Did you know that even the most seasoned traders can mistake an ETF for a fancy sandwich? While they might be delicious, ETFs (Exchange-Traded Funds) are actually powerful tools for day trading. This beginner's guide dives into the essentials of day trading ETFs, covering everything from how they work to the best strategies for choosing and managing them. Learn about the risks, the top ETFs to consider, and how to develop a solid trading plan. We’ll also touch on key indicators, emotional management, and the best platforms for trading. Plus, get insights into tax implications, commission minimization, and the importance of liquidity. With this knowledge, you’ll be well-equipped to navigate the world of ETF day trading, brought to you by DayTradingBusiness.

What are ETFs and how do they work in day trading?

ETFs, or Exchange-Traded Funds, are investment funds that trade on stock exchanges, similar to individual stocks. They hold a collection of assets like stocks, bonds, or commodities and aim to track the performance of a specific index.

In day trading, ETFs allow traders to buy and sell shares throughout the day, taking advantage of price fluctuations. Traders analyze market trends and use technical indicators to make quick trades, benefiting from the liquidity and diversification that ETFs offer. Since ETFs can be bought on margin, they provide leverage, which amplifies both gains and losses.

Why should beginners consider day trading ETFs?

Beginners should consider day trading ETFs because they offer diversification, lower volatility, and liquidity. ETFs track various sectors or indices, reducing risk compared to individual stocks. They can be bought and sold like stocks throughout the day, providing flexibility and quick entry and exit options. Additionally, many ETFs have lower expense ratios than mutual funds, making them cost-effective. This combination makes ETFs a practical choice for those new to day trading.

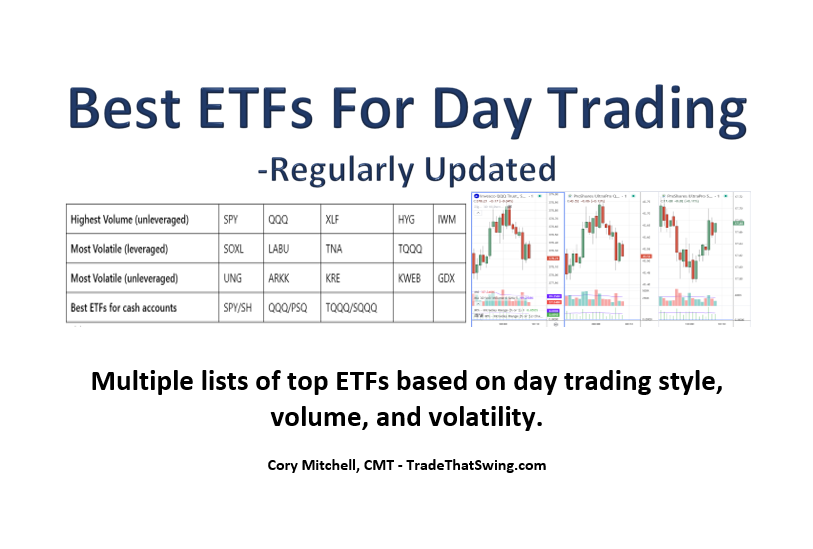

What are the best ETFs for day trading?

The best ETFs for day trading typically have high liquidity and volatility. Consider these options:

1. SPDR S&P 500 ETF (SPY) – Tracks the S&P 500 and offers high volume.

2. Invesco QQQ Trust (QQQ) – Focuses on tech stocks, providing volatility and strong price movements.

3. iShares Russell 2000 ETF (IWM) – Targets small-cap stocks, ideal for larger price swings.

4. SPDR Financial Select Sector ETF (XLF) – Concentrates on financials, often reacting to market news.

5. ProShares UltraShort QQQ (QID) – A leveraged inverse ETF for bearish strategies.

Choose based on your trading strategy and risk tolerance.

How do I choose the right ETF for my trading strategy?

To choose the right ETF for day trading, focus on liquidity, volatility, and expense ratios. Look for ETFs with high average daily trading volume to ensure you can enter and exit positions easily. Select ETFs that have significant price fluctuations, as this provides more trading opportunities. Check the expense ratio; lower fees can enhance your profit potential. Additionally, consider the underlying assets—sector-specific ETFs can align with your strategy based on market trends. Finally, analyze historical performance and use technical indicators to identify entry and exit points.

What are the risks of day trading ETFs?

