Did you know that the stock market can be more unpredictable than a cat on a hot tin roof? Navigating day trading requires a keen understanding of market conditions and the ability to adjust strategies accordingly. This article dives into essential tactics for adapting your day trading approach, whether it's during volatile markets, economic events, or shifting trends. Key topics include identifying market conditions, utilizing indicators, managing risks, and leveraging technical analysis. Additionally, we explore the psychological aspects of trading and provide tools and common mistakes to avoid. With insights from DayTradingBusiness, you'll be well-equipped to refine your trading strategy and maximize your success.

How Can I Adjust My Day Trading Strategy for Volatile Markets?

To adjust your day trading strategy for volatile markets, focus on these key steps:

1. Tighten Stop Losses: Use tighter stop losses to minimize potential losses in rapid price swings.

2. Reduce Position Sizes: Scale down your position sizes to manage risk more effectively during high volatility.

3. Increase Focus on Technical Indicators: Rely on indicators like Bollinger Bands or Average True Range (ATR) to gauge volatility and adjust entry/exit points.

4. Set Clear Profit Targets: Establish realistic profit targets to capture gains quickly before the market reverses.

5. Be Ready to Adapt Quickly: Stay alert and be prepared to change your strategy as market conditions shift.

6. Limit Trading Frequency: Consider trading less frequently to avoid getting caught in erratic price movements.

7. Emphasize News Awareness: Monitor economic news and events closely, as they often trigger volatility.

Implementing these adjustments can help you navigate volatile markets more effectively.

What Indicators Should I Use to Adapt My Day Trading to Market Trends?

Use moving averages to identify trends, like the 50-day or 200-day for direction. The Relative Strength Index (RSI) helps gauge if a stock is overbought or oversold. Bollinger Bands can indicate volatility and potential price reversals. Volume analysis reveals the strength of a trend. Finally, consider the Average True Range (ATR) for measuring market volatility and adjusting your risk management.

How Do Economic Events Impact My Day Trading Strategy?

Economic events significantly impact day trading strategies by influencing market volatility and sentiment. Key events like interest rate announcements, employment reports, and GDP releases can cause price swings.

To adapt, stay informed on upcoming economic data and adjust your trading plan accordingly. For instance, increase position sizes during high volatility events or tighten stop-loss levels to mitigate risk. Use economic calendars to anticipate these events and align your trades with market expectations. This proactive approach can enhance your trading effectiveness.

What Are the Best Strategies for Day Trading During a Bear Market?

1. Focus on Short Selling: Identify overvalued stocks and short them to capitalize on declines.

2. Use Technical Analysis: Rely on charts and indicators to find entry and exit points, especially during price reversals.

3. Set Tight Stop-Loss Orders: Protect your capital by setting stop-loss orders close to your entry points.

4. Trade Volatility: Look for stocks with high volatility; these can provide quick profit opportunities.

5. Stick to Liquid Stocks: Choose stocks with high trading volumes to ensure quick executions.

6. Limit Position Sizes: Reduce your exposure to minimize risk in a bearish environment.

7. Stay Informed: Monitor news and economic indicators that could affect market sentiment.

8. Be Flexible: Adjust your strategies based on changing market conditions and trends.

How Can I Modify My Day Trading Approach in a Bull Market?

To modify your day trading approach in a bull market, focus on these strategies:

1. Increase Position Sizes: With rising prices, consider larger positions to capitalize on momentum.

2. Trend Following: Utilize trend-following strategies, buying stocks that show strong upward movement.

3. Use Momentum Indicators: Rely on indicators like the RSI or MACD to identify strong buy signals.

4. Set Higher Profit Targets: In a bull market, aim for larger gains since stocks may continue to rise.

5. Reduce Short Selling: Limit or avoid short positions, as they can carry higher risks in a bullish environment.

6. Stay Informed: Keep an eye on market news and earnings reports that could drive prices higher.

7. Adjust Stop Losses: Use trailing stops to lock in profits as prices rise.

These adjustments can help you take full advantage of a bull market's opportunities.

