Did you know that the term "arbitrage" comes from the French word meaning "to take advantage of"? In day trading, arbitrage offers a thrilling way to capitalize on price discrepancies across markets. This article explores the ins and outs of day trading arbitrage, detailing its definition, operational mechanics, and various types. Discover essential tools for spotting opportunities, effective strategies to implement, and the risks involved. We also cover how to set up your trading platform, manage trades, and avoid common pitfalls. Plus, learn about the best markets for arbitrage and the technology that can enhance your trading experience. Finally, we'll touch on capital requirements and the tax implications you should be aware of. Dive in with DayTradingBusiness to enhance your trading skills and seize profitable opportunities.

What is Day Trading Arbitrage?

Day trading arbitrage involves exploiting price discrepancies of the same asset across different markets or exchanges within a single trading day. To implement it, follow these steps:

1. Identify Opportunities: Monitor multiple exchanges for price differences in the same asset, such as stocks or cryptocurrencies.

2. Quick Execution: Use trading software or APIs for real-time data and execute trades swiftly to capitalize on the price gap.

3. Low Transaction Costs: Ensure that transaction fees do not eat into your profits by choosing exchanges with low fees.

4. Risk Management: Set stop-loss orders to protect against sudden market movements that could eliminate potential profits.

5. Reinvest Profits: Continuously reinvest gains to take advantage of compounding returns.

Stay disciplined and keep refining your strategy based on market conditions.

How Does Day Trading Arbitrage Work?

Day trading arbitrage involves simultaneously buying and selling an asset across different markets to exploit price discrepancies. To implement it, follow these steps:

1. Identify Opportunities: Monitor various exchanges for the same asset, looking for price differences.

2. Set Up Accounts: Ensure you have accounts on multiple trading platforms to execute trades quickly.

3. Use Technology: Leverage trading software to automate alerts and trades for faster execution.

4. Execute Trades: Buy the asset at a lower price on one exchange while selling it at a higher price on another.

5. Manage Risk: Keep an eye on transaction fees and market fluctuations that could affect profitability.

Focus on speed and precision to capitalize on fleeting opportunities.

What Are the Different Types of Day Trading Arbitrage?

The main types of day trading arbitrage include:

