Did you know that some day traders have mastered the art of buying a stock on one exchange and selling it on another—sometimes within seconds—just like a digital version of a flea market? In this article, we delve into day trading arbitrage, a strategy that capitalizes on price discrepancies across markets. We’ll define how it works and explore key strategies, real-life examples, and the risks involved. You’ll learn how market conditions and transaction costs impact profits, the tools that can enhance your trading, and how to identify opportunities in real time. Additionally, we’ll cover the common assets used in arbitrage, legal considerations, and the psychological factors that can affect your trading decisions. Whether you’re a beginner looking to start or a seasoned trader aiming to refine your approach, DayTradingBusiness has you covered.

What is day trading arbitrage, and how does it work?

Day trading arbitrage involves exploiting price differences of the same asset across different markets or exchanges. For example, if a stock is trading at $100 on Exchange A and $102 on Exchange B, a day trader can buy the stock on Exchange A and sell it on Exchange B, making a profit of $2 per share.

Another example is currency arbitrage. If the euro is worth $1.10 in one market and $1.12 in another, a trader can buy euros at the lower rate and sell them at the higher rate. Successful day trading arbitrage relies on quick execution and often requires sophisticated software to identify and act on these opportunities before they vanish.

What are the key strategies for successful day trading arbitrage?

Key strategies for successful day trading arbitrage include:

1. Market Analysis: Use real-time data to identify price discrepancies between different markets or securities. For example, if stock A is priced lower on one exchange than another, buy low and sell high.

2. Speed and Automation: Employ trading algorithms to execute trades quickly. Automated systems can capitalize on fleeting opportunities faster than manual trading.

3. Risk Management: Set strict stop-loss orders to limit potential losses. For instance, if a position moves against you by a certain percentage, exit to protect your capital.

4. Diversification: Trade multiple pairs or assets simultaneously to spread risk. If one arbitrage opportunity fails, others may still yield profit.

5. Cost Management: Consider transaction fees and spreads. Ensure that the profit from arbitrage exceeds these costs to maintain profitability.

6. Continuous Learning: Stay updated on market trends and changes. Successful traders analyze past trades and adjust strategies accordingly.

Real-life example: A trader noticed a price difference in a cryptocurrency between two exchanges. They bought on the cheaper exchange and sold on the more expensive one, capturing the profit before the prices aligned. This highlights the importance of quick decision-making and execution in arbitrage.

Can you provide real-life examples of day trading arbitrage?

Sure, here are a few real-life examples of day trading arbitrage:

1. Currency Arbitrage: A trader notices that the EUR/USD pair is priced at 1.20 on one exchange and 1.21 on another. They buy euros at the lower price and sell them at the higher price, pocketing the difference.

2. Stock Arbitrage: A stock trades at $100 on the New York Stock Exchange (NYSE) and $102 on a foreign exchange. The trader buys shares on the NYSE and simultaneously sells them on the foreign exchange, gaining $2 per share.

3. ETF Arbitrage: An exchange-traded fund (ETF) tracking a specific index is priced at $50, while the underlying assets are worth $48. The trader buys the ETF and sells the underlying assets, capturing the $2 difference.

4. Futures Arbitrage: A trader identifies that a futures contract for oil is trading at $60, while spot prices are at $58. They buy the spot oil and sell the futures contract, locking in a $2 profit.

5. Cryptocurrency Arbitrage: Bitcoin is trading at $30,000 on one exchange and $30,500 on another. The trader buys Bitcoin on the cheaper exchange and sells it on the more expensive one, earning $500 per coin.

These examples illustrate how traders exploit price discrepancies across different markets to generate profits quickly.

What are the risks associated with day trading arbitrage?

Risks associated with day trading arbitrage include market volatility, execution delays, and liquidity issues. For example, if a trader spots a price discrepancy between two exchanges, rapid changes in market conditions can erase the arbitrage opportunity before a trade is executed. Additionally, high transaction fees can eat into profits, especially if trades are frequent. There's also the risk of technical failures; a system crash can prevent trades from processing. Lastly, regulatory changes can impact strategies, making them less effective or even illegal.

How do market conditions affect day trading arbitrage opportunities?

Market conditions significantly influence day trading arbitrage opportunities by affecting price discrepancies and volatility. For instance, during high volatility, prices can diverge more widely across different exchanges, creating more opportunities for arbitrage. Conversely, in stable markets, price differences tend to narrow, reducing arbitrage chances.

