Did you know that even seasoned day traders sometimes forget their own strategies and end up trading on gut feelings? In the fast-paced world of day trading, having a well-defined strategy is crucial for success. This article explores the importance of strategy in day trading and offers guidance on developing an effective approach tailored to your trading style. Key components of a successful strategy, popular methods for beginners, and the critical role of risk management and technical analysis are covered. Additionally, learn how to backtest your strategy, avoid common pitfalls, and adapt to market changes. With insights from DayTradingBusiness, you’ll be equipped to refine your strategy and improve your trading performance.

What is the importance of strategy in day trading?

A strategy in day trading is crucial because it guides your decisions, helps manage risk, and maximizes profit potential. It provides a clear plan for entry and exit points, ensuring disciplined trading rather than emotional responses. A well-defined strategy allows for consistency, enabling traders to analyze performance and adapt over time. Ultimately, it can differentiate between losses and gains in the fast-paced day trading environment.

How can I develop an effective day trading strategy?

To develop an effective day trading strategy, start by defining your trading goals and risk tolerance. Choose a specific market or asset class to focus on, like stocks or forex. Utilize technical analysis tools, such as charts and indicators, to identify entry and exit points. Set clear criteria for trade execution, including stop-loss and take-profit levels to manage risk. Keep a trading journal to track your trades and analyze performance. Continuously refine your strategy based on your experiences and market conditions. Stay disciplined and stick to your plan, avoiding emotional trading decisions.

What are the key components of a successful day trading strategy?

The key components of a successful day trading strategy include:

1. Market Research: Analyze market trends and news to identify opportunities.

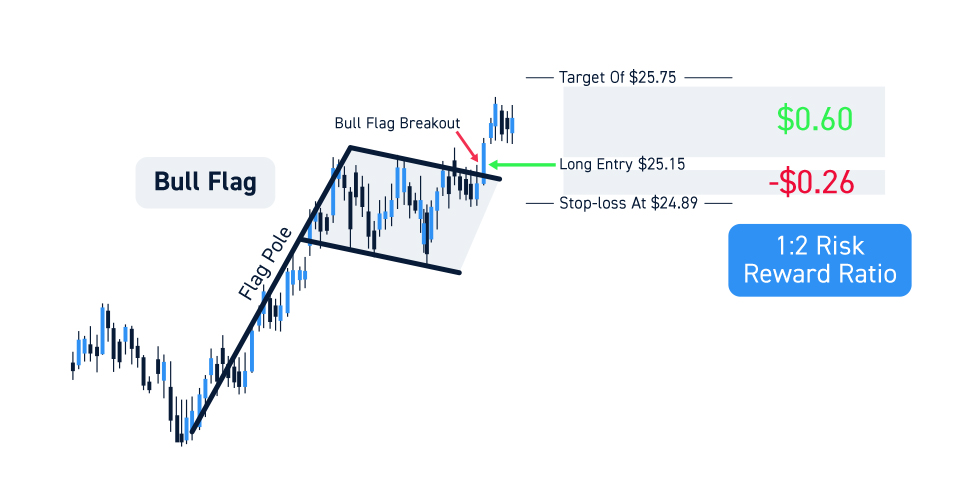

2. Risk Management: Set stop-loss orders and determine position sizes to protect your capital.

3. Technical Analysis: Use charts and indicators to spot entry and exit points.

4. Trading Plan: Define clear rules for when to buy and sell, including profit targets.

5. Discipline: Stick to your plan and avoid emotional trading decisions.

6. Review and Adaptation: Regularly assess your performance and adjust your strategy as needed.

Each component is crucial for maximizing profits and minimizing losses in day trading.

How do I choose the right trading strategy for my style?

To choose the right trading strategy for your style, first assess your risk tolerance and time commitment. If you prefer quick decisions and can monitor the market closely, consider scalping or day trading. If you're more patient and can hold positions longer, swing trading might suit you better. Evaluate your analytical skills; if you're comfortable with technical analysis, trend-following strategies could work well. Test different strategies with a demo account to see which aligns with your personality and goals. Always review your performance and adjust as needed.

