Did you know that the only thing faster than a day trader's decisions is a cheetah on roller skates? In the fast-paced world of day trading, understanding the various strategies is crucial for success. This article breaks down the most popular day trading strategies, from momentum trading and scalping to swing trading techniques. You'll learn how technical analysis and indicators can enhance your approach, the importance of risk management, and how to create a solid day trading plan. Discover the pros and cons of day trading, the impact of news on your strategies, and tips for selecting the right stocks. Additionally, we'll explore common pitfalls, essential workspace setups, psychological factors influencing performance, and effective ways to track your progress. With insights from DayTradingBusiness, you'll be well-equipped to navigate the complexities of day trading.

What are the most popular day trading strategies?

The most popular day trading strategies include:

1. Scalping: Focuses on making small profits from numerous trades throughout the day, capitalizing on minor price changes.

2. Momentum Trading: Involves buying stocks that are trending upward and selling those that are trending downward, often using news or earnings reports as triggers.

3. Reversal Trading: Identifies points where a stock is likely to change direction, buying near support levels and selling near resistance.

4. Breakout Trading: Looks for stocks that break through established support or resistance levels, entering positions on significant volume.

5. Range Trading: Involves buying at the lower end of a price range and selling at the upper end, exploiting market fluctuations within set boundaries.

Each strategy requires different skills and risk management techniques to be effective.

How does momentum trading work in day trading?

Momentum trading in day trading focuses on buying stocks that are trending upward and selling those that are trending downward. Traders identify stocks with strong price movements and high volume, aiming to capitalize on short-term price changes. They often use indicators like the Relative Strength Index (RSI) or moving averages to spot potential entries and exits. The goal is to ride the momentum until signs of reversal appear. Quick decision-making and strict risk management are crucial for success in this strategy.

What is scalping in day trading?

Scalping in day trading is a strategy that involves making numerous trades throughout the day to profit from small price changes. Traders typically hold positions for a few seconds to minutes, aiming for quick gains on minimal price movements. This method requires strict discipline, quick decision-making, and often high leverage. Scalpers rely on technical analysis and real-time data to execute trades rapidly and capitalize on market inefficiencies.

How can I implement swing trading techniques for day trading?

To implement swing trading techniques for day trading, focus on these key strategies:

1. Identify Trends: Use technical analysis to spot short-term trends. Look for patterns in price action and momentum indicators like moving averages.

2. Set Entry and Exit Points: Determine specific price levels for entering and exiting trades. Use support and resistance levels to guide your decisions.

3. Risk Management: Use stop-loss orders to limit potential losses. Aim for a risk-reward ratio of at least 1:2.

4. Time Frame Adjustment: Adapt swing trading time frames to fit day trading. Analyze charts on 5-minute or 15-minute intervals for quicker insights.

5. Volume Analysis: Pay attention to trading volume. Higher volume often confirms trend strength and signals potential reversals.

6. News and Events: Stay updated on market news and economic events that can impact stock prices within the trading day.

By combining these swing trading techniques with day trading execution, you can enhance your chances of success.

What role does technical analysis play in day trading strategies?

Technical analysis is crucial in day trading strategies as it helps traders make informed decisions based on price movements and market trends. It involves analyzing charts, indicators, and patterns to predict future price action. Day traders use technical analysis to identify entry and exit points, manage risk, and capitalize on short-term market fluctuations. Key tools include moving averages, volume analysis, and momentum indicators, which all aid in spotting potential trade setups quickly.

How do I use indicators for day trading success?

To use indicators for day trading success, follow these steps:

1. Choose the Right Indicators: Focus on popular ones like Moving Averages (MA), Relative Strength Index (RSI), and Bollinger Bands. Each provides unique insights into price trends and momentum.

2. Set Up Your Charts: Integrate your chosen indicators on your trading platform. Ensure they're visible and set to appropriate time frames for day trading.

3. Analyze Signals: Look for entry and exit signals. For example, a crossover in MAs can indicate a buy or sell opportunity, while RSI can show overbought or oversold conditions.

4. Combine Indicators: Use multiple indicators together for confirmation. For instance, if the RSI indicates overbought conditions and a price hits the upper Bollinger Band, it might signal a good selling point.

5. Test and Adjust: Backtest your strategy using historical data to see how effective your indicators are. Adjust parameters based on your findings.

6. Stay Disciplined: Stick to your strategy and avoid emotional trading. Use indicators as part of a comprehensive plan.

Implement these methods consistently to improve your day trading outcomes.

