Did you know that even the most seasoned traders can sometimes mistake a stock surge for a sudden case of "market indigestion"? Understanding how regulators detect insider trading in day markets is crucial for every trader looking to navigate these waters safely. This article dives into the mechanisms behind regulatory surveillance, including the signs of insider trading, the role of trade patterns, and how unusual price movements are analyzed. We’ll also explore the data analysis techniques used to spot suspicious activity, the importance of whistleblower reports, and the challenges regulators face. Additionally, we'll outline how traders can avoid unintentional accusations of insider trading. Join us as we unpack these vital insights, brought to you by DayTradingBusiness.

How Do Regulators Detect Insider Trading in Day Markets?

Regulators detect insider trading in day markets by analyzing unusual trading patterns, such as sudden spikes in volume or price movements before news releases. They monitor real-time trading activity for suspicious orders or account behaviors, cross-checking with public news and corporate disclosures. Surveillance systems flag trades made by insiders or related accounts, and whistleblower tips often lead to investigations. They also review communication records and look for pre-market information leaks.

What Signs Indicate Insider Trading During Trading Hours?

Signs of insider trading during trading hours include sudden, unexplained price jumps or drops, unusually high trading volume before major news releases, and transactions that don't match typical patterns. If someone trades just before significant market-moving news or earnings reports, it raises suspicion. Also, quick, repeated trades by a few individuals and atypical activity in less liquid stocks can signal insider activity. Regulators watch for these clues to detect insider trading in day markets.

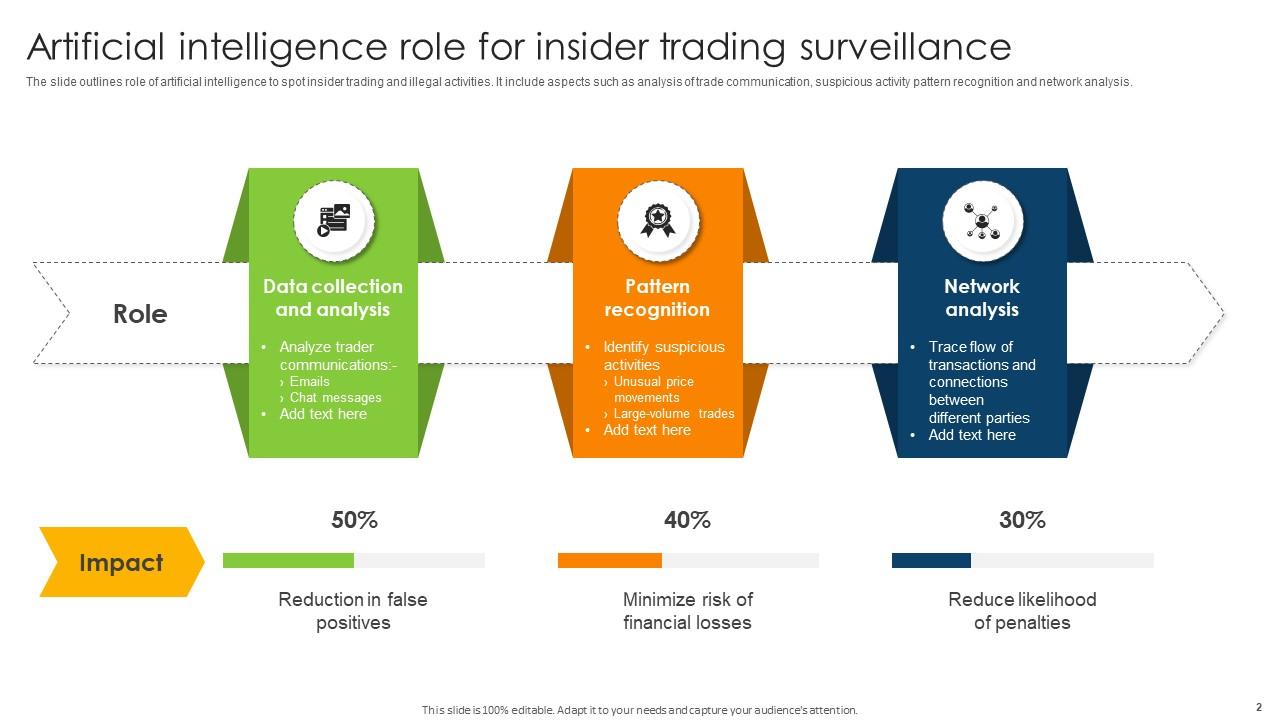

How Do Surveillance Systems Monitor Day Market Activity?

