Did you know that the term "insider trading" has nothing to do with secret handshakes or hidden clubs? In the fast-paced world of day trading, understanding insider trading and market manipulation is crucial for success. This article dives into what insider trading means in day trading, how market manipulation can skew results for traders, and the common signs to watch for. You'll learn about the legalities, potential penalties, and the role of regulators in maintaining market integrity. Additionally, we’ll explore how rumors can sway prices and provide strategies for day traders to safeguard against manipulation. Join us as we uncover the ethical considerations and tools that can help you navigate these complex waters with confidence, brought to you by DayTradingBusiness.

What is insider trading in day trading?

Insider trading in day trading is when someone uses confidential company information not available to the public to buy or sell stocks for quick profits. It involves trading based on non-public data, giving an unfair advantage. This illegal activity can manipulate the market and distort stock prices. For day traders, it means acting on inside info instead of market trends, risking legal consequences and market integrity.

How does market manipulation affect day traders?

Market manipulation skews prices, making it harder for day traders to identify genuine trends. It causes false signals, leading to bad trades and losses. Manipulation can create sudden, unpredictable swings, increasing risk and reducing confidence. Day traders relying on technical analysis get misled by artificial moves, making their strategies less effective. Overall, market manipulation undermines fair trading, forcing day traders to stay extra cautious or withdraw.

What are common signs of insider trading?

Common signs of insider trading include sudden, unexplained stock price spikes or drops, unusually high trading volumes before major news, and trades that don't match public information. Traders might notice suspicious activity like large positions taken just before positive news or rapid sell-offs before bad news. Consistent patterns of these anomalies can indicate someone with confidential info is manipulating the market.

How can I identify market manipulation tactics?

Look for sudden, unexplained price spikes or drops without news, unusual trading volume, and coordinated trades that seem designed to create false market signals. Watch for large trades executed just before major news or events, and patterns of wash trading or layering that distort market perception. Pay attention to suspicious activity by certain traders or accounts that consistently influence prices. Use analytical tools to detect abnormal order book activity and rapid order placements that don't match typical trading behavior.

Is insider trading legal or illegal?

Insider trading is illegal.

What penalties do traders face for insider trading?

Traders caught insider trading face fines, asset forfeitures, and bans from trading. They can also face criminal charges, leading to prison sentences. Regulatory agencies like the SEC may impose civil penalties, while courts can levy hefty fines and imprisonment.

How do regulators detect market manipulation?

Regulators detect market manipulation through surveillance systems that monitor unusual trading patterns, such as sudden spikes in volume, abnormal price movements, and trades executed just before significant news. They analyze trade data for suspicious activity, like wash trades or layering, and compare it against historical patterns. Tips from market participants and whistleblowers also trigger investigations. Advanced algorithms flag anomalies, and regulators review order books, trade timestamps, and account activity to identify insider trading or manipulation schemes.

Can insider trading impact stock prices?

Yes, insider trading can impact stock prices by causing sudden, unfair price swings when insiders buy or sell based on non-public information, misleading other traders and disrupting market fairness.

What role do rumors play in market manipulation?

Rumors can trigger panic or excitement, causing traders to buy or sell based on false or unverified information. This boosts stock prices artificially or depresses them, enabling manipulators to profit from the price swings. In day trading, rumors serve as tools to manipulate market sentiment quickly, often leading to insider trading or coordinated pump-and-dump schemes.

How can day traders protect themselves from manipulation?

Day traders can protect themselves from manipulation by staying informed about common tactics like pump-and-dump schemes and wash trading. Use reputable, regulated platforms that monitor suspicious activity. Avoid getting caught up in hype or chasing volatile moves based on rumors. Set strict stop-loss orders to limit losses during sudden price swings. Keep your trading plan disciplined, and don’t trade on emotion. Watch for unusual volume spikes or price jumps with no news—these often signal manipulation. Staying educated about market manipulation tactics helps identify red flags early.

Learn about How Can Day Traders Benefit from Dark Pool Data?

What are the ethical considerations in day trading?

Insider trading and market manipulation in day trading violate ethical standards by giving insiders unfair advantages and distorting market fairness. Using non-public information to make trades undermines trust and harms other traders. Manipulative tactics like pump-and-dump schemes deceive investors and create false market signals. Ethical day trading requires transparency, fairness, and avoiding any tactics that manipulate or deceive the market.

How does regulatory oversight prevent market abuse?

Regulatory oversight detects and penalizes insider trading and market manipulation by monitoring trading patterns and investigating suspicious activity. It enforces rules that restrict misuse of confidential info and false reporting, deterring traders from manipulating markets. Regulators impose fines, bans, and criminal charges, discouraging illegal behavior. This oversight maintains fair, transparent markets, reducing opportunities for abuse in day trading.

