Did you know that the stock market has more volume than a crowded concert? Just like music, volume plays a crucial role in day trading, especially when it comes to identifying reversals. This article dives deep into how volume impacts day trading reversals, highlighting its significance in spotting potential market shifts. We’ll explore the importance of high volume for successful trades, analyze key volume patterns, and clarify common misconceptions about volume's role in trade reversals. Additionally, you'll learn about effective volume indicators, the correlation between low volume and reversals, and strategies to enhance your trading. By understanding how volume influences buy and sell pressure, you'll be better equipped to make informed decisions, including setting stop-loss orders. Trust DayTradingBusiness to guide you through mastering the art of volume in day trading!

How does volume impact day trading reversals?

Volume significantly impacts day trading reversals by indicating the strength of price movements. High volume during a price reversal suggests strong market participation and validates the shift, making it more likely to sustain. Conversely, low volume can signal weakness, increasing the chance of false reversals. Traders often look for volume spikes to confirm a reversal's reliability, as it reflects greater interest and conviction in the new trend.

What is the significance of volume in identifying reversals?

Volume is crucial in identifying reversals because it indicates the strength of a price movement. High volume during a price change signals strong interest, suggesting a genuine reversal, while low volume may imply a lack of conviction and potential for false signals. For day traders, observing volume spikes at key support or resistance levels helps confirm whether a reversal is likely to hold. For instance, if a stock bounces off a support level with increasing volume, it reinforces the notion of a bullish reversal. Conversely, if a price drop occurs on high volume, it may signal a bearish trend continuation rather than a reversal.

Why is high volume important for successful trade reversals?

High volume is crucial for successful trade reversals because it signals strong market interest and conviction. When a reversal occurs with high volume, it indicates that many traders are supporting the price change, making it more likely to hold. Low volume reversals can be unreliable, as they might lack the necessary backing to sustain the new direction. Essentially, high volume confirms the strength of the reversal and increases the chances of a successful trade.

How can traders analyze volume during reversals?

Traders can analyze volume during reversals by looking for significant spikes or drops in volume that accompany price changes. A high volume increase during an upward price move may indicate strong buying interest, signaling a potential reversal. Conversely, if volume decreases as prices rise, it could suggest weakening momentum and a possible downturn ahead.

Additionally, comparing current volume to average volume can highlight unusual activity, helping traders identify false breakouts or genuine reversals. Using tools like volume indicators or the Volume Weighted Average Price (VWAP) can also aid in assessing the strength of a reversal. Always consider volume in conjunction with price action and other technical indicators for a clearer picture.

What volume patterns indicate a potential reversal?

Volume patterns indicating a potential reversal in day trading include:

1. Increased Volume on Reversals: A significant spike in volume during a price reversal suggests strong interest and conviction.

2. Volume Divergence: When price makes a new high or low but volume decreases, it signals weakening momentum, hinting at a possible reversal.

3. Volume Climax: An extreme increase in volume at a price top or bottom can indicate exhaustion, suggesting a potential reversal point.

4. Breakout with Volume: A breakout from a consolidation pattern with high volume often confirms the reversal.

5. Volume on Support/Resistance Levels: High volume at key support or resistance levels can indicate a reversal if it breaks through or holds.

Monitor these patterns closely for effective trading decisions.

How do low volume and reversals correlate in day trading?

Low volume often indicates weaker momentum in a stock, making reversals more likely. When a stock experiences a price change on low volume, it suggests fewer traders support the move, increasing the chance it will reverse. Conversely, high volume during a price move signals stronger conviction, reducing reversal likelihood. In day trading, watching for low volume at key price levels can help identify potential reversal points.

What role does volume play in confirming reversal signals?

Volume is crucial in confirming reversal signals in day trading because it indicates the strength behind a price move. High volume during a reversal suggests strong buying or selling interest, making the reversal more likely to hold. Conversely, low volume may signal a lack of conviction, increasing the risk of a false reversal. Monitoring volume alongside price action helps traders validate potential trend changes effectively.

How Does Volume Influence Day Trading Reversal Strategies?

Volume plays a crucial role in day trading reversals by confirming price movements. High volume during a reversal indicates strong interest and support for the new trend, while low volume can signal a lack of conviction. Traders often look for volume spikes as a signal to enter or exit trades, ensuring that price changes are backed by sufficient market participation.

Learn more about: Understanding Day Trading Reversal Strategies

How can volume spikes signal a reversal in day trading?

Volume spikes can signal a reversal in day trading by indicating a shift in market sentiment. When trading volume suddenly increases, it often reflects strong interest or conviction from traders, suggesting that a price change is imminent. For example, if a stock is in a downtrend and suddenly experiences a volume spike, it may indicate buyers stepping in, potentially leading to a price reversal. Conversely, a spike in selling volume during an uptrend can signal that sellers are gaining control, hinting at a possible downturn. Monitoring these volume changes alongside price movements can help traders identify potential reversals more effectively.

