Did you know that even professional traders sometimes feel like they’re trying to catch a greased pig when backtesting their strategies? In the world of momentum trading, backtesting is crucial for validating your approach and enhancing your decision-making. This article dives into the essentials of backtesting momentum trading strategies, covering what backtesting entails, its significance, and the best tools to use. We’ll discuss how to select the right strategy, collect historical data, and choose optimal timeframes. Additionally, you’ll learn how to set up your backtest, analyze key metrics, and interpret results effectively. We’ll also highlight common pitfalls, the impact of slippage, and how to optimize your strategy post-backtest. Whether you're using paper trading or adapting to market conditions, DayTradingBusiness provides the insights you need to refine your momentum trading techniques.

What is backtesting in momentum trading?

Backtesting in momentum trading involves testing a trading strategy against historical data to evaluate its effectiveness. You analyze past price movements to see how a strategy would have performed, focusing on assets that show strong trends. This process typically includes defining entry and exit points based on momentum indicators, running simulations, and assessing metrics like returns, drawdowns, and win rates. The goal is to refine the strategy before applying it in real markets, ensuring it aligns with your trading goals and risk tolerance.

Why is backtesting important for momentum strategies?

Backtesting is crucial for momentum strategies because it evaluates their effectiveness using historical data. It helps identify the strategy's potential profitability and risks before real trading. By analyzing past performance, traders can refine entry and exit points, optimize parameters, and reduce emotional decision-making. This process reveals whether the momentum strategy is likely to succeed in current market conditions, ensuring informed trading decisions.

How do I choose a momentum trading strategy to backtest?

To choose a momentum trading strategy for backtesting, start by defining your criteria for momentum, such as price change over a specific period (e.g., 3, 6, or 12 months). Next, select the assets you want to trade, focusing on those with high liquidity and volatility.

Then, determine your entry and exit signals. Common methods include using moving averages or relative strength index (RSI) thresholds.

After setting these parameters, gather historical price data for your selected assets. Use backtesting software or platforms like TradingView or MetaTrader to simulate trades based on your defined strategy.

Finally, analyze the results for profitability, drawdowns, and win/loss ratios to refine your approach before live trading.

What tools are best for backtesting momentum trading strategies?

The best tools for backtesting momentum trading strategies include:

1. MetaTrader 4/5: Offers built-in tools for strategy testing and optimization.

2. TradingView: Provides a user-friendly interface with backtesting capabilities via Pine Script.

3. Amibroker: Powerful for custom strategy development and backtesting with extensive data handling.

4. QuantConnect: Cloud-based platform supporting multiple languages for complex backtesting.

5. Python with Backtrader or Zipline: Flexible coding options for custom strategies and in-depth analysis.

Choose based on your coding skills, data needs, and strategy complexity.

How can I collect historical data for backtesting?

To collect historical data for backtesting momentum trading strategies, follow these steps:

1. Select a Data Source: Use platforms like Yahoo Finance, Quandl, or Alpha Vantage for free historical stock data. For more comprehensive datasets, consider paid services like Bloomberg or FactSet.

2. Determine Data Requirements: Identify the specific securities and timeframes you want. Common choices are daily or weekly price data over several years.

3. Download Data: Export the data in a compatible format, such as CSV or Excel. Ensure it includes open, high, low, close prices, and volume.

4. Clean the Data: Remove any anomalies or missing values to ensure accuracy in your backtesting results.

5. Use a Backtesting Tool: Import the cleaned data into backtesting software or a programming environment like Python or R, using libraries like Backtrader or Quantlib.

6. Test Your Strategy: Implement your momentum trading strategy on the historical data and analyze the results to refine your approach.

By following these steps, you can effectively gather and utilize historical data for backtesting momentum trading strategies.

What timeframes work best for momentum trading backtests?

For momentum trading backtests, the best timeframes typically range from daily to weekly. Daily data captures short-term price movements effectively, while weekly data provides a broader perspective on trends. Test different periods, like 3-month, 6-month, and 1-year windows, to identify which timeframe aligns with your strategy. Ensure your backtest covers various market conditions to validate the strategy's robustness.

