Did you know that even the best day traders can sometimes resemble a squirrel trying to cross the road—frantically dodging traffic without a clear plan? In the fast-paced world of day trading, backtesting your algorithms is crucial for developing effective strategies. This article breaks down the essentials of backtesting, covering what it is, why it's important, and how to select the right data. You'll discover the tools needed for a successful backtesting environment, common pitfalls to avoid, and key metrics to focus on. Learn how to interpret your results and implement risk management while understanding the limitations of backtesting. Additionally, we'll explore walk-forward testing and best practices to enhance your trading strategies. With insights from DayTradingBusiness, you’ll be equipped to refine your algorithmic approaches effectively.

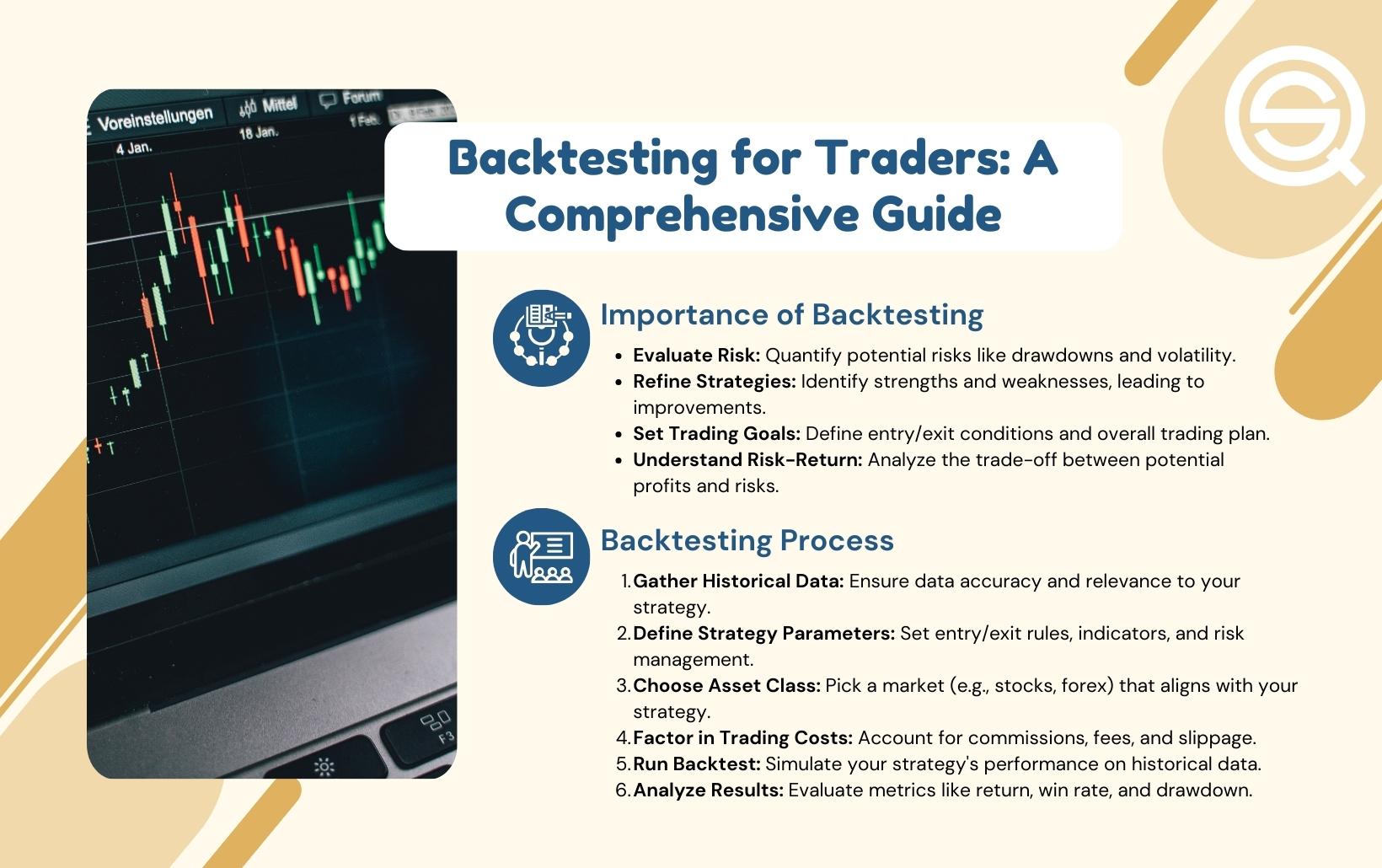

What is backtesting in day trading algorithms?

Backtesting in day trading algorithms is the process of testing a trading strategy using historical market data to evaluate its performance. It involves simulating trades based on past price movements to see how the algorithm would have performed. You analyze metrics like profit, loss, win rate, and drawdown. Effective backtesting helps refine strategies before risking real capital. Use software or platforms that allow for easy data input and analysis to streamline the process.

Why is backtesting important for day trading?

Backtesting is crucial for day trading because it helps validate your trading algorithms using historical data. This process allows you to assess the effectiveness of your strategy, identify potential weaknesses, and refine your approach before risking real capital. By analyzing past performance, you can gain insights into how your algorithm responds to different market conditions, improving your chances of success in live trading. Ultimately, backtesting builds confidence in your strategies and enhances decision-making.

How do you choose the right data for backtesting?

Choose the right data for backtesting by selecting high-quality historical price data that matches your trading strategy. Look for data that includes tick-level or minute-level granularity for precision. Ensure it covers various market conditions to test robustness. Use data from reliable sources to avoid inaccuracies. Additionally, consider the time frame that aligns with your strategy; shorter time frames for day trading, longer for swing trading. Finally, validate the data by checking for gaps or anomalies before starting your backtest.

