Did you know that institutional traders often have more data at their fingertips than some of the world’s top detectives? In the world of trading, these professionals harness both technical and fundamental analysis to navigate the markets effectively. This article dives deep into how institutional traders leverage various strategies, from interpreting market trends and popular technical indicators to evaluating company financials and managing risk. Discover how they combine data from charts, earnings reports, and macroeconomic factors to make informed decisions, while also adapting their strategies in volatile conditions. Get ready to uncover the sophisticated methods that set institutional traders apart and how DayTradingBusiness can support your trading journey.

How Do Institutional Traders Use Technical Analysis?

Institutional traders use technical analysis to identify market trends, support and resistance levels, and entry or exit points through chart patterns and indicators. They analyze volume, moving averages, and momentum to time trades precisely. This helps them execute large orders efficiently and manage risk. Technical analysis complements their fundamental research, allowing them to fine-tune decisions based on price behavior and market sentiment.

What Role Does Fundamental Analysis Play for Institutional Traders?

Fundamental analysis helps institutional traders evaluate a company's intrinsic value, economic conditions, and industry trends. They use it to identify long-term investment opportunities and assess risks. While technical analysis guides entry and exit points, fundamental analysis provides the underlying rationale for holding or buying assets. It enables them to make informed decisions based on financial health, earnings prospects, and macroeconomic factors, aligning their strategies with market fundamentals.

How Do Institutional Traders Combine Technical and Fundamental Analysis?

Institutional traders blend technical analysis to identify entry and exit points using charts, trends, and volume data, while fundamental analysis helps them assess a company's financial health, economic conditions, and industry outlook. They combine these by first analyzing fundamentals to pick promising assets, then using technical signals to time their trades precisely. For example, they might find a stock with strong earnings growth (fundamental) and wait for a bullish technical pattern, like a breakout, before executing the trade. This integrated approach helps them optimize risk and improve trade accuracy.

Which Technical Indicators Are Most Popular Among Institutional Traders?

Institutional traders most often rely on moving averages, relative strength index (RSI), MACD, Bollinger Bands, and volume indicators. They use these tools to identify trends, momentum, and entry or exit points. Moving averages smooth price data for trend detection, RSI gauges overbought or oversold conditions, MACD shows momentum shifts, Bollinger Bands reveal volatility, and volume confirms price movements.

How Do Institutional Traders Interpret Market Trends?

Institutional traders interpret market trends by combining technical analysis—studying charts, patterns, and indicators to identify momentum and entry points—and fundamental analysis, which involves evaluating economic data, company financials, and macroeconomic factors. They look for signals like moving averages, volume, and price action to gauge short-term moves, while assessing earnings reports, interest rates, and industry outlooks for long-term decisions. They use this combined insight to predict market direction, manage risk, and execute large trades strategically.

What Fundamental Data Do Institutional Traders Focus On?

Institutional traders focus on economic indicators, earnings reports, macroeconomic data, industry trends, and company financial statements. They analyze GDP growth, interest rates, inflation, and employment figures. Their goal is to assess a company's intrinsic value and economic health to inform buy or sell decisions.

How Do Institutional Traders Use Charts for Decision-Making?

Institutional traders use charts to identify trends, support and resistance levels, and entry or exit points. They analyze price patterns, volume, and moving averages on charts to time trades precisely. Combined with fundamental analysis, they assess company financials and economic indicators to confirm signals. Charts help them visualize market momentum and gauge the strength of price movements, guiding large-volume trades with confidence.

How Do News Events Influence Institutional Trading Strategies?

News events cause sudden price swings, prompting institutional traders to adjust strategies quickly. They rely on fundamental analysis to assess how news impacts company or market value, influencing long-term trades. Technical analysis helps them spot short-term trends and entry or exit points during volatile reactions. For example, a positive earnings report might lead institutions to buy, while geopolitical news can trigger rapid sell-offs. They combine both analyses to refine timing and manage risk during news-driven market moves.

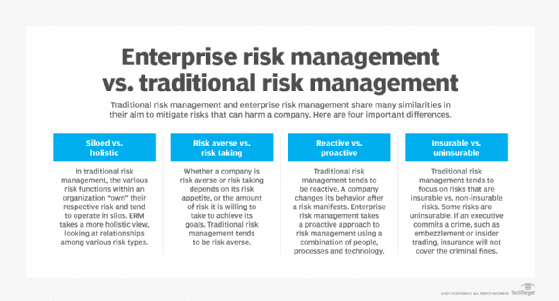

What Is the Typical Approach to Risk Management for Institutional Traders?

Institutional traders manage risk by using a combination of stop-loss orders, position sizing, and diversification. They analyze market trends through technical analysis to time entries and exits and assess company fundamentals for long-term decisions. Constant monitoring and adjusting strategies based on market conditions are key. They also employ risk models and stress testing to prevent large losses.

How Do Institutional Traders Use Earnings Reports in Analysis?

Institutional traders use earnings reports to evaluate a company's financial health, growth potential, and valuation. They analyze revenue, profit margins, and forward guidance to make buy or sell decisions. Earnings reports help them confirm technical signals or identify trends, combining fundamental data with technical analysis for precise timing. They also compare reports across competitors to gauge industry positioning. Essentially, earnings reports are a key fundamental tool for institutional traders to validate or adjust their technical analysis insights.

Learn about How Do Institutional Traders Use Leverage in Day Trading?

How Do Institutional Traders Analyze Market Sentiment?