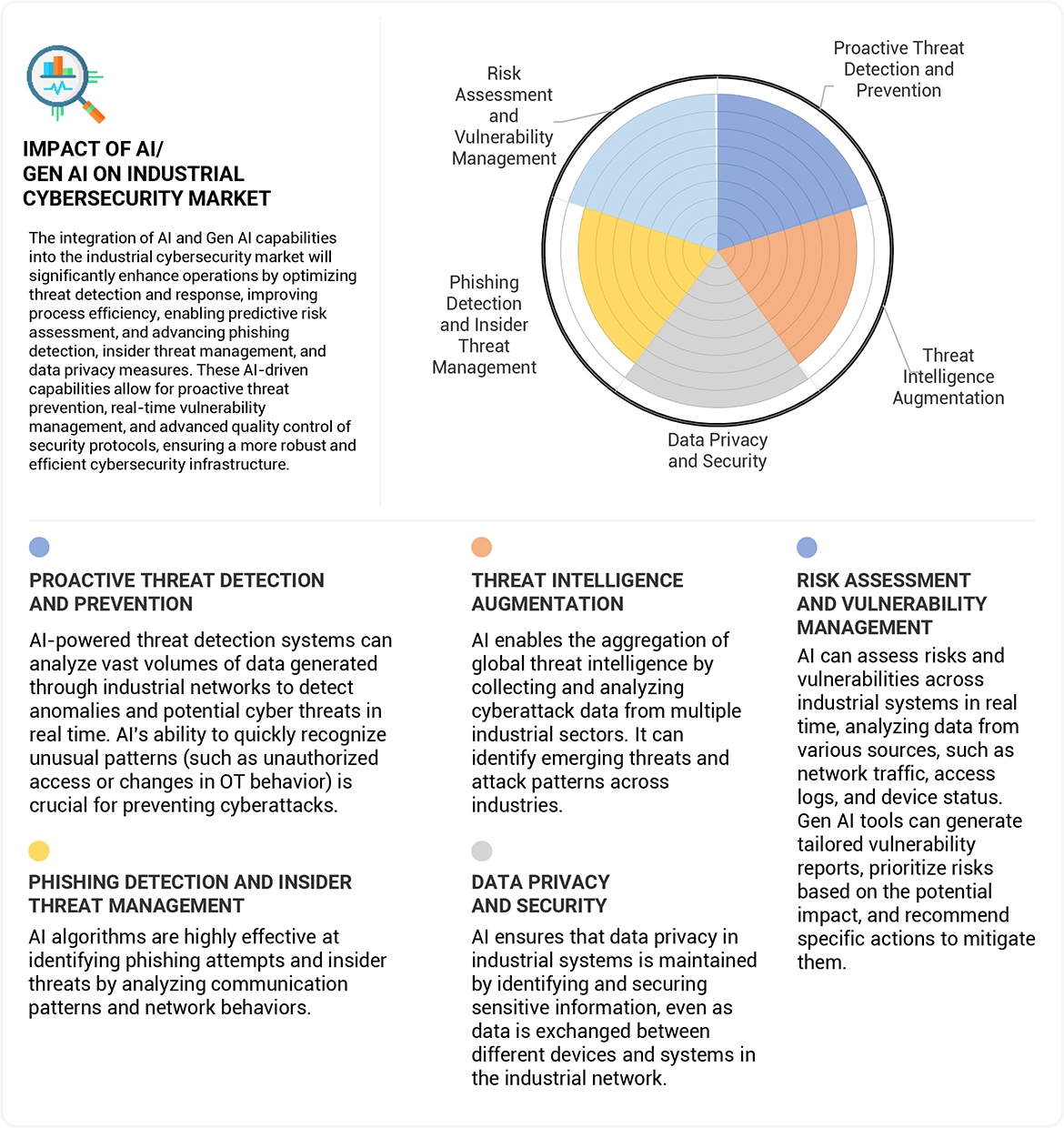

Surveillance systems monitor day market activity by analyzing real-time trading data for unusual patterns, such as sudden spikes, large trades, or inconsistent price movements. They use algorithms to flag suspicious transactions that may indicate insider trading. Regulators track order flows, trade timing, and volume anomalies to identify potential market manipulation. They also compare trading activity against known insider information or news events. Automated systems generate alerts for investigators to review further, helping detect illegal insider trading during trading hours.