What tools can I use to backtest my trading algorithms?

You can use several tools to backtest your trading algorithms:

1. MetaTrader 4/5: Popular for forex trading, it offers built-in backtesting features.

2. TradingView: Allows you to test strategies with its Pine Script and built-in historical data.

3. QuantConnect: A cloud-based platform that supports multiple asset classes and provides extensive data.

4. Python with Backtrader or Zipline: Great for custom backtesting; you can code your own strategies.

5. Amibroker: Features powerful backtesting capabilities and a user-friendly interface.

6. NinjaTrader: Offers advanced backtesting tools with a focus on futures and forex.

7. Thinkorswim: Includes a paper trading feature to test strategies in a simulated environment.

Choose the tool that best fits your trading style and technical skills.

How do I set up a backtesting environment?

To set up a backtesting environment for day trading algorithms, follow these steps:

1. Choose a Programming Language: Select a language like Python or R for script development.

2. Select a Backtesting Framework: Use libraries like Backtrader, Zipline, or QuantConnect to facilitate the backtesting process.

3. Gather Historical Data: Obtain high-quality historical price data, including open, high, low, close, and volume (OHLCV). Sources include Yahoo Finance, Alpha Vantage, or dedicated data providers.

4. Develop Your Trading Strategy: Code your day trading algorithm, including entry and exit signals based on technical indicators or patterns.

5. Implement the Backtest: Load your historical data into the framework, run the algorithm against this data, and track performance metrics like profit, drawdown, and win rate.

6. Analyze Results: Review the output, focusing on key metrics. Adjust your strategy based on findings to improve performance.

7. Iterate: Refine your algorithm and repeat the backtesting process to ensure robustness.

Following these steps will help you create an effective backtesting environment for your day trading algorithms.

What are the common mistakes in backtesting?

