Did you know that the average day trader spends more on transaction costs than on coffee during a trading session? Understanding the impact of transaction costs on day trading profitability is crucial for any trader looking to maximize their gains. This article delves into how these costs affect profits, including common expenses like spreads and commission fees, as well as factors such as slippage and market impact. We’ll explore strategies to minimize transaction costs, variations across different markets, and how they influence the risk-reward ratio. Additionally, we’ll discuss the significance of transaction costs in high-frequency trading and the relationship between trading volume and costs. Finally, find out how to calculate your break-even point and whether low-cost brokers are truly beneficial for day traders. With insights from DayTradingBusiness, you’ll be better equipped to navigate the complexities of trading costs.

How do transaction costs impact day trading profits?

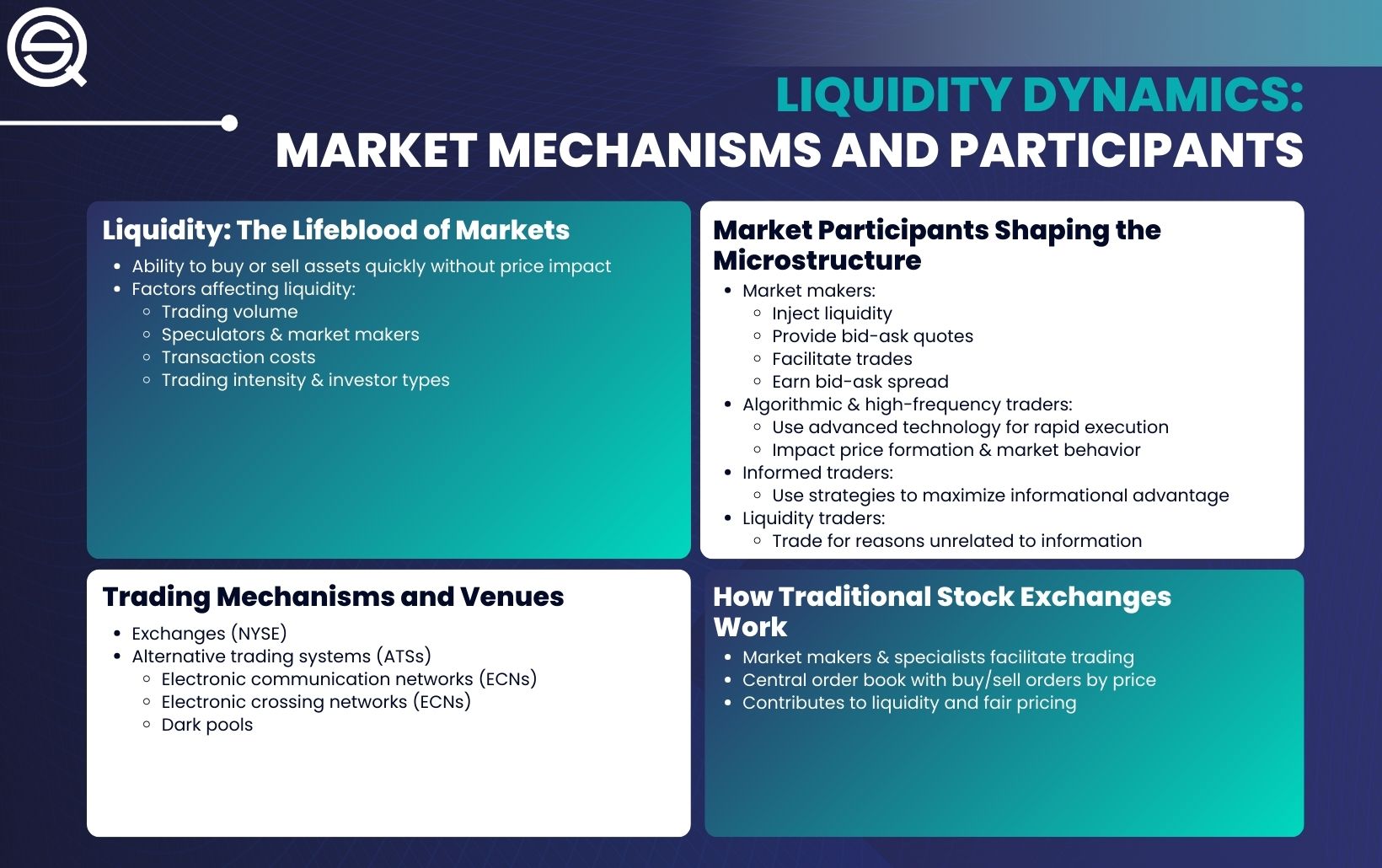

Transaction costs eat into day trading profits by reducing the net gain from each trade. High commissions, spreads, and fees can turn small price movements into losses. Frequent trading amplifies these costs, making it harder to stay profitable. Even minor costs can wipe out gains in quick, short-term trades. Lower transaction costs improve profit margins, but high costs force traders to be more precise and selective.

