Did you know that some day traders can spot price discrepancies faster than a cheetah chasing its prey? In the fast-paced world of trading, understanding day trading arbitrage strategies is crucial for capitalizing on fleeting market opportunities. This article breaks down the essentials of day trading arbitrage, from defining the concept and its mechanics to exploring various types and key strategies. You’ll discover how to identify arbitrage opportunities, the tools and markets involved, and how to calculate potential profits. We also cover the risks, best practices, and common pitfalls to avoid, ensuring that even beginners can start with confidence. With insights from DayTradingBusiness, you’ll be well-equipped to navigate the exciting landscape of arbitrage trading.

What is Day Trading Arbitrage?

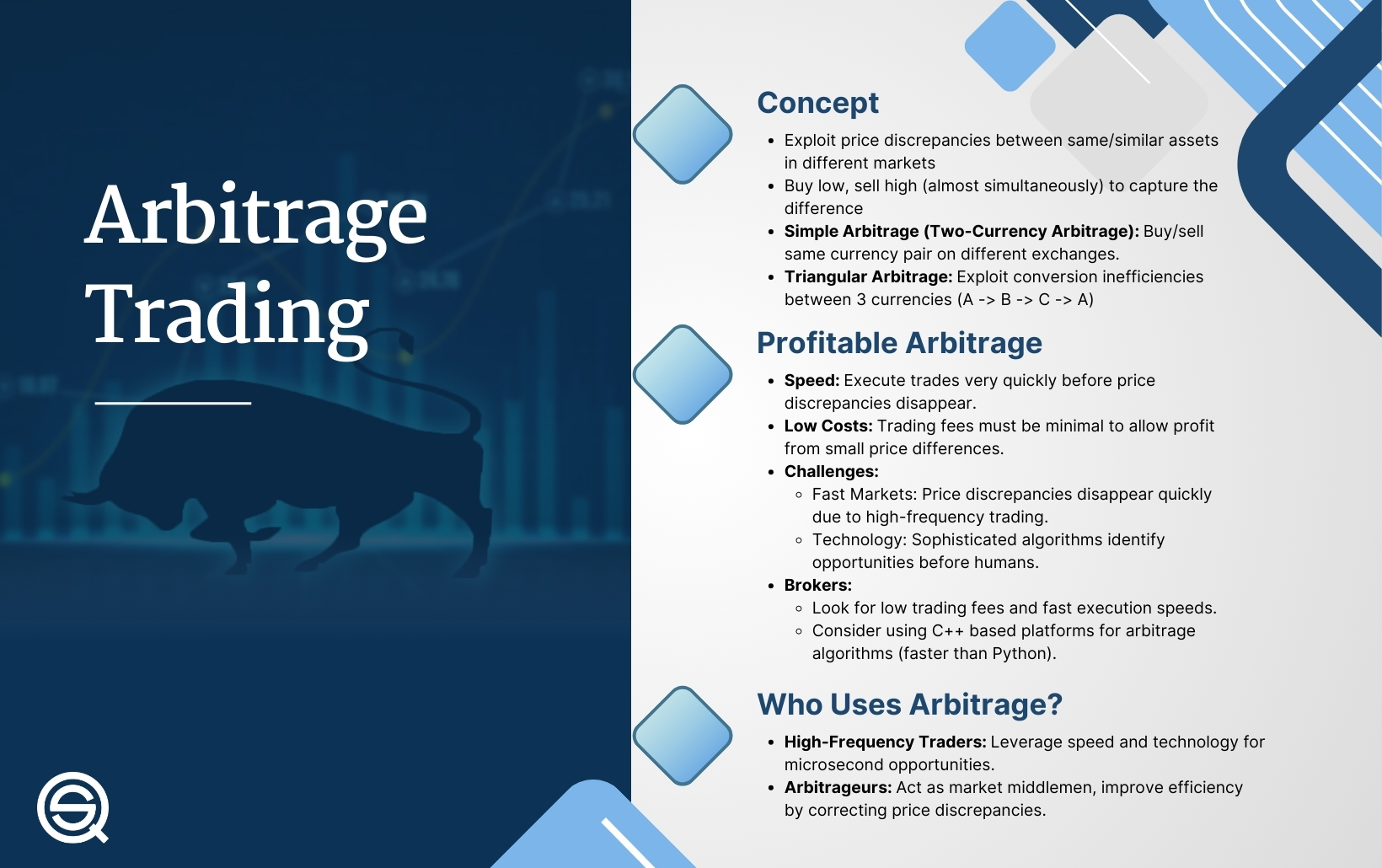

Day trading arbitrage involves exploiting price discrepancies of the same asset across different markets or exchanges. Traders buy low on one platform and sell high on another, capitalizing on the spread. This strategy requires quick execution and often relies on automated trading systems to optimize profits before the price gap closes. Successful arbitrageurs monitor multiple markets and act swiftly to take advantage of fleeting opportunities.