A real-life example is when a stock listed on two exchanges shows a price difference due to varying demand; a trader can buy on the cheaper exchange and sell on the pricier one for a profit. Additionally, news events can create temporary inefficiencies, offering quick arbitrage windows. Thus, understanding current market conditions is vital for identifying and capitalizing on these opportunities effectively.

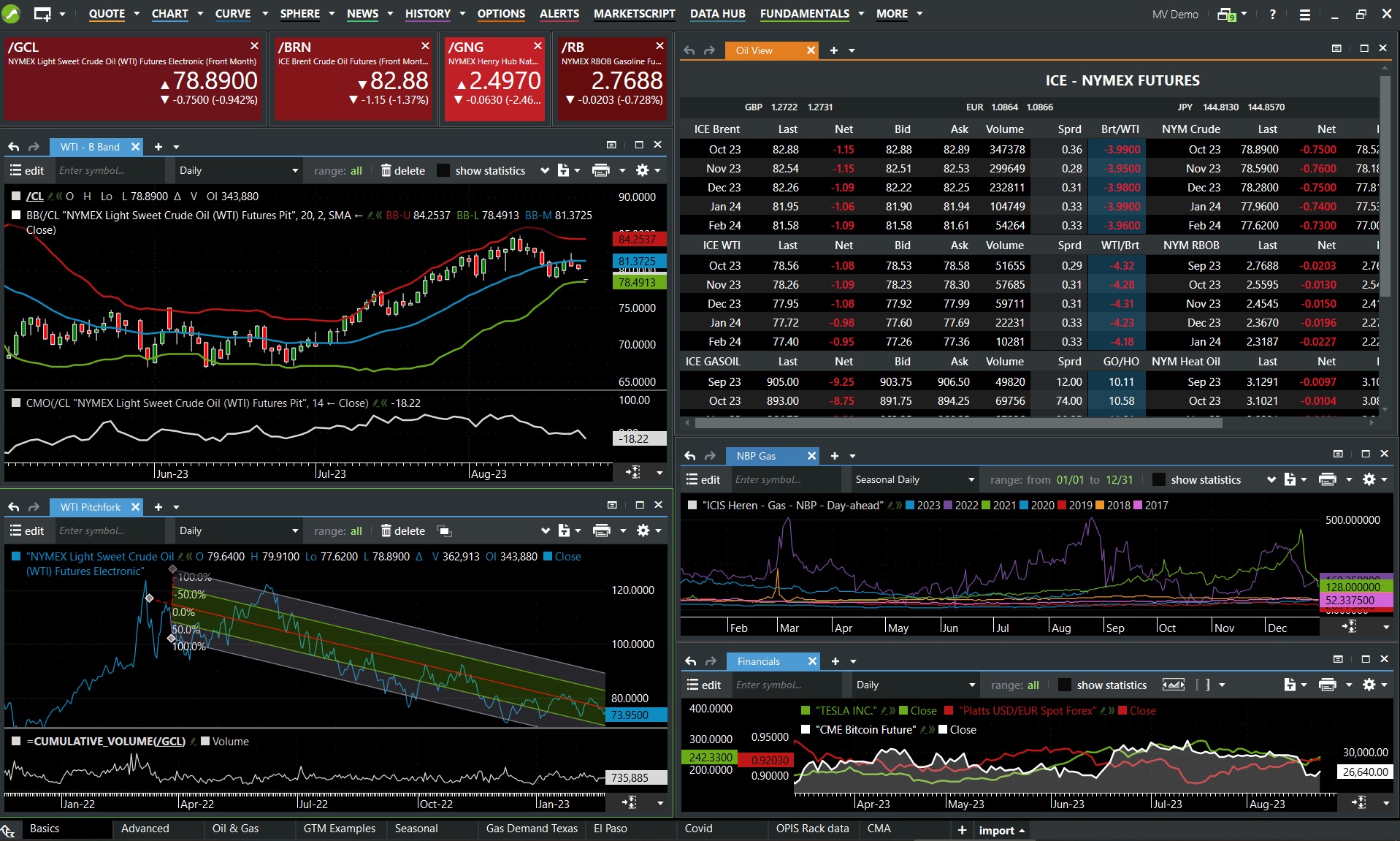

What tools and platforms are best for day trading arbitrage?

For day trading arbitrage, the best tools and platforms include:

1. TradingView: Great for real-time charts and analysis.

2. Interactive Brokers: Offers low commissions and advanced trading tools.

3. CoinMarketCap: Useful for crypto arbitrage opportunities.

4. Cryptohopper: Automates trading strategies across exchanges.

5. QuantConnect: For algorithmic trading and backtesting strategies.

6. MetaTrader 4/5: Popular for Forex and stock arbitrage.

7. Arbitrage.tools: Specifically designed for finding arbitrage opportunities in various markets.

Using these tools, traders can identify price discrepancies and execute trades quickly to capitalize on small profit margins.