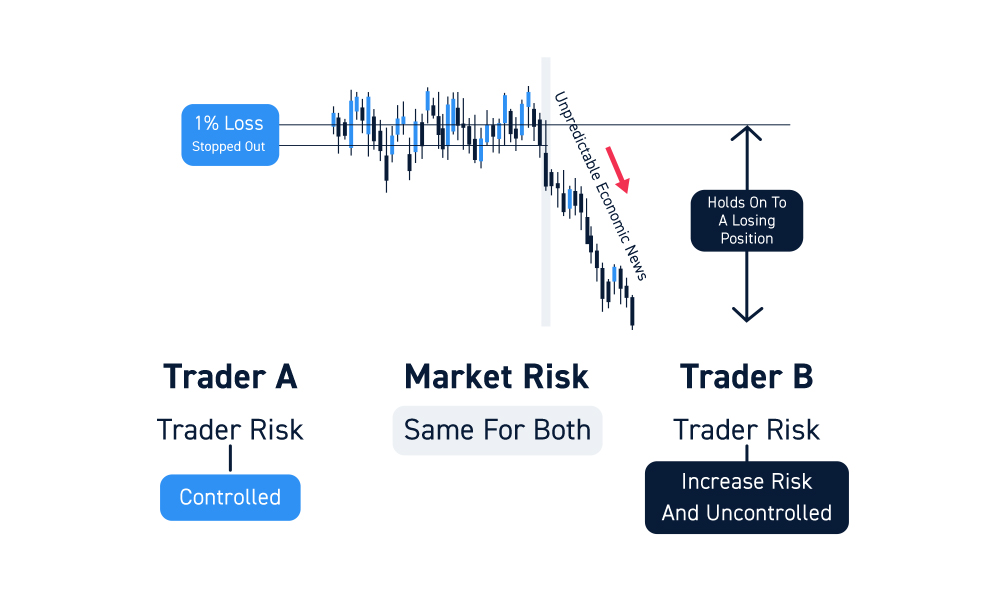

What is the significance of risk management in day trading?

Risk management in day trading is crucial because it protects your capital and minimizes losses. It involves setting stop-loss orders, determining position sizes, and diversifying trades. Effective risk management helps maintain emotional discipline, allowing traders to stick to their strategies without succumbing to panic or greed. By limiting potential losses, traders can stay in the game longer and capitalize on profitable opportunities when they arise.

How can I develop a day trading plan?

To develop a day trading plan, start by defining your goals and risk tolerance. Identify the markets you want to trade, such as stocks, forex, or options. Choose a trading strategy that suits your style, like scalping, momentum trading, or reversal trading.

Set clear entry and exit criteria based on technical indicators, price action, or news events. Determine your position sizes and set stop-loss orders to manage risk. Create a routine for analyzing market trends and backtesting your strategy. Finally, keep a trading journal to track your trades and refine your approach over time.

What are the pros and cons of day trading?

Pros of Day Trading:

1. Potential for Quick Profits: Traders can capitalize on small price movements throughout the day.

2. No Overnight Risk: Positions are closed by the end of the trading session, reducing exposure to overnight market changes.

3. Market Independence: Flexibility to trade various assets, including stocks, currencies, and commodities.

Cons of Day Trading:

1. High Risk: Significant potential for losses due to market volatility and rapid price changes.

2. Time-Intensive: Requires constant monitoring of the market and quick decision-making.

3. Emotional Stress: Can lead to emotional decision-making, affecting overall performance.

Common strategies include scalping, momentum trading, and reversal trading, each with its own risk-reward profile.

How does news impact day trading strategies?

News significantly impacts day trading strategies by creating volatility and influencing price movements. Traders often use news events—like earnings reports, economic indicators, or geopolitical developments—to make quick decisions. For example, a positive earnings report can trigger a surge in a stock's price, prompting traders to buy. Conversely, negative news can lead to sharp declines, pushing traders to sell or short-sell. Incorporating news analysis into strategies helps traders anticipate market reactions and capitalize on swift price changes.

Learn about How News Events Impact Day Trading Decisions

What is the best time frame for day trading?

The best time frame for day trading typically ranges from 1 minute to 15 minutes. Many traders prefer the 5-minute chart for a balance between signal frequency and noise. Using shorter time frames like 1 minute can provide more opportunities but may increase volatility. Ultimately, choose a time frame that aligns with your strategy and comfort level.

How can I choose the right stocks for day trading?

