Did you know that the stock market can be as unpredictable as a cat in a bathtub? In the world of trading, particularly with breakout strategies, adapting to volatile markets is crucial for success. This article dives deep into the essentials of breakout strategies, including identification techniques, key indicators, and risk management. You'll learn how to adjust your strategies for high volatility, the impact of news events, and the importance of volume. Plus, we’ll cover common pitfalls to avoid, profit target setting, and how to optimize your trading plan. With insights from DayTradingBusiness, you'll be equipped to navigate the choppy waters of volatile markets like a pro!

What are breakout strategies in volatile markets?

Breakout strategies in volatile markets focus on identifying price movements beyond established support or resistance levels. Traders look for significant price increases or decreases, often using technical indicators like Bollinger Bands or moving averages to confirm breakouts. In volatile conditions, it's crucial to set tighter stop-loss orders to manage risk and take advantage of rapid price changes. Additionally, scaling into positions can help mitigate the impact of sudden reversals. Monitoring news and market sentiment is vital, as external factors can trigger breakouts.

How can I identify breakouts in a volatile market?

To identify breakouts in a volatile market, focus on these key steps:

1. Use Technical Indicators: Look for increasing volume alongside price movement. Indicators like Bollinger Bands can help signal breakouts when prices touch the upper or lower bands.

2. Set Clear Levels: Define support and resistance levels. A breakout occurs when the price exceeds these levels significantly, ideally by at least 1-2% in a volatile environment.

3. Monitor News and Events: Stay updated on market news that could impact volatility. Major announcements can lead to sudden breakouts.

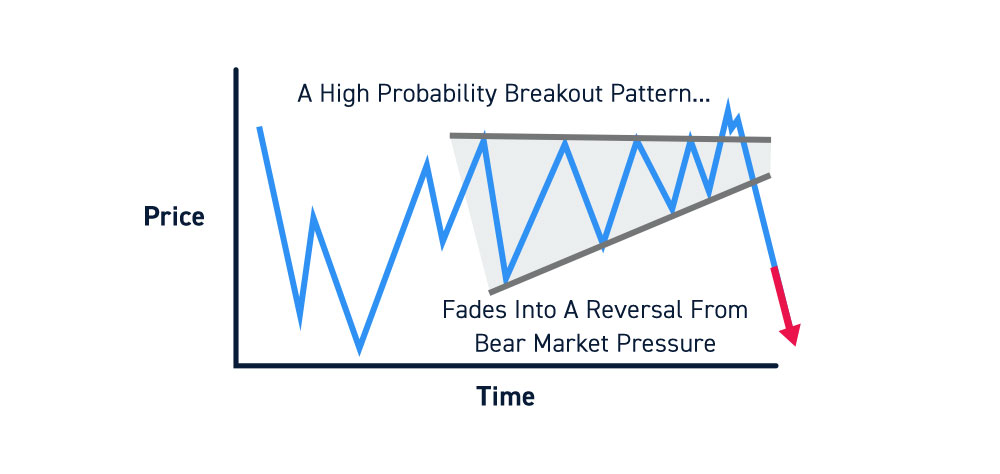

4. Look for Patterns: Identify chart patterns like triangles, flags, or pennants. Breakouts often occur after these formations complete.

5. Use Stop-Loss Orders: Protect your trades with stop-loss orders to manage risk in unpredictable markets.

6. Confirm with Multiple Time Frames: Analyze breakouts on different time frames to confirm strength. A breakout on a daily chart is more significant than one on a 5-minute chart.

By combining these strategies, you can effectively identify breakouts even in a volatile market.

What indicators help predict breakouts during market volatility?

Key indicators that help predict breakouts during market volatility include:

1. Volume Spikes: Increased trading volume often signals strong interest and can precede a breakout.

2. Price Patterns: Look for consolidation patterns like triangles or flags that suggest a potential breakout direction.

3. Bollinger Bands: When prices touch the outer bands, it indicates heightened volatility, often leading to breakouts.

4. Moving Averages: Crossovers, especially with short-term averages above long-term ones, can signal bullish breakouts during volatility.

5. Relative Strength Index (RSI): An RSI moving above 70 or below 30 can indicate overbought or oversold conditions, hinting at potential breakouts.

6. MACD Divergence: A divergence between MACD and price can indicate weakening momentum, often preceding a breakout.

Monitoring these indicators can enhance your breakout strategies in volatile markets.

How do I adjust my breakout strategy for high volatility?

