Did you know that the average day trader spends more time staring at charts than a cat does watching a laser pointer? In the fast-paced world of day trading, selecting the right strategies and managing risks are crucial for success. This article dives deep into effective day trading strategies, tools, and platforms, while also addressing key indicators for performance evaluation. You'll learn how to choose a strategy that suits your style, the importance of timing, and the psychological aspects that can make or break your trading journey. Additionally, we’ll cover common pitfalls to avoid and how to develop a solid trading plan. With insights from DayTradingBusiness, you'll be better equipped to navigate the complexities of day trading with confidence.

What are the most effective day trading strategies?

Effective day trading strategies include:

1. Scalping: This involves making quick trades to capture small price movements. Traders often execute dozens of trades in a day.

2. Momentum Trading: Traders focus on stocks that are moving significantly in one direction on high volume. They buy early and sell quickly to capitalize on continued movement.

3. Breakout Trading: This strategy involves entering a position when the price breaks above a resistance level or below a support level with increased volume, anticipating further movement.

4. Reversal Trading: Day traders look for signs that a trend is reversing, entering trades at potential turning points based on technical indicators.

5. News-Based Trading: Traders react quickly to news releases that can impact stock prices, buying or selling based on the news’ implications.

6. Range Trading: This strategy involves identifying support and resistance levels and buying at the lower end while selling at the upper end of the range.

Each strategy requires careful analysis and risk management to be effective in day trading.

How do I choose the right day trading strategy for me?

To choose the right day trading strategy, start by assessing your risk tolerance and financial goals. Consider strategies like scalping for quick trades, momentum trading for trending stocks, or reversal trading for market pullbacks. Test these approaches with a demo account to see what aligns with your style. Also, analyze your time commitment; some strategies require constant monitoring while others are more flexible. Finally, stay informed about market conditions and choose a strategy that adapts to them.

What are the key indicators for day trading success?

Key indicators for day trading success include:

1. Volume: High trading volume indicates strong interest and can lead to better price movement.

2. Volatility: Look for stocks with significant price fluctuations; they offer more opportunities for profit.

3. Technical Indicators: Use tools like moving averages, RSI, and MACD to identify trends and entry/exit points.

4. Market News: Stay updated on news that could impact market sentiment and stock prices.

5. Risk Management: Implement stop-loss orders to minimize losses and protect profits.

6. Discipline and Strategy: Stick to your trading plan and avoid emotional decision-making.

These indicators help in making informed trading decisions and can significantly enhance your chances of success.

How can I manage risk in day trading?

To manage risk in day trading, start by setting a strict stop-loss order for each trade to limit potential losses. Use position sizing to determine how much of your capital to risk on each trade, generally keeping it to 1-2% of your total account. Diversify your trades to avoid overexposure to a single stock or market. Keep a trading journal to analyze your trades and learn from mistakes. Stay informed about market conditions and use technical analysis to identify entry and exit points effectively. Regularly review and adjust your strategies based on performance.