Institutional traders analyze market sentiment by combining technical analysis—studying price patterns, volume, and momentum indicators—with fundamental analysis, which involves assessing economic data, earnings reports, and macroeconomic trends. They look for signs like overbought or oversold conditions, market volatility, and investor behavior to gauge whether traders are bullish or bearish. They often use tools like sentiment surveys, news sentiment analysis, and social media monitoring to get a real-time pulse of the market mood. This blend helps them make informed decisions about entering or exiting positions.

What Tools Do Institutional Traders Use for Technical Analysis?

Institutional traders use advanced charting platforms like Bloomberg Terminal, Thomson Reuters Eikon, and TradeStation for technical analysis. They rely on software that offers real-time data, customizable indicators, and algorithmic trading capabilities. Tools like Moving Averages, RSI, MACD, and Fibonacci retracements help identify market trends and entry points. They also use proprietary models and high-frequency trading algorithms to analyze large data sets quickly.

How Do Institutional Traders Adjust Strategies in Volatile Markets?

Institutional traders adjust strategies in volatile markets by relying heavily on technical analysis to identify trend shifts and entry/exit points, using tools like moving averages and volume patterns. They also tighten risk management with stop-losses and position sizing to limit losses. Fundamental analysis helps them assess underlying asset value and macroeconomic factors, guiding long-term decisions amid turbulence. They often reduce exposure, hedge positions, or switch to more liquid assets to navigate uncertainty effectively.

Learn about How Do Institutional Traders Affect Day Markets?

How Do Institutional Traders Identify Entry and Exit Points?

Institutional traders identify entry and exit points by combining technical analysis—like chart patterns, moving averages, and volume trends—with fundamental analysis, such as earnings reports and economic data. They look for signals like breakouts, support/resistance levels, or divergence in indicators. They also monitor macroeconomic conditions and company fundamentals to time their trades precisely. This dual approach helps them spot opportunities and manage risk effectively.

How Does Volume Analysis Help Institutional Traders?

Volume analysis helps institutional traders confirm price moves and identify strong buy or sell signals. It shows the intensity behind price changes, indicating whether a trend has momentum or is fading. By analyzing trading volume alongside technical indicators, institutions validate entry and exit points. It also helps spot potential reversals or breakouts, ensuring trades align with market strength. Volume analysis adds a layer of certainty, reducing risk in large institutional trades.

How Do Institutional Traders Evaluate Company Financials?

Institutional traders evaluate company financials by analyzing key metrics like earnings, revenue, profit margins, and debt levels, often using financial statements such as income statements and balance sheets. They compare these figures against industry benchmarks and historical data to assess growth potential and financial health. They also examine ratios like P/E, P/B, and ROE to gauge valuation and efficiency. This fundamental analysis helps them decide if a stock is undervalued or overvalued, guiding large investment decisions.

How Do Macroeconomic Factors Affect Institutional Trading Decisions?

Macroeconomic factors influence institutional trading decisions by shaping market conditions, interest rates, inflation expectations, and economic growth outlooks. Institutional traders use fundamental analysis to evaluate how macro trends—like policy changes or GDP reports—impact asset values. They also incorporate technical analysis to time entries and exits based on macro-driven price patterns and market sentiment shifts. Overall, macroeconomic data guides their strategic positioning, risk management, and short-term trades.

How Do Institutional Traders Use Price Patterns?

Institutional traders use price patterns to identify potential market moves, entry and exit points, and trend reversals. They analyze chart formations like head and shoulders, double tops/bottoms, and flags to gauge market sentiment and timing. Combining these patterns with fundamental analysis helps them confirm if a price trend aligns with economic data or earnings reports. They often act on patterns that signal high probability moves, adjusting their large positions accordingly. Price patterns guide their strategic decisions, minimizing risk and optimizing returns in complex markets.

Learn about How Do Institutional Traders Use Leverage in Day Trading?

How Do Institutional Traders Use Stop-Loss and Take-Profit Orders?

Institutional traders set stop-loss orders to limit losses if a trade moves against their positions, often placing them just below support levels identified through technical analysis. They use take-profit orders to lock in gains once a target price is reached, typically based on resistance levels or fundamental valuation metrics. These orders help manage large positions efficiently, minimize risk, and automate exit strategies aligned with their analysis insights.

Learn about How Do Institutional Traders Use Leverage in Day Trading?

How Do Institutional Traders Monitor Market Liquidity?

Institutional traders monitor market liquidity by tracking bid-ask spreads, trading volumes, and order book depth in real-time. They use advanced trading platforms to observe price movements and identify liquidity gaps. Analyzing market depth helps them gauge how easily they can buy or sell large quantities without impacting prices. They also watch for changes in trading volume and volatility, which signal shifts in liquidity. Combining these technical indicators with fundamental analysis of economic news and market sentiment gives a complete picture of liquidity conditions.

Learn about How Do Institutional Orders Impact Market Liquidity?

Conclusion about How Do Institutional Traders Use Technical and Fundamental Analysis?

In conclusion, institutional traders leverage both technical and fundamental analysis to navigate complex market dynamics effectively. By combining various indicators, analyzing market trends, and interpreting fundamental data, they enhance their decision-making processes. Whether it's through assessing earnings reports or adapting strategies in volatile markets, the expertise of institutional traders is vital in maximizing returns and managing risk. For those looking to deepen their understanding of these strategies, DayTradingBusiness offers valuable insights and resources to enhance your trading knowledge.

Sources:

- Where are the fundamental traders? A model application based on ...

- The use of technical analysis by fund managers: International ...

- Institutional trading, news, and accounting anomalies - ScienceDirect

- Analysis of decision making factors for equity investment by ...

- Can Technical Analysis Boost Portfolio Returns? | CFA Institute ...

- Caught on tape: Institutional trading, stock returns, and earnings ...