Did you know that more people have been bitten by sharks than have successfully day traded their way to riches? While the odds may seem daunting, 2023 presents a wealth of innovative day trading strategies that can help you navigate the market's waters. This article dives into the top strategies for the year, emphasizing the importance of technical analysis, risk management, and identifying high-potential stocks. Learn how to leverage news events, choose the best time frames, and utilize essential tools for your trading arsenal. We also cover common mistakes to avoid, effective chart patterns, and the benefits of algorithmic trading. Plus, discover tips for trading cryptocurrencies, managing your mindset, and understanding tax implications—all crucial for your success. With insights from DayTradingBusiness, you'll be well-equipped to make smart trading decisions in 2023!

What are the top day trading strategies for 2023?

1. Scalping: Focus on small price changes, executing multiple trades throughout the day to capitalize on minor fluctuations.

2. Momentum Trading: Identify and follow stocks with strong upward or downward trends, entering trades as momentum builds.

3. Breakout Trading: Look for stocks that break through established support or resistance levels, entering when the breakout occurs.

4. Reversal Trading: Find stocks that are overbought or oversold, betting on price reversals after significant moves.

5. News-Based Trading: Trade based on news events or earnings reports, reacting quickly to market-moving information.

6. Using Technical Indicators: Employ indicators like moving averages, RSI, or MACD to identify trading signals and trends.

7. Algorithmic Trading: Utilize automated trading systems to execute trades based on predefined criteria, reducing emotional decision-making.

8. Sector Rotation: Shift focus between sectors based on economic indicators or trends, investing in sectors expected to outperform.

9. Pair Trading: Trade correlated stocks by going long on one and short on another to capitalize on relative price movements.

10. Volume Analysis: Monitor trading volume to confirm trends, with higher volume often indicating stronger price movements.

How can I use technical analysis for day trading in 2023?

To use technical analysis for day trading in 2023, focus on these strategies:

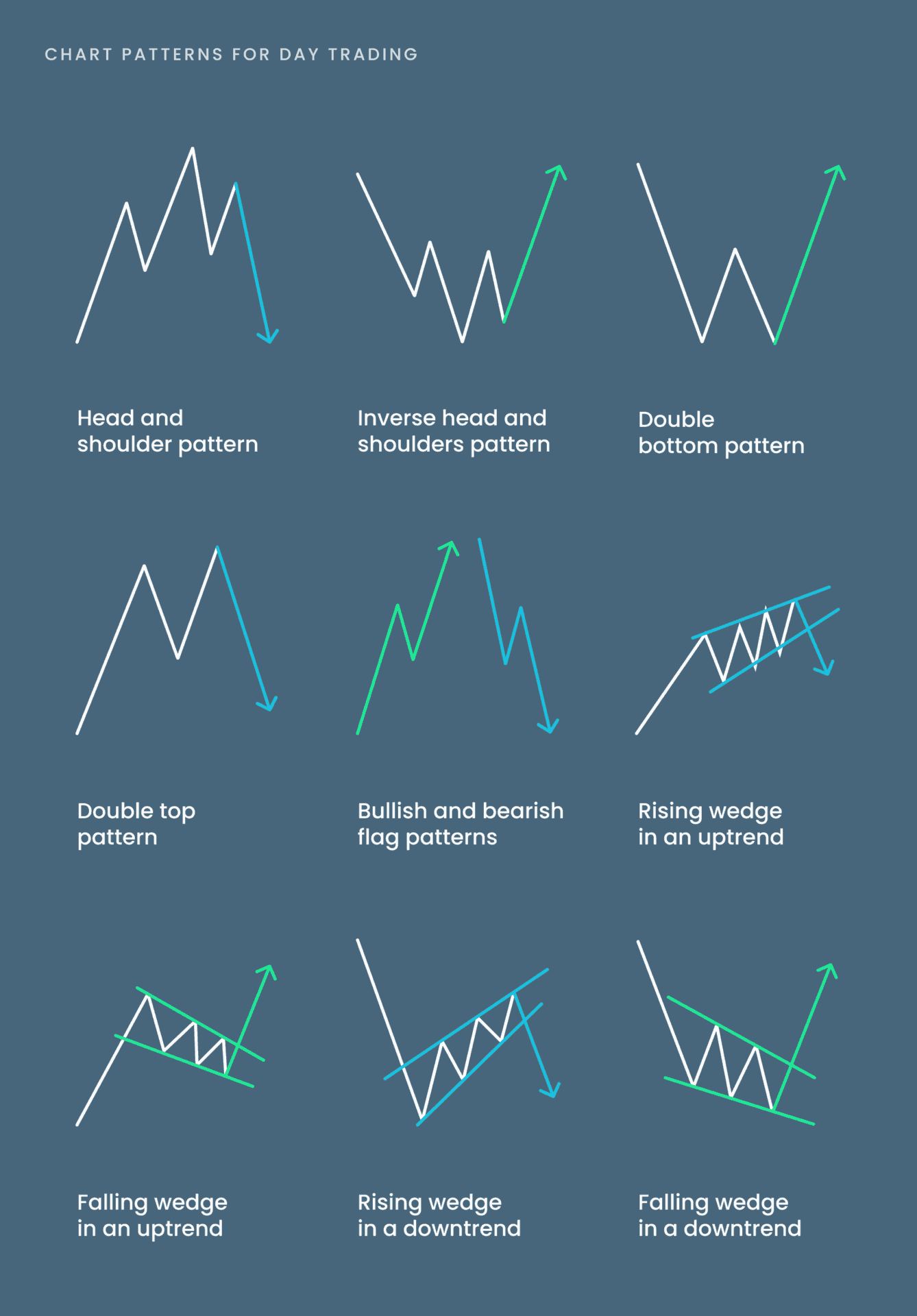

1. Chart Patterns: Identify key formations like head and shoulders, flags, and triangles to predict price movements.

2. Indicators: Utilize moving averages, Relative Strength Index (RSI), and MACD to gauge momentum and identify entry/exit points.

3. Volume Analysis: Monitor trading volume to confirm trends; rising volume with price increases suggests strength.

4. Support and Resistance Levels: Determine these levels to set target prices and stop-loss orders.

5. Candlestick Patterns: Use patterns like dojis and engulfing candles for insights into market sentiment.

6. Time Frames: Analyze multiple time frames (e.g., 5-minute, 15-minute) to enhance decision-making on trades.

7. Risk Management: Set strict risk-reward ratios and adhere to them to protect your capital.

Incorporate these elements consistently to refine your day trading approach.

What role does risk management play in day trading?

Risk management is crucial in day trading as it helps protect your capital and minimize losses. By setting stop-loss orders, you limit potential losses on trades. Position sizing enables you to control how much of your capital is at stake on each trade. Diversifying trades can reduce the impact of a single loss. Effective risk management allows traders to stay in the game longer and take advantage of innovative strategies without jeopardizing their overall portfolio.

How do I identify high-potential stocks for day trading?

To identify high-potential stocks for day trading, focus on these key factors:

1. Volume: Look for stocks with high trading volume; this indicates interest and potential price movement.

2. Volatility: Target stocks that demonstrate price fluctuations; these provide opportunities for profit within a single day.

3. News Catalysts: Monitor news and earnings reports that can trigger rapid price changes.

4. Technical Indicators: Use indicators like moving averages and RSI to spot entry and exit points.

5. Sector Trends: Identify sectors currently in favor; stocks within these sectors often show stronger movements.

6. Pre-market Activity: Check pre-market trading for stocks that are already moving before the market opens.

7. Chart Patterns: Familiarize yourself with chart patterns that historically lead to price spikes.

Combining these strategies will help you pinpoint stocks with high day trading potential.

What is the best time frame for day trading in 2023?

The best time frame for day trading in 2023 is typically between 5 to 15 minutes. This allows traders to capitalize on short-term price movements while maintaining enough data for effective analysis. Many successful day traders use 1-minute or 3-minute charts for precise entry and exit points, but 15-minute charts can provide a broader view for trend confirmation. Ultimately, the choice depends on your strategy and risk tolerance.

How can I leverage news events for day trading success?

To leverage news events for day trading success in 2023, focus on these strategies:

1. Stay Informed: Follow financial news sources and economic calendars for upcoming events like earnings reports, economic indicators, and geopolitical developments.

2. React Quickly: Use real-time news alerts to act fast on breaking news that impacts stock prices. Tools like Twitter and financial news apps can provide immediate updates.

3. Analyze Impact: Assess how news affects market sentiment. Positive earnings can boost stock prices, while negative news may lead to sell-offs.

4. Trade on Volatility: Look for stocks that exhibit high volatility during news events. This can provide opportunities for quick gains.

5. Use Technical Analysis: Combine news events with technical indicators. For example, if a stock has a positive news catalyst and is near a support level, it may be a good buy.

6. Set Clear Entry and Exit Points: Define your risk management strategy before trading around news events to protect against unexpected moves.

7. Follow Sector Trends: Some news affects entire sectors. Identify which sectors are impacted and trade related stocks.

8. Review Historical Reactions: Analyze past price movements following similar news events to gauge potential future reactions.

Incorporating these strategies can enhance your day trading success by capitalizing on the volatility and opportunities that news events create.

What tools and software are essential for day trading?

