Did you know that even the most seasoned institutional traders can make mistakes that would make a rookie cringe? In the world of institutional day trading, common pitfalls abound, ranging from poor risk management and overleveraging to misjudgments about market liquidity. This article dives deep into these frequent errors, highlighting how emotional decision-making and inadequate research can derail even the most strategic plans. We’ll also explore the repercussions of ignoring market volatility, the dangers of relying too heavily on automated systems, and why a solid trading plan is essential. With insights from DayTradingBusiness, you'll learn how to steer clear of these traps and enhance your trading success.

What are the most common mistakes in institutional day trading?

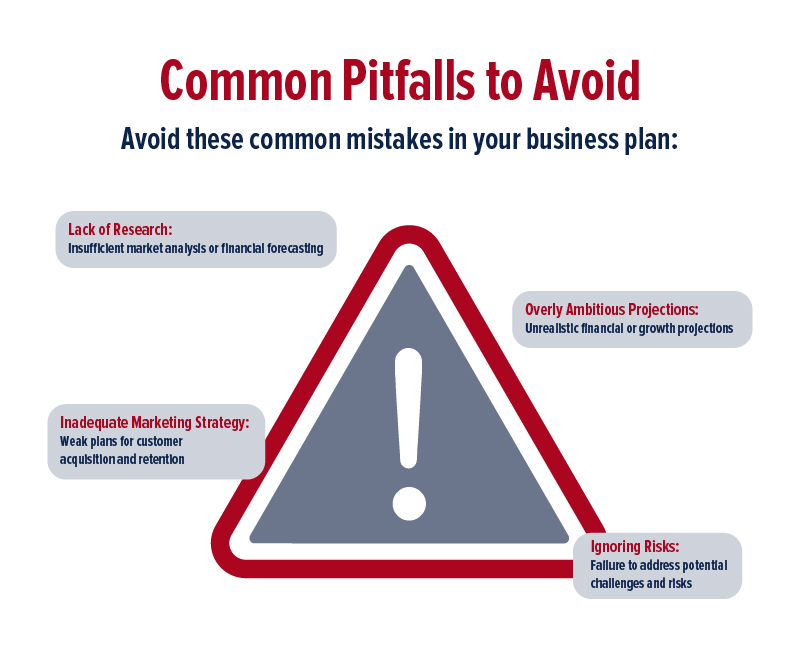

Most common mistakes in institutional day trading include overtrading, ignoring risk management, rushing entries and exits, relying too heavily on short-term signals, and failing to adapt to market conditions. Traders often underestimate the importance of proper position sizing, neglect to set stop-losses, and get swayed by emotions or herd behavior. Poor execution speed and inadequate analysis also lead to costly errors.

How does poor risk management impact institutional day traders?

Poor risk management causes institutional day traders to suffer huge losses, wiping out accounts quickly. It leads to overleveraging, making them vulnerable to sudden market swings. Without proper stop-loss strategies, they can’t limit downside, magnifying mistakes. This increases the chance of margin calls and forced liquidations. Poor risk control erodes capital and confidence, making consistent profits impossible.

Why do traders often overleverage in institutional day trading?

Traders overleverage in institutional day trading to maximize gains from small price moves. They chase quick profits, ignoring risk exposure, because they believe large positions can boost returns. The fast-paced environment and pressure to outperform push them to take bigger risks. Overleverage often stems from a desire to amplify gains, but it increases the chance of rapid, significant losses.

What are the typical errors in trade timing for institutions?

Institutions often misjudge market entry points, leading to premature or delayed trades. They may rely too heavily on outdated data, missing quick shifts in stock movements. Overconfidence in models causes them to ignore real-time signals, resulting in poor timing. Chasing momentum without confirming signals leads to buying high or selling low. Lastly, they often fail to adjust strategies during volatile periods, causing mistimed trades.