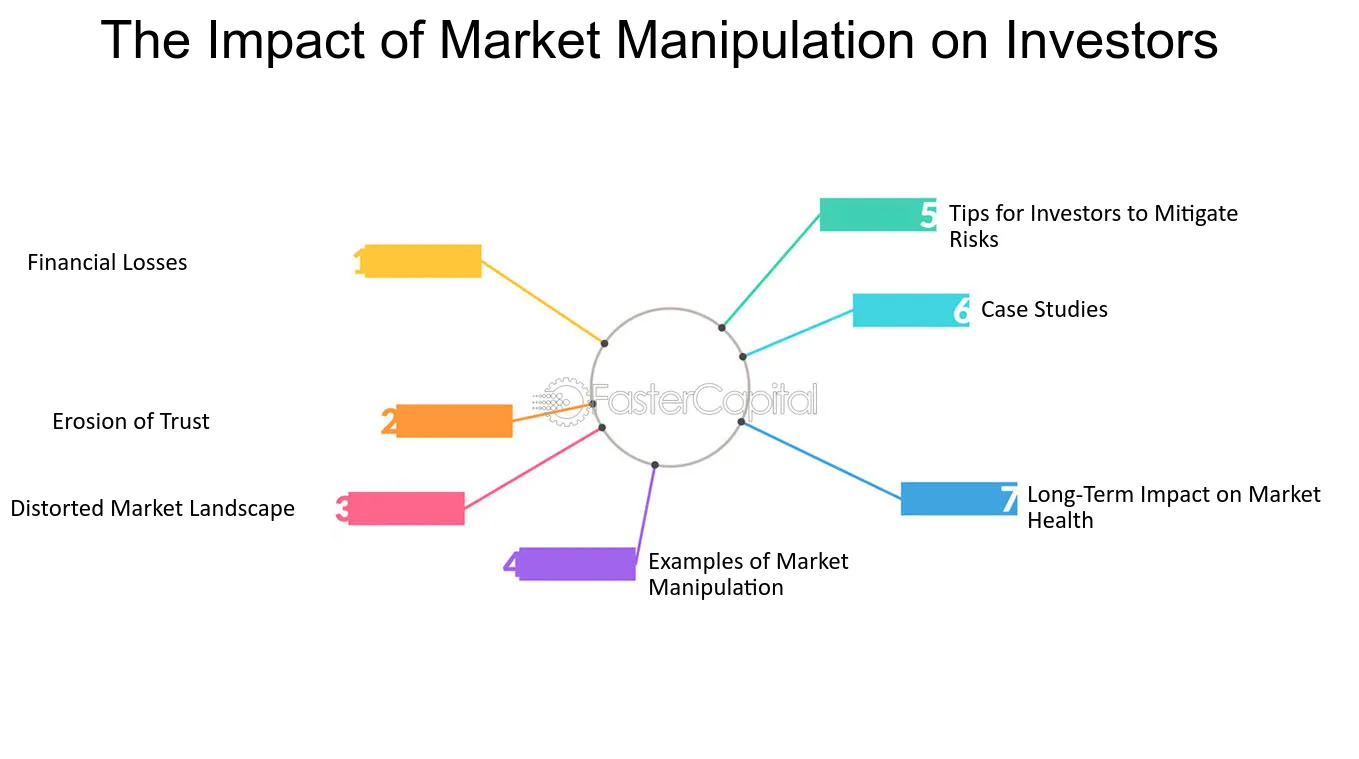

What are the consequences of market manipulation for investors?

Market manipulation, like insider trading, skews prices, making investments risky and unreliable. Investors can face significant losses when false signals drive stock prices up or down. It erodes trust in the market, discouraging participation. Manipulation can lead to legal penalties for perpetrators and create unfair advantages, harming honest traders. Overall, it undermines market integrity and investor confidence.

How do large traders influence market prices?

Large traders can influence market prices by placing big buy or sell orders that move supply and demand. Their trades can create artificial price movements, triggering other traders to follow suit. This can lead to price spikes or drops, especially in less liquid markets. Sometimes, they use tactics like pump-and-dump schemes or spreading false info to manipulate prices. Their actions can distort true market value, making prices deviate from fundamentals.

What tools can help spot insider trading and manipulation?

Tools like FINRA’s ALERT system, SEC’s EDGAR database, and market surveillance software such as SMARTS, Nasdaq Market Surveillance, and Trade Surveillance systems detect insider trading and manipulation. Additionally, algorithms that analyze unusual trading patterns, volume spikes, and timing anomalies help spot suspicious activity. Data analytics platforms like Bloomberg Terminal or Thomson Reuters Eikon provide real-time alerts and deep market insights to identify potential insider trading.

Conclusion about Insider Trading and Market Manipulation in Day Trading

In summary, understanding insider trading and market manipulation is crucial for day traders aiming to navigate the complexities of the financial markets. By recognizing the signs of unethical practices and utilizing available tools, traders can protect themselves and make informed decisions. Regulatory oversight plays a vital role in maintaining market integrity, but vigilance on the part of traders is essential. For comprehensive insights and strategies to safeguard your trading activities, consider the resources provided by DayTradingBusiness.

Learn about Insider Trading vs. Market Rumors in Day Trading