Did you know that high-frequency trading (HFT) can execute thousands of trades in the time it takes you to sip your coffee? In this article, we dive into the intriguing world of HFT versus traditional day trading, unpacking their core differences, advantages, and risks. We’ll explore what each trading style entails, the technology required for HFT, and how transaction costs and market conditions play significant roles. Additionally, we’ll touch on the skills needed for success in day trading and whether retail traders can compete with their high-frequency counterparts. With insights from DayTradingBusiness, this guide equips you with the knowledge to navigate both trading landscapes effectively.

What is High-Frequency Trading (HFT)?

High-Frequency Trading (HFT) is a type of algorithmic trading that involves executing a large number of orders at extremely high speeds. Unlike traditional day trading, which relies on manual decision-making and longer time frames, HFT utilizes sophisticated algorithms and technology to capitalize on small price discrepancies in the market within milliseconds. HFT firms often hold positions for very short durations, from seconds to minutes, while traditional day traders may hold positions for hours. HFT typically requires significant capital and advanced infrastructure, making it distinct from traditional day trading strategies.

How Does Traditional Day Trading Work?

Traditional day trading involves buying and selling financial instruments, like stocks, within the same trading day. Traders aim to profit from small price movements by executing multiple trades based on technical analysis and market trends. Unlike high-frequency trading (HFT), which relies on algorithms and speed to capitalize on minute price changes, traditional day traders make decisions based on broader analysis, charts, and patterns. They typically hold positions for a few minutes to several hours, focusing on liquidity and volatility.

What Are the Key Differences Between HFT and Day Trading?

High-frequency trading (HFT) relies on algorithms and executes thousands of orders in milliseconds, focusing on small price discrepancies. Day trading, on the other hand, involves human traders making fewer trades throughout the day, holding positions for minutes to hours based on market trends. HFT requires significant capital and advanced technology, while day trading can be done with less investment and simpler tools. HFT profits from speed and volume, whereas day traders aim for larger price movements.

What Are the Advantages of High-Frequency Trading?

High-frequency trading (HFT) offers several advantages over traditional day trading:

1. Speed: HFT executes trades in milliseconds, allowing traders to capitalize on small price movements.

2. Increased Liquidity: HFT firms add liquidity to the market, making it easier for traders to enter and exit positions.

3. Lower Transaction Costs: High-frequency traders often benefit from reduced commission rates due to the volume of trades.

4. Advanced Algorithms: HFT utilizes sophisticated algorithms to analyze market data and identify profitable opportunities quickly.

5. Market Efficiency: HFT helps to correct price discrepancies, contributing to overall market efficiency.

In contrast, traditional day trading relies on slower, manual decision-making and typically involves less frequent trades.

What Are the Risks Associated with Traditional Day Trading?

Traditional day trading carries several risks, including market volatility, emotional decision-making, and high transaction costs. Traders face potential losses from rapid price fluctuations and may make impulsive trades based on fear or greed. Additionally, the need for constant monitoring can lead to burnout. Unlike high-frequency trading (HFT), which relies on algorithms for speed and precision, traditional day trading depends heavily on individual judgment, increasing the risk of human error. Overall, the combination of these factors can lead to significant financial losses.

How Do HFT Strategies Differ from Day Trading Strategies?

High-frequency trading (HFT) strategies rely on advanced algorithms to execute thousands of trades within seconds, aiming to profit from small price discrepancies. In contrast, day trading strategies involve human traders making fewer trades throughout the day based on market analysis, trends, and news. HFT focuses on speed and volume, while day trading prioritizes timing and market conditions. HFT typically requires significant capital and infrastructure, whereas day trading can be done with less investment and simpler tools.

What Technology Is Required for High-Frequency Trading?

High-frequency trading (HFT) requires advanced technology like low-latency trading platforms, powerful algorithms, and direct market access. Traders need high-speed internet connections, co-location services to place servers near exchanges, and sophisticated data analysis tools. In contrast, traditional day trading relies less on speed and more on manual analysis and decision-making.

Can Retail Traders Compete with High-Frequency Traders?

Retail traders can compete with high-frequency traders (HFT) to some extent, but they face significant challenges. HFT firms leverage advanced algorithms and high-speed technology to execute trades in milliseconds, giving them an edge in market efficiency and liquidity. Retail traders typically don't have access to the same resources or data, which limits their ability to compete on speed.