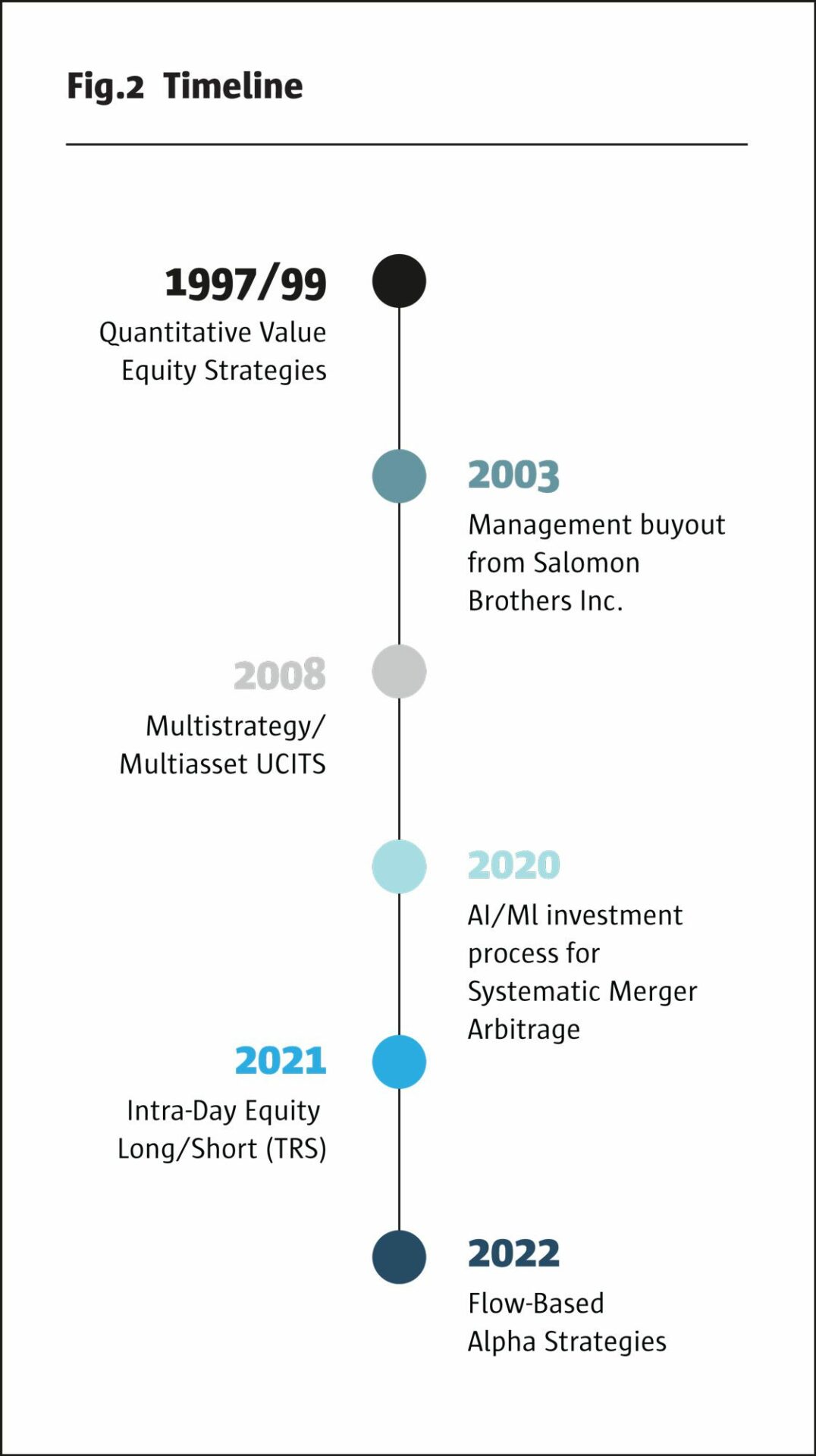

1. Statistical Arbitrage: Exploits price discrepancies between correlated assets based on statistical models.

2. Merger Arbitrage: Involves buying shares of a target company and shorting shares of the acquirer during mergers or acquisitions.

3. Currency Arbitrage: Takes advantage of price differences in currency pairs across different exchanges.

4. Triangular Arbitrage: Involves trading three currencies to exploit discrepancies in exchange rates.

5. Spatial Arbitrage: Capitalizes on price differences of the same asset across different markets or exchanges.

To implement these strategies, identify pricing inefficiencies, execute trades quickly, and manage risks effectively.

What Tools Do I Need for Day Trading Arbitrage?

For day trading arbitrage, you need:

1. Brokerage Account: Choose a reliable broker with low fees and fast execution.

2. Trading Platform: Use software that supports real-time data and charts, like MetaTrader or TradingView.

3. Market Data Feed: Access real-time market data for accurate price tracking.

4. Risk Management Tools: Implement tools for setting stop-loss and take-profit orders.

5. Analytical Tools: Use calculators or spreadsheets to analyze potential arbitrage opportunities.

6. API Access: For automated trading, utilize APIs from exchanges or brokers.

7. News Feed: Stay updated with market news that can impact price movements.

These tools will help you identify and act on arbitrage opportunities effectively.

How Can I Identify Arbitrage Opportunities in Day Trading?

To identify arbitrage opportunities in day trading, follow these steps:

1. Monitor Price Discrepancies: Use real-time trading platforms to track prices across different exchanges. Look for significant variations in the same asset.

2. Set Alerts: Configure alerts for price changes. This helps you act quickly when discrepancies arise.

3. Analyze Correlations: Examine related assets or pairs. Sometimes, shifts in one can indicate an opportunity in another.

4. Utilize Technology: Employ trading bots or software that can analyze multiple markets simultaneously for quicker identification of opportunities.

5. Stay Informed: Follow news and market trends. Events can create short-lived arbitrage opportunities.

6. Practice Risk Management: Ensure you have strategies to minimize losses on trades that don't go as planned.

7. Test Strategies: Use a demo account to refine your approach before committing real capital.

By consistently applying these methods, you can effectively spot and capitalize on arbitrage opportunities in day trading.

What Are the Risks of Day Trading Arbitrage?

The risks of day trading arbitrage include:

1. Market Volatility: Sudden price changes can erode profit margins.

2. Execution Risk: Delays in executing trades can lead to missed opportunities.

3. Liquidity Issues: Insufficient market liquidity can prevent you from entering or exiting positions at desired prices.

4. Transaction Costs: High fees can eat into profits, especially with frequent trades.

5. False Signals: Misjudging price discrepancies can result in losses.

6. Regulatory Risks: Changes in regulations can impact trading strategies and profitability.

7. Technology Failures: System outages or glitches can disrupt trading activities.

Always assess these risks before engaging in day trading arbitrage.