The risks of day trading ETFs include high volatility, which can lead to significant losses in a short time. Liquidity issues may arise, making it hard to sell at desired prices. There's also the potential for overtrading, resulting in increased commissions and fees. Additionally, emotional decision-making can lead to impulsive trades, further amplifying losses. Finally, using leverage can magnify both gains and losses, increasing overall risk.

How can I develop a day trading plan for ETFs?

To develop a day trading plan for ETFs, follow these steps:

1. Set Clear Goals: Define your profit targets and risk tolerance.

2. Choose ETFs: Select liquid ETFs with high trading volumes and volatility that match your strategy.

3. Develop Entry and Exit Strategies: Determine specific criteria for entering and exiting trades based on technical indicators or patterns.

4. Create a Risk Management Plan: Set stop-loss orders to limit losses and use position sizing to manage risk effectively.

5. Establish a Routine: Plan your trading hours, review market news, and analyze pre-market data before trading.

6. Keep a Trading Journal: Record your trades, strategies, and outcomes to learn from successes and mistakes.

7. Review and Adjust: Regularly evaluate your plan’s performance and make necessary adjustments based on market conditions and your experiences.

By following these steps, you can create an effective day trading plan tailored to trading ETFs.

What indicators should I use for day trading ETFs?

For day trading ETFs, focus on these indicators:

1. Moving Averages: Use the 50-day and 200-day moving averages to identify trends.

2. Relative Strength Index (RSI): Look for overbought (above 70) or oversold (below 30) conditions.

3. Volume: Monitor trading volume to confirm price movements—higher volume often indicates stronger trends.

4. Bollinger Bands: These help identify volatility and potential reversal points.

5. MACD (Moving Average Convergence Divergence): Use this to spot momentum shifts and trend changes.

6. Stochastic Oscillator: This can indicate potential entry and exit points based on momentum.

Combine these indicators for better decision-making in day trading ETFs.

How can I manage my emotions while day trading ETFs?

To manage your emotions while day trading ETFs, establish a clear trading plan with specific entry and exit points. Stick to your strategy, regardless of market fluctuations. Use stop-loss orders to limit losses and reduce anxiety. Take regular breaks to clear your mind and prevent impulsive decisions. Practice mindfulness or deep-breathing exercises to stay calm during trades. Keep a trading journal to reflect on your emotions and decisions; this helps identify patterns and improve your mindset. Finally, set realistic goals to maintain perspective and avoid frustration.

What trading platforms are best for day trading ETFs?

The best trading platforms for day trading ETFs include:

1. TD Ameritrade: Offers powerful tools and no commission on ETF trades.

2. Charles Schwab: Provides a user-friendly interface and extensive research resources.

3. Fidelity: Known for excellent customer service and no commissions on ETF trades.

4. E*TRADE: Features advanced trading platforms and a wide selection of ETFs.

5. Interactive Brokers: Ideal for experienced traders with low commissions and advanced tools.

Choose a platform based on your trading style, fees, and available resources.

How do I read ETF charts for day trading?

To read ETF charts for day trading, start by focusing on key elements: price action, volume, and time frames. Look for candlestick patterns to identify trends; green candles indicate upward movement, while red indicates downward. Pay attention to support and resistance levels, which are critical for entry and exit points. Use indicators like moving averages and RSI to gauge momentum. Analyze volume spikes for confirmation of breakouts or reversals. Finally, always keep an eye on news that might impact the ETF's sector.

Learn about How to Read Day Trading Charts Effectively

What are the tax implications of day trading ETFs?

Day trading ETFs typically triggers short-term capital gains tax on profits, taxed as ordinary income. Losses can offset gains but must be reported. Holding periods under a year means you won't benefit from lower long-term capital gains rates. Additionally, frequent trading may lead to increased transaction costs, impacting overall profitability. Consult a tax professional for personalized advice.

Learn about Tax Implications of Day Trading in Different Countries

How can I minimize commissions when day trading ETFs?

To minimize commissions when day trading ETFs, consider these strategies:

1. Choose Commission-Free Brokers: Use platforms that offer commission-free trading for ETFs.

2. Trade in Larger Increments: Execute fewer trades with larger positions to spread out costs over more shares.

3. Limit Orders: Use limit orders to control entry and exit points, potentially reducing slippage and additional fees.

4. Avoid Frequent Trading: Reduce the number of trades per day to minimize commissions and fees.

5. Check for Fee Structures: Understand your broker's fee structures and choose one that aligns with your trading habits.