What are common transaction costs faced by day traders?

Common transaction costs for day traders include commissions paid to brokers, bid-ask spread costs, slippage from price changes between order placement and execution, and exchange fees.

How do spreads affect day trading profitability?

Spreads lower your profit margin on each trade by increasing the cost of entering and exiting positions. A wider spread means you need the asset to move more in your favor before making a profit. High spreads can wipe out small gains, turning potential profits into losses, especially in quick, frequent trades. Tight spreads make it easier to capitalize on small price movements, boosting overall profitability.

Does high commission fee reduce day trading gains?

Yes, high commission fees cut into day trading gains by increasing transaction costs, making it harder to profit from frequent trades.

How do slippage and market impact influence profits?

Slippage and market impact cut into profits by causing trades to execute worse than expected prices. Slippage occurs when you fill a trade at a less favorable price than planned, often during high volatility or rapid price moves. Market impact happens when your large order moves the market, pushing prices against your position. Together, they increase transaction costs, reducing net gains and making profitable strategies harder to sustain.

What is the role of transaction costs in trading strategies?

Transaction costs eat into profits and can turn a seemingly profitable day trading strategy into a loss. They include commissions, spreads, and fees that reduce net gains from each trade. High transaction costs discourage frequent trading, making strategies that rely on quick, small moves less viable. Traders must account for these costs when designing their strategies to ensure that expected returns outweigh expenses. Ignoring transaction costs can lead to overestimating profitability and taking unprofitable trades.

How can traders minimize transaction costs?

Traders minimize transaction costs by using limit orders instead of market orders, reducing the frequency of trades, and choosing brokers with low commissions and spreads. They also avoid overtrading and time their trades to avoid high bid-ask spreads during volatile periods. Additionally, leveraging trading tools and algorithms can optimize entry and exit points, cutting down unnecessary costs.

Do transaction costs vary across different markets?