However, retail traders can succeed by focusing on different strategies. They can take advantage of longer-term trends, conduct thorough research, and utilize risk management techniques that HFT often overlooks. By being patient and strategic, retail traders can find opportunities that HFT might miss. Ultimately, while direct competition is tough, retail traders can carve out a niche by leveraging their unique strengths.

What Market Conditions Favor HFT Over Day Trading?

Market conditions that favor high-frequency trading (HFT) over traditional day trading include high volatility, increased market liquidity, and narrow bid-ask spreads. HFT thrives in fast-moving markets where price discrepancies are frequent, allowing for quick trades to capitalize on small price movements. Additionally, low transaction costs and favorable regulatory environments enhance HFT's profitability. In contrast, day trading typically benefits from more stable conditions where traders can analyze trends over longer periods.

How Do Transaction Costs Impact HFT vs. Day Trading?

Transaction costs significantly impact HFT and day trading strategies. In high-frequency trading (HFT), minimal transaction costs are crucial since trades are executed in milliseconds and profits per trade are small. HFT firms leverage technology to reduce these costs, often utilizing algorithms to optimize trades.

In contrast, day traders face higher transaction costs relative to their profit margins. Frequent buying and selling can erode gains, making it essential for day traders to factor these costs into their strategies. Effective risk management and selecting low-cost brokers are vital for day traders to maintain profitability amidst transaction costs.

Learn about How Do SEC Rules Impact Day Trading?

What Regulatory Challenges Do HFT Firms Face?

High-frequency trading (HFT) firms face several regulatory challenges, including compliance with market manipulation regulations, reporting requirements, and risk management mandates. They must navigate complex rules from entities like the SEC and FINRA, which scrutinize trading practices for potential abuses like spoofing. HFT firms also deal with data privacy regulations and the need for robust cybersecurity measures. Additionally, changes in market structure, such as the introduction of new trading venues or order types, require constant adaptation to stay compliant.