To choose the right stocks for day trading, focus on stocks with high liquidity and volatility. Look for stocks that have significant price movements during the day, ideally with a daily average volume over 1 million shares. Use technical analysis to identify entry and exit points based on patterns and indicators like moving averages or RSI. Monitor news and earnings reports, as they can create price swings. Finally, set a clear risk management strategy to protect your capital.

Learn about How to Choose the Right Backtesting Software for Day Trading

What are common mistakes to avoid in day trading?

Common mistakes to avoid in day trading include:

1. Overtrading: Taking too many trades can lead to losses and increased fees.

2. Lack of a Trading Plan: Not having a clear strategy can cause impulsive decisions.

3. Ignoring Risk Management: Failing to set stop-loss orders can result in significant losses.

4. Chasing Losses: Trying to recover losses quickly often leads to even bigger losses.

5. Emotional Trading: Letting fear or greed drive your decisions can derail your strategy.

6. Neglecting Market Research: Not staying informed about market conditions can lead to missed opportunities.

7. Using Too Much Leverage: High leverage can amplify losses and wipe out accounts quickly.

8. Inadequate Record-Keeping: Failing to track trades makes it hard to learn from mistakes and improve.

Avoid these pitfalls to increase your chances of success in day trading.

Learn about What Are Common Mistakes in Institutional Day Trading?

How do I set up a day trading workspace?

To set up a day trading workspace, follow these steps:

1. Choose a Dedicated Space: Find a quiet area with minimal distractions for focus.

2. Select Equipment: Invest in a reliable computer or laptop with dual monitors for better multitasking. Ensure a fast internet connection to avoid lag.

3. Use Trading Software: Install trading platforms like TD Ameritrade, E*TRADE, or Interactive Brokers. Familiarize yourself with their features.

4. Set Up Charting Tools: Utilize charting software like TradingView or MetaTrader to analyze market trends and strategies.

5. Organize Your Desk: Keep essential tools—like notebooks, pens, and a calculator—within reach.

6. Create a Trading Journal: Document trades, strategies, and outcomes to refine your approach over time.

7. Stay Updated: Follow financial news and trends through reliable sources to inform your trading decisions.

8. Establish a Trading Plan: Define your strategies, risk management rules, and daily goals.

By creating a structured environment, you’ll enhance your focus and efficiency in executing day trading strategies.

Learn about How to Set Up Your Day Trading Platform

What Are Common Day Trading Strategies for Beginners?

Common day trading strategies for beginners include scalping, momentum trading, swing trading, and range trading. Scalping focuses on small price changes, while momentum trading capitalizes on trends. Swing trading aims to profit from price swings over days, and range trading identifies support and resistance levels. Each strategy requires a clear understanding of market movements and risk management.

Learn more about: Day Trading Strategies for Beginners

Learn about Common HFT Strategies Used in Day Trading

What psychological factors affect day trading performance?

Psychological factors that affect day trading performance include emotional control, risk tolerance, and decision-making under pressure. Fear and greed can lead to impulsive trades, while overconfidence may result in ignoring market signals. Discipline is crucial for sticking to strategies and managing losses effectively. Additionally, cognitive biases, such as loss aversion and confirmation bias, can distort judgment and impact trading outcomes. Managing stress and maintaining a clear mindset are essential for consistent performance in day trading.

Learn about How Does Stress Affect Day Trading Performance?

How can I track my day trading performance effectively?

To track your day trading performance effectively, use a trading journal to log every trade, including entry and exit points, reasons for the trade, and outcomes. Analyze your win-loss ratio regularly to identify successful strategies. Utilize trading software or apps that provide performance analytics, like profit and loss tracking, win rates, and average hold times. Set specific performance metrics and review them weekly to adjust your strategies accordingly. Consider using spreadsheets for detailed tracking or automated tools that sync with your trading accounts.

Learn about How Do Brokers Track and Report Day Trading Activity?

Conclusion about Common Day Trading Strategies Explained

In summary, mastering day trading requires a solid understanding of various strategies, including momentum trading, scalping, and swing trading, as well as a firm grasp of technical analysis and risk management. By developing a comprehensive day trading plan and choosing the right stocks, traders can enhance their chances of success. Staying informed about market news and avoiding common mistakes are crucial for maintaining performance. For those looking to deepen their knowledge and improve their skills, resources from DayTradingBusiness can provide valuable insights and guidance.

Learn about What Are the Most Common Myths About Day Trading Bots?