Common mistakes in backtesting day trading algorithms include:

1. Overfitting: Tailoring the strategy too closely to historical data, which reduces its effectiveness in real markets.

2. Ignoring Transaction Costs: Not accounting for slippage and commissions can skew results.

3. Data Snooping: Using the same data to develop and test the strategy, leading to biased outcomes.

4. Inadequate Sample Size: Testing on too few trades can result in unreliable performance metrics.

5. Neglecting Market Conditions: Failing to consider different market environments can misrepresent a strategy’s robustness.

6. Static Parameters: Keeping parameters fixed without testing their adaptability to changing conditions.

7. Emotional Bias: Allowing personal beliefs to influence the backtesting process instead of relying solely on data.

Avoiding these pitfalls can lead to more reliable and practical trading strategies.

How can I interpret backtesting results effectively?

To interpret backtesting results effectively, focus on key metrics like net profit, drawdown, win rate, and risk-reward ratio. Analyze how the algorithm performs across different market conditions. Look for consistency in results over various timeframes to ensure reliability. Assess the maximum drawdown to understand potential risks. Compare performance against a benchmark to gauge effectiveness. Finally, consider the impact of slippage and commissions on real-world trading outcomes.

What metrics should I focus on during backtesting?

Focus on these key metrics during backtesting your day trading algorithms:

1. Profit Factor: The ratio of gross profit to gross loss. Aim for a profit factor above 1.5.

2. Maximum Drawdown: The largest drop from a peak to a trough. Keep it under 20% for manageable risk.

3. Win Rate: The percentage of profitable trades. A win rate of 50% or higher is generally good.

4. Risk-Reward Ratio: The average profit per trade divided by the average loss. Target a ratio of at least 2:1.

5. Sharpe Ratio: Measures risk-adjusted return. Aim for a Sharpe ratio above 1.0.

6. Trade Duration: Average time each trade is held. Monitor for alignment with your day trading strategy.

7. Consistency: Look for steady performance across different market conditions.

These metrics provide a comprehensive view of your algorithm's effectiveness.

How do I avoid overfitting in my backtests?

To avoid overfitting in your backtests, follow these strategies:

1. Use a Robust Dataset: Ensure your historical data is extensive and covers various market conditions.

2. Split Your Data: Divide your dataset into training and testing sets. Train your algorithm on one part and validate it on another.

3. Limit Complexity: Keep your trading algorithms simple. Avoid excessive parameters that can lead to overfitting.

4. Cross-Validation: Implement cross-validation techniques to assess your model's performance across different subsets of data.

5. Out-of-Sample Testing: Test your algorithm on unseen data to gauge its real-world performance.

6. Regularization Techniques: Apply regularization methods to penalize overly complex models.

7. Avoid Data Snooping: Don't adjust your strategy based on past performance. Stick to predefined rules.

8. Use Walk-Forward Analysis: Continuously test and optimize your model over time to adapt to changing market conditions.

Implementing these steps will help ensure your backtests are reliable and your trading strategies remain effective.