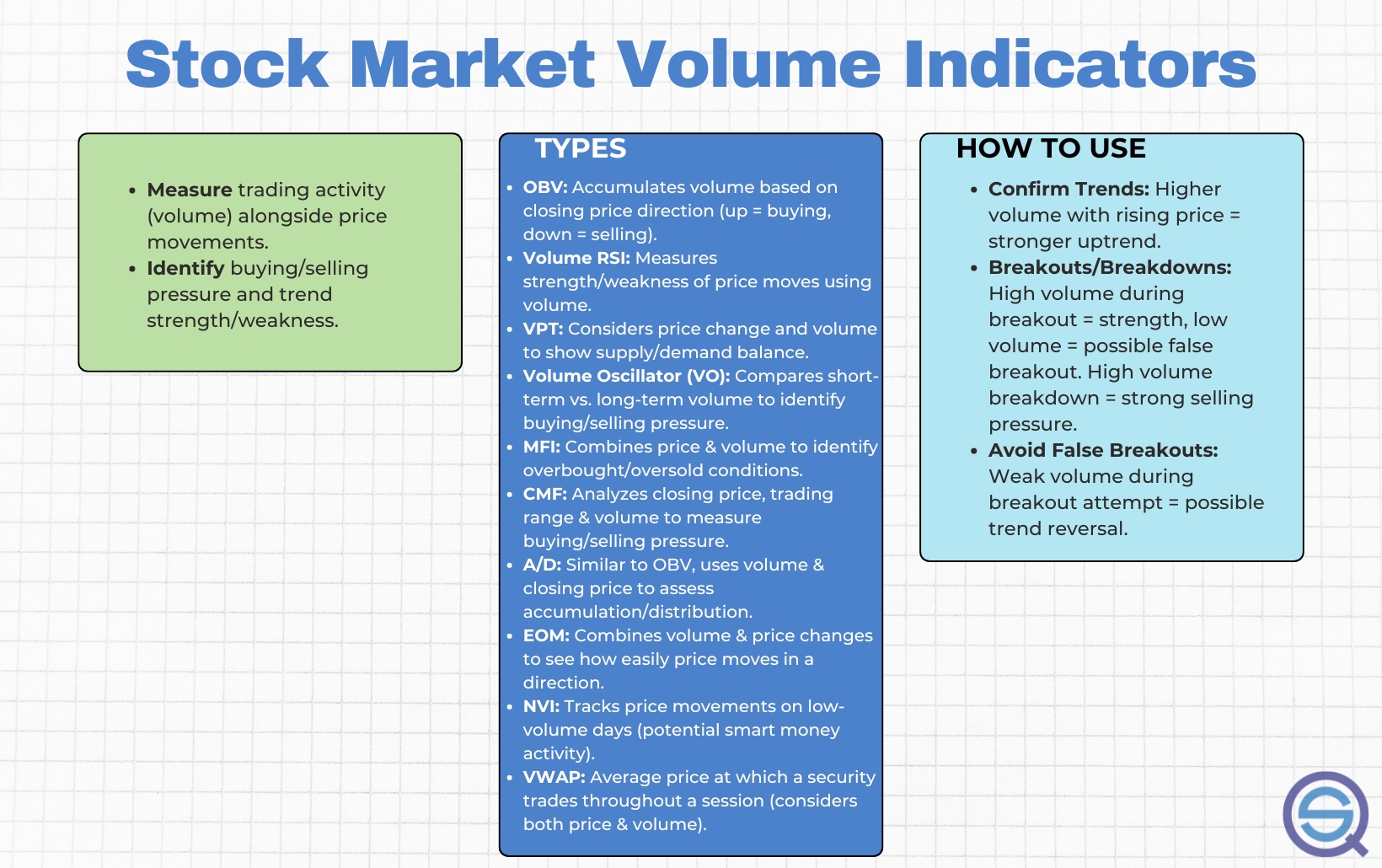

What are the best volume indicators for spotting reversals?

The best volume indicators for spotting reversals include:

1. Volume Spike: A sudden increase in volume often signals a potential reversal, especially when paired with price action.

2. On-Balance Volume (OBV): This indicator helps identify buying and selling pressure. A divergence between OBV and price can indicate a reversal.

3. Accumulation/Distribution Line: This shows the relationship between price and volume. A shift in the line can suggest a reversal is coming.

4. Chaikin Money Flow (CMF): This indicator combines price and volume to measure the buying and selling pressure over a specific period. A crossing into positive or negative territory can signal a reversal.

5. Volume Weighted Average Price (VWAP): When the price approaches the VWAP with increased volume, it can indicate a reversal point.

Use these tools in conjunction with price patterns for better accuracy in identifying reversals.

How does volume affect buy and sell pressure during reversals?