To adjust your breakout strategy for high volatility, first, widen your entry and exit points to accommodate larger price swings. Use a longer time frame for your charts to filter out noise and identify more reliable breakouts. Incorporate volatility indicators like the Average True Range (ATR) to set appropriate stop-loss levels. Consider scaling into positions gradually rather than committing all at once. Also, be prepared to exit quickly if the market moves against you, as volatility can lead to rapid reversals. Finally, stay updated on news events that can trigger spikes in volatility.

What are the risks of using breakout strategies in volatile conditions?

Using breakout strategies in volatile conditions carries several risks:

1. False Breakouts: Price may spike briefly beyond a resistance or support level before reversing, leading to losses.

2. Slippage: Rapid price movements can result in executing trades at worse prices than expected.

3. Increased Spread: Wider bid-ask spreads in volatile markets can erode profits.

4. Emotional Trading: Volatility can trigger impulsive decisions, deviating from strategy.

5. Market Gaps: Sudden price jumps overnight can leave traders with unfilled orders or unexpected positions.

Mitigating these risks involves tighter stop-loss orders, smaller position sizes, and ensuring proper risk management.

Can breakout strategies work in bear markets?

Yes, breakout strategies can work in bear markets. In these conditions, look for breakdowns below key support levels or price patterns signaling further declines. Focus on strong volume to confirm the breakout's validity. Adjust your risk management and set tighter stop-loss orders to protect against volatility. Use technical indicators like moving averages to identify trends and refine entry points.

What timeframes are best for breakout strategies in volatile markets?

For breakout strategies in volatile markets, focus on short to medium timeframes, typically ranging from 5 minutes to 1 hour for day trading. For swing trading, 1 hour to daily charts work well. These timeframes allow you to capture quick price movements while managing risk effectively. Use volatility indicators, like the Average True Range (ATR), to identify optimal entry points and set stop-loss levels.

How do news events impact breakout strategies?

News events can significantly impact breakout strategies by introducing volatility and altering market sentiment. Traders should adapt by closely monitoring news releases and adjusting entry points based on anticipated price movements. For example, if a major economic report is due, consider waiting for the initial reaction before executing a breakout trade. Using tighter stop-loss orders can help manage risk during unpredictable market swings. Additionally, be prepared for false breakouts; validate signals with volume or other indicators to avoid getting caught in rapid reversals.

What tools can assist in executing breakout strategies?

To execute breakout strategies in volatile markets, use these tools:

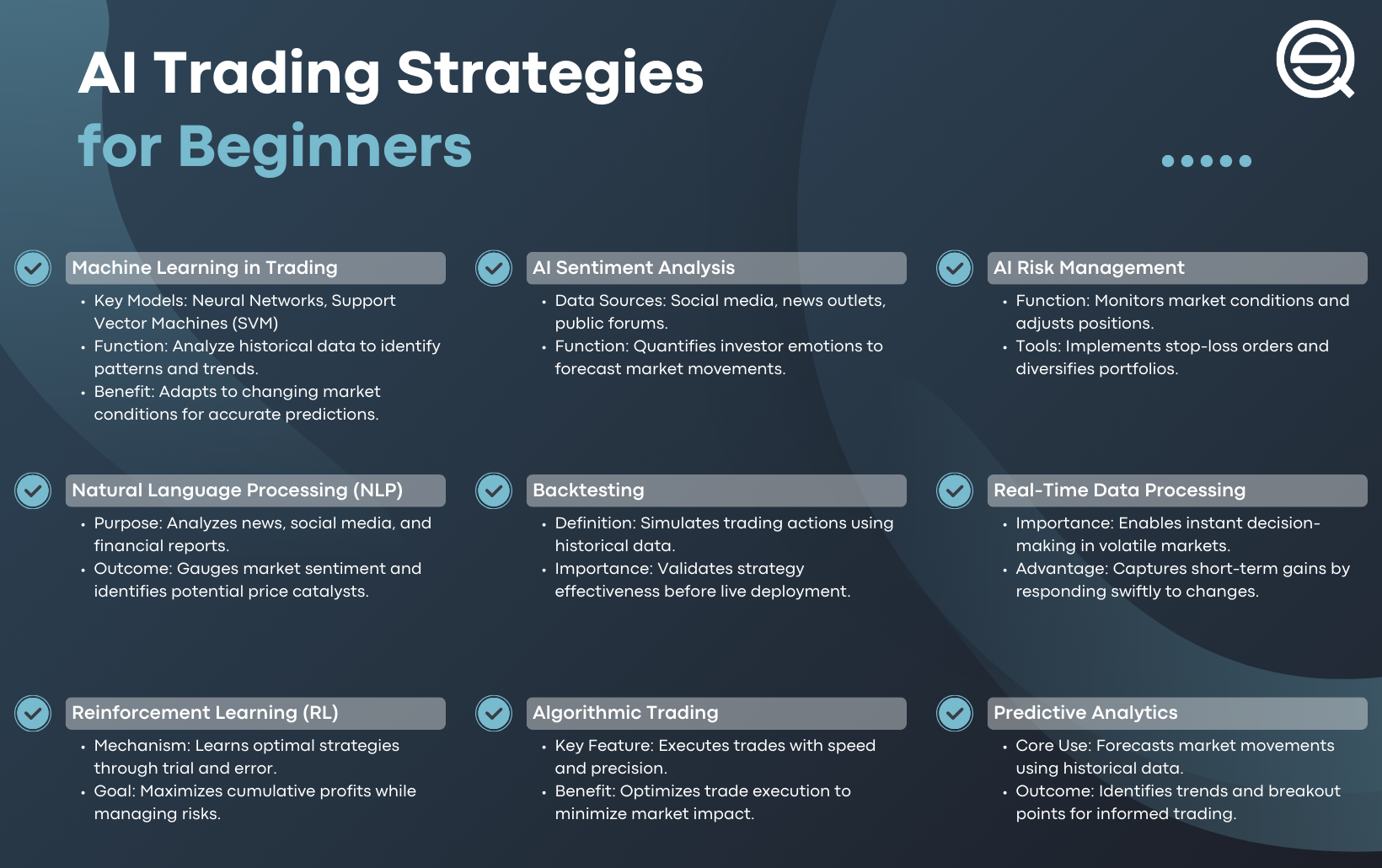

1. Technical Analysis Software: Tools like TradingView or MetaTrader help identify breakout points through chart patterns and indicators.

2. Volatility Indicators: Use tools like Average True Range (ATR) or Bollinger Bands to measure market volatility and set entry/exit points.

3. News Aggregators: Platforms like Bloomberg or Reuters keep you updated on market-moving news that could trigger breakouts.

4. Automated Trading Systems: Utilize algorithms or bots that can execute trades instantly based on predefined breakout criteria.

5. Risk Management Tools: Position sizing calculators and stop-loss order settings help manage risk during volatile conditions.

6. Backtesting Software: Tools like Amibroker allow you to test breakout strategies against historical data to refine your approach.

These tools enhance your ability to spot and act on breakout opportunities effectively.

How Can I Adapt Day Trading Breakout Strategies for Volatile Markets?

Day trading breakout strategies involve identifying key price levels and entering trades when the price breaks above resistance or below support. To adapt these strategies for volatile markets, focus on setting wider stop-loss orders to accommodate larger price swings. Use technical indicators like Bollinger Bands or Average True Range to gauge volatility and adjust entry points accordingly. Prioritize quick execution and be prepared for rapid reversals, ensuring you have a solid risk management plan in place.

Learn more about: What Are Day Trading Breakout Strategies?

Learn about How to Combine Charting with Day Trading Strategies

How should I manage risk when trading breakouts?

To manage risk when trading breakouts in volatile markets, use these strategies:

1. Set Stop-Loss Orders: Place stop-loss orders just below support levels or recent lows to limit losses if the breakout fails.

2. Position Sizing: Only risk a small percentage of your trading capital on each trade. This helps cushion against significant losses.

3. Confirm Breakouts: Wait for confirmation, such as a candle closing above resistance, before entering a trade to avoid false breakouts.

4. Use Volatility Indicators: Apply indicators like the Average True Range (ATR) to gauge market volatility and adjust your stop-loss and target levels accordingly.

5. Scale In: Consider entering positions gradually rather than all at once. This allows you to assess market conditions and adjust your exposure.

6. Monitor News and Events: Stay aware of economic news or events that could impact market volatility and adjust your strategy accordingly.

7. Review and Adapt: Regularly analyze your trades to identify patterns and improve your risk management approach over time.

Implementing these strategies can help you effectively manage risk while trading breakouts in volatile markets.

Learn about How to manage leverage risk when day trading?

What role does volume play in breakout strategies?

Volume is crucial in breakout strategies as it confirms the strength of a price movement. High volume during a breakout indicates strong interest and increases the likelihood that the breakout will sustain. Conversely, low volume can signal a lack of conviction, suggesting that the breakout may fail. In volatile markets, monitoring volume helps traders distinguish between genuine breakouts and false signals, enhancing decision-making and risk management.

How can I backtest breakout strategies for volatility?

To backtest breakout strategies for volatility, follow these steps:

1. Select Your Data: Gather historical price data for the assets you're interested in, focusing on periods of high volatility.