Essential tools and software for day trading include:

1. Trading Platforms: Look for platforms like TD Ameritrade's Thinkorswim, Interactive Brokers, or TradeStation for executing trades efficiently.

2. Charting Software: Use tools like TradingView or MetaTrader for advanced chart analysis and technical indicators.

3. Market News Feeds: Subscribe to services like Bloomberg or CNBC for real-time news that affects market movements.

4. Stock Screeners: Tools like Finviz or Trade Ideas help identify potential stocks based on specific criteria and performance metrics.

5. Risk Management Software: Utilize tools like TraderVue to track performance and manage risk effectively.

6. Economic Calendars: Follow platforms like Forex Factory for keeping up with important economic events that can impact trading.

7. Algorithmic Trading Software: Consider using tools like QuantConnect for automated trading strategies.

These tools help streamline the trading process, analyze market trends, and manage risks effectively.

How do I create a day trading plan for 2023?

To create a day trading plan for 2023, follow these steps:

1. Define Your Goals: Set specific financial targets and determine your risk tolerance.

2. Choose Your Market: Decide whether you’ll trade stocks, options, forex, or cryptocurrencies.

3. Develop a Strategy: Research innovative strategies, such as momentum trading or using algorithmic tools. Consider technical indicators like moving averages or RSI.

4. Set Entry and Exit Rules: Clearly when to enter and exit trades, including stop-loss and take-profit levels.

5. Risk Management: Allocate a percentage of your capital per trade, typically no more than 1-2%.

6. Create a Trading Schedule: Decide on the times you’ll trade based on market hours and your availability.

7. Maintain a Trading Journal: Track your trades, strategies used, outcomes, and lessons learned to refine your approach.

8. Stay Informed: Keep up with market news and economic indicators that may affect your trading.

9. Review and Adjust: Regularly evaluate your performance and adjust your plan based on results and changing market conditions.

Implement these elements for a structured and effective day trading plan in 2023.

What are the common mistakes to avoid in day trading?

Common mistakes to avoid in day trading include:

1. Overtrading: Taking too many positions can lead to losses. Stick to your strategy and set limits.

2. Ignoring Risk Management: Always use stop-loss orders to protect your capital. Don’t risk more than 1-2% of your trading account on a single trade.

3. Chasing Losses: Avoid the temptation to double down on losing trades. Accept losses and move on.

4. Lack of a Trading Plan: Entering trades without a clear strategy can lead to impulsive decisions. Have a well-defined plan.

5. Emotional Trading: Decisions based on fear or greed can derail your strategy. Stay disciplined and stick to your plan.

6. Neglecting Market Research: Stay informed about market trends and news that can impact your trades. Research is key.

7. Ignoring Transaction Costs: Frequent trading can rack up fees that eat into profits. Be mindful of costs associated with each trade.

8. Failure to Adapt: Markets change; strategies that worked yesterday may not work today. Be flexible and ready to adjust your approach.

Avoiding these pitfalls can enhance your day trading success in 2023.

How can I effectively use chart patterns in day trading?

To effectively use chart patterns in day trading, start by familiarizing yourself with key patterns like head and shoulders, triangles, and flags. Identify these patterns on your charts to anticipate price movements.

Use volume as a confirmation tool; increased volume during a breakout signals strength. Set clear entry and exit points based on your patterns, and always apply stop-loss orders to manage risk.

Practice with paper trading to refine your skills before using real capital. Stay disciplined and stick to your trading plan to maximize your success in 2023.

Learn about How to Use Chart Patterns for Day Trading Analysis

What are the most innovative day trading strategies for beginners in 2023?

Innovative day trading strategies for 2023 include momentum trading, scalping, and using algorithmic trading bots. Additionally, consider employing technical analysis with indicators like RSI and moving averages, along with news-based trading to capitalize on market events.

Learn more about: Day Trading Strategies for Beginners

Learn about Day Trading Strategies for Beginners

What are the benefits of using algorithmic trading strategies?

Algorithmic trading strategies offer several benefits for day traders in 2023. They provide speed and efficiency, executing trades in milliseconds, which is crucial for capitalizing on market opportunities. These strategies minimize emotional bias, enabling traders to stick to their plans without succumbing to fear or greed. They also allow for backtesting, where traders can analyze historical data to refine their strategies before applying them in real-time. Additionally, algorithmic trading can handle complex calculations and multiple market factors simultaneously, increasing accuracy and potential profitability. Overall, they enhance decision-making, optimize trade execution, and improve risk management.

How should I approach day trading for cryptocurrencies?

Focus on these key strategies for day trading cryptocurrencies in 2023:

1. Technical Analysis: Use charts and indicators like RSI, MACD, and moving averages to identify trends and entry/exit points.