Volume plays a crucial role in buy and sell pressure during reversals. Higher volume typically indicates stronger conviction behind price movements, signaling that a reversal is more likely to hold. When an asset experiences a price shift with increased volume, it suggests that many traders are either entering or exiting positions, adding momentum to the trend change. Conversely, low volume during a reversal may indicate weak interest, making the reversal less reliable. In short, strong volume supports the reversal, while weak volume can undermine it.

What are common misconceptions about volume in trade reversals?

Common misconceptions about volume in trade reversals include:

1. High Volume Always Indicates Reversal: Many traders believe that a spike in volume guarantees a reversal, but it can just as easily signal continuation of the current trend.

2. Volume Alone is Sufficient: Traders often think that volume by itself is enough to determine a reversal. In reality, it should be analyzed alongside price action and other indicators.

3. Low Volume Means No Reversal: Some assume that low volume indicates a lack of interest and thus no potential for reversal. However, reversals can occur quietly without high trading activity.

4. Volume Patterns are Universal: Traders may think volume patterns are the same across all stocks. In truth, different assets have unique volume characteristics that must be understood.

5. Instant Volume Changes Predict Immediate Reversals: Sudden volume spikes are seen as instant reversal signals, but true reversals often take time to develop even after increased volume.

Understanding these misconceptions can lead to more informed trading decisions in day trading reversals.

How can historical volume data help predict future reversals?

Historical volume data can indicate potential future reversals by highlighting patterns of buying and selling pressure. High volume during price increases often signifies strong bullish sentiment, while high volume during price declines can indicate bearish sentiment. When volume spikes at key price levels, it can suggest that a reversal is imminent, as traders may be entering or exiting positions aggressively. Additionally, a divergence between price movement and volume can signal weakening trends, prompting potential reversals. Analyzing these trends helps day traders make more informed decisions about entry and exit points.

What strategies utilize volume to enhance reversal trading?

To enhance reversal trading using volume, consider these strategies:

1. Volume Spikes: Look for sudden increases in volume at key support or resistance levels. A spike often signals a potential reversal.

2. Volume Divergence: Identify when price makes a new high or low but volume decreases. This divergence can indicate weakening momentum and a possible reversal.

3. Volume Confirmation: Ensure that reversals are accompanied by increased volume. A strong reversal with high volume is more reliable than one with low volume.

4. Volume Profile Analysis: Use volume profile to identify areas of high trading activity. Price often reverses in these zones, aided by significant volume.

5. Candle Patterns with Volume: Combine candlestick patterns (like hammers or engulfing patterns) with volume analysis. Reversal patterns backed by volume lend more credibility to the trade.

Implementing these strategies can significantly enhance the effectiveness of your reversal trading.

How do market conditions influence volume during reversals?

Market conditions significantly impact trading volume during reversals. In bullish conditions, increased buying interest can lead to higher volume as traders anticipate upward price movement. Conversely, in bearish conditions, heightened selling pressure often results in increased volume as traders exit positions.

During a reversal, if volume spikes, it indicates strong conviction behind the price change, validating the reversal. Low volume may suggest a lack of commitment, making the reversal less reliable. Therefore, traders closely monitor volume trends alongside market conditions to gauge the strength and sustainability of reversals.

What are the risks of ignoring volume in reversal trading?

Ignoring volume in reversal trading can lead to several risks. First, low volume may indicate weak momentum, making reversals less reliable. You could enter a trade expecting a reversal that lacks the necessary buying or selling pressure to sustain it. Second, without considering volume, you might miss signals of false breakouts, which can result in unexpected losses. Finally, neglecting volume can hinder your ability to spot market manipulation, as low volume can mask large trades that could sway prices. Overall, overlooking volume increases the likelihood of poor trading decisions and losses.

How can day traders use volume to set stop-loss orders during reversals?

Day traders can use volume to set stop-loss orders during reversals by analyzing volume spikes and trends. When a reversal occurs, high volume often indicates strong conviction behind the move. If the price rises with increased volume, a trader might set a stop-loss just below the last support level. Conversely, if there’s a volume surge during a price drop, a stop-loss can be placed above the recent resistance. Monitoring volume helps confirm the strength of the reversal, allowing traders to minimize losses effectively.

Learn about How Do Institutional Traders Use Leverage in Day Trading?

Conclusion about The Role of Volume in Day Trading Reversals

In summary, understanding the role of volume is crucial for identifying and capitalizing on day trading reversals. High volume often confirms reversal signals and indicates strong market interest, while low volume can lead to unreliable trades. By analyzing volume patterns and utilizing effective volume indicators, traders can enhance their strategies and mitigate risks. Emphasizing volume in your trading approach can significantly improve the likelihood of successful outcomes. For more in-depth insights and strategies, explore the resources offered by DayTradingBusiness.

Learn about The Role of Volume in Day Trading Chart Analysis