Did you know that the average money launderer washes about $300 billion annually, enough to buy nearly 3 million Teslas? In the world of day trading, anti-money laundering (AML) laws play a crucial role in maintaining market integrity and preventing illicit activities. This article dives into how AML regulations affect day traders, outlining their impact on account opening, compliance requirements, transaction monitoring, and the associated costs. You'll discover the necessary documentation for AML compliance, the obligations around identity verification, and the implications for foreign trading accounts. Additionally, we’ll explore the penalties for non-compliance and the vital role of the Financial Action Task Force in shaping these laws. Stay informed with DayTradingBusiness as we unpack the complexities of AML in day trading.

How do AML laws impact day trader account opening?

AML laws require day traders to verify their identity and provide detailed personal information when opening accounts. They must undergo thorough background checks and comply with know-your-customer (KYC) procedures. These regulations can delay account approval and increase paperwork, making the onboarding process more stringent. AML laws also mandate ongoing monitoring of trading activity to detect suspicious transactions, which can lead to account freezes or freezes if activity appears suspicious. Overall, AML laws add layers of compliance that day traders must navigate before and after opening their trading accounts.

What AML requirements must day traders comply with?

Day traders must verify their identity through KYC procedures, report suspicious activities, and comply with bank and brokerage AML policies. They should maintain clear records of transactions, avoid suspicious fund sources, and adhere to anti-money laundering regulations to prevent illegal activity.

How do AML regulations affect day trading transactions?

AML laws require day traders to verify their identity, report large transactions, and monitor suspicious activity. This means brokerages must flag and report trades over certain thresholds, delaying or scrutinizing transactions. Traders must provide personal info and sometimes source of funds, which adds steps and transparency to their activity. These rules aim to prevent money laundering but can slow down rapid trades and increase compliance costs for day traders.

Are day traders subject to AML reporting thresholds?

Yes, day traders are subject to AML reporting thresholds if they conduct large or suspicious transactions, especially when involving brokerages that must report cash transactions over $10,000 or identify patterns indicating money laundering.

How does AML influence the monitoring of day trading activities?

AML laws require day traders to verify their identities and report suspicious transactions, making it harder to hide illegal activity. Traders must comply with Know Your Customer (KYC) protocols and monitor for unusual trading patterns that could indicate money laundering. Financial institutions flag large or irregular trades, increasing scrutiny on day trading activity. This oversight discourages illicit funds from flowing through day trading accounts and enforces transparency.

What are the penalties for AML violations in day trading?

Penalties for AML violations in day trading can include hefty fines, account freezes, and even criminal charges leading to imprisonment. Regulators can revoke trading licenses or impose sanctions if traders knowingly bypass AML protocols. False or incomplete disclosures related to suspicious activities may trigger enforcement actions. Essentially, violating AML laws risks financial penalties, legal trouble, and losing trading privileges.

How do anti-money laundering laws affect broker compliance?

Anti-money laundering laws require brokers to verify client identities, monitor transactions for suspicious activity, and report large or unusual trades. This increases compliance workload for brokers, forcing stricter customer due diligence and record-keeping. Day traders must provide identification and sometimes face transaction limits to prevent money laundering. Overall, AML laws add layers of regulation that brokers and traders must navigate to avoid penalties.

Do AML laws increase the cost of day trading?

Yes, AML laws can increase the cost of day trading by requiring stricter identity verification, transaction monitoring, and compliance measures, which may lead to higher fees and operational costs for traders.

How do AML rules impact foreign day trading accounts?

AML rules require foreign day trading accounts to verify identities and report suspicious transactions. Traders must provide detailed documentation and stay compliant with international regulations. These laws can slow account setup, increase scrutiny, and lead to restrictions on large or unusual trades. Non-compliance risks account freezes, penalties, or even legal action.

What documentation is needed for AML compliance in day trading?

For AML compliance in day trading, you need valid ID (like a driver’s license or passport), proof of address (utility bill or bank statement), and sometimes a source of funds verification. Brokers also require completed W-9 or W-8 forms, and you might need to provide information about your trading experience and financial status.

How does AML affect the use of cash vs. electronic transfers?

AML laws make cash transactions more scrutinized, often limiting large cash trades and requiring detailed identification. For electronic transfers, AML mandates increased monitoring and reporting of suspicious activity, pushing traders to rely more on digital payments with verified identities. This reduces cash’s anonymity but streamlines electronic transaction compliance. Overall, AML laws push day traders toward electronic transfers, increasing transparency but adding compliance hurdles.

Are day traders required to verify their identities under AML laws?

Yes, day traders are required to verify their identities under AML laws when opening accounts with brokerages.

How do AML regulations prevent money laundering through day trading?