How do I set up a backtest for a momentum strategy?

To set up a backtest for a momentum strategy, follow these steps:

1. Define Your Strategy: Specify your entry and exit criteria, like using a moving average crossover or price momentum over a certain period.

2. Choose Your Data: Gather historical price data for the assets you want to test. This data should include open, high, low, and close prices.

3. Select a Backtesting Platform: Use platforms like MetaTrader, TradingView, or specialized software like Amibroker or QuantConnect.

4. Code Your Strategy: Implement your momentum strategy in the platform’s scripting language. For example, if using Python, libraries like Pandas and NumPy can be helpful.

5. Run the Backtest: Execute the backtest on historical data. Analyze how your strategy would have performed over different time frames.

6. Evaluate Results: Look at metrics such as total return, Sharpe ratio, maximum drawdown, and win/loss ratio to assess performance.

7. Optimize and Iterate: Adjust parameters and re-test to refine your strategy based on results.

8. Validate with Out-of-Sample Testing: After optimizing, test the strategy on unseen data to ensure it performs well in different market conditions.

This approach will help you effectively backtest your momentum trading strategies.

What metrics should I analyze in a momentum backtest?

In a momentum backtest, analyze these key metrics:

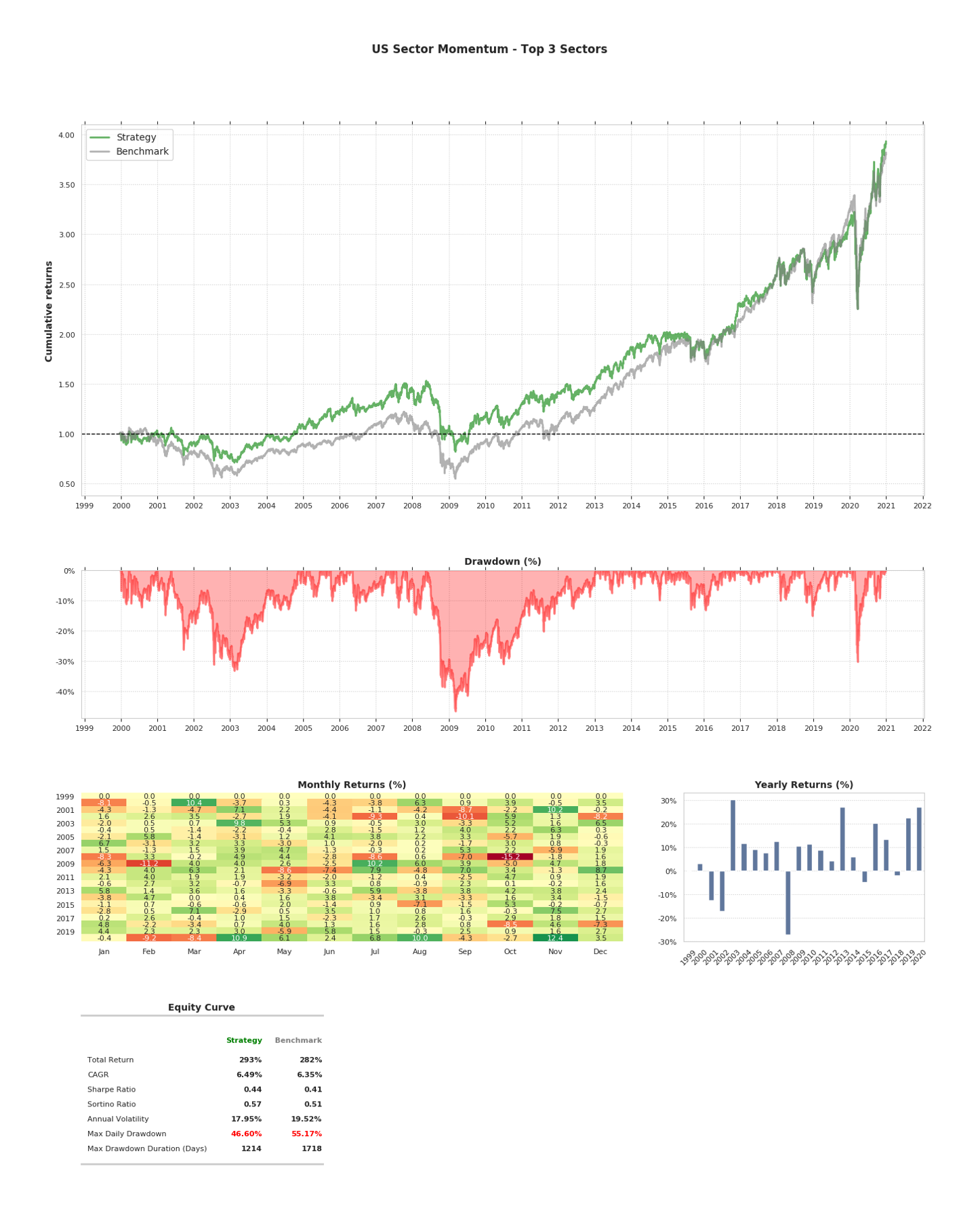

1. Cumulative Returns: Measure the total return over the backtest period.

2. Annualized Return: Calculate the average yearly return to gauge performance.

3. Sharpe Ratio: Assess risk-adjusted returns; higher values indicate better risk management.

4. Maximum Drawdown: Identify the largest peak-to-trough loss; helps evaluate risk.

5. Win Rate: Determine the percentage of profitable trades; indicates strategy effectiveness.

6. Average Trade Duration: Understand how long positions are held.

7. Volatility: Measure price fluctuations; lower volatility can signify stability.

8. Transaction Costs: Factor in commissions and slippage to see real profitability.

These metrics provide a comprehensive view of your momentum strategy's performance and risk.

How do I interpret the results of my momentum trading backtest?

