Did you know that dark pools, the secretive trading venues, can make a ninja look like an open book? In our latest article, we dive into the complex world of dark pools and their significant implications for market fairness. We explore how dark pools affect market transparency and whether they provide large traders with an unfair advantage. Additionally, we examine their role in market manipulation, price discovery, and volatility. You'll learn about the differences between dark pools and public exchanges, their impact on small investors, and the effectiveness of their regulation. We'll also discuss the risks associated with trading in dark pools and how they influence market liquidity and confidence. Finally, the article addresses whether dark pools contribute to market inequality and their potential connection to insider trading. Join DayTradingBusiness as we unravel the mysteries of dark pools in trading!

How Do Dark Pools Affect Market Transparency?

Dark pools reduce market transparency by allowing large traders to execute significant orders without public visibility, which can hide market intentions and obscure price discovery. This lack of transparency can lead to less fair trading conditions, as retail investors and smaller traders don’t see the full picture, potentially giving institutional traders an unfair advantage. It can also cause price discrepancies and reduce the overall efficiency of the market, making it harder to gauge true supply and demand.

Do Dark Pools Give Large Traders an Advantage?

Yes, dark pools give large traders an advantage by allowing them to execute big orders without revealing their intentions, reducing market impact. This secrecy helps them avoid price swings that smaller traders might cause if they knew the full size of the trades. As a result, large traders can secure better prices, which can distort perceived market fairness and transparency.

Are Dark Pools Responsible for Market Manipulation?

Dark pools can facilitate market manipulation by enabling large traders to hide their intentions, potentially distorting price discovery. Because trades happen away from public view, they can be used to influence market prices unfairly. While not inherently malicious, their lack of transparency raises concerns about fairness and manipulation.

How Do Dark Pools Impact Price Discovery?

Dark pools limit transparent price discovery by hiding large trades, which can distort the true market value. They reduce the visibility of supply and demand, making it harder for investors to gauge fair prices. This opacity can lead to less efficient market pricing and give institutional traders an advantage. As a result, dark pools weaken overall market fairness by creating information asymmetry.

Do Dark Pools Increase Market Volatility?

Dark pools can increase market volatility by hiding large trades that suddenly hit the public markets, causing unexpected price swings. When big orders are executed privately, they can lead to sudden liquidity gaps and sharp price movements once revealed. This lack of transparency can make the overall market less predictable, amplifying volatility. However, some argue dark pools help reduce volatility by easing large trades without disrupting public prices. Still, the potential for sudden, hidden trades to impact market stability remains a concern.

Can Dark Pools Lead to Fairness in Trading?

Dark pools can undermine market fairness by hiding trade information, giving institutional traders an advantage and reducing transparency. This lack of visibility can distort price discovery, making it harder for retail traders to compete fairly. While they may improve liquidity and reduce market impact for large orders, dark pools often create asymmetries that challenge equal access and fairness in trading.

How Do Dark Pools Differ from Public Exchanges?

Dark pools are private trading venues where large orders are executed away from public exchanges, reducing market visibility. Unlike public exchanges, they lack transparency, allowing traders to hide order sizes and intentions. This can lead to less market fairness because it creates information asymmetry, giving institutional traders an advantage over retail investors. Dark pools can distort price discovery and create an uneven playing field, impacting overall market integrity.

Do Dark Pools Help or Hurt Small Investors?

Dark pools can hurt small investors by reducing market transparency, making it harder to see real prices and leading to less competition. They often favor big institutions with large order sizes, which can cause small traders to get worse prices. While dark pools offer privacy and reduce market impact for big players, they can create an uneven playing field, undermining overall market fairness for small investors.

Are Dark Pools Regulated Effectively?

Dark pools are less regulated than public exchanges, which can lead to less transparency and potential unfair advantages. While they’re overseen by financial authorities, their private nature makes it harder to detect manipulative practices. This lack of visibility can distort market fairness by hiding large trades that influence prices. Overall, dark pools aren’t fully effective at maintaining market fairness due to limited oversight and transparency.

How Do Dark Pools Influence Market Liquidity?

Dark pools can reduce market fairness by hiding large trades from public view, which can lead to information asymmetry. They often allow institutional traders to execute big orders without moving the market, potentially giving them an advantage over retail investors. This lack of transparency can distort price discovery and create an uneven playing field. While dark pools increase overall market liquidity by enabling large transactions, they also raise concerns about fairness and equal access.

Learn about How Do Dark Pools Obscure Market Transparency?

Do Dark Pools Contribute to Market Inequality?