How Do I Set Up My Trading Platform for Arbitrage?

To set up your trading platform for arbitrage, follow these steps:

1. Choose a Reliable Broker: Select a broker that offers low latency, fast execution, and competitive spreads.

2. Connect to Multiple Exchanges: Sign up for accounts on different exchanges to access various price points.

3. Use Trading Software: Install software that supports automated trading. Tools like MetaTrader or custom scripts can help.

4. Set Up Price Alerts: Configure alerts for price discrepancies between exchanges to spot arbitrage opportunities quickly.

5. Establish a Risk Management Strategy: Define your risk tolerance and set stop-loss limits to protect your capital.

6. Test Your Setup: Run paper trades to ensure your system works efficiently without risking real money.

7. Monitor and Adjust: Regularly track your trades and adjust your strategy based on market conditions.

By following these steps, you can effectively set up your trading platform for day trading arbitrage.

What Strategies Are Effective for Day Trading Arbitrage?

To implement day trading arbitrage effectively, follow these strategies:

1. Identify Price Discrepancies: Monitor multiple exchanges for the same asset and look for price differences. Use real-time data feeds for accuracy.

2. Use Trading Bots: Automate your trades with bots that can execute orders at lightning speed when arbitrage opportunities arise.

3. Leverage Low-Latency Connections: Ensure your internet connection is fast and stable to reduce delays in trade execution.

4. Diversify Assets: Trade various assets to increase the number of arbitrage opportunities. Focus on highly liquid markets for easier execution.

5. Monitor Fees: Account for transaction fees and ensure they don’t eat into your profits. Choose exchanges with lower fees.

6. Risk Management: Set strict stop-loss orders to protect your capital from sudden market movements.

7. Stay Informed: Keep up with market news and trends that could affect asset prices and create arbitrage opportunities.

By combining these strategies, you can optimize your day trading arbitrage approach.

How Much Capital Do I Need to Start Day Trading Arbitrage?

To start day trading arbitrage, you typically need at least $1,000 to $10,000. This range allows for sufficient capital to cover trading fees and potential losses. However, having $25,000 can provide a better buffer, especially to meet the Pattern Day Trader rule. Your actual requirement may vary based on the markets you choose and your trading strategy.

What Markets Are Best for Day Trading Arbitrage?

The best markets for day trading arbitrage include stock markets, cryptocurrency exchanges, and forex markets. Look for high liquidity assets with price discrepancies across different platforms. Stocks with significant volume, such as large-cap companies, are ideal. In crypto, focus on popular coins like Bitcoin and Ethereum across various exchanges. For forex, major currency pairs like EUR/USD or GBP/USD often present arbitrage opportunities due to small spreads. Always monitor transaction costs to ensure profitability.

Learn about Best Markets for Day Trading Arbitrage

How Do I Manage My Trades in Day Trading Arbitrage?

To manage your trades in day trading arbitrage, follow these steps:

1. Identify Opportunities: Monitor multiple exchanges for price discrepancies in the same asset. Use trading software or bots to automate this process.

2. Set Up Alerts: Create alerts for significant price changes to act quickly when an arbitrage opportunity arises.

3. Use Limit Orders: Place limit orders to ensure you buy at a specific price, minimizing slippage and maximizing profit.

4. Manage Risk: Implement stop-loss orders to protect against sudden market movements. Only risk a small percentage of your capital on each trade.

5. Monitor Transaction Fees: Factor in fees from exchanges and transfers to ensure your profits remain viable.

6. Analyze Performance: Regularly review your trades to identify successful strategies and areas for improvement.

7. Stay Informed: Keep up with market news and trends that may affect asset prices across different exchanges.

By following these steps, you can effectively manage your trades in day trading arbitrage and maximize your profitability.

Learn about How to Use Charts to Manage Day Trading Risk

What Are Common Mistakes in Day Trading Arbitrage?

Common mistakes in day trading arbitrage include:

1. Ignoring Transaction Costs: Failing to account for fees can erode profits.

2. Overleveraging: Using too much leverage increases risk and can lead to significant losses.

3. Lack of Research: Not thoroughly understanding the assets involved can result in poor decisions.

4. Timing Issues: Misjudging market timing can cause missed opportunities or losses.

5. Emotional Trading: Letting emotions dictate trades can lead to irrational decisions.

6. Inadequate Risk Management: Not setting stop-loss orders can expose you to larger losses.

7. Neglecting Market Conditions: Ignoring market volatility and liquidity can impact the effectiveness of arbitrage strategies.