2. Define Your Breakout Criteria: Determine the parameters for your breakout strategy, such as price levels, volume thresholds, or technical indicators.

3. Set Up Your Backtesting Environment: Use a backtesting tool or software like Python, R, or dedicated trading platforms that support strategy testing.

4. Implement Your Strategy: Code your breakout rules, including entry and exit signals based on your defined criteria.

5. Run the Backtest: Apply your strategy to the historical data, simulating trades to see how it would have performed under varying volatility conditions.

6. Analyze Results: Evaluate key metrics like win rate, profit factor, drawdowns, and risk-reward ratios to assess the effectiveness of your strategy.

7. Optimize and Adjust: Based on the results, tweak your strategy parameters and re-run the backtest to improve performance.

8. Consider Forward Testing: After backtesting, test your strategy in a simulated environment with real-time data to validate its effectiveness before live trading.

What common mistakes should I avoid with breakout strategies?

Avoid these common mistakes with breakout strategies in volatile markets:

1. Ignoring Volume: Ensure that breakouts are supported by significant trading volume; low volume can signal false breakouts.

2. Chasing Price: Don’t enter a trade after the breakout has already occurred significantly; this increases your risk.

3. Not Setting Stop Losses: Always use stop losses to protect against sudden reversals, which are common in volatile conditions.

4. Overtrading: Be selective with your trades; don’t jump into every breakout opportunity, as volatility can lead to whipsaws.

5. Neglecting Market Conditions: Consider broader market trends and news; volatility can drastically affect breakout reliability.

6. Ignoring Risk Management: Allocate a reasonable percentage of your capital to each trade to avoid large losses.

7. Failing to Adapt: Be flexible; adjust your strategy based on changing market dynamics and volatility levels.

How do I set profit targets using breakout strategies?

To set profit targets using breakout strategies in volatile markets, first identify key resistance levels where the price has previously struggled. Aim for a profit target that is 1.5 to 2 times your risk, calculated from your entry point to your stop-loss. Use trailing stops to lock in profits as the trade moves in your favor. Additionally, monitor volatility indicators like the Average True Range (ATR) to adjust your targets dynamically based on market conditions. This approach helps ensure that your profit targets are aligned with market movements while minimizing risk.

What psychological factors affect breakout trading in volatile markets?

Psychological factors affecting breakout trading in volatile markets include fear of missing out (FOMO), leading traders to enter positions too early; loss aversion, causing them to hold onto losing trades; and overconfidence, which can result in excessive risk-taking. Additionally, anxiety during rapid price movements can trigger indecision, while herd mentality may lead to following trends without proper analysis. Successful breakout traders must manage these emotions to stick to their strategies and maintain discipline.

How can I optimize my trading plan for breakout strategies?

To optimize your trading plan for breakout strategies in volatile markets, focus on these key areas:

1. Identify Key Levels: Use support and resistance levels to pinpoint potential breakout points. Look for areas where price has historically reversed.

2. Incorporate Volatility Indicators: Use tools like the Average True Range (ATR) to gauge market volatility and adjust your entry and exit points accordingly.

3. Set Tight Stop Losses: In volatile conditions, place stop losses closer to your entry to minimize losses while allowing for normal price fluctuations.

4. Use Volume Confirmation: Confirm breakouts with increased trading volume. A breakout on low volume often fails.

5. Adjust Position Sizing: Adapt your position size based on market volatility. Decrease size during high volatility to manage risk effectively.

6. Implement a Quick Reaction Plan: Be prepared to exit quickly if the price reverses after a breakout. Set alerts to stay informed.

7. Backtest and Analyze: Regularly backtest your strategies in different volatile scenarios to refine your approach and improve performance.

By focusing on these aspects, you can enhance your breakout strategies to navigate volatile markets more effectively.

Conclusion about Adapting Breakout Strategies for Volatile Markets

In volatile markets, adapting breakout strategies requires a keen understanding of market dynamics and robust risk management. By utilizing key indicators, adjusting to market conditions, and recognizing the influence of news events, traders can enhance their chances of success. It’s crucial to backtest strategies and remain aware of psychological factors that may impact decision-making. With the right tools and a structured approach, traders can effectively navigate volatility. For further insights and tailored guidance, DayTradingBusiness is here to support your trading journey.

Sources:

- A hybrid decision support system for adaptive trading strategies ...

- Pro Trader RL: Reinforcement learning framework for generating ...

- Assessing the profitability of intraday opening range breakout ...

- Interconnectivity and investment strategies among commodity prices ...

- Iran Overview: Development news, research, data | World Bank