How do traders identify arbitrage opportunities in real time?

Traders identify arbitrage opportunities in real time by using advanced tools and strategies. For instance, they monitor multiple exchanges for price discrepancies on the same asset. A trader may notice Bitcoin priced at $40,000 on Exchange A and $40,500 on Exchange B. They would buy on Exchange A and sell on Exchange B, pocketing the $500 difference.

Furthermore, traders employ algorithms that scan markets for rapid price changes. They also use news feeds to react quickly to events that cause price shifts. For example, if a stock suddenly drops due to a negative earnings report, a trader could buy low and sell once the market corrects itself.

Additionally, many traders leverage high-frequency trading platforms that execute orders in milliseconds to capitalize on fleeting opportunities. By maintaining a keen awareness of market conditions and having the right technology, traders can efficiently spot and act on arbitrage opportunities.

What are the most common assets used in day trading arbitrage?

The most common assets used in day trading arbitrage include stocks, ETFs, futures contracts, and cryptocurrencies. Traders often exploit price differences between exchanges or related assets. For example, if a stock trades at different prices on two exchanges, a trader buys low on one and sells high on the other for quick profit. Cryptocurrencies like Bitcoin or Ethereum are popular due to their volatility and multiple trading platforms. Futures contracts can also provide arbitrage opportunities based on price discrepancies between spot and future prices.

How do transaction costs impact day trading arbitrage profits?

Transaction costs significantly reduce day trading arbitrage profits by eating into the margins of potential gains. For example, if an arbitrage opportunity offers a profit of $0.50 per share, but transaction costs (like commissions and spreads) total $0.30 per share, the net profit shrinks to just $0.20. High-frequency trading strategies often rely on executing numerous trades quickly, where even minimal costs can accumulate, making profitable opportunities less viable. Thus, effective day traders must factor in these costs to ensure their strategies remain profitable.

What role does technology play in day trading arbitrage?

Technology is crucial in day trading arbitrage, as it enables traders to execute rapid transactions, analyze vast data sets, and identify price discrepancies across markets. For example, high-frequency trading algorithms can instantly spot differences in stock prices between exchanges, allowing traders to buy low and sell high within milliseconds.

Platforms like Bloomberg Terminal provide real-time market data, helping traders make informed decisions. Additionally, automated trading systems can handle multiple trades simultaneously, maximizing profit opportunities. In essence, technology streamlines the arbitrage process, making it faster and more efficient.

Learn about What Role Does Compliance Play in Day Trading Platform Certification?

How can beginners start with day trading arbitrage?

Beginners can start day trading arbitrage by following these steps:

1. Choose a Market: Focus on stocks, cryptocurrencies, or forex where price discrepancies occur.

2. Research Tools: Use trading platforms with real-time data and analysis tools to track price differences.

3. Identify Opportunities: Monitor multiple exchanges for the same asset. For example, if Bitcoin is cheaper on Exchange A than on Exchange B, buy low and sell high.

4. Set Up Alerts: Use price alerts to notify you of arbitrage opportunities as they arise.

5. Practice with a Demo Account: Use a demo account to simulate trades without risking real money.

6. Start Small: Begin with a small investment to minimize risk while learning the process.

7. Analyze Trades: After each trade, review what worked and what didn’t to improve your strategy.

Real-life example: If Ethereum is priced at $3,000 on one exchange and $3,050 on another, you can buy it on the first exchange and sell it on the second, pocketing the $50 difference minus fees.

Learn about How to Start Day Trading for Beginners

What are the legal considerations for day trading arbitrage?

Legal considerations for day trading arbitrage include adherence to securities regulations, understanding market manipulation laws, and ensuring compliance with reporting requirements. For instance, day traders must avoid practices like insider trading, which can lead to severe penalties.

Real-life examples highlight these points: a trader exploiting price differences between exchanges must ensure their trades don't constitute market manipulation. Additionally, they need to be aware of the implications of high-frequency trading rules set by regulatory bodies. Always consult legal experts to navigate these complexities properly.

Learn about What legal considerations are there for automated day trading systems?

How do successful day traders manage their portfolios for arbitrage?

Successful day traders manage their portfolios for arbitrage by closely monitoring price discrepancies across different markets or exchanges. For example, if a stock is priced lower on one exchange than another, a trader will buy it on the cheaper platform and sell it on the more expensive one, capitalizing on the price difference.