How Does Day Trading Arbitrage Work?

Day trading arbitrage involves exploiting price differences of the same asset across different markets or exchanges. Traders buy low in one market and sell high in another, profiting from the spread.

For example, if a stock is priced at $100 on Exchange A and $102 on Exchange B, a trader can buy on A and sell on B, making a $2 profit per share.

Key strategies include:

1. Statistical Arbitrage: Using mathematical models to identify pricing inefficiencies.

2. Merger Arbitrage: Buying shares of a company being acquired while shorting the acquirer's shares.

3. Triangular Arbitrage: In currency trading, taking advantage of discrepancies in exchange rates between three currencies.

Success in day trading arbitrage requires quick execution and careful monitoring of market conditions to capitalize on fleeting opportunities.

What Are the Types of Arbitrage in Day Trading?

The main types of arbitrage in day trading include:

1. Statistical Arbitrage: Using statistical models to identify mispriced assets based on historical price relationships.

2. Merger Arbitrage: Buying and selling stocks of companies involved in mergers or acquisitions, capitalizing on price discrepancies.

3. Triangular Arbitrage: Exploiting discrepancies in currency exchange rates between three currencies in the foreign exchange market.

4. Retail Arbitrage: Buying discounted products from retail stores to resell at higher prices online.

5. Crypto Arbitrage: Taking advantage of price differences for the same cryptocurrency across different exchanges.

6. Futures Arbitrage: Trading futures contracts against the underlying asset to profit from price differences.

Each type requires quick execution and thorough analysis to be successful.

What Are the Key Strategies for Day Trading Arbitrage?

Key strategies for day trading arbitrage include:

1. Market Analysis: Continuously monitor multiple exchanges for price discrepancies in the same asset.

2. Speed Execution: Use trading algorithms or high-frequency trading platforms to quickly capitalize on price differences.

3. Diversification: Trade various asset pairs to spread risk and increase opportunities.

4. Risk Management: Set strict stop-loss orders to minimize potential losses on trades.

5. Leverage Research: Stay updated on news and events that may affect asset prices to anticipate market movements.

6. Pair Trading: Identify correlated assets and capitalize on temporary divergences in their price relationship.

Implementing these strategies can enhance your chances of success in day trading arbitrage.

How to Identify Arbitrage Opportunities in Day Trading?

To identify arbitrage opportunities in day trading, follow these steps:

1. Monitor Price Discrepancies: Watch for differences in asset prices across various exchanges or markets. Use trading platforms that provide real-time price feeds.

2. Use Arbitrage Software: Leverage tools designed to detect arbitrage opportunities automatically. These can quickly analyze multiple markets and highlight discrepancies.

3. Focus on Liquid Markets: Concentrate on highly liquid assets where price differences are more likely to occur and can be exploited quickly.

4. Set Up Alerts: Create alerts for significant price changes or spreads that exceed your predefined thresholds.

5. Analyze Transaction Costs: Calculate fees and commissions to ensure that potential profits exceed costs.

6. Keep an Eye on News: Market-moving news can create short-lived arbitrage opportunities. Stay updated on economic events and announcements.

7. Practice Speed and Precision: Successful arbitrage relies on executing trades swiftly. Practice your trading skills to minimize execution time.

By following these strategies, you can effectively spot and capitalize on day trading arbitrage opportunities.

What Tools Do Day Traders Use for Arbitrage?

Day traders use several tools for arbitrage, including:

1. Trading Platforms: Software like MetaTrader, ThinkorSwim, or Interactive Brokers that allows quick execution of trades.

2. Market Data Feeds: Real-time data services like Bloomberg or Reuters for up-to-the-minute pricing.

3. Algorithmic Trading Software: Custom scripts or programs to automate trades based on specific conditions.

4. Arbitrage Calculators: Tools that help analyze the potential profit from price differences across markets.

5. News Aggregators: Services like Feedly or StockTwits to stay updated on market-moving news.

6. Risk Management Tools: Software for tracking positions and setting stop-loss orders to minimize losses.

These tools help day traders identify and capitalize on arbitrage opportunities efficiently.