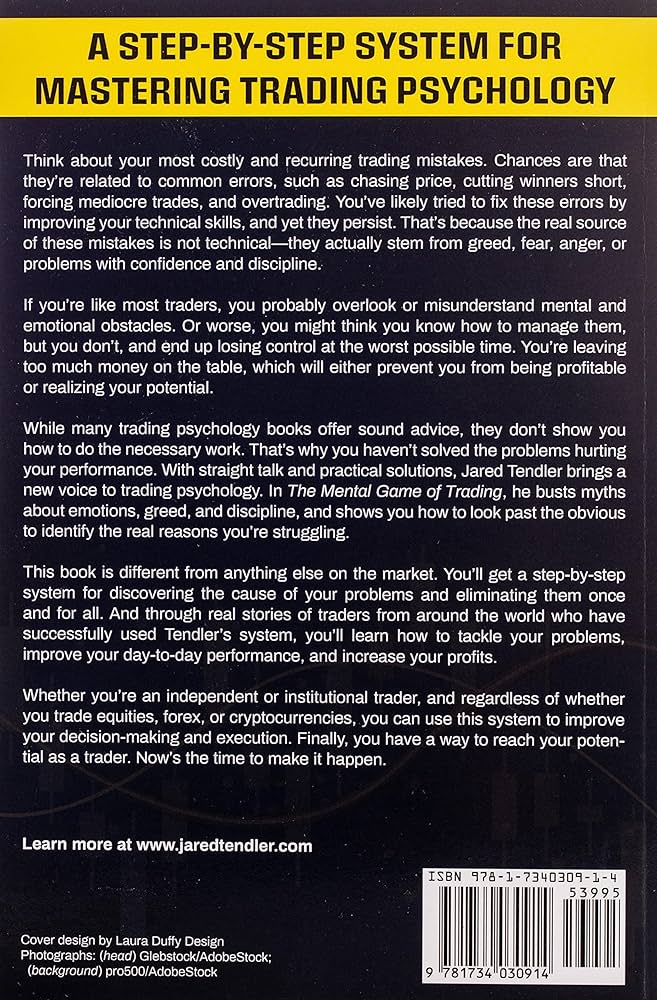

How does lack of research lead to mistakes in institutional day trading?

Lack of research causes mistakes in institutional day trading by leading traders to make decisions without understanding market trends, news, or stock behavior. Without thorough research, traders miss critical data that influences price movements, increasing the chance of entering wrong positions. This oversight results in poor timing, overconfidence, and increased risk of losses. Insufficient research means missing out on key indicators, making impulsive trades, and reacting to false signals, all of which cause costly mistakes.

Why do institutional traders sometimes ignore market volatility?

Institutional traders sometimes ignore market volatility because they rely on long-term strategies, quantitative models, or algorithms that focus on fundamental data rather than short-term price swings. They may also have large positions that are less affected by daily volatility, or they believe volatility is temporary and won't impact their core investment thesis. Additionally, they might overlook volatility to avoid overreacting to noise, aiming for steadier, predictable gains over time.

What are the frequent errors in setting stop-loss and take-profit levels?

Common errors in setting stop-loss and take-profit levels include placing stops too close, causing premature exits from trades, or too far away, risking larger losses. Traders often set stops based on arbitrary amounts rather than technical support or resistance levels, reducing effectiveness. Overly tight take-profit targets can limit gains, while overly broad ones risk turning small wins into losses. Ignoring market volatility leads to stop-loss placements that get triggered by normal price swings. Lastly, relying on emotions rather than a solid trading plan causes inconsistent risk management.

How does emotional decision-making affect institutional day trading?

Emotional decision-making leads to impulsive trades, abandoning strategies, and overtrading, which cause significant losses in institutional day trading. It skews judgment, making traders chase quick profits instead of sticking to data-driven plans. Emotions like fear or greed can trigger panic selling or reckless buying, undermining discipline and increasing risk. This common mistake erodes consistency and can wipe out gains built on solid analysis.