Yes, dark pools can contribute to market inequality by limiting transparency, giving institutional traders an advantage over retail investors who see less price information. They allow big players to execute large trades without impacting the market, potentially manipulating prices or hiding market activity. This creates a two-tier system where institutions access better information and execution quality, widening the gap between informed and average investors.

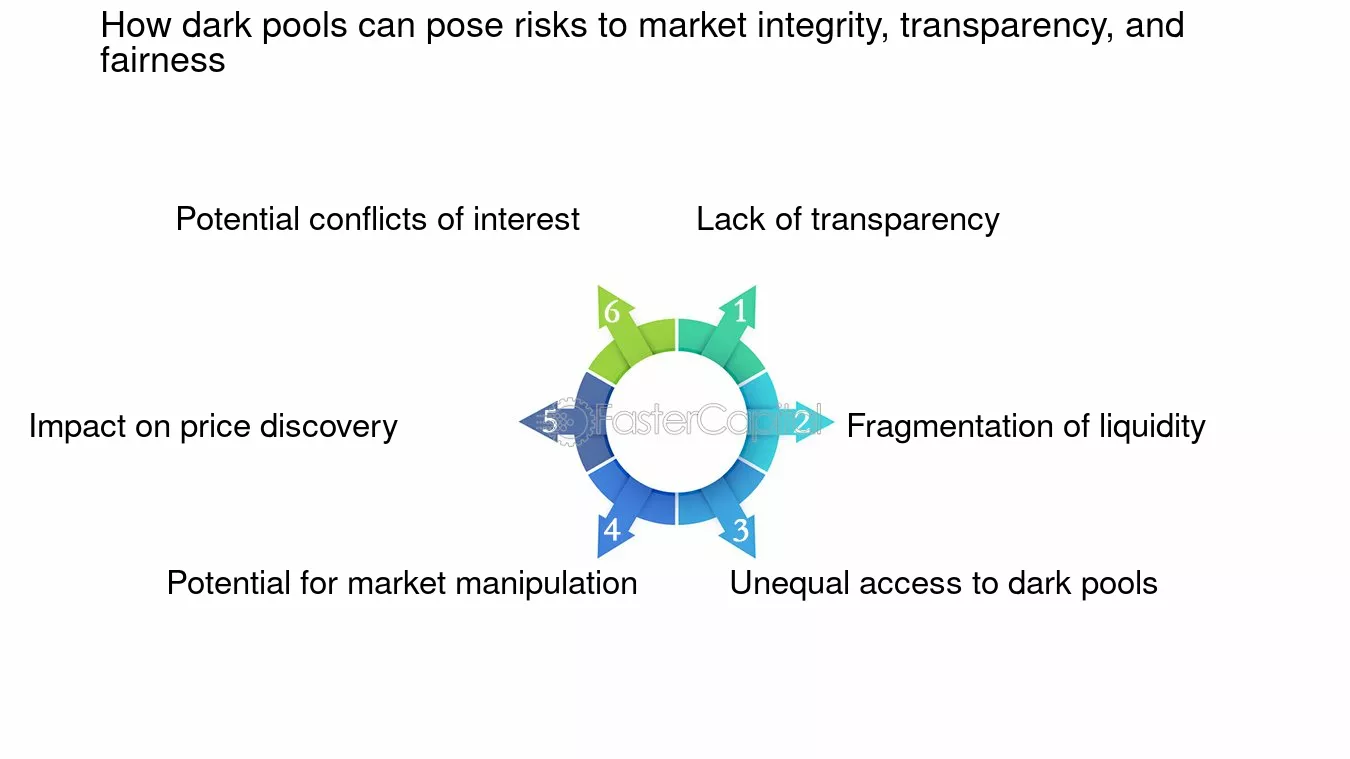

What Are the Risks of Trading in Dark Pools?

Dark pools can reduce market transparency, giving large traders an unfair advantage and potentially manipulating prices. They may lead to less price discovery, causing wider spreads and less accurate market signals. This opacity can distort true supply and demand, undermining market fairness. Smaller investors might face disadvantages because they can't see the full picture, increasing the risk of information asymmetry. Ultimately, dark pools can erode trust in market integrity and create an uneven trading environment.

How Do Dark Pools Impact Market Confidence?

Dark pools can undermine market fairness by hiding large trades, which can lead to information asymmetry and uneven playing fields. When big investors execute trades in dark pools, retail traders and smaller institutions might miss out on price signals, creating an uneven advantage. This opacity can erode trust in the overall market, making participants question whether prices reflect true supply and demand. As a result, market confidence dips when transparency diminishes and perceived fairness declines.

Learn about How Do Dark Pools Obscure Market Transparency?

Can Dark Pools Be Used for Insider Trading?