What Markets Can You Use for Day Trading Arbitrage?

You can use several markets for day trading arbitrage, including:

1. Stock Markets: Trade stocks listed on major exchanges like NYSE or NASDAQ, exploiting price differences across brokers.

2. Forex Market: Capitalize on currency pair discrepancies between different forex brokers.

3. Cryptocurrency Exchanges: Take advantage of price variances between different cryptocurrency platforms.

4. Futures Markets: Engage in arbitrage between futures contracts and their underlying assets.

5. Options Markets: Use options pricing discrepancies on the same underlying asset across different exchanges.

Each of these markets offers opportunities for quick gains through arbitrage by identifying and acting on price inefficiencies.

How to Calculate Arbitrage Profit in Day Trading?

To calculate arbitrage profit in day trading, follow these steps:

1. Identify Price Differences: Find two markets where the same asset has different prices. For example, stock A is $100 on Exchange 1 and $102 on Exchange 2.

2. Determine Transaction Costs: Factor in any fees involved in buying and selling on both exchanges. Let’s say the transaction cost is $1 per trade.

3. Calculate Profit: Use the formula:

[

text{Profit} = (text{Selling Price} – text{Buying Price} – text{Total Transaction Costs})

]

For our example:

[

text{Profit} = (102 – 100 – 2) = 0

]

If the profit is zero or negative, there’s no arbitrage opportunity.

4. Execute Trades: If the profit is positive, buy on the cheaper exchange and sell on the more expensive one.

5. Repeat: Continuously monitor the markets for new opportunities to maximize your arbitrage profits.

Adjust your calculations based on real-time data and market conditions to ensure accuracy.

What Risks Are Involved in Day Trading Arbitrage?

Day trading arbitrage involves several risks, including:

1. Market Volatility: Rapid price changes can lead to unexpected losses.

2. Execution Risks: Delays in executing trades can result in missed opportunities or unfavorable prices.

3. Liquidity Issues: Low liquidity can make it hard to enter or exit positions without impacting the price.

4. Transaction Costs: High trading fees can erode profits, especially in high-frequency trading.

5. Regulatory Risks: Changes in regulations can affect trading strategies or lead to penalties.

6. Leverage Risks: Using leverage increases potential losses and can lead to significant financial strain.

Understanding these risks is crucial for effective day trading arbitrage strategies.

How Can Beginners Start with Day Trading Arbitrage?

Beginners can start with day trading arbitrage by following these steps:

1. Educate Yourself: Learn the basics of day trading and arbitrage strategies. Focus on how price discrepancies exist between markets.

2. Choose Markets: Identify which assets you want to trade, such as stocks, cryptocurrencies, or forex.

3. Set Up a Trading Account: Open a brokerage account that offers low fees and fast execution. Ensure it supports the markets you choose.

4. Analyze Price Differences: Use tools or platforms that provide real-time data to spot price differences across exchanges.

5. Develop a Trading Plan: your entry and exit strategies, risk management rules, and profit targets.

6. Start Small: Begin with a small investment to test your strategies without risking significant capital.

7. Monitor Trades: Keep an eye on your trades and be ready to act quickly, as arbitrage opportunities can vanish fast.

8. Review and Adjust: After a few trades, evaluate your performance and adjust your strategies based on what you learn.

By following these steps, beginners can effectively start day trading arbitrage.

Learn about How to Start Day Trading for Beginners

What Are the Best Practices for Successful Arbitrage Trading?

1. Research: Stay informed about market trends and news that affect prices.

2. Speed: Use high-speed internet and trading platforms to execute trades quickly.

3. Automation: Implement trading bots to identify and act on arbitrage opportunities.

4. Diversification: Trade across multiple markets and assets to mitigate risks.

5. Low Fees: Choose brokers with minimal transaction fees to maximize profits.

6. Risk Management: Set stop-loss orders to protect against significant losses.

7. Monitor Liquidity: Ensure there's enough volume in the markets you trade to enter and exit positions smoothly.

8. Analyze Data: Use historical data and analytics to identify patterns and refine strategies.

9. Stay Disciplined: Stick to your trading plan and avoid emotional decisions.

10. Continuous Learning: Keep updating your skills and strategies based on market changes.

How Is Day Trading Arbitrage Different from Regular Day Trading?