6. Leverage Promotions: Look for brokers offering promotions or reduced fees for high-volume traders.

Implementing these tactics can significantly cut down on commissions while day trading ETFs.

Learn about How to Minimize Losses in Day Trading

What is the importance of liquidity in day trading ETFs?

Liquidity in day trading ETFs is crucial because it ensures that you can quickly buy and sell shares without significantly affecting the price. High liquidity means tighter bid-ask spreads, reducing trading costs. It allows for efficient entry and exit points, essential for capitalizing on short-term price movements. Without sufficient liquidity, you may face slippage, resulting in less favorable trade outcomes. In summary, liquidity is vital for executing trades swiftly and maintaining profitability in day trading ETFs.

How do market hours affect day trading ETFs?

Market hours directly impact day trading ETFs by determining when you can buy and sell. Day trading occurs during regular market hours, typically from 9:30 AM to 4 PM EST for U.S. exchanges. Trades made within this window can capitalize on price movements and volatility. Pre-market and after-hours trading can also affect ETF prices, but liquidity is lower, which may lead to wider spreads and slippage. Understanding these hours helps traders optimize their strategies and manage risks effectively.

Learn about How Does Market Microstructure Affect Day Trading Strategies?

What Are the Best ETFs for Day Trading Beginners?

The best ETFs for day trading typically include those with high liquidity and volatility. Consider these options:

1. **SPDR S&P 500 ETF (SPY)** – High volume, tracks the S&P 500.

2. **Invesco QQQ Trust (QQQ)** – Focuses on tech stocks, offers volatility.

3. **iShares Russell 2000 ETF (IWM)** – Targets small-cap stocks with significant price movements.

4. **SPDR Gold Trust (GLD)** – Ideal for trading gold prices.

5. **Direxion Daily Financial Bull 3X Shares (FAS)** – Provides leveraged exposure to financials.

These ETFs are favored for day trading due to their price fluctuations and trading volume.

Learn more about: What Are the Best ETFs for Day Trading?

Learn about Best Platforms for Day Trading ETFs

What common mistakes should beginners avoid in ETF day trading?

Beginners should avoid these common mistakes in ETF day trading:

1. Overtrading: Frequent buying and selling can lead to high fees and losses.

2. Ignoring Research: Not analyzing trends or the underlying assets can result in poor decisions.

3. Lack of a Trading Plan: Trading without a clear strategy often leads to emotional decisions.

4. Neglecting Risk Management: Failing to set stop-loss orders can increase potential losses.

5. Chasing Losses: Trying to recover losses quickly often leads to bigger losses.

6. Not Understanding Market Hours: Trading outside regular hours can lead to volatility and lower liquidity.

7. Focusing on Short-Term Gains: Prioritizing quick profits over long-term strategies can be detrimental.

8. Ignoring Costs: Overlooking commissions and fees can erode profits.

Avoid these pitfalls to improve your ETF day trading success.

Learn about What Are Common Mistakes in Institutional Day Trading?

How can I stay updated on ETF market news and trends?

To stay updated on ETF market news and trends, follow these steps:

1. Financial News Websites: Regularly check sites like Bloomberg, CNBC, and Yahoo Finance for the latest ETF news.

2. Social Media: Follow influential investors and financial analysts on platforms like Twitter and LinkedIn for real-time insights.

3. ETFs Newsletters: Subscribe to newsletters from financial institutions or dedicated ETF platforms for curated content.

4. Market Data Platforms: Use tools like Morningstar or ETF.com for in-depth analysis and performance tracking.

5. Podcasts and Webinars: Tune into finance-related podcasts or webinars focusing on ETFs for expert discussions and market trends.

6. Join Online Communities: Engage in forums like Reddit or specialized trading groups to share insights and learn from others.

Implementing these strategies will keep you informed about ETF market developments effectively.

Learn about How to Stay Updated on Crypto Market News for Day Trading

Conclusion about Day Trading ETFs: A Beginner’s Guide

In summary, day trading ETFs offers a practical entry point for beginners, combining flexibility with diverse investment opportunities. By understanding how ETFs work, selecting the right funds, and developing a solid trading plan, traders can enhance their performance while managing risks. Emphasizing emotional control and using the right indicators are crucial for success. As you embark on your day trading journey, leveraging resources from DayTradingBusiness can provide you with valuable insights and guidance to refine your strategies and navigate the complexities of the market effectively.

Learn about Day Trading Reversals: A Beginner’s Guide