What Role Do Trade Patterns Play in Detecting Insider Trading?

Trade patterns reveal unusual activity, like sudden spikes or abnormal timing, signaling potential insider trading. Regulators watch for patterns such as large volume surges before major news or consistent trades ahead of market moves. These anomalies help identify suspicious behavior that differs from typical market activity. Analyzing trade patterns allows regulators to flag possible insider trading by spotting deviations from normal investor behavior.

How Are Unusual Price Movements Identified as Insider Trading?

Regulators spot unusual price moves by analyzing sudden, significant price spikes or drops that lack news or fundamentals. They compare trading volume with historical patterns to flag abnormal activity. They look for trades executed before major corporate announcements or earnings reports. Investigators track suspicious trading patterns, such as large blocks placed just before market-moving news. They also use surveillance software to detect patterns like coordinated trades or rapid order placements. If these movements coincide with insider information leaks, regulators flag them as potential insider trading.

What Are Common Indicators of Insider Trading in Day Markets?

Common indicators of insider trading in day markets include unusually large trades just before significant news, sudden spikes in stock volume without news, and rapid price movements that lack public explanation. Repeated patterns of trading ahead of earnings reports or regulatory announcements also raise suspicion. Additionally, traders with access to non-public information may exhibit consistent timing advantages, and suspicious communication or relationships with insiders can hint at illegal activity.

How Do Regulators Use Data Analysis to Spot Insider Trading?

Regulators analyze trading patterns, looking for unusual volume spikes, rapid trades before news releases, and large orders that don’t match typical investor behavior. They compare trading activity with public news and corporate disclosures to identify suspicious timing. Advanced algorithms flag anomalies, such as sudden price movements without news, and cross-reference trader activity with known insider accounts. Surveillance teams review these alerts, analyzing data to confirm whether illegal insider trading occurred.

What Types of Market Data Are Analyzed for Insider Trading?

Regulators analyze trade volume spikes, unusual price movements, timing of trades before news releases, and patterns of large transactions by insiders or related parties. They also examine order book activity, frequency of trades, and cross-referencing insider disclosures with market activity. These data points help spot suspicious trading that indicates insider trading in day markets.

How Do Trade Timing and Volume Signal Insider Trading?

Regulators spot insider trading by analyzing unusual trading volume spikes and timing patterns that don’t match public information releases. If a stock jumps significantly just before a major news announcement, and volume surges unexpectedly, it hints at inside knowledge. They also track rapid trades aligned with tiny market windows, suggesting someone with confidential info is acting before the news hits. Combining these signals with suspicious trade patterns and cross-checking for linked accounts helps regulators catch insiders.

What Are Red Flags for Insider Trading in Intraday Trading?

Red flags for insider trading in intraday trading include sudden, suspiciously large trades before major news, unusually high trading volume without clear news, and consistent profit patterns that defy market logic. Watch for traders who repeatedly profit from tiny, rapid trades just before stock-moving announcements. Unexplained account activity, like frequent trades from a single account or options activity that hints at advanced knowledge, also signals insider trading. If a trader’s behavior seems out of sync with market trends, especially when linked to confidential information, regulators pay close attention.

How Do Regulators Investigate Suspicious Day Market Trades?

Regulators analyze trading patterns for unusual volume, rapid trades, and price spikes. They scrutinize order book data, flagging trades that deviate from normal activity. They use sophisticated algorithms to detect insider trading signals, such as coordinated trades or insider information leaks. Regulators interview traders, review communication records, and monitor market sentiment. They compare trades against news releases and corporate disclosures to find discrepancies. If suspicious activity is found, they may conduct deeper investigations or issue subpoenas.

What Legal Tools Are Used to Detect Insider Trading?