Why is insufficient capital analysis a common mistake?

Insufficient capital analysis leads to poor risk management, making traders vulnerable to big losses. Without enough capital, traders can't withstand market swings or diversify effectively. It often results in overtrading or taking on positions too large, risking their entire account. This mistake happens because traders underestimate the importance of proper capital assessment to sustain long-term trading.

What role does overtrading play in institutional trading errors?

Overtrading increases the risk of mistakes in institutional trading by causing impulsive decisions, reducing focus, and amplifying errors. It leads to rushed trades, poor risk management, and emotional trading, all of which heighten the chance of costly errors.

How do misjudgments about market liquidity cause problems?

Misjudging market liquidity leads to unexpected price swings, making it hard to execute trades at desired levels. It causes slippage, increasing costs and eroding profits. Traders might hold onto positions too long, thinking they can exit easily, but low liquidity traps them, amplifying losses. Overestimating liquidity can give false confidence, resulting in large, uncontrollable moves that wipe out accounts. In institutional day trading, these misjudgments create unpredictability, making risk management nearly impossible.

Why do traders underestimate transaction costs?

Traders often underestimate transaction costs because they focus on potential profits and overlook the cumulative impact of spreads, commissions, and slippage. They assume ideal conditions, ignoring how small costs add up quickly during frequent trades. This oversight leads to overestimating gains and making riskier decisions.

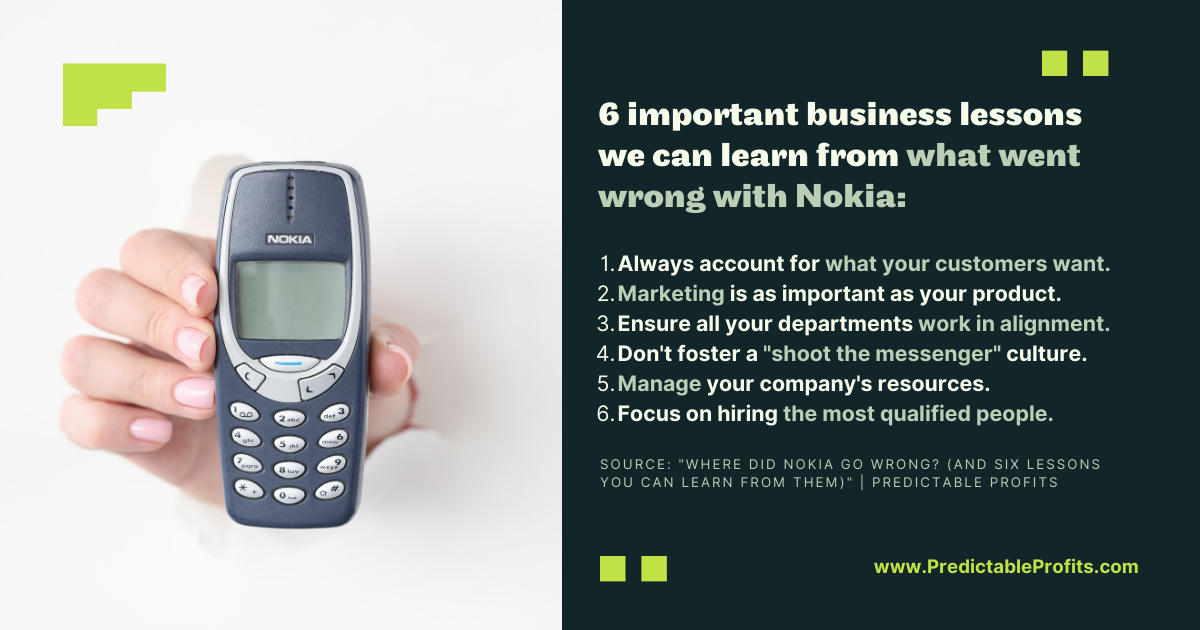

How does failure to adapt to market conditions lead to losses?