To interpret the results of your momentum trading backtest, focus on key metrics. Look at the total return to see how much profit or loss you generated. Check the Sharpe ratio, which indicates risk-adjusted returns; higher values are better. Analyze the maximum drawdown to understand the worst-case loss during the period. Review win rate and average trade duration to gauge consistency and effectiveness. Finally, assess the equity curve for overall growth trends and volatility. Each of these factors gives insights into the strategy's reliability and potential for real-world application.

How Can You Effectively Backtest Day Trading Momentum Strategies?

Day trading momentum strategies focus on identifying stocks or assets that are moving significantly in one direction and capitalizing on that movement. To backtest momentum trading strategies, follow these steps:

1. **Select a Trading Platform**: Use a platform that offers backtesting capabilities.

2. **Define Your Strategy**: Specify entry and exit criteria based on momentum indicators (e.g., moving averages, RSI).

3. **Gather Historical Data**: Obtain historical price data for the assets you want to test.

4. **Run Backtests**: Apply your strategy to the historical data and analyze the results, focusing on key performance metrics like win rate and return on investment.

5. **Refine Your Strategy**: Adjust parameters based on backtest outcomes to improve performance.

This process helps validate the effectiveness of your day trading momentum strategies before live trading.

Learn more about: What Are Day Trading Momentum Strategies?

Learn about How to Backtest Day Trading Strategies Effectively

What common pitfalls should I avoid when backtesting?

Avoid these common pitfalls when backtesting momentum trading strategies:

1. Ignoring Data Quality: Use high-quality, clean data. Poor data can skew results.

2. Overfitting: Don't tailor your strategy too closely to historical data. This can lead to poor performance in live trading.

3. Neglecting Transaction Costs: Always factor in commissions and slippage; they can significantly impact profitability.

4. Inadequate Sample Size: Use a sufficient amount of historical data to ensure robust results.

5. Failure to Simulate Real Conditions: Test under various market conditions to see how your strategy holds up during volatility.