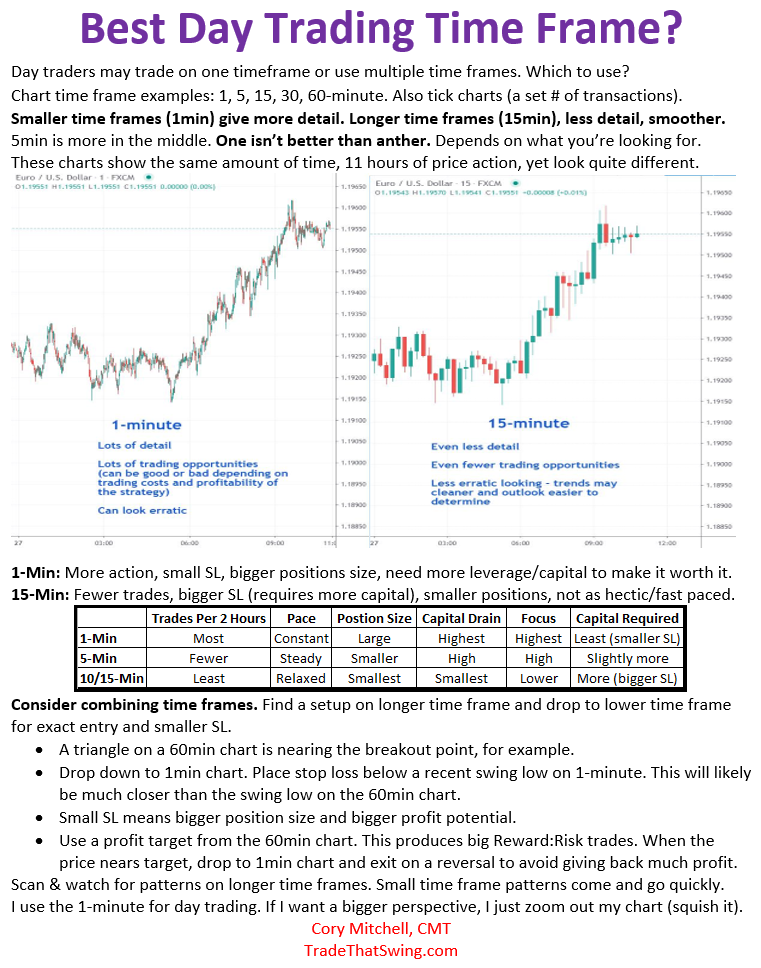

What role does technical analysis play in day trading?

Technical analysis is crucial in day trading as it helps traders make informed decisions based on price movements and patterns. By using charts, indicators, and volume data, day traders identify trends, entry and exit points, and potential reversals. This analysis allows for quick execution of trades, maximizing profits while minimizing losses. Techniques like moving averages, RSI, and candlestick patterns are commonly employed to gauge market sentiment and volatility. Ultimately, technical analysis equips day traders with the tools to navigate the fast-paced market effectively.

How does market volatility affect day trading strategies?

Market volatility directly impacts day trading strategies by providing opportunities for quick profits through price fluctuations. Higher volatility often leads to larger price swings, allowing traders to capitalize on short-term movements. Strategies like scalping and momentum trading thrive in volatile conditions, as they focus on rapid trades to exploit these price changes. Conversely, low volatility can limit potential gains and may lead traders to adjust their approach, such as incorporating range trading or waiting for breakout signals. Successful day traders adapt their tactics to the current volatility, using tools like stop-loss orders to manage risk effectively.

What are the best tools and platforms for day trading?

The best tools and platforms for day trading include:

1. TradingView: Excellent for charting and technical analysis with a strong community.

2. Thinkorswim by TD Ameritrade: Offers advanced trading features and a powerful interface.

3. MetaTrader 4/5: Popular for forex trading, with customizable indicators and automated trading capabilities.

4. E*TRADE: User-friendly platform with robust research tools and mobile access.

5. Interactive Brokers: Low-cost trading with extensive market access and research tools.

6. NinjaTrader: Great for futures and forex with advanced charting and analysis tools.

7. Webull: Commission-free trading with a focus on mobile usability and real-time data.

Choose based on your trading strategy, asset class, and required features.

How important is timing in day trading?

Timing is crucial in day trading. It determines entry and exit points, impacting profit potential. Successful traders often rely on technical analysis, market trends, and real-time data to make split-second decisions. Missing an optimal moment can lead to losses, while precise timing can maximize gains. Therefore, mastering timing strategies is essential for effective day trading.

What Are the Most Effective Day Trading Strategies for Beginners?

Analyzing day trading strategies for beginners, effective approaches include trend following, breakout trading, and scalping. Focus on high liquidity stocks, set clear entry and exit points, and use stop-loss orders to manage risk. Monitor market news and use technical indicators like moving averages to inform decisions.

Learn more about: Day Trading Strategies for Beginners

What mistakes should I avoid in day trading?

Avoid these mistakes in day trading:

1. Lack of a Trading Plan: Trading without a clear strategy can lead to impulsive decisions. Always have a plan for entry, exit, and risk management.

2. Ignoring Risk Management: Never risk more than you can afford to lose. Set stop-loss orders to protect your capital.

3. Overtrading: Trading too frequently can increase costs and lead to poor decisions. Stick to your strategy and avoid chasing losses.

4. Neglecting Market Research: Failing to stay informed about market trends and news can result in missed opportunities or unexpected losses.

5. Emotional Trading: Allowing emotions like fear or greed to dictate your trades can derail your strategy. Stay disciplined and stick to your plan.

6. Poor Timing: Not paying attention to entry and exit points can cost you profits. Use technical analysis to time your trades effectively.

7. Ignoring Diversification: Putting all your money into one stock increases risk. Diversify your portfolio to spread risk across different assets.

8. Chasing Losses: Trying to recover lost money quickly often leads to bigger losses. Accept losses as part of trading and move on.

9. Using Excessive Leverage: While leverage can amplify gains, it also increases potential losses. Use it cautiously and understand the risks involved.

10. Failing to Adapt: Sticking to a strategy that no longer works can lead to losses. Be flexible and willing to adjust your approach based on market conditions.

How can I develop a day trading plan?

To develop a day trading plan, follow these steps:

1. Set Clear Goals: Define your profit targets and risk tolerance. Know how much you aim to earn daily or monthly.

2. Choose a Market: Decide which asset class (stocks, forex, options) you’ll trade. Focus on a few to master.

3. Develop a Strategy: Select a trading strategy based on technical analysis, like scalping or momentum trading. Backtest it to ensure effectiveness.