Failing to adapt to market conditions causes losses by making trades based on outdated strategies, missing new opportunities, or holding onto losing positions longer than needed. When market trends shift and traders don’t adjust their approach, they risk bigger setbacks. For example, ignoring a sudden volatility spike can lead to rapid capital erosion. Not adapting means missing signs of changing market sentiment, resulting in poor decision-making and financial losses.

What are the risks of relying on automated trading systems?

Relying on automated trading systems risks algorithm errors, technical failures, and sudden market swings that the system can't adapt to. These systems may execute flawed strategies or react too slowly during high volatility, leading to unexpected losses. Overconfidence in automation can cause traders to ignore market signals or fail to intervene during crashes. Poorly configured algorithms might also amplify risks, especially if they’re based on outdated data or flawed assumptions.

How do institutional traders often overlook the importance of a trading plan?

Institutional traders often overlook the importance of a trading plan by relying too much on market intuition or past success, skipping detailed analysis and predefined strategies. They get caught up in the speed of the market, making impulsive decisions without sticking to a structured plan. Sometimes, they assume their size or resources compensate for a lack of disciplined planning, leading to inconsistent results.

Learn about How Can Retail Traders Mimic Institutional Trading Techniques?

Why is poor record-keeping a mistake in institutional day trading?

Poor record-keeping in institutional day trading leads to missed insights, errors in compliance, and difficulty tracking performance. Without accurate records, traders can’t analyze strategies, identify mistakes, or meet regulatory requirements, increasing risks and reducing profitability. It hampers decision-making and accountability, making it a costly mistake in high-stakes trading environments.

How can ignoring news and economic reports harm trading outcomes?

Ignoring news and economic reports can lead to missed market shifts, causing unexpected losses. Without current info, traders miss key events like earnings reports or economic data releases that drive prices. This oversight can result in holding positions during volatile moves or missing timely exits. Overlooking reports also reduces situational awareness, making trades less informed and more prone to sudden reversals. In institutional day trading, ignoring these reports risks poor timing, increased volatility exposure, and ultimately, damaging trading outcomes.

What mistakes are made in data analysis and chart interpretation?

Common mistakes in data analysis and chart interpretation include overfitting data, ignoring volume trends, relying too heavily on single indicators, misreading chart patterns, and neglecting context like news or market sentiment. Traders often draw conclusions from incomplete or cherry-picked data, leading to false signals. They may also misjudge support and resistance levels or assume trends will continue without considering potential reversals. Overconfidence in past performance or ignoring time frames can cause misinterpretation.

Why do traders sometimes neglect diversification strategies?

Traders neglect diversification because they focus on high-reward trades or believe they can master specific assets. They often think concentrating on a few stocks or sectors boosts returns, ignoring risks. Overconfidence, impatience, or pressure to hit quick profits lead them to overlook spreading investments. Sometimes, limited capital or lack of experience makes diversification seem less manageable or less urgent.

How does inadequate training contribute to trading errors?

Inadequate training leaves traders unfamiliar with market nuances, leading to poor decision-making and missed signals. Without proper knowledge, they might misinterpret charts or overlook risk management, causing costly mistakes. Lack of training also hampers discipline, making traders more prone to impulsive moves or emotional trading. This increases the chance of executing incorrect orders, such as wrong-sized positions or timing errors, ultimately harming profitability.

Conclusion about What Are Common Mistakes in Institutional Day Trading?

In conclusion, institutional day trading presents various challenges that can lead to significant errors, from poor risk management and overleveraging to emotional decision-making and inadequate training. A thorough understanding of these common pitfalls is essential for success. By addressing these mistakes, traders can enhance their strategies and improve outcomes. To navigate the complexities of institutional trading effectively, consider leveraging insights and resources provided by DayTradingBusiness.