What are some popular day trading strategies for beginners?

Popular day trading strategies for beginners include:

1. Scalping: Quickly buying and selling stocks to capture small price movements. Focus on high-volume stocks.

2. Momentum Trading: Identifying stocks that are trending strongly and buying them to ride the wave until signs of reversal appear.

3. Breakout Trading: Entering trades when a stock price breaks above resistance or below support levels, often accompanied by high volume.

4. Reversal Trading: Looking for stocks that have moved significantly in one direction and betting on a reversal based on technical indicators.

5. News-Based Trading: Capitalizing on stocks that react to news events, earnings reports, or economic data.

6. Technical Analysis: Using charts and indicators like moving averages or RSI to make informed trading decisions.

These strategies help beginners navigate the fast-paced day trading landscape effectively.

How does risk management fit into day trading strategies?

Risk management is crucial in day trading strategies because it helps protect capital and minimize losses. Traders should set stop-loss orders to limit potential losses on each trade. Diversifying trades and not risking more than a small percentage of total capital on a single trade also helps manage risk. Additionally, using position sizing techniques ensures that trades align with the trader's risk tolerance and market conditions. Effective risk management allows traders to stay in the game longer and increases the chances of overall profitability.

What role does technical analysis play in day trading strategies?

Technical analysis is crucial in day trading strategies as it helps traders identify price trends and potential entry and exit points. By analyzing charts, indicators, and patterns, traders can make informed decisions based on historical price movements. This data-driven approach allows them to capitalize on short-term market fluctuations, manage risk effectively, and maximize profit opportunities. In essence, technical analysis provides the tools needed to navigate the fast-paced day trading environment.

How can I backtest my day trading strategy effectively?

To backtest your day trading strategy effectively, follow these steps:

1. Define Your Strategy: Clearly the rules for entry, exit, and risk management.

2. Choose a Backtesting Platform: Use software like TradingView, MetaTrader, or specialized backtesting tools that fit your needs.

3. Gather Historical Data: Obtain accurate historical price data for the assets you trade, ensuring it covers various market conditions.

4. Input Your Strategy: Program your strategy into the backtesting platform, including all parameters and conditions.

5. Run the Backtest: Execute the backtest over your selected time frame, analyzing performance metrics like win rate, profit factor, and drawdowns.

6. Analyze Results: Review the outcomes critically. Look for patterns, strengths, and weaknesses in your strategy.

7. Refine Your Strategy: Make necessary adjustments based on the backtest results, and retest to validate improvements.

8. Forward Test: Once satisfied, implement your strategy in a simulated environment before trading with real money.

This process ensures you understand how your strategy performs under different market conditions, increasing your chances of day trading success.

What are common mistakes in day trading strategies?

Common mistakes in day trading strategies include:

1. Lack of a Plan: Trading without a clear strategy can lead to impulsive decisions.

2. Ignoring Risk Management: Failing to set stop-loss orders can result in significant losses.

3. Overtrading: Excessive buying and selling can erode profits due to commissions and fees.

4. Emotional Trading: Allowing fear or greed to drive decisions often leads to poor outcomes.

5. Neglecting Market Research: Not staying informed on market trends and news can result in missed opportunities.

6. Chasing Losses: Trying to recover from losses quickly can lead to even larger losses.

7. Inadequate Position Sizing: Investing too much in a single trade can increase risk disproportionately.

Avoid these pitfalls to enhance your day trading success.

How do trading indicators influence day trading strategies?

Trading indicators are essential tools in day trading strategies as they provide insights into market trends, price movements, and potential entry and exit points. Indicators like moving averages help traders identify trends, while oscillators like RSI signal overbought or oversold conditions. By analyzing these indicators, day traders can make informed decisions, enhance their risk management, and optimize their timing for trades. Ultimately, effective use of trading indicators can lead to more successful and profitable day trading outcomes.

Learn about How Do Institutional Traders Influence Day Trading Strategies?