Traders use real-time data analysis tools to identify these opportunities quickly. They often employ algorithms to automate trades and execute them within seconds, minimizing risk and maximizing profit.

A real-life example is when a trader notices that Company XYZ shares are priced at $50 on Exchange A and $52 on Exchange B. They purchase 100 shares on Exchange A, sell them on Exchange B, and secure a profit of $200 after accounting for transaction fees.

Additionally, successful traders maintain a well-diversified portfolio, managing risk by not placing all bets on a single arbitrage opportunity. They also set strict stop-loss orders to limit potential losses and ensure they can exit trades quickly if the market moves against them.

Learn about How Do Institutional Traders Manage Risk During Day Trading?

What mistakes should be avoided in day trading arbitrage?

Avoid these mistakes in day trading arbitrage:

1. Neglecting Fees: High transaction costs can erode profits. Always factor in commissions and spreads.

2. Ignoring Market Conditions: Volatile markets can disrupt arbitrage opportunities. Stay informed about news and events.

3. Overleveraging: Using too much leverage increases risk. Stick to a manageable level to preserve capital.

4. Lack of Research: Failing to analyze the assets involved can lead to poor decisions. Conduct thorough research before executing trades.

5. Emotional Trading: Letting emotions dictate actions can result in impulsive decisions. Stick to your strategy and remain disciplined.

6. Poor Timing: Delaying execution can lead to missed opportunities. Use fast and reliable trading platforms.

7. Not Diversifying: Relying on a single arbitrage opportunity can be risky. Spread your trades across different assets to mitigate risk.

8. Ignoring Execution Speed: Slow execution can turn a profitable arbitrage into a loss. Ensure your trading setup is optimized for speed.

Real-life example: A trader spotted a price difference in a stock between two exchanges. They calculated potential profits but didn’t account for transaction fees, which ended up wiping out their gains. Always calculate costs before trading.

How can one measure the effectiveness of day trading arbitrage strategies?

To measure the effectiveness of day trading arbitrage strategies, analyze the following:

1. Profitability: Calculate total profits versus losses over a specific period. Look for consistent gains.

2. Win Rate: Determine the percentage of successful trades compared to total trades. A higher win rate indicates better effectiveness.

3. Risk-Adjusted Returns: Use metrics like Sharpe ratio to assess returns relative to risk taken.

4. Execution Speed: Measure the time taken to execute trades. Faster execution can enhance profitability.

5. Market Impact: Evaluate how trades affect market prices. Minimal impact suggests a more effective strategy.

6. Transaction Costs: Factor in commissions and fees. Effective strategies should generate profits after costs.

7. Backtesting Results: Use historical data to simulate past performance. This can reveal potential effectiveness.

Example: A trader using an arbitrage strategy between two exchanges finds that, over three months, they have a 70% win rate and a 3:1 profit-to-loss ratio, indicating a potentially effective strategy.

Learn about How Do Prop Firms Affect Day Trading Strategies?

What are the psychological factors influencing day trading arbitrage?

Psychological factors influencing day trading arbitrage include risk tolerance, emotional control, and cognitive biases. Traders with high risk tolerance may chase volatile opportunities, while those with lower tolerance might hesitate, missing potential profits. Emotional control is crucial; fear can lead to impulsive decisions, while overconfidence might result in underestimating risks. Cognitive biases, like confirmation bias, can skew a trader's analysis, causing them to favor information that supports their existing beliefs. For example, a trader might ignore negative news about a stock they’ve invested in, leading to poor decision-making. Successful arbitrageurs often cultivate a disciplined mindset to navigate these psychological challenges effectively.

Conclusion about Real-Life Examples of Day Trading Arbitrage

In summary, day trading arbitrage presents significant profit potential through strategic execution and market analysis. Understanding key strategies, recognizing risks, and leveraging technology are essential for success. Additionally, awareness of transaction costs and market conditions can enhance profitability. For those looking to navigate this complex landscape, resources and insights from DayTradingBusiness can provide valuable guidance in honing your skills and making informed decisions.

Learn about Real-Life Examples of Successful Day Trading Backtesting

Sources:

- Wish or reality? On the exploitability of triangular arbitrage in ...

- On the role of arbitrageurs in rational markets - ScienceDirect

- Canada Eh? The Curious Case of Arbitrage Opportunities in the ...

- Fundamentals of Perpetual FuturesWe are grateful to Lin William ...

- Service stacking using energy storage systems for grid applications ...