Regulators use surveillance tools like trade monitoring systems to flag abnormal trading patterns, analyze suspicious order activity, and cross-reference trades with confidential information leaks. They also employ data analytics and algorithms to identify unusual volume spikes or price movements, and conduct forensic analysis of communication records such as emails and phone calls. Undercover investigations and tips from whistleblowers complement these digital tools.

How Do Whistleblower Reports Help Detect Insider Trading?

Whistleblower reports alert regulators to suspicious trading activities, often revealing inside information used for insider trading. They provide firsthand evidence or tips that target specific traders or patterns, enabling investigations. These reports can uncover hidden relationships, unusual transaction volumes, or timing that suggests illegal insider information exchange. Ultimately, whistleblowers help regulators identify and build cases against traders exploiting confidential info in day markets.

What Challenges Do Regulators Face in Detecting Insider Trading?

Regulators struggle with anonymous trades, complex schemes, and rapid execution in day markets. Insider trading often involves subtle clues, making it hard to distinguish from normal activity. Coordinated trading across accounts and using encrypted communication complicate detection. Limited resources and the need for advanced technology also hinder timely identification. Fake or delayed disclosures further obscure suspicious patterns. Overall, catching insider traders requires sifting through massive data and uncovering hidden relationships in fast-paced markets.

How Effective Are Surveillance Algorithms in Spotting Insider Trading?

Surveillance algorithms are highly effective at spotting insider trading in day markets by analyzing trading patterns, detecting unusual activity, and cross-referencing news or disclosures. They flag suspicious trades quickly, often catching manipulative behavior before it becomes widespread. However, they aren’t foolproof; savvy insiders can sometimes evade detection, but overall, these algorithms significantly enhance regulators' ability to identify illicit trading.

How Do Cross-Market Trades Reveal Insider Trading?

Cross-market trades can reveal insider trading when large, unusual trades appear simultaneously across related markets or securities. Regulators look for patterns like rapid, coordinated buying or selling that don't match public information or typical market behavior. If an insider trades ahead of news, their activity often triggers abnormal cross-market signals—such as a sudden spike in related stocks or derivatives—alerting investigators. These suspicious patterns, especially when inconsistent with normal market movements, help regulators identify potential insider trading.

What Role Do Market News and Rumors Play in Detection?

Market news and rumors help regulators spot insider trading by revealing suspicious trading patterns before official disclosures. If traders act on non-public info reflected in sudden price moves or volume spikes, it raises red flags. Rumors circulating before a market-moving event can signal leaks. Regulators analyze these signals to identify potential insider trading, cross-referencing with trading activity and news timelines.

How Do Regulators Use Confidential Tips in Their Investigations?

Regulators use confidential tips as initial leads to identify suspicious trading activities in day markets. They analyze tip details, cross-reference with trading data, and look for patterns indicating insider trading. Tips often trigger undercover investigations, surveillance, or data analysis to confirm illegal activity. They rely on the tip’s credibility and corroborate it with other evidence before taking enforcement action.

What Are the Common Penalties for Insider Trading in Day Markets?

Common penalties for insider trading in day markets include hefty fines, imprisonment, asset forfeiture, and bans from trading. Regulators use surveillance systems, tip-offs, and transaction analysis to detect illegal trades. When caught, traders face criminal charges that can lead to years in prison and fines that match or exceed profits gained. Regulatory agencies also impose cease-and-desist orders and revoke trading licenses.

How Can Traders Avoid Unintentional Insider Trading Accusations?

Traders can avoid unintentional insider trading accusations by strictly following insider trading laws, avoiding trading on non-public information, and maintaining clear records of their trades and research sources. Staying compliant with regulations and implementing strong internal controls helps prevent accidental violations. Regularly training staff about insider trading rules and monitoring trading activity for suspicious patterns also reduces risk.

Conclusion about How Regulators Detect Insider Trading in Day Markets

In conclusion, understanding how regulators detect insider trading in day markets is crucial for all traders. By recognizing the signs, patterns, and data analysis involved in surveillance, traders can better navigate the complexities of the market. Awareness of red flags and legal frameworks not only helps in compliance but also enhances overall trading strategy. For more in-depth insights and guidance on navigating these challenges, consider leveraging the resources available through DayTradingBusiness.