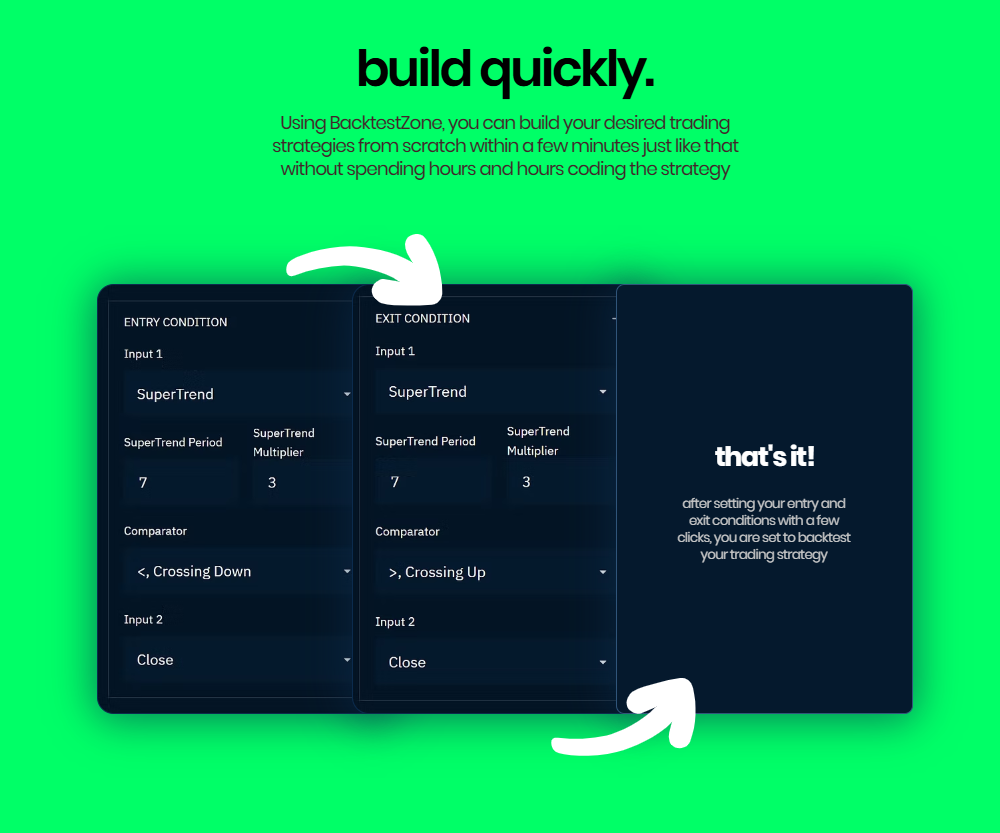

Can I backtest my trading strategy without coding?

Yes, you can backtest your trading strategy without coding. Use platforms like TradingView or MetaTrader that offer built-in backtesting tools. You can manually input your strategy parameters and run tests using historical data. Additionally, some apps allow for drag-and-drop strategy creation, making it easy to visualize and analyze performance without any programming skills.

How often should I update my backtesting data?

You should update your backtesting data regularly—ideally every month or whenever significant market changes occur. This ensures your day trading algorithms reflect current market conditions and remain effective. Regular updates help identify shifts in trends, volatility, and other factors that could impact performance.

What are the limitations of backtesting day trading strategies?

Backtesting day trading strategies has several limitations:

1. Historical Data Quality: Poor-quality or incomplete historical data can lead to inaccurate results.

2. Market Conditions: Strategies may perform well in past markets but fail in different conditions, like volatility changes.

3. Overfitting: Optimizing a strategy too much on historical data can create a model that doesn't perform well in real-time.

4. Slippage and Execution: Backtesting often ignores slippage and execution delays, leading to unrealistic profit expectations.

5. Psychological Factors: Backtesting doesn’t account for emotional reactions during live trading, which can impact decision-making.

6. Transaction Costs: Failing to include realistic transaction costs can skew results, making strategies seem more profitable than they are.

7. Regime Changes: Changes in regulations, market structure, or economic conditions can render previously effective strategies obsolete.

Learn about Understanding the Limitations of Day Trading Backtesting

How do I implement risk management in backtests?

To implement risk management in backtests for day trading algorithms, follow these steps:

1. Set a Risk Percentage: Determine a fixed percentage of your capital to risk on each trade, typically between 1-3%.

2. Define Stop-Loss Orders: Use stop-loss orders to limit potential losses on each trade. Set them based on volatility, support levels, or a fixed percentage.

3. Position Sizing: Calculate the position size for each trade based on your risk percentage and the distance to your stop-loss. Use the formula: Position Size = (Account Risk Amount) / (Trade Risk).

4. Diversification: Avoid over-concentration by diversifying across different assets or strategies in your backtests.

5. Maximum Drawdown Limits: Set a maximum drawdown limit to stop trading if losses exceed a certain threshold, protecting your capital.

