margins signify better control over costs. Seek companies with operating margins above industry averages.

7. Volume: Not a ratio, but high trading volume signals liquidity, essential for day trading.

Focus on these for quick decision-making and effective trades.

How can industry trends influence day trading choices?

Industry trends can significantly influence day trading choices by guiding traders on which sectors are gaining momentum, helping them identify potential stocks to buy or sell.

1. Sector Performance: Monitor which industries are outperforming or underperforming. For instance, if tech stocks are surging, focus on day trading in that sector.

2. Economic Indicators: Pay attention to reports like GDP growth, employment rates, or consumer confidence, as these can impact market sentiment and specific industries.

3. News Impact: Follow news related to industry developments or regulations. Positive news can drive stock prices up, while negative news can create selling opportunities.

4. Market Sentiment: Gauge overall market sentiment through social media, forums, and financial news to align trades with prevailing attitudes.

5. Earnings Reports: Look at upcoming earnings announcements in trending industries. A strong earnings report can lead to significant price movements.

Incorporating these elements into a fundamental analysis checklist can enhance decision-making for day trading.

What is the significance of market sentiment in day trading?

Market sentiment is crucial in day trading because it reflects the overall mood and attitudes of investors toward a stock or the market. Understanding sentiment helps traders anticipate price movements. Positive sentiment can drive prices up, while negative sentiment often leads to declines. Monitoring news, social media, and economic indicators can provide insights into sentiment shifts. This awareness allows traders to make informed decisions, align their strategies with market psychology, and manage risks effectively.

How do you assess management effectiveness in day trading?

To assess management effectiveness in day trading, focus on the following criteria:

1. Decision-Making Speed: Evaluate how quickly management responds to market changes.

2. Risk Management: Look for strategies that minimize losses and protect capital.

3. Performance Metrics: Analyze profit margins, return on investment (ROI), and win-loss ratios.

4. Adaptability: Assess how well management adjusts strategies based on market conditions.

5. Communication: Check for clear, timely updates on trading decisions and market insights.

6. Track Record: Review past performance and consistency in achieving targets.

Use these points to create a checklist that helps gauge management's effectiveness in day trading.

Learn about How can poor risk management lead to losses in day trading?

What tools can help streamline fundamental analysis for day trading?

To streamline fundamental analysis for day trading, consider these tools:

1. Stock Screeners: Use platforms like Finviz or Screener.co to filter stocks based on criteria like earnings, P/E ratios, and volume.

2. News Aggregators: Tools like Benzinga or Seeking Alpha provide real-time news and analysis that impact stock prices.

3. Earnings Calendars: Websites like EarningsWhispers or Yahoo Finance help track upcoming earnings reports and forecasts.

4. Financial Metrics Websites: Sites like Yahoo Finance and Google Finance offer key metrics at a glance, including market cap and dividends.

5. Social Media Analytics: Utilize tools like StockTwits to gauge market sentiment and trends from retail investors.

6. Economic Calendars: Websites like Forex Factory display upcoming economic events that can influence market movements.

7. Charting Software: Tools like TradingView allow for technical analysis alongside fundamental data, helping to make informed decisions.

These tools collectively enhance your ability to analyze stocks quickly and effectively for day trading.

Learn about What tools help with hedging in day trading?

How often should you update your fundamental analysis checklist?

Update your fundamental analysis checklist for day trading at least quarterly. This ensures you capture the latest earnings reports, economic indicators, and market trends. Additionally, review it after significant market events or major news that could impact stocks you trade. Regular updates keep your analysis relevant and effective.

What are common mistakes to avoid in fundamental analysis for day trading?

1. Ignoring Economic Indicators: Failing to monitor key reports like GDP, unemployment rates, or inflation can lead to poor decisions.

2. Overlooking Company News: Neglecting earnings reports, management changes, or product launches can skew your analysis.

3. Relying Solely on Historical Data: Past performance doesn't guarantee future results; always consider current market conditions.

4. Misunderstanding Valuation Metrics: Using the wrong metrics, like P/E ratios without context, can mislead your investment decisions.

5. Not Considering Market Sentiment: Day trading is heavily influenced by trader psychology; ignore sentiment at your peril.

6. Overtrading Based on News: Reacting impulsively to news can lead to losses; assess the impact carefully before acting.

7. Neglecting Risk Management: Failing to set stop-loss orders can result in significant losses.

8. Ignoring Technical Analysis: Combining fundamental insights with technical indicators can enhance your trading strategy.

9. Underestimating Liquidity: Trading illiquid stocks can result in slippage; ensure there’s enough volume before entering a position.

10. Forgetting to Stay Updated: Markets change quickly; regularly refresh your knowledge and analysis to stay relevant.

Learn about Common Mistakes in Day Trading Analysis to Avoid

How can you balance technical and fundamental analysis in day trading?

To balance technical and fundamental analysis in day trading, create a checklist that includes key fundamental metrics and technical indicators.

1. Fundamental Metrics: Focus on earnings reports, news releases, and economic indicators. Track earnings surprises, revenue growth, and guidance changes.

2. Technical Indicators: Use charts to identify trends, support and resistance levels, and volume patterns. Incorporate moving averages, RSI, and MACD for entry and exit signals.

3. Market Sentiment: Monitor news sentiment and social media for market mood. This can influence stock movement and should align with your technical signals.

4. Risk Management: Set stop-loss orders based on both fundamental news triggers and technical levels to protect your capital.

5. Combine Insights: Look for alignment where technical patterns confirm fundamental developments, such as a breakout on high volume after positive news.

By integrating these elements, you can make informed trading decisions that leverage both technical and fundamental strengths.

Learn about How to Combine Fundamental and Technical Analysis in Day Trading

What resources are available for effective fundamental analysis in day trading?

For effective fundamental analysis in day trading, use these resources:

1. Financial News Websites: Bloomberg, CNBC, and Reuters provide real-time news and analysis.

2. Earnings Reports: Review quarterly earnings reports and guidance from companies.

3. Economic Calendars: Track economic indicators like GDP, employment data, and interest rate announcements.

4. Analyst Ratings: Check websites like Yahoo Finance or MarketWatch for analyst upgrades/downgrades.

5. Stock Screeners: Use tools like Finviz or Trade Ideas to filter stocks based on fundamental metrics.

6. Social Media: Follow financial experts on Twitter or Reddit for insights and sentiment.

7. Company Websites: Directly access investor relations sections for presentations and reports.

Utilize these resources to build a checklist that includes key metrics, news events, and market sentiment to guide your day trading decisions.

Learn about Tools for Effective Fundamental Analysis in Day Trading

Conclusion about Building a Fundamental Analysis Checklist for Day Trading

Incorporating a robust fundamental analysis checklist is essential for successful day trading. By focusing on key metrics, earnings reports, economic indicators, and market sentiment, traders can make informed decisions that enhance their strategies. Regularly updating this checklist and utilizing the right tools can streamline the analysis process. Avoiding common pitfalls ensures a balanced approach between technical and fundamental analysis. For those looking to deepen their trading knowledge, DayTradingBusiness offers valuable insights and resources to refine your skills and improve your trading outcomes.

Learn about How to Create a Day Trading Analysis Checklist