What Role Does Market Sentiment Play in Day Trading Adjustments?

Market sentiment significantly influences day trading adjustments. When sentiment shifts to bullish, traders may increase their positions, anticipating upward momentum. Conversely, in a bearish sentiment, traders often cut losses or short sell to maximize gains. Monitoring news, social media, and economic indicators helps gauge this sentiment, allowing traders to adapt their strategies accordingly. For example, if positive earnings reports boost sentiment, a trader might focus on buying stocks in that sector. Staying attuned to sentiment trends ensures timely adjustments and better risk management in day trading.

How Do I Identify Changing Market Conditions for Day Trading?

To identify changing market conditions for day trading, monitor key indicators like price action, volume changes, and volatility. Look for patterns in charts, such as breakouts or reversals. Pay attention to economic news and events that can impact market sentiment. Use technical indicators like RSI or MACD to gauge overbought or oversold conditions. Regularly assess the overall market trend—bullish or bearish—and adjust your strategy accordingly. Keep a close watch on sector performance; strong or weak sectors can signal shifts in broader market dynamics.

What Risk Management Techniques Should I Use in Different Market Conditions?

In trending markets, use trailing stops to lock in profits as prices move. In choppy markets, employ tighter stop-loss orders to minimize losses. For volatile conditions, consider options strategies like straddles or strangles to capture price swings. In sideways markets, focus on range trading, buying at support and selling at resistance. Always adjust position sizes based on market volatility to manage risk effectively.

How Can I Stay Informed About Market Changes Affecting Day Trading?

To stay informed about market changes affecting day trading, follow these steps:

1. Use Financial News Apps: Download apps like Bloomberg or CNBC for real-time updates.

2. Set Alerts: Create alerts for specific stocks or market indices to get instant notifications on price changes or news.

3. Follow Market Analysts: Subscribe to insights and analysis from trusted traders or analysts on social media platforms like Twitter or LinkedIn.

4. Join Trading Forums: Engage in online communities or forums where traders share strategies and market news.

5. Monitor Economic Calendars: Check calendars for upcoming economic reports, earnings announcements, or other events that can impact the market.

6. Review Technical Indicators: Regularly analyze charts and indicators to identify trends and shifts in market conditions.

7. Stay Updated on Global Events: Watch global news that could influence market sentiment, such as geopolitical developments or economic policy changes.

By actively using these resources, you can adapt your day trading strategy more effectively to market conditions.

What Tools Can Help Me Adapt My Day Trading Strategy?

To adapt your day trading strategy to market conditions, consider using the following tools:

1. Technical Analysis Software: Tools like TradingView or MetaTrader provide charts and indicators to analyze price movements and identify trends.

2. News Aggregators: Use platforms like Benzinga or Bloomberg to stay updated on market news that could impact your trades.

3. Economic Calendars: Websites like Forex Factory or Investing.com help you track upcoming economic events that may influence market volatility.

4. Backtesting Tools: Software like Amibroker or NinjaTrader allows you to test your strategy against historical data to gauge its effectiveness.

5. Risk Management Tools: Use apps or calculators to determine position sizes and set stop-loss orders to protect your capital.

6. Social Trading Platforms: Consider using eToro or ZuluTrade to follow experienced traders and adapt strategies based on their insights.

7. Volatility Indicators: Tools like the Average True Range (ATR) can help you assess market volatility and adjust your trading approach accordingly.

Incorporating these tools will enhance your ability to adapt to changing market conditions effectively.

How Do I Backtest My Day Trading Strategy Against Various Market Conditions?

To backtest your day trading strategy against various market conditions, follow these steps:

1. Select a Trading Platform: Use a trading platform that offers historical data and backtesting tools, like MetaTrader or TradingView.

2. Define Market Conditions: Identify different market conditions (bullish, bearish, sideways) you want to test against.

3. Gather Historical Data: Collect historical price data for the assets you trade, focusing on different time frames.

4. Create Backtest Scenarios: Simulate your strategy under the defined market conditions using the historical data. Adjust parameters like entry and exit points.