6. Simulate Realistic Conditions: Include slippage and transaction costs in your backtests to see how they affect your risk management strategy.

7. Analyze Risk-Reward Ratios: Ensure your trades have favorable risk-reward ratios, ideally 1:2 or better.

8. Review and Adjust: Regularly analyze backtest results to refine your risk management techniques based on performance metrics.

By incorporating these elements, you can effectively manage risk in your day trading algorithm backtests.

Learn about How to Implement Risk Management in Day Trading Algorithms

What is walk-forward testing, and how does it differ from backtesting?

Walk-forward testing involves evaluating a trading algorithm by repeatedly using a set period of historical data to optimize parameters, then testing it on subsequent data. This method simulates real-time trading conditions, adapting the strategy as new data becomes available.

In contrast, backtesting uses a static dataset to evaluate the algorithm's performance over a fixed historical period without adjusting for future market changes. Walk-forward testing offers a more realistic assessment of a strategy's robustness and adaptability compared to the often overly optimistic results from backtesting.

How can I validate my backtest results?

To validate your backtest results, follow these steps:

1. Use Out-of-Sample Testing: Split your data into a training set and a separate validation set. Test your algorithm on the validation set to see if it performs well.

2. Check for Overfitting: Ensure your model generalizes well by testing it on different time periods or market conditions. Avoid tailoring your strategy too closely to past performance.

3. Analyze Performance Metrics: Look at metrics like Sharpe ratio, maximum drawdown, and win/loss ratio. Consistent performance across these metrics indicates reliability.

4. Run Monte Carlo Simulations: Simulate various random outcomes based on your backtest results to assess how your strategy performs under different conditions.

5. Use Walk-Forward Analysis: Continuously test your strategy on rolling time frames to adapt to changing market conditions while validating performance.

6. Compare to Benchmark: Evaluate your results against a relevant benchmark (like an index) to ensure your strategy adds value.

7. Seek Peer Review: Share your methodology and results with experienced traders or forums to get feedback and insights.

By applying these techniques, you can confidently validate your backtest results and improve your day trading algorithms.

What are the best practices for backtesting day trading algorithms?

1. Define Clear Objectives: Establish your trading goals and criteria for success.

2. Use Historical Data: Gather high-quality, relevant historical data that reflects the market conditions you intend to trade in.

3. Choose the Right Timeframe: Select a timeframe that aligns with your day trading strategy, such as 1-minute or 5-minute charts.

4. Implement Realistic Trading Costs: Include commissions, slippage, and taxes in your calculations to mimic real trading conditions.

5. Avoid Overfitting: Create a model that performs well on historical data but doesn’t rely on specific patterns that won’t repeat.

6. Run Multiple Test Scenarios: Test your algorithm across different market conditions and time periods to assess robustness.

7. Analyze Performance Metrics: Focus on key metrics like win rate, profit factor, and maximum drawdown to evaluate effectiveness.

8. Incorporate Risk Management: Implement stop-loss and risk-reward ratios in your backtesting to ensure realistic risk exposure.

9. Keep a Trading Journal: Document your findings, including successes and failures, to refine your strategy over time.

10. Conduct Walk-Forward Testing: Validate your strategy on unseen data after backtesting to ensure it adapts well to changing market conditions.

Learn about What Are the Best Practices for Maintaining Day Trading Broker Compliance?

Conclusion about How to Backtest Your Day Trading Algorithms

Backtesting is an essential step for any trader looking to refine their strategies and enhance performance. By carefully selecting data, utilizing the right tools, and avoiding common pitfalls, traders can gain valuable insights into their algorithms. Regular updates and effective risk management are key to maintaining relevance in a dynamic market. For comprehensive guidance and resources, DayTradingBusiness is here to support your journey in mastering backtesting and optimizing your trading strategies.

Learn about How to Backtest Day Trading Bots Effectively?