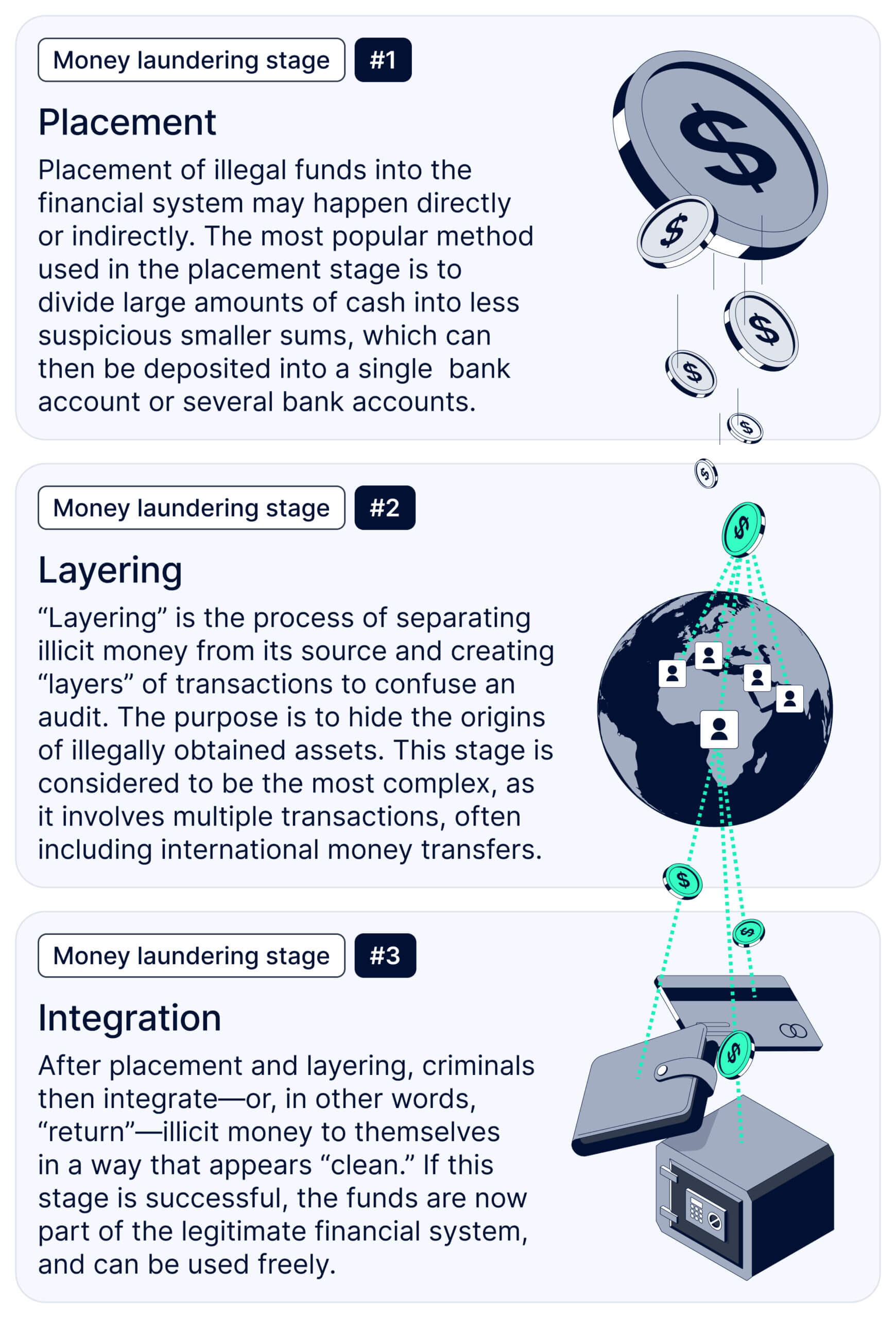

AML regulations require day traders to verify identities, monitor suspicious transactions, and report large or unusual trades. This makes it harder for money launderers to use day trading accounts to clean illicit funds, since authorities can trace and flag suspicious activity. By enforcing strict customer due diligence and transaction monitoring, AML laws close loopholes that criminals might exploit for laundering money through quick, high-volume trades.

Learn about How Do Brokers Prevent Money Laundering and Fraud in Day Trading?

What role does the Financial Action Task Force play in AML for traders?

The Financial Action Task Force sets global standards to prevent money laundering, which influences AML laws that traders must follow. For day traders, these regulations mean they must verify identities, monitor transactions for suspicious activity, and report large or unusual trades. Compliance helps prevent their platforms from being used for money laundering, and failure to adhere can lead to penalties or account restrictions. Essentially, FATF's guidelines shape the AML rules traders operate under to ensure transparency and security in financial markets.

How do AML laws influence the reporting of suspicious activities?

AML laws require day traders to report large or suspicious transactions to authorities. They must file reports like Suspicious Activity Reports (SARs) if activity looks unusual, such as sudden large deposits or inconsistent trading patterns. These laws aim to detect and prevent money laundering by scrutinizing trading behaviors that could hide illicit funds. Non-compliance risks fines and legal action. Traders need to maintain detailed records to comply with AML reporting standards.

Conclusion about How Do Anti-Money Laundering Laws Affect Day Traders?

In conclusion, anti-money laundering (AML) laws play a significant role in shaping the day trading landscape. These regulations affect account openings, compliance requirements, and transaction monitoring, ensuring that traders adhere to strict documentation and reporting standards. As day traders navigate these requirements, it's crucial to stay informed about the implications of AML laws, including potential penalties and increased costs. Understanding these regulations not only safeguards traders but also reinforces the integrity of the financial markets. For more insights and guidance on navigating these complexities, DayTradingBusiness is here to help.

Learn about How Does Insider Trading Affect Day Traders?