5. Analyze Results: Evaluate performance metrics such as win rate, average profit, and drawdown for each condition. Look for patterns in how your strategy performs.

6. Refine Your Strategy: Use insights from your backtesting to tweak your strategy for better adaptability across different market conditions.

7. Forward Test: After backtesting, conduct a forward test in a demo account to validate your findings in real-time market scenarios.

This process will help you understand how your day trading strategy holds up against varying market conditions.

Learn about How Market Microstructure Insights Improve Day Trading Accuracy

What Common Mistakes Should I Avoid When Adapting My Day Trading Strategy?

1. Ignoring Market Conditions: Always adjust your strategy based on current market trends. Failing to do so can lead to losses.

2. Overtrading: Avoid taking too many trades in a short time. Stick to your plan and only trade when conditions align with your strategy.

3. Lack of Risk Management: Never risk more than a small percentage of your capital on a single trade. Set stop-loss orders to limit potential losses.

4. Emotional Trading: Don’t let fear or greed dictate your decisions. Stay disciplined and stick to your strategy.

5. Neglecting Technical Analysis: Ensure you’re using up-to-date charts and indicators to inform your trades. Ignoring them can lead to poor decisions.

6. Failing to Review Performance: Regularly analyze your trades to identify what works and what doesn’t. Continuous improvement is key.

7. Not Adapting to Volatility: Adjust your strategy to account for increased or decreased market volatility. Different conditions require different approaches.

Learn about Common Mistakes in Day Trading Analysis to Avoid

How Can I Use Technical Analysis to Modify My Day Trading?

To use technical analysis for modifying your day trading strategy, start by analyzing price charts and identifying key patterns like support and resistance levels. Use indicators such as moving averages and RSI to gauge momentum and identify potential entry and exit points. Adjust your strategy based on market conditions; for instance, if volatility increases, consider tighter stop-loss orders. Incorporate trend analysis to align your trades with the prevailing market direction. Regularly backtest your modifications to ensure effectiveness before applying them in live trades.

Learn about How to Use Technical Analysis for Day Trading ETFs

How Can Beginners Adapt Their Day Trading Strategies to Changing Market Conditions?

To adapt your day trading strategy to market conditions, assess volatility, market trends, and news events. Use technical indicators like moving averages and RSI to identify entry and exit points. Adjust position sizes based on market risk and ensure your stop-loss orders reflect current conditions. Stay flexible and continuously monitor your strategy's effectiveness against changing market dynamics.