Dark pools can be exploited for insider trading because their lack of transparency allows traders with non-public information to execute large trades without revealing their intentions, giving them an unfair advantage over the broader market.

Do Dark Pools Promote or Hinder Market Efficiency?

Dark pools can hinder market fairness by hiding order details, giving institutional traders an advantage over retail investors. They reduce transparency, making it harder for all participants to gauge true market prices. This can lead to less efficient price discovery, causing prices to deviate from true value. However, dark pools also lower market impact for large traders, which can improve overall market efficiency by allowing big trades without disrupting prices. Overall, dark pools tend to undermine market fairness and can impair true market efficiency.

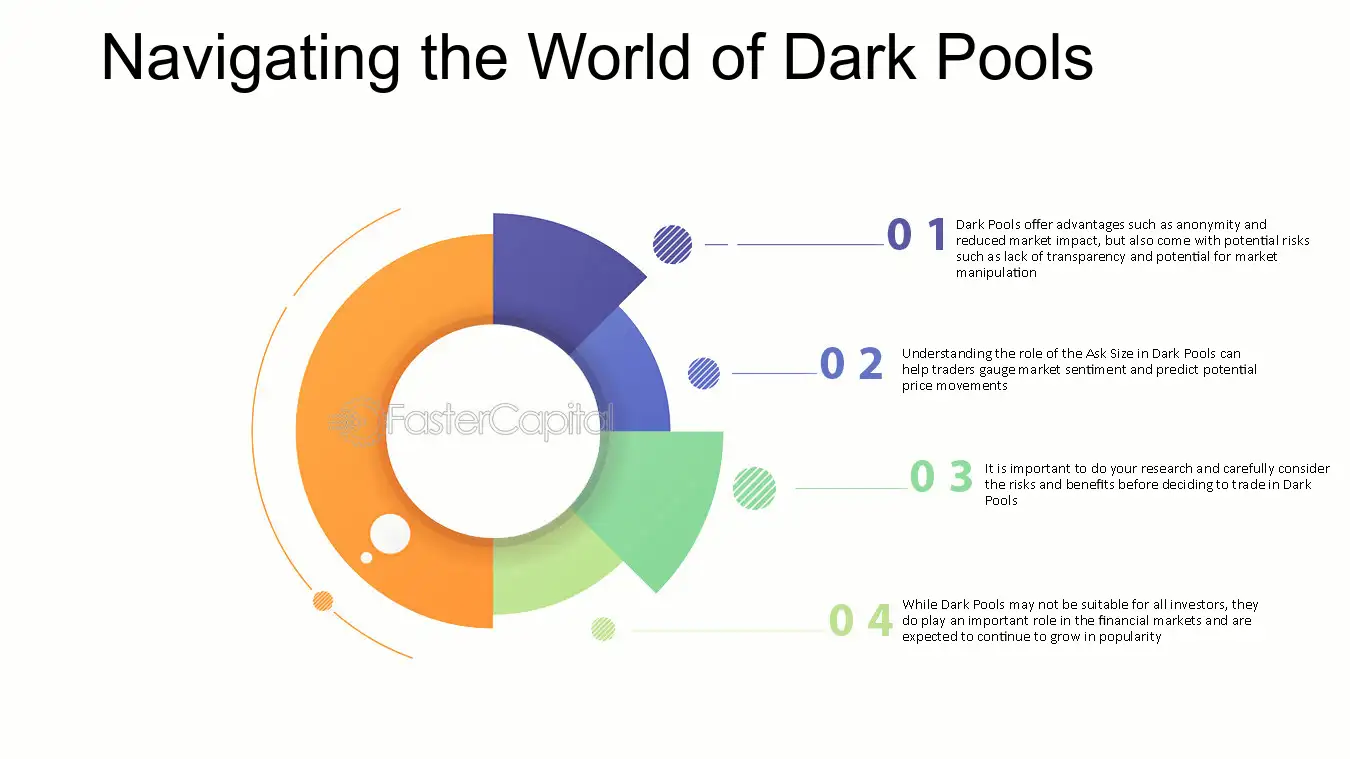

Conclusion about How Do Dark Pools Impact Market Fairness?

In conclusion, dark pools present a complex landscape that significantly impacts market fairness, transparency, and price discovery. While they can provide liquidity and potentially reduce volatility, concerns regarding their influence on large traders' advantages and market manipulation remain. Small investors may face challenges due to the opacity of these venues, highlighting the need for effective regulation. Understanding the nuances of dark pools is essential for all traders, and resources like DayTradingBusiness can equip you with the knowledge to navigate this intricate environment.

Learn about How Do Dark Pools Obscure Market Transparency?