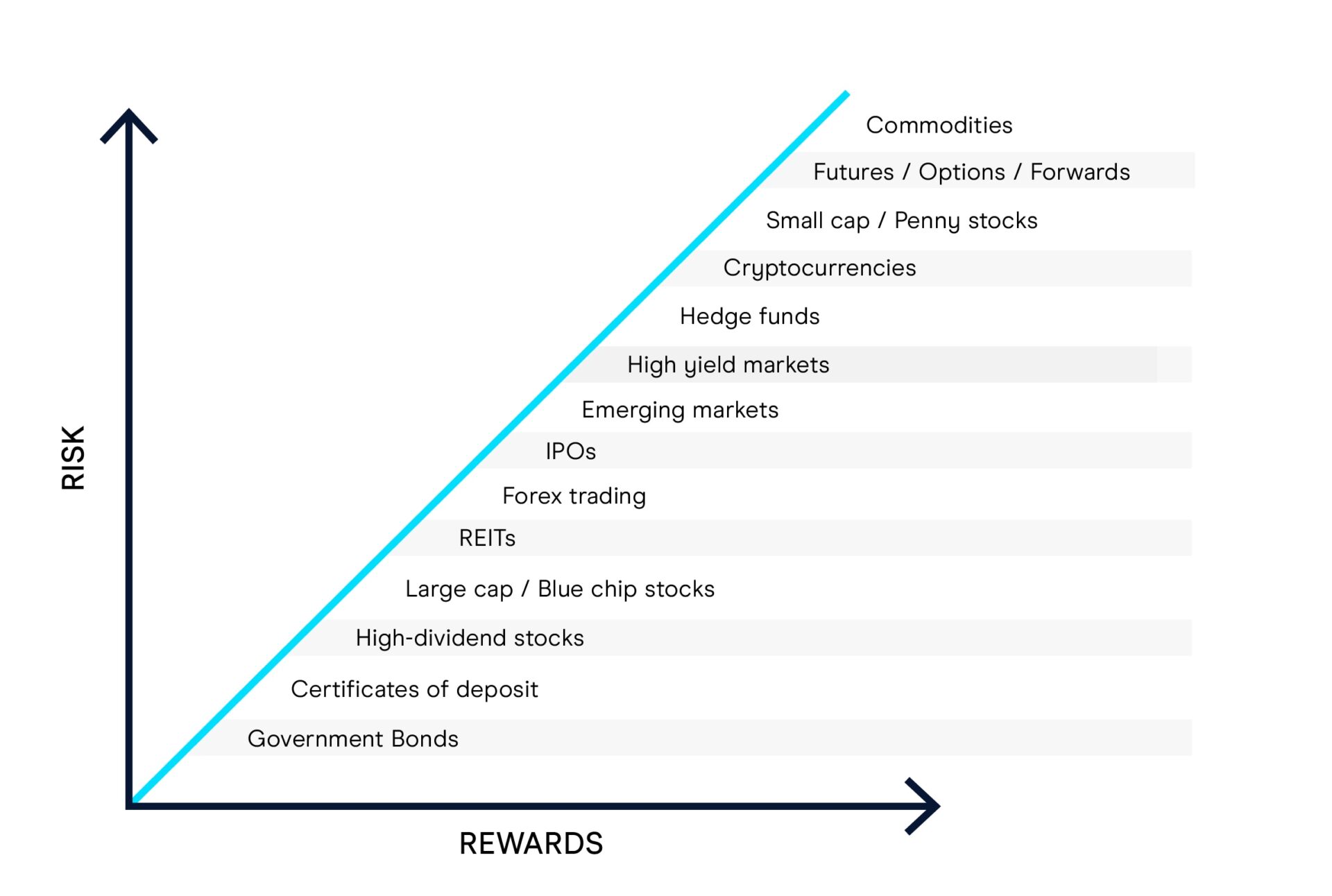

Yes, transaction costs vary across markets. Stock markets, forex, and cryptocurrencies all have different fees, spreads, and commissions. These differences impact day trading profitability directly by increasing or decreasing trading expenses.

How do transaction costs affect the risk-reward ratio?

Transaction costs reduce net profits, lowering the risk-reward ratio in day trading. Higher costs mean traders need bigger gains to offset expenses, making profitable trades riskier relative to potential rewards. When costs rise, the potential reward must outweigh these expenses significantly to justify the trade, increasing the difficulty of achieving a favorable risk-reward ratio.

Are low-cost brokers better for day traders?

Low-cost brokers can boost day trading profitability by reducing transaction costs, which eat into gains. Lower fees mean more of your capital stays active, increasing potential returns on frequent trades. However, cost isn't everything—reliability, execution speed, and platform features matter too. If a broker offers cheap trades but delays order execution or has poor support, it can hurt your strategy. For many day traders, low-cost brokers are advantageous because they keep expenses minimal, allowing more room for profit.

How significant are transaction costs in high-frequency trading?

Transaction costs are crucial in high-frequency trading because they can erode small profit margins earned from rapid trades. Even tiny fees or spreads add up quickly when executing hundreds or thousands of trades per second. If transaction costs exceed the tiny price movements targeted by algorithms, profitability drops sharply. In high-frequency trading, minimizing these costs through tight spreads and low commissions is essential for sustained gains.

Can high transaction costs lead to trading losses?

Yes, high transaction costs can eat into or wipe out day trading profits, making it harder to turn a profit and increasing the risk of trading losses.

How does volume affect transaction costs for day traders?

Higher trading volume lowers transaction costs for day traders by increasing liquidity, making it cheaper and faster to buy and sell assets without impacting prices. Low volume causes wider spreads and more slippage, raising costs and reducing profit margins. When volume is high, traders can execute trades quickly and at better prices, improving profitability. Conversely, in low-volume markets, transaction costs eat into gains more significantly, making profitable trading harder.

Learn about How Does Insider Trading Affect Day Traders?

What is the break-even point considering transaction costs?

The break-even point considering transaction costs is when your gross profit from trades equals the sum of all trading fees and commissions. For example, if each trade costs $10 in fees, and your average profit per trade is $10, you need to make at least one profitable trade to cover costs. In percentage terms, if your average trade profit margin is 0.2% and transaction costs total 0.2%, then your net profit per trade drops to zero, marking the break-even point.

How do transaction costs influence trading frequency?

Higher transaction costs reduce the profits from each trade, discouraging frequent trading. When costs are high, traders avoid numerous small trades to preserve margins, leading to lower trading frequency. Conversely, low transaction costs make frequent trading more feasible and attractive, increasing trading frequency.

Conclusion about The Effect of Transaction Costs on Day Trading Profitability

In conclusion, transaction costs play a crucial role in determining day trading profitability. From spreads and commission fees to slippage and market impact, understanding these costs is essential for developing effective trading strategies. By selecting low-cost brokers and implementing techniques to minimize expenses, traders can enhance their risk-reward ratio and improve overall performance. For those navigating the complexities of day trading, leveraging insights from experts at DayTradingBusiness can provide valuable guidance to optimize profits while managing transaction costs effectively.

Sources:

- The cross-section of speculator skill: Evidence from day trading ...

- Technical analysis in cryptocurrency markets: Do transaction costs ...

- Implications of Transaction Costs for the Post-Earnings ...

- The impact and profitability of day trading following the relaxation of ...

- Wish or reality? On the exploitability of triangular arbitrage in ...