4. Create Rules: Establish entry and exit rules. Specify conditions for buying and selling, including stop-loss and take-profit levels.

5. Risk Management: Allocate a percentage of your capital for each trade. Never risk more than 1-2% of your total account on a single trade.

6. Keep a Trading Journal: Document every trade. Analyze your successes and mistakes to refine your approach.

7. Stay Informed: Follow market news and trends. Use economic calendars to anticipate market movements.

8. Practice Discipline: Stick to your plan and avoid emotional trading. Review and adjust your plan periodically based on performance.

By following these steps, you can create a structured day trading plan that aligns with your trading goals.

Learn about How to Develop a Risk Management Plan for Day Trading

What are the psychological aspects of day trading?

The psychological aspects of day trading include emotional control, decision-making under pressure, and risk tolerance. Traders often experience fear and greed, which can lead to impulsive decisions. Maintaining discipline is crucial; sticking to a trading plan helps manage emotions. Additionally, cognitive biases, like overconfidence and loss aversion, can impact judgment. Successful day traders develop a strong mental framework to handle stress and remain focused on their strategies. Building resilience against losses and practicing patience can enhance overall performance.

How do I evaluate the performance of my day trading strategy?

To evaluate your day trading strategy, start by analyzing key metrics like win rate, risk-reward ratio, and average profit per trade. Track your trades in a journal, noting entry and exit points, market conditions, and emotional responses. Review performance over various market conditions to ensure consistency. Use backtesting with historical data to see how your strategy would have performed. Additionally, assess transaction costs and slippage, as they impact profitability. Regularly refine your approach based on this analysis to improve results.

Learn about How Do Prop Firms Evaluate Day Trading Performance?

What are common day trading patterns to watch for?

Common day trading patterns to watch for include:

1. Head and Shoulders: Indicates a reversal; a peak (head) between two lower peaks (shoulders).

2. Double Top and Bottom: Signals reversals; a double top occurs after an uptrend, while a double bottom follows a downtrend.

3. Triangles: Ascending, descending, or symmetrical; suggest continuation or reversal based on breakout direction.

4. Flags and Pennants: Short-term continuation patterns that follow a strong price movement, usually indicating a brief consolidation before the trend resumes.

5. Cup and Handle: Indicates bullish continuation; a rounded bottom followed by a consolidation period before breaking out.

6. Gap Patterns: Gaps up or down can signal strong momentum; watch for gap fill or continuation.

Focus on volume and price action to confirm these patterns for effective trading decisions.

Learn about Top 10 Day Trading Patterns to Watch

How can I stay disciplined in day trading?

To stay disciplined in day trading, establish a clear trading plan that outlines your goals, risk tolerance, and strategies. Stick to your plan without deviating based on emotions or market fluctuations. Use stop-loss orders to manage risk effectively and protect your capital. Keep a trading journal to track your trades, decisions, and emotions, which helps identify patterns and improve your strategy. Set specific trading hours and avoid overtrading to maintain focus. Regularly review your performance to learn from both successes and failures. Prioritize mental discipline through practices like mindfulness or meditation to keep emotions in check.

Learn about How to Stay Updated on AI Trends in Day Trading?

What are the tax implications of day trading?

Day trading can lead to significant tax implications. Profits are typically taxed as short-term capital gains, which means they're taxed at your ordinary income tax rate. Additionally, if you qualify as a "trader" under IRS rules, you might be able to deduct trading-related expenses. However, you must meet specific criteria for this status. Losses can offset gains, but any unrecognized losses can't be carried forward unless you meet certain conditions. Keep detailed records to ensure accurate reporting.

How can I learn from my day trading losses?

To learn from day trading losses, start by reviewing your trades. Analyze what went wrong—was it poor timing, emotional decision-making, or a flawed strategy? Keep a trading journal to document your thought process and outcomes. Identify patterns in your losses to pinpoint frequent mistakes. Adjust your strategies based on these insights, and consider backtesting them to see if they improve your results. Lastly, continuously educate yourself about market trends and risk management to enhance your decision-making.

Learn about How to Learn from Day Trading Mistakes

Conclusion about Analyzing Day Trading Strategies: What Works?

In conclusion, mastering day trading requires a combination of effective strategies, risk management, and continuous evaluation. By leveraging key indicators, conducting thorough technical analysis, and utilizing the right tools, traders can enhance their chances of success. Understanding market volatility and timing is crucial, while maintaining discipline and learning from mistakes will further refine your approach. For those looking to deepen their knowledge and skills, resources like DayTradingBusiness can provide invaluable insights and guidance.