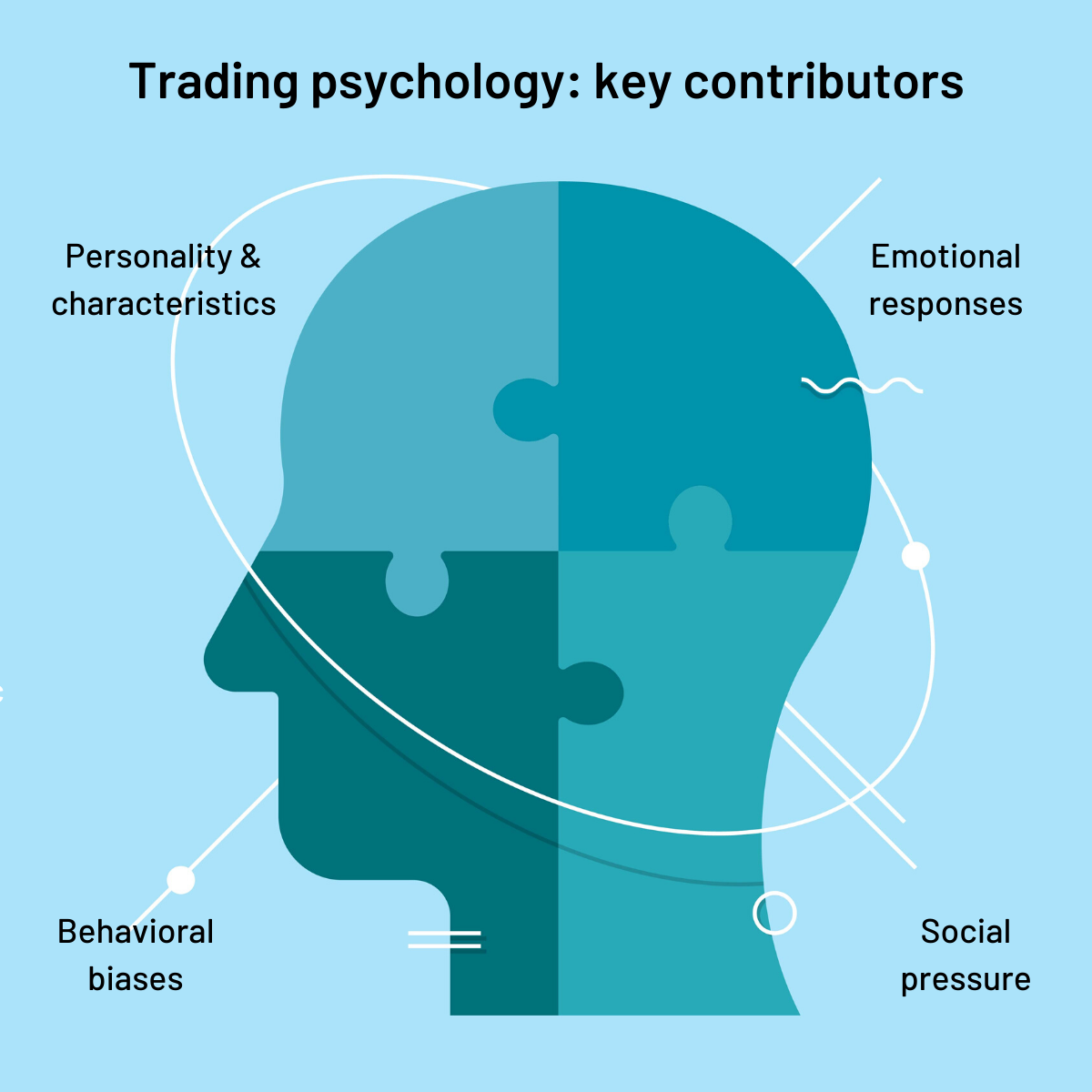

What is the significance of trading psychology in strategy development?

Trading psychology is crucial in strategy development because it influences decision-making, risk management, and emotional control. A trader's mindset can determine how effectively they stick to their strategy, especially during volatile market conditions. Understanding psychological factors helps in creating strategies that align with one’s risk tolerance and emotional responses. This leads to more consistent execution and better overall performance in day trading.