6. Not Considering Risk Management: Incorporate stop-loss and position sizing rules in your backtest to reflect real-world risks.

7. Disregarding Walk-Forward Testing: Validate your strategy with walk-forward analysis to prevent curve-fitting.

By avoiding these pitfalls, you'll enhance the reliability of your momentum trading strategy backtests.

How can I optimize my momentum trading strategy after backtesting?

To optimize your momentum trading strategy after backtesting, analyze the performance metrics such as win rate, average gain, and maximum drawdown. Adjust parameters like entry and exit points based on your findings. Implement risk management techniques like stop-loss orders to protect capital. Test different asset classes or timeframes to identify the most effective combinations. Use walk-forward analysis to validate your strategy on unseen data. Continuously refine and iterate based on new data and market conditions.

How does slippage affect backtesting momentum strategies?

Slippage negatively impacts backtesting momentum strategies by distorting expected returns. When executing trades, the price at which orders are filled may differ from the backtested price due to market fluctuations, leading to lower profits or increased losses. This discrepancy can make a strategy appear more effective in backtests than it actually is in real trading. To accurately assess a momentum strategy, incorporate slippage into your backtesting model.

Can I backtest momentum strategies using paper trading?

Yes, you can backtest momentum strategies using paper trading. Paper trading allows you to simulate trades without real money, letting you apply your momentum strategy to historical data and evaluate its effectiveness. Use a trading platform that supports backtesting features to analyze performance metrics like returns, drawdowns, and win rates. This approach helps refine your strategy before committing real capital.

How do market conditions impact the effectiveness of backtested strategies?

Market conditions significantly influence backtested momentum trading strategies. In trending markets, these strategies often perform well, capitalizing on sustained price movements. Conversely, in volatile or sideways markets, momentum strategies may underperform due to whipsaw effects and false signals.

Additionally, changes in economic indicators, interest rates, or geopolitical events can alter market dynamics, affecting historical performance. It's crucial to consider the current market environment when evaluating the effectiveness of any backtested momentum strategy, as past results may not predict future outcomes. Always adapt strategies to the prevailing market conditions to enhance their success.

What are some examples of successful momentum trading strategies?

1. Relative Strength Index (RSI): Buy when the RSI crosses above 30 and sell when it crosses below 70.

2. Moving Average Crossover: Enter a long position when a short-term moving average crosses above a long-term moving average and exit when the opposite occurs.

3. Breakout Trading: Identify key resistance levels; buy when the price breaks above resistance and sell when it drops below support.

4. Trend Following: Use a combination of price action and indicators like the Average Directional Index (ADX) to confirm trends before entering trades.

5. Momentum Indicators: Utilize indicators like MACD (Moving Average Convergence Divergence) to capture price momentum; buy on bullish crossovers and sell on bearish crossovers.

6. Volume Analysis: Look for increasing volume to confirm momentum; buy on high volume breakouts and sell on low volume pullbacks.

To backtest these strategies, use historical price data and simulate trades based on your entry and exit rules to evaluate performance metrics like win rate and drawdown.

How often should I update my backtesting results for momentum strategies?

You should update your backtesting results for momentum strategies at least quarterly. This frequency allows you to account for changing market conditions and ensures your strategy remains relevant. If the market experiences significant volatility or shifts, consider updating your results sooner. Regular reviews help identify any necessary adjustments to maintain performance.

Conclusion about How to Backtest Momentum Trading Strategies

Backtesting momentum trading strategies is a critical step in developing a successful trading approach. By understanding how to effectively backtest, select the right tools, and analyze key metrics, traders can refine their strategies to adapt to market conditions. Avoid common pitfalls and regularly update your backtesting results to ensure your strategies remain robust. With the insights gained through backtesting, traders can enhance their decision-making and increase their chances of success in the dynamic trading landscape. For further guidance and expertise, consider exploring the resources offered by DayTradingBusiness.

Learn about How to Backtest Day Trading Strategies Effectively