Learn more about: Day Trading Strategies for Beginners

Learn about How Market Microstructure Insights Improve Day Trading Accuracy

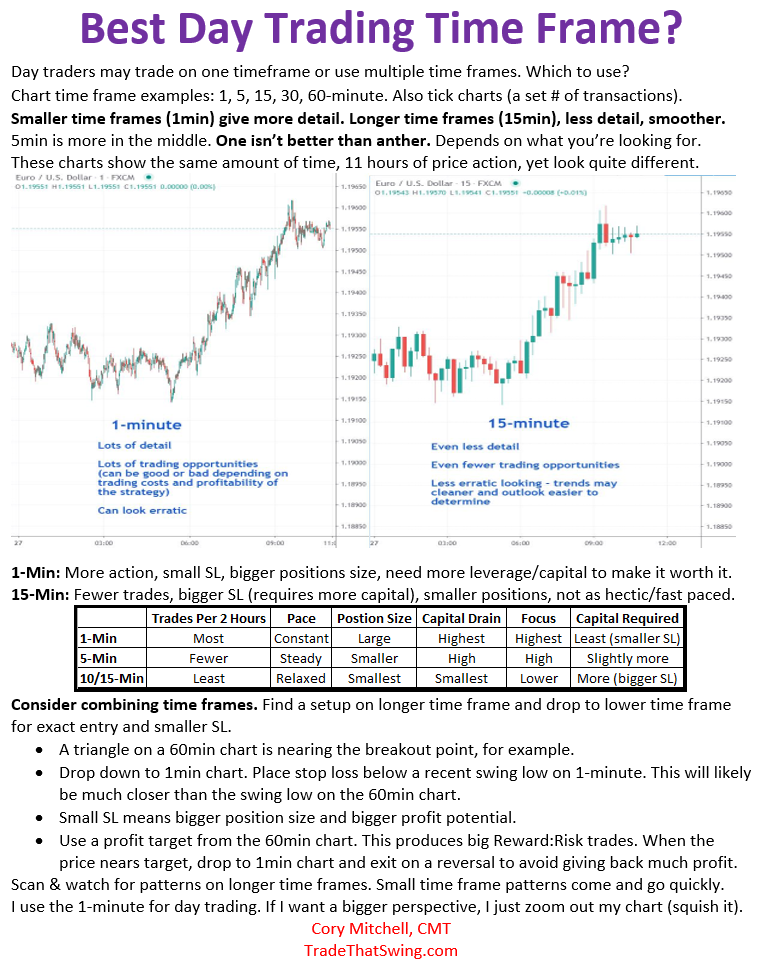

What Time Frames Should I Consider for Day Trading in Different Markets?

For day trading, consider the following time frames based on market conditions:

1. Stocks: Use 1-minute to 5-minute charts for quick trades and 15-minute charts for broader trends.

2. Forex: Stick to 5-minute to 15-minute charts for fast-paced trades, and 30-minute charts for slightly longer strategies.

3. Futures: Opt for 1-minute to 5-minute charts for speed, while 15-minute charts can help spot larger moves.

4. Cryptocurrency: Use 1-minute to 5-minute charts for rapid trades, but also check 15-minute charts for trend validation.

Adapt your strategy by observing volatility and volume; higher volatility may favor shorter time frames while calmer markets might allow for slightly longer positions.

How Do Seasonal Trends Affect My Day Trading Strategy Adaptations?

Seasonal trends can significantly impact your day trading strategy. For example, certain stocks may perform better during specific seasons, like retail stocks in Q4 due to holiday shopping. Adjust your strategy by analyzing historical price movements during these periods to identify patterns.

Additionally, consider volume fluctuations; trading volumes can drop during summer months, affecting liquidity. You might need to tighten your stop losses or adjust your position sizes.

Stay updated on economic reports tied to seasonal trends, as they may influence market sentiment. Incorporating these insights can enhance your day trading decisions and improve your overall performance.

Learn about How Does Insider Trading Affect Day Traders?

What Are the Psychological Aspects of Adapting Day Trading Strategies?

Adapting day trading strategies requires a keen understanding of psychological aspects like emotional control, discipline, and risk tolerance. Traders must manage fear and greed to avoid impulsive decisions. Staying disciplined helps in sticking to a well-defined plan, while self-awareness allows traders to recognize biases and adjust strategies effectively. Additionally, maintaining a growth mindset can help in learning from losses and refining approaches based on market conditions. Regular self-reflection and journaling can enhance decision-making and adaptability in fluctuating markets.

Learn about Psychological Aspects of Day Trading Scalping

Conclusion about Adapting Your Day Trading Strategy to Market Conditions

In conclusion, successfully adapting your day trading strategy to ever-changing market conditions is crucial for maximizing profits and minimizing losses. By understanding market volatility, utilizing appropriate indicators, and staying informed about economic events, you can enhance your trading approach. Risk management techniques and the ability to identify market sentiment further empower your strategy adjustments. As you refine your methods, remember that continuous learning and adaptation are key. For comprehensive insights and support, DayTradingBusiness is here to guide you in navigating the complexities of day trading.

Learn about The Impact of Market Conditions on Day Trading Backtesting

Sources:

- A hybrid decision support system for adaptive trading strategies ...

- Adaptation and development pathways for different types of farmers ...

- A global perspective on the marketing mix across time and space ...

- Speech by Chair Powell on the economic outlook - Federal Reserve ...

- Financial News-Driven LLM Reinforcement Learning for Portfolio ...

- Automate Strategy Finding with LLM in Quant investment