Learn about Common mistakes that increase stop-loss risk in day trading

How Can I Minimize Costs in Day Trading Arbitrage?

To minimize costs in day trading arbitrage, focus on these strategies:

1. Choose Low-Cost Brokers: Select brokers with low commissions and fees to reduce trade costs.

2. Use Direct Market Access: Opt for platforms that provide direct market access to lower latency and execution costs.

3. Limit Trades: Execute only high-probability trades to avoid unnecessary commissions and fees.

4. Utilize Algorithmic Trading: Implement algorithms that can quickly identify and execute arbitrage opportunities, minimizing manual errors and time.

5. Monitor Spreads: Trade securities with tight bid-ask spreads to decrease the cost of entering and exiting positions.

6. Leverage Tax Efficiency: Be mindful of tax implications and hold positions within tax-advantaged accounts when possible.

7. Optimize Position Sizes: Adjust your position sizes based on transaction costs to maximize profit potential while minimizing losses.

Implementing these strategies can effectively lower your costs in day trading arbitrage.

Learn about How Do Broker Compliance Rules Affect Day Trading Costs and Fees?

What Role Does Technology Play in Day Trading Arbitrage?

Technology is crucial in day trading arbitrage as it enables traders to execute rapid transactions across different markets. High-speed internet and trading platforms allow for real-time data analysis and quick order placements. Algorithmic trading software can identify price discrepancies instantly, optimizing entry and exit points. Tools like APIs facilitate automated trading strategies, reducing the time between identifying an arbitrage opportunity and executing the trade. Additionally, advanced charting software helps in monitoring trends and signals, enhancing decision-making. Overall, leveraging technology maximizes efficiency and profitability in day trading arbitrage.

Learn about What Role Does Compliance Play in Day Trading Platform Certification?

How Do I Track Performance in Day Trading Arbitrage?

To track performance in day trading arbitrage, follow these steps:

1. Set Up a Trading Journal: Record every trade, including entry and exit points, profits, and losses.

2. Use Software Tools: Employ trading platforms that provide analytics and performance metrics, such as profit-loss tracking and win rate.

3. Monitor Key Metrics: Focus on return on investment (ROI), risk-reward ratio, and average holding time for trades.

4. Review Daily: Analyze your trades at the end of each day. Identify patterns in successful and unsuccessful trades.

5. Adjust Strategies: Based on your performance data, tweak your arbitrage strategies for better results.

By regularly tracking and analyzing these elements, you can effectively gauge your performance in day trading arbitrage.

Learn about How Do Brokers Track and Report Day Trading Activity?

What Should I Know About Tax Implications for Day Trading Arbitrage?

When day trading arbitrage, be aware of the following tax implications:

1. Short-Term Capital Gains: Profits from day trading are typically taxed as short-term capital gains, which are taxed at ordinary income rates.

2. Wash Sale Rule: If you sell a security at a loss and repurchase it within 30 days, the loss may be disallowed for tax purposes. This can affect your overall tax liability.

3. Record Keeping: Maintain detailed records of all trades, including dates, amounts, and prices, to accurately report gains and losses.

4. Tax Deductions: You may be able to deduct trading-related expenses, such as software or commissions, which can reduce your taxable income.

5. Investment vs. Trader Status: The IRS distinguishes between traders and investors. If you qualify as a trader, you might be able to use mark-to-market accounting, which could simplify reporting.

6. State Taxes: Consider state tax implications, as some states have different rules regarding capital gains.

Consult a tax professional to ensure compliance and optimize your tax strategy.

Learn about Tax Implications of Day Trading in Different Countries

Conclusion about How to Implement Day Trading Arbitrage

In conclusion, successfully implementing day trading arbitrage requires a clear understanding of its mechanisms, risks, and tools. Identifying opportunities and utilizing effective strategies while managing trades efficiently is crucial. Remember to track your performance and consider the tax implications of your activities. For a deeper dive into mastering day trading arbitrage, DayTradingBusiness offers valuable insights and resources to enhance your trading journey.

Learn about How to Implement Risk Management in Day Trading Algorithms

Sources:

- Statistical arbitrage trading on the intraday market using the ...

- Reserve Balances, the Federal Funds Market and Arbitrage in the ...

- Intraday indirect arbitrage between European index ETFs ...

- Canada Eh? The Curious Case of Arbitrage Opportunities in the ...

- Do ETFs Increase Volatility? Itzhak Ben-David, Francesco Franzoni ...

- Trading and arbitrage in cryptocurrency markets - ScienceDirect