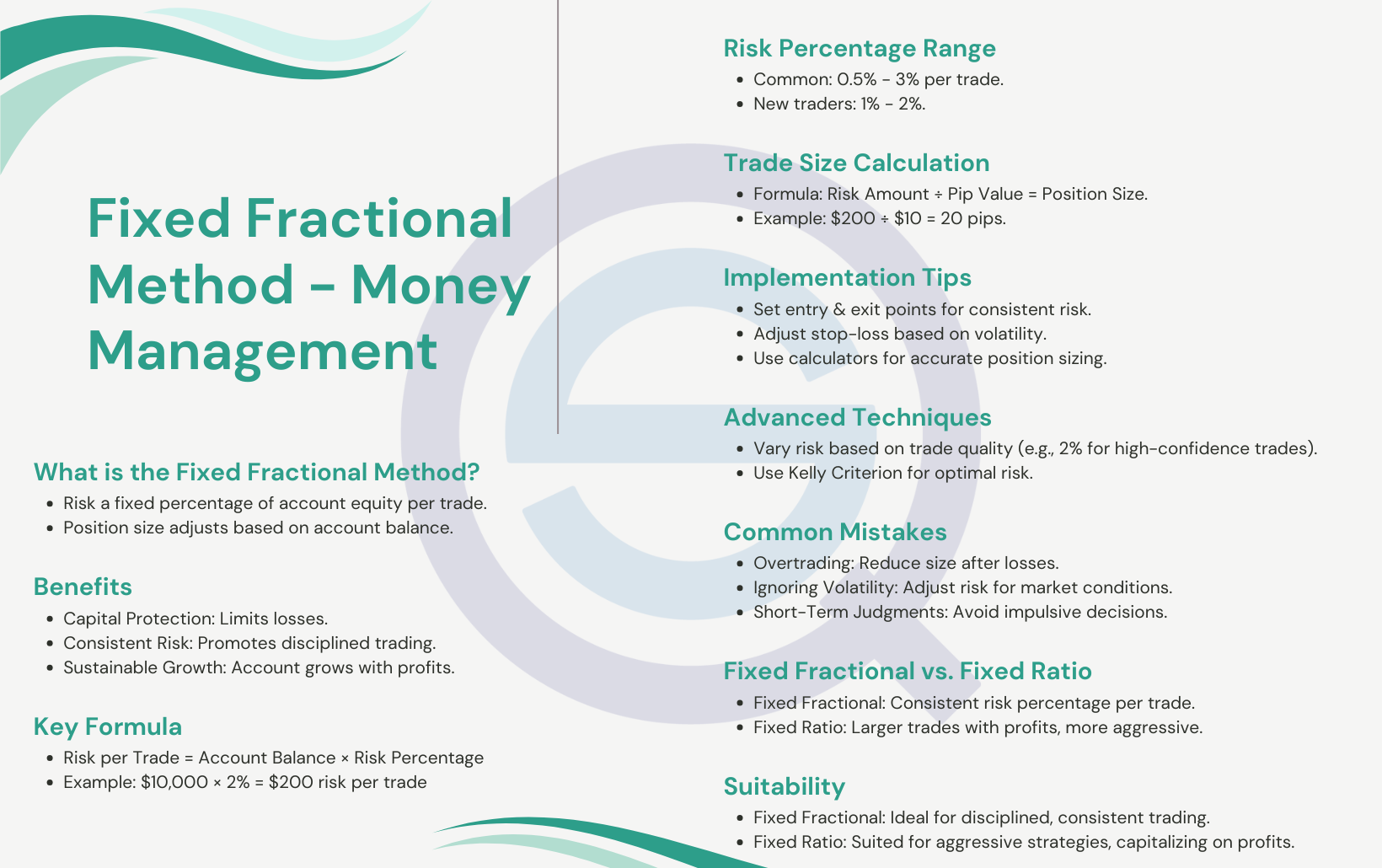

How Do Traders Manage Risk in Day Trading?

Traders manage risk in day trading by using strategies like setting stop-loss orders, limiting position sizes, and diversifying trades. High-frequency trading (HFT) relies on algorithms and speed to capitalize on small price movements, minimizing exposure time. Traditional day trading focuses more on analysis and market trends, often involving manual execution. Both approaches emphasize risk management but differ in execution speed and strategy complexity.

Learn about How Do Institutional Traders Manage Risk During Day Trading?

What Is the Role of Algorithms in HFT?

Algorithms in high-frequency trading (HFT) automate buy and sell decisions at lightning speed, enabling traders to capitalize on minute price fluctuations. Unlike traditional day trading, which relies on human intuition and analysis, HFT algorithms execute thousands of trades per second based on pre-set criteria. They analyze vast amounts of market data in real-time, identify patterns, and optimize trade execution, leading to increased efficiency and reduced latency. This technological edge allows HFT firms to profit from arbitrage opportunities that traditional traders might miss.

How Do Trading Hours Affect HFT and Day Trading?

Trading hours significantly impact both high-frequency trading (HFT) and traditional day trading. HFT relies on milliseconds, thriving during peak trading hours when market liquidity is highest, allowing algorithms to execute numerous trades quickly. In contrast, traditional day trading benefits from volatility, often focusing on specific hours when price movements are more pronounced, typically at market open and close. Thus, while HFT capitalizes on speed and volume during active trading sessions, day traders seek optimal conditions for price swings within regular trading hours.

Learn about How Does Insider Trading Affect Day Traders?

What Skills Are Needed for Success in Day Trading?

Successful day trading, whether high-frequency trading (HFT) or traditional, requires strong analytical skills, quick decision-making, and risk management. HFT demands advanced programming knowledge and algorithmic strategy development, while traditional day trading relies more on technical analysis and market trends. Both require emotional discipline, the ability to stay focused under pressure, and a solid understanding of trading platforms and tools. Additionally, staying updated on market news and economic indicators is crucial for both approaches.

How Can Beginners Start with Traditional Day Trading?

Beginners can start with traditional day trading by first educating themselves on the basics of stock market mechanics, chart patterns, and trading strategies. Open a trading account with a reputable brokerage that offers a user-friendly platform. Start with a practice account to familiarize yourself with trading without risking real money.

Focus on developing a solid trading plan that includes risk management strategies, like setting stop-loss orders. Begin with a small amount of capital to minimize risk and gradually increase your investment as you gain experience.

Stay disciplined, stick to your trading strategy, and continuously review your trades to learn from mistakes. Unlike high-frequency trading (HFT), which relies on algorithms and rapid execution, traditional day trading involves making informed decisions based on market trends and price movements throughout the day.

Learn about How to Start Day Trading for Beginners

Conclusion about HFT vs. Traditional Day Trading: What’s the Difference?

In summary, High-Frequency Trading (HFT) and traditional day trading each present unique advantages and challenges. While HFT relies on speed and sophisticated algorithms, traditional day trading focuses on strategic decision-making and market analysis. Understanding these differences can help traders choose the approach that best aligns with their goals and resources. For those looking to delve deeper into trading strategies, DayTradingBusiness offers invaluable insights and support to enhance your trading journey.

Learn about Day Trading Backtesting vs. Forward Testing: What’s the Difference?