Day trading arbitrage involves exploiting price discrepancies between different markets or assets to make quick profits, while regular day trading focuses on buying and selling securities based on market trends and technical analysis. Arbitrage relies on simultaneous transactions to lock in profits with minimal risk, whereas traditional day trading often involves holding positions based on predictions of price movements. In essence, arbitrage is about capitalizing on inefficiencies, while regular day trading is about market timing and strategy.

Learn about What Makes Day Trading Different from Other Trading?

What Role Does Technology Play in Day Trading Arbitrage?

Technology plays a crucial role in day trading arbitrage by enabling faster execution of trades, real-time data analysis, and automated trading strategies. Advanced algorithms identify price discrepancies across markets quickly, allowing traders to capitalize on small profit margins before they disappear. High-speed internet and trading platforms facilitate instant access to multiple exchanges, enhancing the ability to execute arbitrage strategies effectively. Additionally, tools like APIs and trading bots help automate processes, minimizing human error and maximizing efficiency. Overall, technology is essential for successful day trading arbitrage.

Learn about What Role Does Compliance Play in Day Trading Platform Certification?

How to Manage Your Capital for Day Trading Arbitrage?

To manage your capital for day trading arbitrage, follow these steps:

1. Determine Your Capital Allocation: Decide how much of your total capital you’re willing to risk on each trade, typically 1-2%.

2. Use a Trading Plan: your entry and exit points, stop-loss levels, and profit targets for each arbitrage opportunity.

3. Diversify Trades: Spread your capital across multiple arbitrage opportunities to minimize risk.

4. Monitor Market Conditions: Stay updated on volatility and liquidity, as these factors impact your trades.

5. Set Aside a Reserve: Keep a portion of your capital liquid for unexpected opportunities or market changes.

6. Adjust Position Sizes: Scale your position sizes according to your confidence level in each trade.

7. Maintain Discipline: Stick to your strategy and avoid emotional decisions to protect your capital.

Implementing these strategies will help you effectively manage your capital in day trading arbitrage.

Learn about How Do Regulations Impact Day Trading Capital Requirements?

What Are Common Mistakes to Avoid in Arbitrage Trading?

Common mistakes to avoid in arbitrage trading include:

1. Neglecting Transaction Costs: Always factor in fees that can erode profits.

2. Ignoring Market Timing: Failing to act quickly can lead to missed opportunities as price discrepancies close.

3. Overleveraging: Using too much leverage increases risk and can lead to significant losses.

4. Lack of Research: Not understanding the assets involved can result in poor decisions.

5. Inadequate Risk Management: Failing to set stop-loss orders can amplify losses.

6. Emotional Trading: Letting emotions dictate trades can lead to irrational decisions.

7. Focusing on Too Many Markets: Spreading resources too thin can dilute effectiveness.

8. Misunderstanding Correlation: Not recognizing how assets are correlated can lead to incorrect trades.

Avoid these pitfalls to enhance your arbitrage trading success.

How Can You Monitor Market Conditions for Arbitrage Opportunities?

To monitor market conditions for arbitrage opportunities in day trading, use real-time data feeds and trading platforms that offer price alerts. Track price discrepancies between different exchanges or assets using tools like price comparison websites or specialized arbitrage software. Keep an eye on market news, economic indicators, and social media for sudden price shifts. Set up automated trading bots to execute trades quickly when opportunities arise. Regularly analyze historical price data to identify patterns that may indicate future arbitrage chances.

Conclusion about Understanding Day Trading Arbitrage Strategies

In summary, day trading arbitrage offers a unique approach to capitalizing on price discrepancies across various markets. By understanding the mechanics of arbitrage, leveraging the right tools, and applying effective strategies, traders can enhance their profit potential while managing risks. For those starting out, it’s essential to learn from best practices and avoid common pitfalls. With the right resources and guidance, including insights from DayTradingBusiness, you can navigate the complexities of arbitrage trading more effectively.

Learn about Tools for Day Trading Arbitrage Strategies

Sources:

- Strategic arbitrage in segmented markets - ScienceDirect

- Market efficiency assessment under dual pricing rule for the Turkish ...

- Bidding zero? An analysis of solar power plants' price bids in the ...

- Statistical arbitrage trading on the intraday market using the ...

- Statistical arbitrage trading across electricity markets using ...

- Impact of battery technological progress on electricity arbitrage: An ...