2. Scalping: Aim for small, quick profits by making numerous trades throughout the day, capitalizing on minor price fluctuations.

3. News Trading: Stay updated on crypto news and events. Trade based on market reactions to announcements or regulatory changes.

4. Risk Management: Set strict stop-loss orders to minimize losses. Never risk more than 1-2% of your capital on a single trade.

5. Diversification: Trade multiple cryptocurrencies to spread risk. Focus on high-volume coins for better liquidity.

6. Use Trading Bots: Automate your strategies with bots to execute trades quickly based on predefined criteria.

7. Market Sentiment: Monitor social media and forums to gauge trader sentiment. This can influence price movements.

8. Practice: Use paper trading to refine your strategies without risking real money.

Implementing these strategies can enhance your day trading success in the volatile crypto market.

What indicators should I focus on for day trading?

Focus on these key indicators for day trading in 2023:

1. Moving Averages: Use the 50-day and 200-day moving averages to identify trends.

2. Relative Strength Index (RSI): Look for overbought or oversold conditions to find entry and exit points.

3. Volume: Monitor trading volume to confirm trends and reversals.

4. Bollinger Bands: Assess price volatility and potential breakout points.

5. MACD (Moving Average Convergence Divergence): Identify momentum shifts and potential buy/sell signals.

6. Fibonacci Retracement: Use it to spot potential support and resistance levels.

Combine these indicators for a robust trading strategy.

How do I stay disciplined as a day trader?

To stay disciplined as a day trader in 2023, establish a clear trading plan with specific entry and exit points. Set strict risk management rules, like limiting losses to a certain percentage of your capital. Stick to your plan regardless of emotions or market noise. Use technology, like trading journals or apps, to track your trades and analyze performance. Regularly review and adjust your strategies based on what works and what doesn’t. Finally, practice mindfulness techniques to maintain focus and reduce stress during trading hours.

Learn about How to Stay Disciplined While Day Trading Scalping

What are the tax implications of day trading in 2023?

Day trading in 2023 has specific tax implications. Profits from day trading are typically taxed as short-term capital gains, which means they are taxed at your ordinary income tax rate. If you trade frequently, you might qualify for trader tax status, allowing you to deduct certain expenses, like trading fees and home office costs. Keep in mind that losses can offset gains, but you'll need to report them accurately. Always consult a tax professional for personalized advice, as regulations can vary based on your location and situation.

Learn about Tax Implications of Day Trading in Different Countries

How can I improve my day trading psychology and mindset?

To improve your day trading psychology and mindset, focus on these strategies:

1. Set Clear Goals: Define specific, measurable objectives for your trading sessions. This keeps you focused and motivated.

2. Develop a Routine: Establish a consistent daily routine that includes market analysis, trading hours, and breaks. This creates a structured environment.

3. Practice Mindfulness: Use techniques like meditation or deep breathing to stay calm and focused during trading. This helps manage stress and emotional reactions.

4. Keep a Trading Journal: Document your trades, thoughts, and emotions. Reviewing your journal helps identify patterns and areas for improvement.

5. Limit Social Media Influence: Reduce exposure to trading forums and social media distractions. This allows you to make decisions based on your analysis, not others' opinions.

6. Embrace Losses: Accept that losses are part of trading. Learn to view them as opportunities for growth rather than failures.

7. Stay Educated: Continuously learn new strategies and market trends. Knowledge boosts confidence and decision-making.

8. Use Visualization: Imagine successful trades and how you’ll react to challenges. This mental practice prepares you for real scenarios.

9. Set Risk Parameters: Determine how much you’re willing to lose on each trade. Stick to these limits to avoid emotional decision-making.

10. Cultivate Patience: Wait for your trading setup before entering a trade. Avoid impulsive decisions driven by fear or greed.

Implement these strategies to enhance your day trading mindset and improve overall performance.

Learn about How Market Microstructure Insights Improve Day Trading Accuracy

Conclusion about Innovative Day Trading Strategies for 2023

In conclusion, mastering innovative day trading strategies in 2023 requires a comprehensive approach that encompasses technical analysis, risk management, and the identification of high-potential stocks. Utilizing essential tools and staying informed on market news can enhance your trading success. By focusing on disciplined practices and learning from common pitfalls, traders can navigate the complexities of the market effectively. For deeper insights and tailored strategies, consider leveraging the expertise offered by DayTradingBusiness.

Sources:

- Stochastic optimization of trading strategies in sequential electricity ...

- An innovative high-frequency statistical arbitrage in Chinese futures ...

- Synergizing quantitative finance models and market microstructure ...

- The impact and profitability of day trading following the relaxation of ...

- Artificial Intelligence Can Make Markets More Efficient—and More ...

- Trading strategies and Financial Performances: A simulation approach