How often should I revise my day trading strategy?

Revise your day trading strategy regularly, ideally after every trading week or month. Analyze your performance, identify trends, and adapt to market changes. If you notice consistent losses or shifting market conditions, update your strategy immediately. Flexibility is key for day trading success.

What are the differences between short-term and long-term day trading strategies?

Short-term day trading strategies focus on quick trades, typically lasting seconds to minutes, aiming for small price movements. They rely on real-time market data and technical analysis, requiring constant monitoring and quick decision-making.

Long-term day trading strategies, on the other hand, involve holding positions for hours or even a full trading day. They aim for larger price shifts and often incorporate a combination of technical and fundamental analysis.

In summary, short-term strategies prioritize speed and quick gains, while long-term strategies focus on larger trends and less frequent trades.

Learn about Differences Between Day Trading Analysis and Long-Term Analysis

How can I use market news in my day trading strategy?

Incorporate market news into your day trading strategy by following these steps:

1. Stay Informed: Monitor financial news sources and economic calendars for upcoming events that could impact stock prices.

2. Analyze Impact: Assess how specific news, like earnings reports or economic data releases, may affect the stocks you're trading.

3. Set Alerts: Use trading platforms to set alerts for news events related to your target stocks, ensuring you're ready to react.

4. Identify Trends: Look for patterns in how stocks have reacted to similar news in the past to guide your trading decisions.

5. Use Technical Analysis: Combine news with technical indicators to confirm entry and exit points for trades.

6. Stay Flexible: Be ready to adjust your strategy as news develops, as market sentiment can shift quickly.

By integrating market news into your approach, you can better anticipate price movements and enhance your day trading success.

Learn about How to Use Market Microstructure Data to Improve Day Trading Outcomes

What metrics should I track to measure strategy performance in day trading?

Track these key metrics to measure strategy performance in day trading:

1. Win Rate: Percentage of profitable trades versus total trades.

2. Risk-Reward Ratio: Average profit per trade divided by average loss.

3. Average Trade Duration: Time spent in each trade, indicating strategy efficiency.

4. Drawdown: Peak-to-trough decline in account balance, showing risk exposure.

5. Total Return: Overall profit or loss over a specific period.

6. Sharpe Ratio: Risk-adjusted return, indicating how much excess return you're getting for the risk taken.

7. Trade Frequency: Number of trades executed in a given timeframe, reflecting strategy activity.

Monitoring these metrics helps you refine your day trading strategy and improve overall performance.

How Do Day Trading Strategies Impact Success for Beginners?

The role of strategy in day trading success is crucial. A well-defined strategy helps beginners make informed decisions, manage risk, and set clear entry and exit points. It allows traders to stay disciplined, avoid emotional trading, and adapt to market conditions effectively. Successful day trading relies on consistent application of a strategy that suits individual risk tolerance and trading style.

Learn more about: Day Trading Strategies for Beginners

Learn about How to Backtest Day Trading Strategies for Success

How do I adapt my day trading strategy to changing market conditions?

To adapt your day trading strategy to changing market conditions, first, analyze current market trends and volatility. Adjust your entry and exit points based on real-time data and indicators. Incorporate new technical analysis tools to assess momentum shifts. Stay flexible; if a strategy isn't working, be ready to pivot quickly. Use stop-loss orders to manage risk effectively during unpredictable movements. Regularly review your performance and refine your strategy to align with evolving market dynamics.

Learn about How Market Microstructure Insights Improve Day Trading Accuracy

Conclusion about The Role of Strategy in Day Trading Success

In summary, a well-defined strategy is crucial for success in day trading, as it guides decision-making and risk management. Developing an effective strategy involves understanding your trading style, incorporating technical analysis, and utilizing market news. Key components include risk management, backtesting, and the ability to adapt to market changes. Regularly revising your approach and tracking performance metrics will enhance your trading outcomes. For more in-depth insights and support, DayTradingBusiness is here to help you navigate these complexities.